Virtual Fitness Market Report Scope & Overview:

Get more information on Virtual Fitness Market - Request Free Sample Report

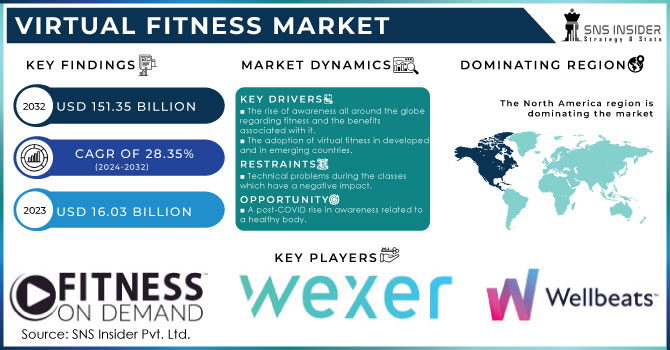

The Virtual Fitness Market size was estimated at USD 16.03 billion in 2023 and is expected to reach USD 151.35 billion by 2032 at a CAGR of 28.35% during the forecast period of 2024-2032.

The demand for virtual fitness solutions is driven by several factors, including the increasing prevalence of sedentary lifestyles, the desire for personalized workout experiences, and the convenience of home-based exercise. The study findings indicate that users are motivated by the engaging and effective nature of virtual fitness trainers, which can be attributed to the incorporation of practice learning strategies and the use of observation learning principles.

The increasing number of chronic diseases like cancer and others which requires physical activities and exercise, because of sedative as well as busy lifestyles they demand for personalized and home-based exercise also increases the demand for the virtual fitness market in future year. The increasing preference for convenient and accessible workouts, coupled with heightened health consciousness and stress levels, has driven consumers to shift from traditional gym memberships to digital fitness solutions. This trend is particularly prevalent among millennials.

A recent clinical trial showcased the effectiveness of virtual mind-body fitness in reducing hospitalization rates among cancer patients. By providing patients with a variety of exercise and mindfulness options, these programs empower individuals to maintain their physical and mental health while undergoing treatment. As research continues to validate the benefits of virtual fitness for cancer patients, it is likely that demand for these programs will continue to grow, leading to increased integration into standard cancer care protocols.

According to WHO, in 2022 alone, there were approximately 20 million new cancer cases diagnosed worldwide, resulting in nearly 10 million deaths. While 53.5 million people survived cancer for at least five years, the disease still claims the lives of roughly one in nine men and one in twelve women.

The supply side of the virtual fitness market is characterized by the development of AI-powered trainers, which can provide personalized guidance and adapt to individual fitness levels. While these platforms offer a cost-effective and accessible alternative to traditional personal training, there is still room for improvement in terms of content variety and user experience.

The convergence of virtual and physical realms, often termed the metaverse, is rapidly transforming the fitness industry. Building upon advancements in virtual and augmented reality, fitness experiences are becoming increasingly immersive and interactive. While early platforms offered basic virtual workout environments, the metaverse is unlocking new possibilities for personalized, social, and gamified fitness experiences. With major tech companies investing heavily in this space, the availability of affordable VR headsets and smartphones has made virtual fitness more accessible to a wider audience. This shift is not only redefining how we exercise but also creating new opportunities for fitness businesses and content creators.

As the metaverse continues to evolve, expected to see even more innovative fitness applications, from virtual personal training to competitive gaming-inspired workouts. However, challenges such as ensuring data privacy and accessibility for all users must be addressed to fully realize the potential of virtual fitness within the metaverse.

Overall, the results suggest a strong market demand for virtual fitness solutions, with the potential for significant growth as technology continues to advance and consumer preferences evolve.

Market Dynamics

Drivers

-

Personalized Workouts, Real-Time Feedback, and Injury Prevention Drive Demand for Advanced Home Fitness Solutions

AI is transforming the fitness industry, with AI-powered virtual trainers leading the charge. These digital coaches offer personalized workout plans, real-time feedback, and injury prevention, making fitness more accessible and effective. The increasing popularity of home workouts has fueled demand for such platforms. By leveraging advanced technologies like motion tracking, AI trainers provide tailored guidance, helping users achieve their fitness goals while avoiding common pitfalls. This shift towards virtual fitness is driven by convenience, cost-effectiveness, and the desire for personalized health and wellness solutions.

-

Increasing rate of obesity and related health conditions

-

Rising healthcare costs

-

Low levels of physical activity in the population

-

Advancements in virtual reality and wearable technologies

-

Growing demand for personalized and appropriate fitness solutions

Restraints

-

Social Interaction Deficits, Technical Issues, and Privacy Concerns Limit Adoption

A lack of social interaction, technical difficulties, equipment requirements, concerns about accountability, and the limitations of virtual environments compared to physical gyms. Privacy and security issues also deter users from fully embracing this digital fitness trend. Overcoming these obstacles is essential for the continued growth of the virtual fitness market.

Key Segmentation

By Session Type

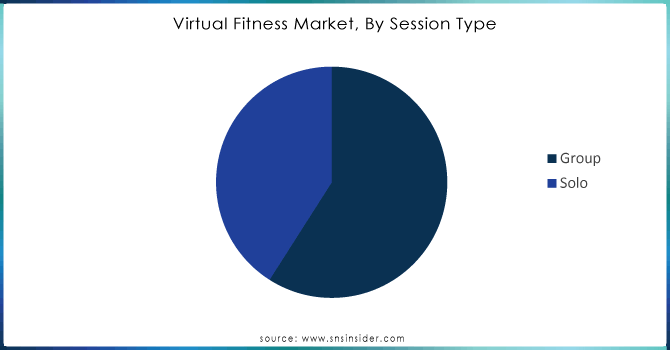

In 2023, group segment dominated, held a massive 59.1% share of the market. This popularity stems from the focus on functional fitness and improved posture offered by group sessions. Additionally, many people simply enjoy the camaraderie and motivation that comes with exercising alongside others. Surveys show this preference, with 56% favoring group workouts, while 27% enjoy exercising with some level of social interaction. Group fitness offers a wide variety of options, from yoga to Zumba, allowing individuals to choose the style that best suits them.

However, the solo segment is predicted to be the fastest growing area of the market between 2024 and 2032. This surge is due to the highly personalized nature of one-on-one training. Solo sessions allow trainers to tailor programs and provide specific guidance to help individuals achieve their unique fitness goals more efficiently. This trend is further fueled by the development of innovative software and company collaborations aimed at delivering advance solo programs to meet the diverse needs of virtual fitness participants.

Need any customization research on Virtual Fitness Market- Enquiry Now

By Streaming Type

On-demand was the dominated segment with 63% share in 2023, are the most popular choice. Consumers appreciate the flexibility of accessing a wide range of workouts, trainers, and programs at their convenience. To cater to diverse preferences, on-demand platforms are expanding their offerings to include various fitness levels, music styles, and workout intensities.

The live segment is projected to experience rapid growth. Live workouts offer real-time interaction with trainers and a sense of community. Major gym chains and fitness equipment manufacturers are entering the live streaming market, providing high-quality workouts and opportunities for social engagement.

By Device Type

Smartphones segment emerged as the primary platform for virtual fitness with 68% share in 2023. Their widespread adoption across age groups, coupled with the integration of fitness apps and trackers, has solidified their dominance in the market. The increasing smartphone penetration in developing countries like India further fuels this trend.

While smartphones lead the way, laptops, desktops, and tablets segments are also gaining traction. The rise of indoor workouts has boosted the demand for larger screens and better performance offered by these devices. As a result, this segment is poised for significant growth in the forecast period.

Regional Analysis

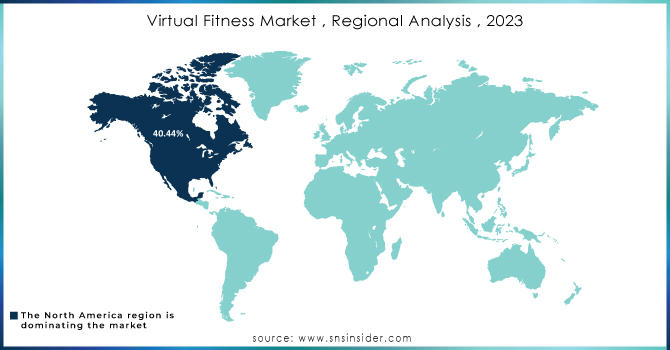

North America dominated the virtual fitness market in 2023 with 40.44%, driven by a perfect storm of factors. The surge in smartphone ownership, coupled with the aging population and rising chronic disease rates, created a fertile ground for digital health solutions. The COVID-19 pandemic accelerated this trend as people sought at-home workout alternatives.

A significant portion of Americans adopted fitness apps during the pandemic and even cancelled gym memberships.

Asia Pacific is poised for substantial growth. Countries like Japan, South Korea, and China are experiencing a fitness and health consciousness surge. The region's high obesity rates and increasing diabetes prevalence are driving demand for online workouts. As awareness of the health risks associated with sedentary lifestyles grows, more people are turning to virtual fitness platforms for convenient and accessible exercise options.

Key Players

The major key players are Éconofitness, Les Mills International Ltd., Viva Leisure, FitXR, ClassPass, Wexer, MINDBODY, Inc., Fitness On Demand, Fitbit, Move Technologies Group Ltd, Sworkit (Nexercise, Inc.), Unscreen, Wellbeats, Navigate Wellbeing Solutions, VIXY BV, Sworkit (Nexercise, Inc), CFX, Reh-Fit Centre, GoodLife Fitness and others.

Recent developments

-

Aug 2024: Virtual fitness expands to care homes with Aria Care partners with Burns Gym to bring workouts to 50 facilities.

| Report Attributes | Details |

| Market Size in 2023 | US$ 16.03 Bn |

| Market Size by 2032 | US$ 151.35 Bn |

| CAGR | CAGR of 28.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Session Type (Group, Solo) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Éconofitness, Les Mills International Ltd., Viva Leisure, FitXR, ClassPass, Wexer, MINDBODY, Inc., Fitness On Demand, Fitbit, Move Technologies Group Ltd, Sworkit (Nexercise, Inc.), Unscreen, Wellbeats, Navigate Wellbeing Solutions, VIXY BV, Sworkit (Nexercise, Inc), CFX, Reh-Fit Centre, GoodLife Fitness |

| Key Drivers | • The rise of awareness all around the globe regarding fitness and the benefits associated with it. • The Adaption of virtual fitness in the developed and in the emerging countries. |

| Market Opportunities | • The demand for the fitness trainings and rise in the health-related problem amongst the older people. • Post Covid rise in the awareness related to healthy body. |