Optical Modulators Market Report Scope & Overview:

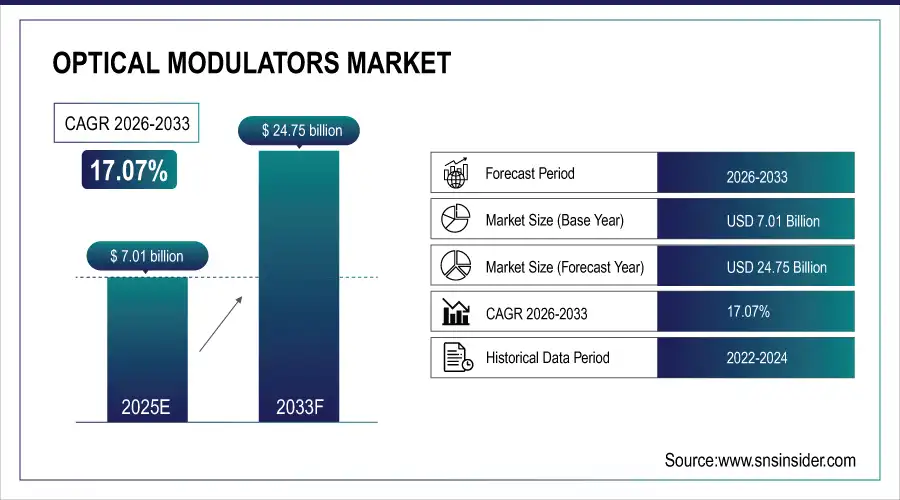

The Optical Modulators Market size was valued at USD 7.01 Bn in 2025E and is expected to reach USD 24.75 Bn by 2033 and grow at a CAGR of 17.07% by 2026-2033

The optical modulators market is now a vital part of the larger photonics sector, serving a critical function in transmitting optical signals. The market has been driven significantly by the increasing need for fast internet, data processing, and communication, with optical modulators allowing for the effective management of large data volumes on fiber optic networks. The increasing growth of 5G networks has led to a higher demand for advanced optical modulators, necessary for handling greater bandwidths and quicker data transfer speeds. The drive towards 5G has had a notable impact on the market, leading to ongoing advancements in modulator technologies to satisfy the strict performance demands of these advanced networks. by the middle of 2024, significant advancements and widespread adoption of 5G technology have been observed in the United States. About 90% of the American population now has access to 5G networks, thanks to the rapid spread of services provided by top carriers such as Verizon, AT&T, and T-Mobile.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 7.01 Billion

-

Market Size by 2033 USD 24.75 Billion

-

CAGR of 17.07% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Get more information on Optical Modulators Market - Request Sample Report

Optical Modulators Market Trends:

-

Accelerating deployment of fiber-optic communication networks to support high-speed and long-distance data transmission requirements.

-

Rising adoption of advanced optical modulators to enable higher bandwidth, lower latency, and energy-efficient data transfer.

-

Rapid expansion of hyperscale data centers and cloud infrastructure increasing demand for high-performance optical modulation technologies.

-

Growing data traffic from IoT devices, video streaming, and bandwidth-intensive applications driving network capacity upgrades.

-

Increased public and private investment in next-generation optical infrastructure to support digital transformation and 5G/6G connectivity.

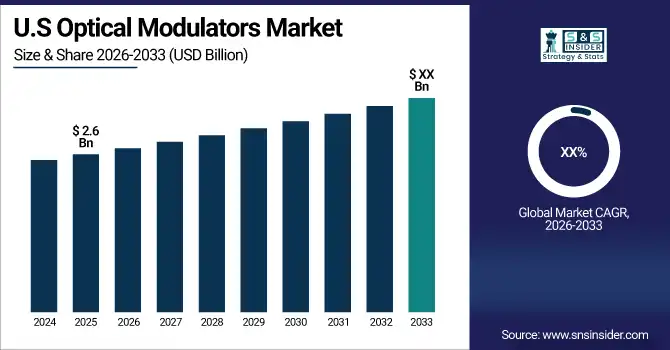

The U.S. optical modulators market, valued at approximately USD 2.6 billion in 2025E, is driven by strong demand for high-speed optical communication, expanding data centers, and rapid cloud adoption. Investments in fiber-optic infrastructure, 5G networks, and hyperscale facilities support market growth, while rising data traffic from IoT and AI applications further accelerates adoption across telecom and enterprise sectors.

Optical Modulators Market Growth Drivers:

-

The increasing usage of optical communication networks is becoming more prevalent.

The increasing usage of optical communication networks is a significant factor influencing the optical modulation technologies market. Optical communication networks utilize light signals for transmitting data over long distances with minimal loss, which makes them well-suited for high-speed data transmission. The increasing need for quicker and more dependable communication networks is leading to a rise in the use of optical networks, which is driving the need for optical modulators. The growing need for high-definition video streaming, online gaming, and other bandwidth-intensive applications is a crucial factor in the popularity of optical communication networks. These apps need to transmit huge amounts of data rapidly and consistently, a task most effectively done through optical communication systems. Optical modulators are essential in these networks as they facilitate the modulation of light signals, which leads to the efficient transfer of data at fast rates.

Optical Modulators Market Restraints:

-

Challenges related to technology in integrating systems and ensuring compatibility.

The integration and compatibility of optical modulators with current communication systems pose a major hurdle for the market due to technical challenges. Incorporating optical modulators into intricate optical communication networks poses difficulties concerning signal processing, alignment, and compatibility with other components. Integrating optical modulators with current electronic and photonic systems is a significant technical difficulty. Optical modulators need to function smoothly alongside lasers, detectors, and amplifiers in an optical communication network. Ensuring that these components are compatible can be difficult, especially when working with various technologies and materials. For instance, the complexity of integrating silicon photonics-based optical modulators with conventional electronic components may necessitate specialized interfaces or signal-processing techniques.

Optical Modulators Market Segment Analysis:

By Type

Phase modulators held a market share of over 38% in 2025E and dominated the market because of their vital function in sophisticated optical communication systems. These devices manipulate the phase of an optical signal while leaving its amplitude unchanged, which is necessary for fast data transmission. Phase modulators excel in the areas of high precision and stability, which are demanded by these networks. Lumentum and Thorlabs incorporate phase modulators in their optical network equipment to improve the quality and efficiency of data transmission. Liquid Crystal Modulators are expected to have rapid growth in the market during 2026-2033, due to their flexibility and ability to be used in different applications. LCMs control light by changing how liquid crystals are aligned, allowing for accurate adjustment of light brightness, polarization, and phase. Leading the development of advanced LCMs for various purposes, companies such as Meadowlark Optics and Santec Corporation are at the forefront in industries like holographic displays and optical coherence tomography. A growing need for high-quality screens and sophisticated imaging technology is driving the expansion of liquid crystal modulators, positioning them as a critical area of interest within the optical modulator sector.

By Application

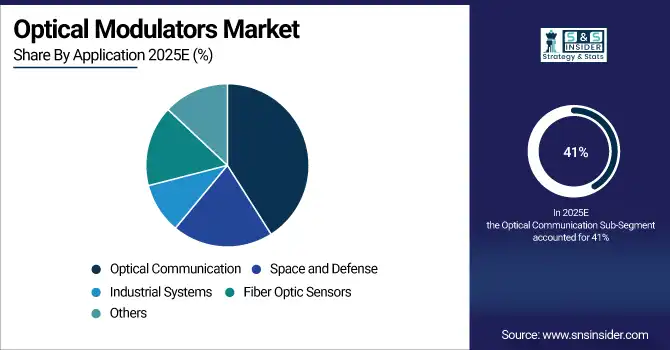

The optical communication sector led the market with over 41% market share in 2025E, due to increased data traffic, cloud services, and the rollout of 5G networks. Optical modulators are essential for improving the effectiveness of data transfer in fiber optic communication systems, which serve as the foundation of contemporary telecommunications. The growth of this sector is being driven by the rising need for greater bandwidth and reduced latency in data centers, telecommunications networks, and internet infrastructure.The space and defense segment is the most rapidly growing application in the optical modulators market during the forecast period, driven by the growing need for advanced, secure communication systems in military and space operations. Optical modulators play a crucial role in satellite communication, radar systems, and secure data links by facilitating the transfer of high-frequency signals with little loss and interference.

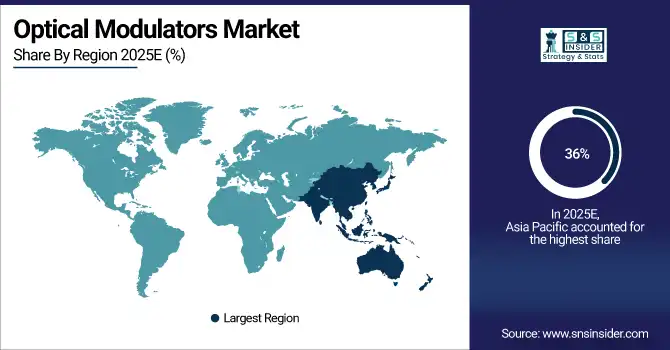

Optical Modulators Market Regional Analysis:

Asia Pacific Optical Modulators Market Insights

Asia-Pacific dominated the market in 2025E with more than 36% market share. Nations such as China, Japan, and South Korea are leading in the implementation of 5G technology, driving up the need for optical modulators in the area. The increase in data usage, along with the rise in data center quantity, is boosting market expansion even more. Fujitsu and Sumitomo Electric are important companies in the APAC region, working on the development of optical modulators for different uses like telecommunications, data centers, and fiber-optic networks. The optical modulators market in APAC is projected to experience continued growth due to the region's emphasis on digital transformation and smart city projects, especially in China and India, positioning it as a key area for advancing optical communication technologies.

Get Customized Report as per your Business Requirement - Request For Customized Report

North America Optical Modulators Market Insights

North America is accounted to have the fastest CAGR during 2026-2033 because of its state-of-the-art telecommunications infrastructure and substantial funding for research and development. Market growth has been driven by the existence of large technology firms and the quick acceptance of advanced communication technologies. Main companies such as Lumentum Holdings and Cisco Systems are leading advancements in optical modulators for high-speed data transmission in this area. The strong need for high-bandwidth communication networks in the area, fueled by cloud computing, data centers, and the rollout of 5G technology, reinforces its top status. Furthermore, efforts by the government to improve broadband connection in the U.S. and Canada are helping to boost the growth of the optical modulators market.

Europe Optical Modulators Market Insights

The Europe optical modulators market is driven by expanding fiber-optic networks, strong demand for high-speed broadband, and rising investments in data centers. Adoption of 5G infrastructure, cloud computing, and Industry 4.0 initiatives further supports growth. Countries such as Germany, the U.K., and France lead in technology adoption, research activities, and optical communication deployments.

Latin America (LATAM) and Middle East & Africa (MEA) Optical Modulators Market Insights

The LATAM and MEA optical modulators market is growing steadily due to increasing investments in telecom infrastructure and expanding fiber-optic networks. Rising internet penetration, cloud services adoption, and data center development in Brazil, Mexico, Saudi Arabia, and the UAE are driving demand for efficient optical modulation technologies across emerging digital economies.

Optical Modulators Market Key Players:

The key market players in Global Optical Modulators Market are Fujitsu Ltd., QuantaTech, QUBIG GmbH, Schafter + Kirchhoff GmbH, IBM Corp, Agiltron Inc, Cisco Systems Inc, Intel Corp, Gooch & Housego PLC, Jenoptik AG, Lumentum Holdings Inc, Inrad Optics, Inc., Intel Corporatonm, IPG Photonics Corporation, iXBlue Inc, Jenoptik AG, Newport Corporation, MKS Instruments Inc, Thorlabs Inc, Brimrose Corporation of America, Conoptics, Inc., Felles Photonic Instruments Limited, Sumitomo Corporation, Thorlabs, Inc., Viavi Solutions, Inc. and Other.

Competitive Landscape for Optical Modulators Market:

Coherent Inc. is a key player in the optical modulators market, offering advanced photonic solutions for high-speed optical communication, data centers, and industrial applications. The company’s expertise in lasers, optics, and electro-optic technologies supports efficient signal modulation, enabling higher bandwidth, low latency, and reliable performance across telecom and next-generation networking environments.

-

In March 2024, Coherent Inc. announced a nano-second optical modulator designed to enhance laser systems for telecommunication and medical equipment applications. It is characterized by the improved switching speed and flexibility of integration. The tool is geared toward high-growing industries.

Lumentum is a leading provider in the optical modulators market, delivering advanced photonic and electro-optic solutions for high-speed optical communication and data center networks. The company supports telecom operators and cloud service providers with high-performance modulation technologies that enable faster data transmission, improved signal integrity, and scalable network infrastructure.

-

In January 2024, Lumentum announced the innovation of the new high-speed silicon photonics modulator. As the industry was in great demand for a new solution for data centers and 5G networks, the tool was expected to be consumed on the highest level. The advantage of the new modulator was the low power dissipation and improved bandwidth.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 7.01 Billion |

| Market Size by 2033 | USD 24.75 Billion |

| CAGR | CAGR of 17.07% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Analog, Modulators, Amplitude Modulators, Phase Modulators, Liquid Crystal Modulators, Polarization Modulators, Others) • By Application (Optical Communication, Fiber Optic Sensors, Space And Defense, Industrial Systems, Other) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Fujitsu Ltd., QuantaTech, QUBIG GmbH, Schafter + Kirchhoff GmbH, IBM Corp, Agiltron Inc, Cisco Systems Inc, Intel Corp, Gooch & Housego PLC, Jenoptik AG, Lumentum Holdings Inc, Inrad Optics, Inc., Intel Corporatonm, IPG Photonics Corporation |