Optical Coherence Tomography Market Report Scope & Overview:

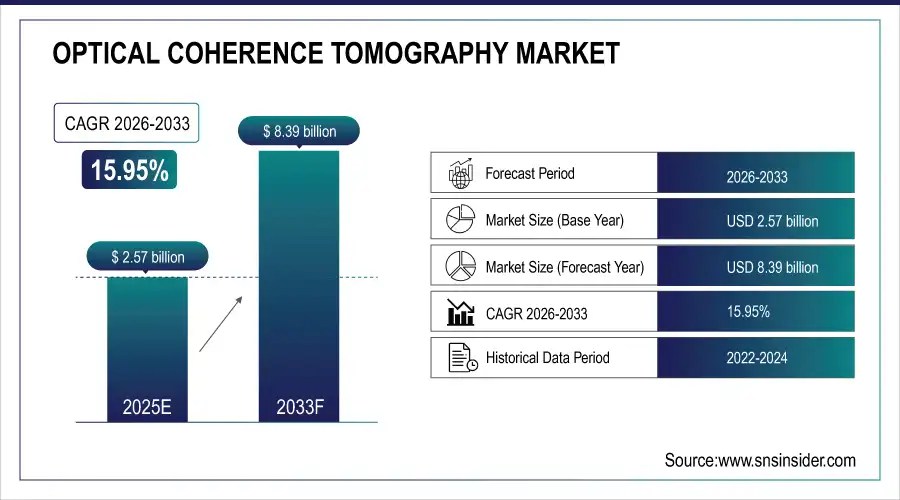

The Optical Coherence Tomography Market size was valued at USD 2.57 Billion in 2025E and is expected to reach USD 8.39 Billion by 2033, growing at a CAGR of 15.95% over the forecast period 2026–2033.

The market is gaining traction with increasing applications in ophthalmology, dermatology, cardiology, and oncology. Its ability to generate high-resolution, cross-sectional imaging without invasive procedures significantly supports early diagnosis and patient care. Technological integration with AI, portable devices, and cloud-enabled imaging platforms is further strengthening its dominance in clinical and research ecosystems.

To Get more information on Optical Coherence Tomography Market - Request Free Sample Report

The Optical Coherence Tomography Market is witnessing strong growth fueled by rising demand for non-invasive diagnostics and early-stage disease detection. Increasing incidence of ophthalmic disorders, skin cancers, and cardiovascular diseases accelerates adoption across hospitals and research institutes. Advancements in frequency-domain techniques, portable Optical Coherence Tomography devices, and AI-driven image analytics are fostering efficiency, improving accessibility, and enabling wider applications in routine medical practice, thereby solidifying global market expansion.

Optical Coherence Tomography Market Size and Forecast:

-

Market Size in 2025E: USD 2.57 Billion

-

Market Size by 2032: USD 8.39 Billion

-

CAGR: 15.95% from 2025 to 2032

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Key Optical Coherence Tomography Market Trends:

-

Rising prevalence of ophthalmic conditions such as diabetic retinopathy and glaucoma is fueling Optical Coherence Tomography device adoption.

-

Miniaturization of handheld Optical Coherence Tomography devices is boosting portability and accessibility for point-of-care diagnostics.

-

Integration of Optical Coherence Tomography with AI and machine learning enhances image interpretation speed and clinical decision-making.

-

Growing use of Optical Coherence Tomography in dermatology for skin cancer detection supports market diversification.

-

Development of Doppler Optical Coherence Tomography expands its role in cardiovascular and blood-flow visualization.

-

Increasing funding for research accelerates development of next-generation Optical Coherence Tomography systems with higher resolution and depth.

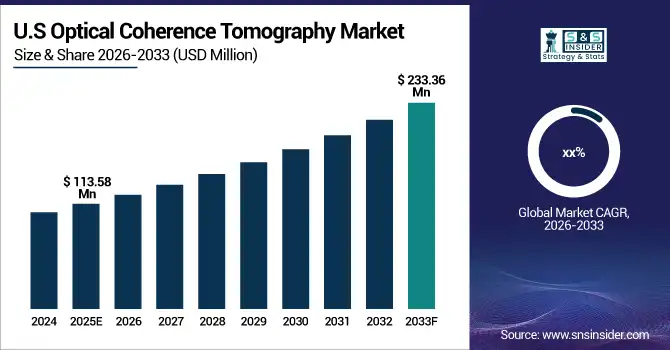

U.S. Optical Coherence Tomography Market Insights

The U.S. Optical Coherence Tomography Market size was USD 113.58 million in 2025E and is expected to reach USD 233.36 million by 2033. According to a study, increasing prevalence of diabetic retinopathy in nearly 10 million Americans by 2030 is driving rapid adoption of Optical Coherence Tomography in ophthalmology centers. This cause, rising chronic disease burden, effects accelerated Optical Coherence Tomography integration into hospital settings, supporting early detection and treatment management. Advanced Optical Coherence Tomography imaging technologies enhance patient outcomes through real-time, high-resolution screening, making them integral to the U.S. healthcare ecosystem.

Optical Coherence Tomography Market Driver:

-

Growing Prevalence of Ophthalmic Disorders Drives Optical Coherence Tomography Advancements in Medical Imaging Research Launch

The growing prevalence of vision-threatening diseases such as glaucoma, age-related macular degeneration (AMD), and diabetic retinopathy has become a pivotal driver for Optical Coherence Tomography adoption. In May 2025, a major U.S. research institute announced an advanced FD-Optical Coherence Tomography imaging platform capable of detecting microstructural eye changes years before clinical symptoms. This cause, rising patient needs for early detection, effects high adoption in diagnostic centers and hospitals. Optical Coherence Tomography is reducing blindness risks through its rapid, non-invasive imaging accuracy, creating expanded market demand.

In 2025, the American Academy of Ophthalmology highlighted that Optical Coherence Tomography usage prevents up to 40% of avoidable blindness cases linked to AMD and diabetic retinopathy. Hospitals with advanced Optical Coherence Tomography systems recorded faster intervention capabilities, reinforcing Optical Coherence Tomography’s role as a critical diagnostic technology in modern healthcare ecosystems.

Optical Coherence Tomography Market Restraints:

-

High Cost of Optical Coherence Tomography Devices and Limited Insurance Coverage Restrict Accessibility Across Emerging Healthcare Systems

Despite clinical benefits, the high upfront costs of Optical Coherence Tomography devices, averaging USD 40,000–75,000, and limited insurance reimbursement barriers restrict mass adoption. This cause, financial inaccessibility and poor policy support, effects delays in widespread application, particularly in developing regions. Training needs and maintenance requirements further compound entry challenges. Smaller clinics in cost-sensitive regions often avoid Optical Coherence Tomography adoption, perpetuating diagnostic gaps for preventable eye diseases. Addressing affordability and reimbursement frameworks remains essential for global Optical Coherence Tomography expansion.

In 2024, a survey of 300 private clinics across India revealed over 60% cited high investment costs as the primary reason for not adopting Optical Coherence Tomography devices. Inadequate reimbursement coverage discouraged purchase decisions, leaving patients reliant on tertiary hospitals for advanced eye imaging services.

Optical Coherence Tomography Market Opportunities:

-

AI-Powered Optical Coherence Tomography Platforms Open New Growth Opportunities in Cloud-Integration Launch by a U.S. Startup

The integration of artificial intelligence and cloud-based platforms with Optical Coherence Tomography devices presents significant opportunities. In June 2025, a U.S.-based imaging startup launched an AI-driven cloud-integrated Optical Coherence Tomography solution that enables remote diagnostics for retinal diseases. This cause, demand for faster clinical insights, effects improved accuracy, accessibility, and scalability across healthcare networks. Remote consultation potential accelerates Optical Coherence Tomography penetration, especially in telehealth ecosystems, broadening patient reach and supporting value-driven healthcare delivery.

A joint AI-Optical Coherence Tomography pilot program in 2025 across U.S. rural clinics reduced ophthalmologist review time by 65% and improved diagnostic confidence rates for diabetic retinopathy. Cloud-enabled Optical Coherence Tomography imaging allowed specialists to analyze high-resolution scans remotely, drastically reducing patient referral delays while expanding care access.

Optical Coherence Tomography Market Segmentation Analysis:

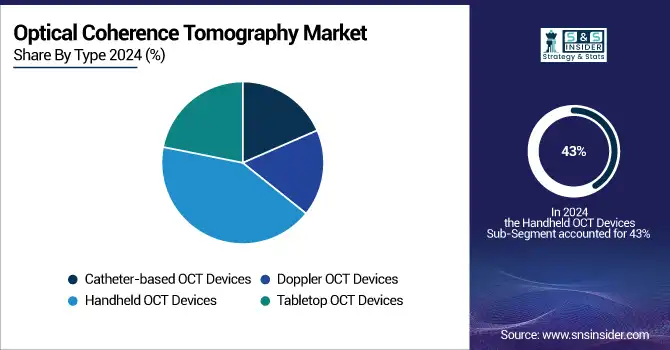

By Type: Handheld Optical Coherence Tomography Devices Lead Market While Doppler Optical Coherence Tomography Devices Register Fastest Growth.

Handheld Optical Coherence Tomography Devices captured 43% of revenue share in 2025E, dominating the market. This cause, ease of portability and point-of-care use, effects higher adoption in ophthalmology clinics and outreach programs. Product development focusing on compact, wireless, and AI-integrated handheld scanners is accelerating usage, strengthening their dominance in routine diagnostics.

Doppler Optical Coherence Tomography Devices are expanding rapidly with a CAGR of 21.55%, the fastest in the segment. This cause, demand for cardiovascular blood-flow measurement, effects higher R&D investment and new clinical approvals. Their ability to visualize microvascular structures supports growth, particularly in interventional cardiology, where Optical Coherence Tomography complements traditional angiography.

By Technology: Frequency Domain Optical Coherence Tomography Leads Market While Time Domain Optical Coherence Tomography Registers Fastest Growth.

Frequency Domain Optical Coherence Tomography (FD-OCT) holds 42% of market share in 2025E, dominating due to high-speed image capture and precision. This cause, demand for accurate cross-sectional eye imaging, effects preferred usage in ophthalmology diagnostics. Advances in FD-Optical Coherence Tomography platforms are enhancing resolution, reinforcing market leadership in clinical diagnostic equipment.

Time Domain Optical Coherence Tomography is expected to grow at a CAGR of 21.24% during the forecast period. This cause, affordability and wider accessibility, effects adoption in smaller diagnostic centers and emerging economies. Continuous product enhancements for improved scan speed ensure TDO remains a viable cost-effective option, expanding the patient base.

By Application: Ophthalmology Leads Market While Dermatology Registers Fastest Growth.

Ophthalmology applications accounted for 43% of revenue in 2025E, dominating the Optical Coherence Tomography market. This cause, rising prevalence of diabetic eye disease and AMD, effects reliance on Optical Coherence Tomography for early detection. Its integration into eye hospitals globally highlights Optical Coherence Tomography as the gold standard in ophthalmic diagnostics.

Dermatology applications are expected to grow at the highest CAGR within the forecast, driven by rising cases of melanoma and other skin cancers. This cause, demand for non-invasive skin imaging, effects deeper Optical Coherence Tomography penetration in dermatology clinics. Technological innovations extending tissue penetration enable accurate lesion diagnosis without biopsies, spurring adoption.

By End-User: Hospitals & Clinics Lead Market While Ambulatory Surgical Centers Register Fastest Growth.

Hospitals & Clinics dominated the end-user segment with 35% revenue share in 2025E. This cause, larger patient bases and advanced infrastructure, effects consistent Optical Coherence Tomography adoption for ophthalmology, cardiology, and oncology imaging. Healthcare investments in modern diagnostic imaging strengthen hospitals’ leadership role.

Ambulatory Surgical Centers (ASCs) are expected to grow fastest during the forecast period. This cause, rising outpatient diagnostic procedures, effects rapid Optical Coherence Tomography installation in minimally invasive care pathways. Product innovations focusing on compact, cost-effective Optical Coherence Tomography units are accelerating adoption in ASCs, supporting efficient patient turnaround and cost savings.

Optical Coherence Tomography Market Regional Analysis

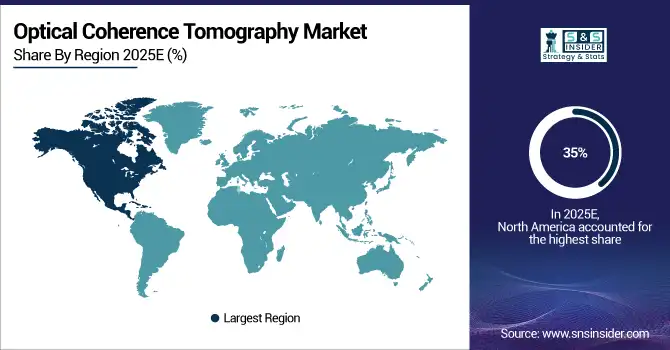

North America dominates the Optical Coherence Tomography Market in 2025E.

In 2025E, North America holds an estimated 35% share of the Optical Coherence Tomography (Optical Coherence Tomography) Market, driven by strong healthcare infrastructure, early technology adoption, and increasing prevalence of ophthalmic disorders. The region benefits from advanced reimbursement systems, widespread hospital networks, and robust R&D initiatives. High awareness of AI-based Optical Coherence Tomography platforms and integration of cutting-edge imaging technologies reinforce North America’s leadership in the global Optical Coherence Tomography market.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

United States leads North America’s Optical Coherence Tomography Market

The U.S. dominates due to advanced healthcare systems, high prevalence of chronic eye diseases, and rapid adoption of AI-enabled Optical Coherence Tomography platforms. Well-established hospitals, specialized clinics, and research centers drive demand. Government-backed healthcare initiatives, coupled with increasing investments in diagnostic imaging, ensure the U.S. remains the largest contributor to North America’s Optical Coherence Tomography revenues.

Asia Pacific is the fastest-growing region in the Optical Coherence Tomography Market in 2025E.

The Asia Pacific Optical Coherence Tomography market is projected to grow at an estimated CAGR of 14.8% in 2025E, fueled by expanding healthcare access, rising chronic disease populations, and government-led digital health initiatives. Increasing ophthalmology screening programs and adoption of AI-enabled Optical Coherence Tomography solutions accelerate market growth. Rapid urbanization and awareness campaigns for diabetic retinopathy screening further drive the adoption of Optical Coherence Tomography devices across the region.

-

China leads Asia Pacific’s Optical Coherence Tomography Market

China dominates the Asia Pacific market due to substantial healthcare digitalization investments, large-scale ophthalmology programs, and government-led AI-healthcare partnerships. Focused initiatives on early detection of retinal disorders and widespread integration of advanced Optical Coherence Tomography platforms in hospitals and clinics reinforce China’s position as the leading contributor to the region’s fast-growing Optical Coherence Tomography revenues.

Europe Optical Coherence Tomography Market insights, 2025E

Europe accounted for a significant share of the Optical Coherence Tomography market in 2025E, supported by advanced healthcare infrastructure, early adoption of Optical Coherence Tomography in ophthalmology and dermatology, and robust R&D activities. Strict EU medical policies, regulatory compliance, and focus on high-precision diagnostics sustain Optical Coherence Tomography demand across hospitals and diagnostic centers. The region emphasizes AI integration and clinical innovation, strengthening adoption and market stability.

-

Germany leads Europe’s Optical Coherence Tomography Market

Germany dominates due to its strong optometry ecosystem, growing aging population, and government support for diagnostic imaging innovations. High adoption of Optical Coherence Tomography in ophthalmology, dermatology, and research institutions reinforces regional leadership. Strategic investments in AI-enabled Optical Coherence Tomography solutions and robust healthcare funding make Germany a primary driver of Europe’s Optical Coherence Tomography revenues.

Middle East & Africa and Latin America Optical Coherence Tomography Market insights, 2025E

The Optical Coherence Tomography market in MEA and Latin America shows steady growth in 2025E, driven by healthcare modernization, government-backed digital health initiatives, and rising awareness of ophthalmic disorders. Investments in AI-enabled Optical Coherence Tomography platforms and clinical infrastructure support market expansion in both regions.

In Latin America, Brazil leads with extensive diabetic retinopathy screening programs, export-oriented healthcare equipment, and adoption of advanced Optical Coherence Tomography devices. In the Middle East & Africa, the UAE dominates with healthcare reforms, AI integration in diagnostics, and strategic investments in medical imaging infrastructure, driving regional growth.

Competitive Landscape for the Optical Coherence Tomography Market

Sentek Technologies

Sentek Technologies is a global leader in Optical Coherence Tomography instrument development, specializing in high-resolution imaging for ophthalmology and life sciences. The company provides advanced Optical Coherence Tomography scanners widely used in disease diagnosis, research, and clinical applications. Sentek’s role in the Optical Coherence Tomography market is significant, supporting precision imaging and enhanced diagnostic accuracy across medical and research institutions.

-

In April 2025, Sentek launched a portable Optical Coherence Tomography scanner with AI-enhanced analytics for early retinal disease detection, expanding accessibility in clinical environments.

Campbell Scientific

Campbell Scientific develops Optical Coherence Tomography-integrated imaging platforms, focusing on combining high-precision Optical Coherence Tomography with environmental and medical sensing systems. Its contribution lies in enabling cross-domain adoption by integrating Optical Coherence Tomography with multiparameter diagnostic and research platforms, facilitating accurate and comprehensive monitoring.

-

In March 2025, Campbell released a hybrid Optical Coherence Tomography-datalogger solution tailored for advanced research and clinical ophthalmology applications, enhancing both operational efficiency and data accuracy.

Irrometer Company

Irrometer Company specializes in cost-efficient Optical Coherence Tomography platforms designed for small and mid-scale diagnostic practices. The company emphasizes affordability and robust design, fostering adoption in developing and resource-limited markets. Irrometer’s solutions increase accessibility while maintaining high-quality imaging standards.

-

In January 2025, Irrometer introduced a compact Optical Coherence Tomography unit for community clinics, expanding market reach and supporting broader clinical adoption of Optical Coherence Tomography technology.

Delta-T Devices

Delta-T Devices, headquartered in the U.K., delivers innovative Optical Coherence Tomography imaging solutions with strong academic and clinical partnerships. The company focuses on enhancing resolution, precision, and analytical capabilities for research and healthcare ecosystems.

-

In June 2025, Delta-T Devices unveiled an Optical Coherence Tomography platform integrated with machine learning algorithms for advanced disease forecasting, strengthening predictive diagnostics and clinical decision-making in ophthalmology and life sciences.

Optical Coherence Tomography Market Key Players:

-

Carl Zeiss Meditec AG

-

Topcon Corporation

-

Canon Inc.

-

NIDEK Co., Ltd.

-

Optovue, Inc.

-

Heidelberg Engineering GmbH

-

Santec Corporation

-

Lumedica, Inc.

-

Olympus Corporation

-

Abbott Laboratories

-

Terumo Corporation

-

Siemens Healthineers

-

Philips Healthcare

-

Thorlabs, Inc.

-

Avinger, Inc.

-

Bioptigen, Inc.

-

Canon U.S.A., Inc.

-

Quantel Medical

-

Edmund Optics, Inc.

-

Optiscan Imaging Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 2.57 Billion |

| Market Size by 2032 | US$ 8.39 Billion |

| CAGR | CAGR of 15.95 % From 2025 to 2032 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Catheter-based OCT Devices, Doppler OCT Devices, Handheld OCT Devices, Tabletop OCT Devices) • By Technology (Time Domain OCT (TDOCT), Frequency Domain OCT (FD-OCT), Spatial Encoded Frequency Domain OCT, Fourier Domain OCT (FDOCT), Others) • By Application (Ophthalmology, Cardiovascular, Oncology, Dermatology, Others) • By End-User (Hospitals & Clinics, Diagnostic Centers, Research Institutes, Ambulatory Surgical Centers (ASCs), Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Carl Zeiss Meditec AG, Topcon Corporation, Canon Inc., NIDEK Co., Ltd., Optovue, Inc., Heidelberg Engineering GmbH, Santec Corporation, Lumedica, Inc., Olympus Corporation, Abbott Laboratories, Terumo Corporation, Siemens Healthineers, Philips Healthcare, Thorlabs, Inc., Avinger, Inc., Bioptigen, Inc., Canon U.S.A., Inc., Quantel Medical, Edmund Optics, Inc., Optiscan Imaging Limited, and Others. |