Rheology Modifiers Market Size & Overview:

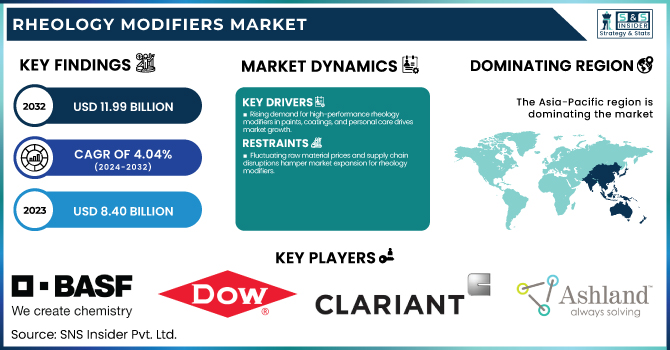

The Rheology Modifiers Market size was USD 8.40 billion in 2023 and is expected to reach USD 11.99 billion by 2032 and grow at a CAGR of 4.04% over the forecast period of 2024-2032.

To Get more information on Rheology Modifiers Market - Request Free Sample Report

The report provides a comprehensive analysis of production capacity and utilization by type in 2023, highlighting demand shifts across key industries. It examines feedstock price trends, assessing cost fluctuations in cellulose derivatives, acrylics, and organoclays. The report explores the regulatory impact by region, focusing on compliance challenges with REACH (EU) and TSCA (U.S.). Sustainability metrics, including emissions data and waste management, are covered, emphasizing the shift toward eco-friendly formulations. Innovation and R&D investments are analyzed, showcasing advancements in smart and multifunctional rheology modifiers. Additionally, it details market adoption trends by industry, highlighting increasing demand in coatings, personal care, and 3D printing applications. This report serves as a data-driven resource for industry stakeholders navigating evolving market dynamics.

The United States dominated the rheology modifiers market in 2023, holding a 76% market share, with a market size of approximately USD 1.40 billion. This dominance is primarily driven by the strong presence of major end-use industries, including paints & coatings, personal care, pharmaceuticals, and oil & gas, which are the largest consumers of rheology modifiers. The U.S. has a well-established chemical manufacturing sector with advanced R&D capabilities, allowing for the development of high-performance and eco-friendly rheology modifiers. Additionally, stringent regulatory frameworks such as those enforced by the EPA (Environmental Protection Agency) and FDA (Food and Drug Administration) have pushed manufacturers to innovate and develop low-VOC and biodegradable rheology modifiers, further strengthening market growth. The country's stable supply chain, access to key raw materials, and strong presence of global manufacturers such as Dow, Lubrizol, and Ashland have also contributed to its leadership position.

Rheology Modifiers Market Dynamics

Drivers

-

Rising demand for high-performance rheology modifiers in paints, coatings, and personal care drives market growth.

The increasing demand for high-performance rheology modifiers in paints & coatings, personal care, and cosmetics is a key growth driver for the market. In the paints & coatings sector, rheology modifiers enhance viscosity, prevent sagging, and improve application properties, making them crucial for architectural and industrial coatings. Similarly, in the personal care industry, they are widely used in skincare and haircare products to ensure stability, texture enhancement, and improved product feel. With the growing trend toward water-based formulations and bio-based additives, manufacturers are investing in advanced rheology modifiers that provide sustainable and high-performance benefits. Additionally, stringent environmental regulations are pushing companies to shift toward low-VOC and biodegradable solutions, further fueling market expansion. The continued innovation in multifunctional and nanotechnology-based rheology modifiers is expected to sustain this growth trajectory.

Restrain

-

Fluctuating raw material prices and supply chain disruptions hamper market expansion for rheology modifiers.

The rheology modifiers market is significantly impacted by fluctuating raw material prices and supply chain disruptions, posing a major restraint to growth. Key raw materials such as cellulose derivatives, acrylics, organoclays, and polyurethane are subject to price volatility due to geopolitical tensions, trade restrictions, and fluctuating crude oil prices. The leading to higher production costs and reduced profit margins for manufacturers. Additionally, stringent environmental regulations on petroleum-based chemicals have limited the availability of synthetic rheology modifiers, further increasing raw material costs. To mitigate these challenges, companies are focusing on regionalizing supply chains, investing in bio-based alternatives, and securing long-term raw material contracts. However, continued uncertainties in global trade policies remain a persistent hurdle for market players.

Opportunity

-

The growing adoption of bio-based and sustainable rheology modifiers creates lucrative market opportunities.

The shift toward bio-based and sustainable rheology modifiers is creating significant growth opportunities for the market. Rising environmental concerns and stringent VOC (volatile organic compound) regulations have prompted manufacturers to develop biodegradable, plant-derived, and water-based rheology modifiers for various industries. In paints & coatings, bio-based alternatives are gaining traction due to their low toxicity and reduced carbon footprint, aligning with global sustainability goals. Similarly, in personal care and cosmetics, the demand for natural thickeners such as xanthan gum, guar gum, and cellulose derivatives is increasing as consumers prefer clean-label and organic products. Key market players are heavily investing in R&D to enhance the performance of bio-based rheology modifiers, ensuring they provide superior viscosity control, stabilization, and dispersion properties, making them a viable alternative to conventional synthetic options.

Challenge

-

Regulatory challenges in compliance with environmental and health safety standards impact market growth.

Stringent regulatory frameworks on chemical formulations pose a significant challenge to the rheology modifiers market. Government agencies such as the EPA (Environmental Protection Agency), REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), and FDA (Food and Drug Administration) have imposed strict guidelines on the use of petroleum-based and synthetic rheology modifiers, restricting the presence of toxic chemicals, heavy metals, and high-VOC compounds in final products. These regulations are particularly stringent in industries such as pharmaceuticals, food processing, and personal care, where safety and sustainability standards are crucial. Compliance with these evolving regulations requires extensive product reformulation, additional testing, and increased R&D investments, adding to production costs. Additionally, regional disparities in regulatory policies further complicate global trade, making it difficult for manufacturers to expand operations across multiple markets without facing legal hurdles.

Rheology Modifiers Market Segmentation Analysis

By Type

The organic rheology modifiers dominated the market in terms of the largest share, around 70%, in 2023. characterized by their performance, eco-friendliness, and several applications across various industries. Cellulose, xanthan gum, guar gum, and polymers that are based upon acrylics are some of the derivatives which are combined within these groups of modifiers, to provide optimum viscosity control, suspension, and stability enhancement in systems, making these four of the most favored modifiers used in paints & coatings, personal care, pharmaceuticals, and construction. Governments around the world are imposing stringent environmental regulations prohibiting the use of synthetic and petroleum-based alternatives, forcing manufacturers to shift towards bio-based and low-VOC organic rheology modifiers from systems that comply with sustainability goals related to EPA and REACH regulations.

By End-Use

Paints & Coatings segment held the largest market share at around 35% in 2023. It is due to its broad usage in architectural, industrial, automotive, and protective coatings during the years to come. Rheology modifiers are used in paints to manage viscosity, increase stability, enhance application properties, and prevent sagging or settling in the formulation. Manufacturers are adopting organic and bio-based rheology modifiers as demand increases for water-based and low-VOC coatings due to stringent environmental regulations imposed by the EPA, REACH, and other agencies. In addition to this, the demand for decorative and protective coatings, especially in middle-income countries, where the construction sector is booming, has supported the market. Moreover, innovations such as smart coatings and high-performance industrial coatings have resulted in customized rheology modifiers that have positively impacted the adoption of this modifier in the paints & coatings sector.

By Distribution Channel

Indirect held the largest market share around 72% in 2023. This is owing to its potential of increasing market access, increasing the overall supply chain efficiency, and being a cost-effective solution for the manufacturers. Rheology modifier manufacturers offering their products through distributors, wholesalers, and third-party suppliers can service a broad spectrum of end-use industries such as paints & coatings, personal care, pharmaceuticals, and construction without needing direct sales forces in different geographies. This channel allows manufacturers to utilize the distributor logistics network and their customer bases to achieve shorter lead times in delivery, local inventory management, and easier compliance with regulations in each geography. Furthermore, along with the above-mentioned functions, distributors also provide technical support, customization of product, and post-sales services, which therefore makes it the most preferred choice for end-users among others.

Rheology Modifiers Market Regional Outlook

Asia Pacific held the largest market share, around 39%, in 2023. The growing industrialization, infrastructural development, and urbanization in emerging economies such as China, India, and Japan have contributed to escalating the demand for high-performance coatings, adhesives, and sealants, which rely highly on rheology modifiers. Moreover, the growing personal care and cosmetics sector, as a result of increasing disposable incomes and altering consumer preferences, has stimulated the market growth. Asia Pacific has dominated over the global chemical warehousing market owing to the presence of significant raw material suppliers, low-cost manufacturing facilities, and government policies favoring domestic chemical manufacturing. In addition, the increasing demand for bio-based & eco-friendly rheology modifiers due to the stringent regulations in countries like China and South Korea has assisted the region in retaining its market dominance.

North America held a significant market share. It is attributed to the presence of a high industrial base, advanced technological infrastructure, and regulatory framework pushing companies to innovate in product development. North America registered the highest market share in the global rheology modifiers market, owing to the presence of leading manufacturers of paints & coatings, personal care, and pharmaceuticals, who are among the largest consumers of these modifiers in the region, specifically in the U.S. In North America, rising demand for sustainable and high-performance formulations is fuelling the need for bio-based and low-VOC rheology modifiers that comply with environmental regulations established by agencies such as the EPA and FDA. Moreover, existing supply chains, R&D, and skilled labor have helped produce innovative rheology modifier products, resulting in continued dominance of the region. In addition, rapid growth of the construction and automotive industries also drives demand for quality coatings and sealants, which in turn strengthens the market share of North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Attagel, Rheovis)

-

The Dow Chemical Company (Acusol, Dowanol)

-

Clariant AG (Aristoflex, Genamin)

-

Elementis plc (Bentone, Rheolate)

-

Ashland Global Holdings Inc. (Aqualon, Natrosol)

-

Croda International Plc (Syncrowax, ViscOptima)

-

Lubrizol Corporation (Carbopol, Pemulen)

-

Arkema S.A. (Coapur, Rheostyl)

-

Evonik Industries AG (Aerosil, Sipernat)

-

AkzoNobel N.V. (Bermocoll, ELOTEX)

-

Allnex (Cymel, ADDITOL)

-

SNF Floerger (Flosperse, Flopam)

-

KCC Corporation (SilSense, RheoCare)

-

Stepan Company (Stepanpol, Stepanquat)

-

Wacker Chemie AG (VINNAPAS, HDK)

-

BYK-Chemie GmbH (BYK-410, BYK-7420)

-

Troy Corporation (Troysan, Mergal)

-

DSM (NeoRez, NeoRad)

-

Eastman Chemical Company (Advantex, Solusolv)

-

Cabot Corporation (Empower, SpectrAl)

Recent Development:

-

In 2023, BASF introduced Attagel 50, an advanced rheology modifier developed to enhance the suspension and stability of coatings and inks, meeting the increasing demand for high-performance and sustainable solutions.

-

In 2023, Clariant expanded its Aristoflex range with the launch of Aristoflex Velvet, a sustainable rheology modifier designed to enhance texture and sensory characteristics in personal care formulations, catering to the rising demand for clean beauty products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.40 Billion |

| Market Size by 2032 | USD 11.99 Billion |

| CAGR | CAGR of 4.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Organic, Inorganic) •By End Use (Paints & Coatings, Personal Care & Cosmetics, Pharmaceuticals, Oil & Gas, Construction, Others) •By Distribution Channel (Direct, Indirect) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, The Dow Chemical Company, Clariant AG, Elementis plc, Ashland Global Holdings Inc., Croda International Plc, Lubrizol Corporation, Arkema S.A., Evonik Industries AG, AkzoNobel N.V., Allnex, SNF Floerger, KCC Corporation, Stepan Company, Wacker Chemie AG, BYK-Chemie GmbH, Troy Corporation, DSM, Eastman Chemical Company, Cabot Corporation |