Optic Adhesives Market Report Scope & Overview:

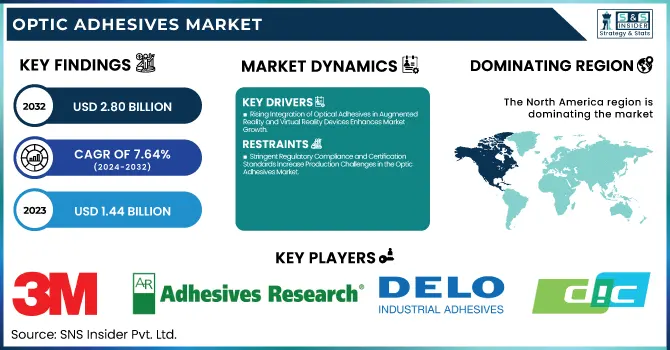

The Optic Adhesives Market Size was valued at USD 1.44 Billion in 2023 and is expected to reach USD 2.80 Billion by 2032, growing at a CAGR of 7.64% over the forecast period of 2024-2032.

To Get more information on Optic Adhesives Market - Request Free Sample Report

The Optic Adhesives Market is evolving with technological advancements, regulatory shifts, and rising industrial demand. Our report explores investment and funding trends, showcasing venture capital inflows and corporate investments driving innovation. A deep dive into patent analysis and intellectual property trends highlights proprietary technologies shaping the competitive landscape. With raw material pricing trends impacting costs, the study examines supply chain dynamics and sourcing strategies. Understanding global and regional regulations, including REACH, ISO, and FDA, is crucial for compliance and market expansion. Additionally, AI-driven predictive maintenance is transforming adhesive longevity and performance optimization. This strategic market analysis equips stakeholders with insights to navigate emerging opportunities and challenges in this rapidly advancing sector.

The US Optic Adhesives Market Size was valued at USD 0.40 Billion in 2023 and is expected to reach USD 0.72 Million by 2032, growing at a CAGR of 6.66% over the forecast period of 2024-2032.

The U.S. Optic Adhesives Market is experiencing significant growth, driven by advancements in telecommunications, consumer electronics, and medical devices. The expansion of 5G infrastructure and the increasing adoption of fiber-optic networks, supported by organizations like the Fiber Broadband Association, are fueling demand. In medical applications, the American Academy of Ophthalmology highlights the growing use of precision adhesives in optical instruments. Additionally, U.S.-based companies like Dymax Corporation and Master Bond Inc. are innovating UV-curable and epoxy-based optic adhesives, enhancing performance in AR/VR, automotive HUDs, and aerospace optics. Stringent FDA and ISO regulations are also pushing manufacturers toward high-quality, compliant solutions, further driving market expansion.

Optic Adhesives Market Dynamics

Drivers

-

Rising Integration of Optical Adhesives in Augmented Reality and Virtual Reality Devices Enhances Market Growth

The increasing adoption of augmented reality (AR) and virtual reality (VR) devices across industries such as gaming, healthcare, automotive, and aerospace is driving the Optic Adhesives Market. These devices require high-performance optical adhesives that provide superior bonding, optical clarity, and durability to ensure optimal functionality. Companies like Meta, Apple, and Microsoft are investing heavily in AR and VR headsets, increasing demand for low-shrinkage, high-refractive-index adhesives that offer environmental resistance and enhanced optical performance. In the automotive industry, the rising adoption of head-up displays (HUDs) and advanced driver-assistance systems (ADAS) has created a growing need for optical adhesives that maintain high optical transparency and mechanical stability. Similarly, medical applications, including surgical visualization systems and endoscopic imaging devices, require precise optical bonding solutions to enhance clarity and performance. The need for UV-curable and epoxy-based optic adhesives is rising due to their fast-curing time and long-term durability, making them essential for cutting-edge AR and VR applications. As technological advancements continue, the demand for high-quality optical adhesives will further accelerate.

Restraints

-

Stringent Regulatory Compliance and Certification Standards Increase Production Challenges in the Optic Adhesives Market

Manufacturers in the Optic Adhesives Market face stringent regulatory requirements imposed by organizations such as the Food and Drug Administration (FDA), Restriction of Hazardous Substances (RoHS), and Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH). Compliance with ISO 10993 biocompatibility standards for medical adhesives and MIL-SPEC standards for defense applications increases production complexities. These regulations require manufacturers to develop low-toxicity, non-outgassing, and environmentally safe formulations, driving up R&D costs and production lead times. Additionally, optical adhesives used in aerospace and high-precision electronics must meet strict thermal stability, chemical resistance, and optical performance criteria, further complicating product development. The lengthy approval processes for new formulations delay market entry and increase costs, making it difficult for small and mid-sized companies to compete with industry leaders.

Opportunities

-

Integration of Smart and Adaptive Adhesives Enhances Performance in High-Tech Optical Applications

The development of smart adhesives with self-healing, adaptive refractive index, and thermal-responsive properties is transforming the Optic Adhesives Market. These advanced materials enable dynamic optical adjustments in applications such as photonic circuits, precision lenses, and biomedical imaging. For instance, researchers are designing adhesives that alter refractive properties based on external stimuli like temperature, pressure, or light exposure, optimizing performance in adaptive optics and laser systems. Additionally, nano-engineered adhesive coatings enhance durability, scratch resistance, and chemical stability, making them ideal for fiber-optic components, AR/VR lenses, and military-grade optics. The increasing demand for wearable optical devices, smart contact lenses, and next-generation displays is accelerating the adoption of these intelligent adhesives. Furthermore, self-healing adhesives extend the lifespan of optical assemblies, reducing maintenance costs and improving long-term reliability in high-precision applications. As industries integrate AI-driven automation and nanotechnology, smart adhesives will play a crucial role in advancing optical innovation and expanding market potential.

Challenge

-

Limited Availability of High-Performance Optical-Grade Adhesives for Extreme Environmental Conditions

The Optic Adhesives Market faces a significant challenge due to the limited availability of ultra-high-performance adhesives that can withstand extreme environmental conditions. Industries such as aerospace, deep-sea exploration, and high-altitude surveillance require adhesives with exceptional optical clarity, mechanical strength, and resistance to thermal fluctuations, radiation, and humidity. However, current formulations often degrade under prolonged exposure to UV radiation, vacuum environments, and cryogenic temperatures, limiting their use in satellites, military optics, and space telescopes. For example, adhesives used in NASA’s space optics must meet low-outgassing and extreme temperature tolerance requirements, making material selection highly restrictive. Developing adhesives with enhanced thermal stability, non-yellowing properties, and prolonged durability is costly and requires advanced R&D investments. Additionally, achieving precise refractive index matching while ensuring chemical inertness remains a major technical challenge. As optical applications expand into harsh environments, the lack of robust, long-lasting adhesive solutions could hinder industry growth, prompting the need for new material innovations and enhanced formulation techniques.

Optic Adhesives Market Segmental Analysis

By Resin Type

In 2023, cyanoacrylate adhesives dominated the optic adhesives market, accounting for approximately 30.2% of the market share. Cyanoacrylates, commonly known as super glues, are favored for their rapid curing times and strong bonds, making them ideal for applications requiring quick assembly and high precision. Their ability to bond various substrates, including glass, metal, and plastics, has led to widespread adoption in industries such as electronics, automotive, and medical devices. For instance, in the electronics sector, cyanoacrylate adhesives are used to bond components in smartphones and tablets, enhancing device durability. Additionally, their application in medical devices, such as assembling surgical instruments, underscores their reliability and performance. The versatility and efficiency of cyanoacrylate adhesives have solidified their leading position in the optic adhesives market.

By Application

In 2023, the optical bonding and assembly segment dominated the optic adhesives market, capturing approximately 38.5% of the market share. This dominance is driven by the increasing demand for high-quality displays in consumer electronics, automotive dashboards, and medical devices. Optical bonding enhances display performance by reducing reflections and improving contrast, which is critical for devices like smartphones, tablets, and advanced automotive displays. For example, the integration of optical bonding in automotive head-up displays (HUDs) has improved visibility and safety for drivers. The medical industry also benefits from optical bonding in diagnostic equipment, where clear and accurate displays are essential. The growing emphasis on superior display quality across various sectors has propelled the optical bonding and assembly segment to the forefront of the optic adhesives market.

Optic Adhesives Market Regional Outlook

In 2023, North America dominated the optic adhesives market, holding a 35% market share. This leadership is attributed to the region's robust technological advancements and substantial investments in industries such as electronics, automotive, and aerospace. The United States, in particular, has been a significant contributor, driven by the presence of leading companies like 3M and Henkel, which have pioneered innovative adhesive solutions. The U.S. government's support for research and development in advanced materials has further bolstered market growth. For instance, initiatives by the National Science Foundation (NSF) to fund materials science research have facilitated advancements in adhesive technologies. Additionally, the increasing adoption of electric vehicles (EVs) in the U.S. has spurred demand for optic adhesives in automotive applications, such as battery systems and infotainment displays. Canada and Mexico have also contributed to regional growth, with Canada's focus on aerospace manufacturing and Mexico's expanding electronics assembly sector. The combined efforts of these countries have solidified North America's leading position in the optic adhesives market.

During the forecast period, the Asia Pacific region has emerged as the fastest-growing market for optic adhesives, with a significant CAGR. This rapid growth is fueled by the region's expanding electronics manufacturing industry, particularly in countries like China, Japan, and South Korea. China, for instance, has become a global hub for smartphone and consumer electronics production, driving the demand for high-performance adhesives in device assembly. The Chinese government's initiatives, such as the "Made in China 2025" plan, aim to enhance manufacturing capabilities, further boosting the optic adhesives market. Japan's advancements in automotive technologies, including the development of electric and hybrid vehicles, have increased the need for specialized adhesives in automotive electronics. South Korea's leadership in display technologies, particularly in OLED and flexible displays, has also contributed to the rising demand for optic adhesives. Additionally, the growing telecommunications sector in the region, with the rollout of 5G networks, has heightened the need for fiber optic components, where optic adhesives play a crucial role. The confluence of these factors underscores Asia Pacific's position as a rapidly growing market in the optic adhesives industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

3M Company (Optically Clear Adhesive 8146, Optically Clear Adhesive 8211)

-

Adhesives Research, Inc. (ARclear 8932, ARclear 90560)

-

Atom Adhesives (AA-BOND UV15, AA-BOND 2116)

-

DELO Industrie Klebstoffe GmbH & Co. KGaA (DELO PHOTOBOND 4468, DELO KATIOBOND AD494)

-

DIC Corporation (MEIPALAC W-801, MEIPALAC W-829)

-

Dow Inc. (The Dow Chemical Company) (DOWSIL 3145, DOWSIL 1-4173)

-

Dymax Corporation (Dymax OP-67-LS, Dymax 921-GEL)

-

H.B. Fuller Company (UVOCURE 7555, EV OPT 6001)

-

Henkel AG & Co. KGaA (LOCTITE STYCAST 1265, LOCTITE ABLESTIK 2035SC)

-

Master Bond Inc. (EP30-2, UV15-7DC)

-

Momentive Performance Materials Inc. (Silopren LSR 2030, InvisiSil OP2700)

-

Nan Pao Resins Co., Ltd. (NP UV-2500, NP OP-360)

-

Nitto Denko Corporation (Nitto 5015N, Nitto 9119)

-

Panacol-Elosol GmbH (Vitralit 1605, Vitralit UC 6686)

-

Parson Adhesives India Private Limited (Parson UV-1800, Parson UV-5500)

-

Resintech Limited (Resintech UVR 5000, Resintech OP-360)

-

Showa Denko Corporation (SDC Optical Adhesive 1800, SDC Optical Adhesive 2000)

-

Tesa SE (Tesa 4965, Tesa 51970)

-

ThreeBond International, Inc. (ThreeBond 3035B, ThreeBond 3930)

-

Vitrochem Technology Pte Ltd (Vitrobond 2100, Vitrobond 5200)

Recent Developments

-

December 2023: NIMS researchers in Japan developed a moisture-resistant adhesive inspired by mussels, offering strong bonding in high-humidity environments. This innovation benefits electronics, medical, and marine industries by enhancing adhesive durability and reliability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.44 Billion |

| Market Size by 2032 | USD 2.80 Billion |

| CAGR | CAGR of 7.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin Type (Epoxy, Acrylic, Cyanoacrylate, Silicone, Others) •By Application (Optical Bonding & Assembly, Lens Bonding Cement, Fiber Optics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG & Co. KGaA, Dymax Corporation, DELO Industrie Klebstoffe GmbH & Co. KGaA, H.B. Fuller Company, The Dow Chemical Company (Dow Inc.), 3M Company, Panacol-Elosol GmbH, DIC Corporation, Master Bond Inc., Tesa SE and other key players |