3D Printing Materials Market Key Insights:

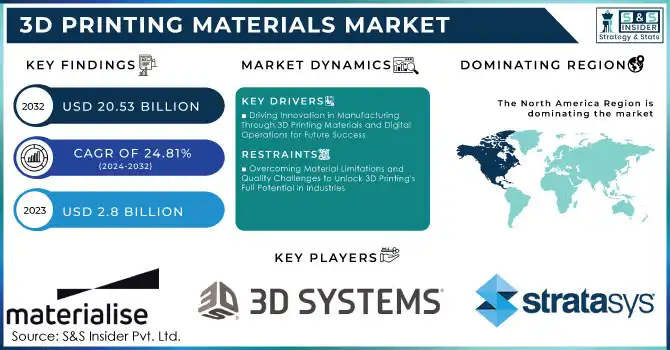

The 3D Printing Materials Market size was valued at USD 2.8 Billion in 2023 and is expected to reach USD 20.53 Billion by 2032 and grow at a CAGR of 24.81% during the forecast period of 2024-2032.

The 3D printing material market is growing due to the advancement of 3D printing technology which has been one of the main drivers for 3D printing materials. As a result of technological advancements, led to the specific requirements of industries and the diversification of materials based on their origin, chemical composition, performance, and other features. For example, 3D-printed metals can withstand high temperatures, and they have been used more frequently in the automotive and aerospace industries. As for polymers, they are mainly applied in 3D printing household appliances and larger objects due to the cheap price of the production and relatively low functionality. Simultaneously, such a widespread application of various materials was still preferable to traditional manufacturing methods, where different polymers are still used. Corporate aircraft average 75,000 miles per month. A single 3D-printed component can reduce air drag by 2.1%, cutting fuel costs by 5.41%. Additionally, producing jigs and fixtures through 3D printing can lower costs and lead times by 60 to 90% for each aircraft, as companies often have hundreds of these parts. Weight reduction is another significant benefit a 3D-printed metal bracket can weigh 50-80% less, saving around USD 2.5 million annually in fuel. Furthermore, 3D printing allows for precise material usage, leading to up to a 40% reduction in waste in metal applications

Get More Information on 3D Printing Materials Market - Request Sample Report

With more industries applying 3D printing for their operations, there was a growing need for appropriate materials that could have a high mechanical performance suitable for specific mechanical and functional requirements. This will also be particularly pronounced in the biomedical and healthcare industries, where 3D printing materials will become medical-grade and applicable to prosthetics, implants, and other biomedical devices.

3D Printing Materials Market Dynamics

KEY DRIVERS:

-

Driving Innovation in Manufacturing Through 3D Printing Materials and Digital Operations for Future Success

The increased application of digital manufacturing and Industry 4.0 is one of the key drivers of 3D printing materials’ growth. With more manufacturers opting for all-digital operations, there is a growing demand for materials that can work seamlessly with advanced 3D printing systems. A survey by Smartsheet found that about 40% of manufacturing companies are actively investing in 3D printing technologies and materials to enhance product design and reduce time-to-market. Indeed, the opportunity to reduce lead times of production cycles, as well as to create products that are extremely complex and customizable at once, is hard to ignore. Thus, material suppliers have to adjust to the changing operational patterns of many companies and develop formulations that are optimized for printing systems. For these industries that now have access to increased design freedom, it is critical to continue developing materials to suit the need for physical objects. Furthermore, companies are collecting data to analyze how the materials can be optimized, which implies that 3D printing materials will likely continue evolving as manufacturers learn how to improve different products’ properties. A study by MIT found that companies implementing 3D printing can reduce supply chain costs by 25-30% due to decreased transportation and inventory costs

-

Revolutionizing Manufacturing with Localized 3D Printing for Faster Production and Sustainable Practices

Mass production and shipment by some manufacturers and suppliers result in long supply chains that may be costly and can create delays. For example, after the introduction of the 3D printing technology to General Electric's process of producing the parts for jet engines, the number of details required to complete a fuel nozzle for a GE jet engine was reduced from 20 parts to one. In addition, the components were ready for delivery six times faster, with the entire lead time decreasing from 30 weeks to only 3. 3D printing is opening up opportunities to localize production so that parts and products can be produced on location at the given plant or factory. It is a development that fits with the aerospace industries or automotive sectors. As these industries increasingly wish to complete prototyping as rapidly as possible, and even on-site, there is a call for advanced materials that can be used in innovative 3D printing systems. Aerospace and automotive manufacturers will need to keep various components to match the chart covering all possible malfunctions and accidents. Airbus uses 3D printing in the production of some of its aircraft parts. The company has reportedly determined that lead times for specific components manufactured with this technology are decreased by 90% from the normal methods. According to forecasts, by 2030, Airbus will have integrated additive manufacturing when producing 20% of its parts.

RESTRAIN:

-

Overcoming Material Limitations and Quality Challenges to Unlock 3D Printing's Full Potential in Industries

The list of materials suitable for printing seems only to be expanding, many high-performance materials are still underdeveloped, and thus, their use is limited. As a result, certain industries, such as aerospace or medicine, struggle to utilize 3D printing for all components. Approximately 40% of manufacturers identified material constraints as a major impediment to the adoption of 3D printing technologies. Although the 3D printing materials market will be growing, only 15-20% are high-performing materials. Such a low amount of 3D printing materials can be used for different kinds of applications such as aerospace, and medical. Furthermore, the quality of the items remains questionable at best. The items created via 3D printing can vary in quality significantly, making them a potential concern in cases when the safety requirements must be met. Finally, although considerable advancements have been made in the realm of 3D printing, the high demand for skilled workers persists. With the complexity of the operation of 3D printing devices and the knowledge of materials required for the purpose, the staff should first obtain comprehensive training. Furthermore, the compatibility with the existing regulations in the realm of quality Management standards is a concern. In the context of aviation, for instance, every detail of an aircraft must be tested and certified by the appropriate authorities. Minding the above-mentioned facts is imperative to promote the further adoption and integration of the technology in other sectors.

3D Printing Materials Market Segment Analysis

BY OUTLOOK

Photopolymers segment dominated the total market share of 39.4% in 2023, and this industry is presently growing because of several factors. The material is in great demand since it can create the most intricate models, prototypes, and end-use objects. Furthermore, their superb resolution allows for obtaining highly detailed structures of relatively small sizes, which is useful in many industries, such as dentistry, jewelry, electronics, and others. Finally, they are both easy to use and convenient due to their quick curing time and ability to create smooth finishes. Thus, high-precision applications where such materials are in demand allow it to be the leading resin at the moment.

The thermoplastic segment is expected to grow at a high CAGR for 2024-2032. Organic chemicals encompassing synthetic polymers make this group of resins familiar to many and multifunctional. Its excellent mechanical properties and high tensile strength provide greater flexibility and durability, which is why such material is used for creating a wide range of objects, such as functional prototypes and end-use objects. The growing automotive, aerospace, and consumer goods industries require materials resistant to high temperatures or mechanical stress, which thermoplastics can provide. Additionally, the increasing demand for environmentally friendly materials is likely to enhance the demand for thermoplastics, creating some of the most significant market growth.

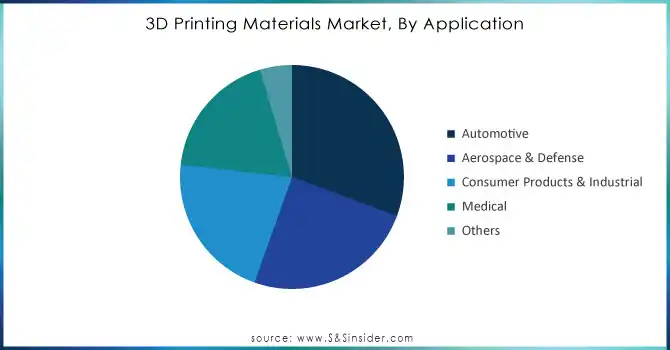

BY APPLICATION

The automotive segment dominated the 3D printing materials market with a market share of 30.6% in 2023, the automotive industry is adopting 3D printing due to the increased usage of this technology in prototyping, tooling, and manufacturing of end-use parts. Moreover, 3D printing facilitates the design process and reduces the design to a product lead time, physical waste, and cost. In emerging markets such as BRIC, automotive manufacturers are developing composite thermosetting parts, bumpers, and other automotive parts made from composites. Additionally, the trend of lightweight parts for achieving efficiency in performance is gaining the utmost importance in the manufacturing of components.

The aerospace and defense segment is expected to experience the highest growth from 2024 to 2032. First, the aerospace industry increasingly embraces 3D printing to produce complex components with reduced weight, which is crucial for improving fuel efficiency and performance. The ability to manufacture parts on demand significantly enhances supply chain efficiency and reduces the need for large inventories. Moreover, stringent regulations in the aerospace sector necessitate continuous innovation in materials that meet safety and performance standards. As manufacturers look to push the boundaries of design and functionality, they are increasingly turning to advanced 3D printing materials, including high-performance metals and polymers.

Need Any Customization Research On 3D Printing Materials Market - Inquiry Now

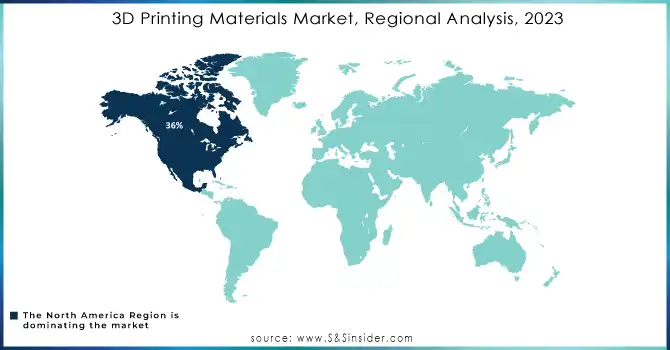

3D Printing Materials Market Regional Overview

North America held a dominant market share of 36% in 2023 in the 3D printing materials market, which can be attributed to its highly developed manufacturing infrastructure and considerable investments in research and development. It is also the home to many key players and innovative companies that lead and contribute to the development of 3D printing technologies. For instance, the United States is a hub for the global market leader in 3D printing solutions, Stratasys, which has been at the forefront of new material development and new applications in the automotive and aerospace industries. Moreover, the presence of car giants such as Ford and General Motors in North America has given strength to the adoption curve of 3D printing for prototype as well as production purposes, making North America a market leader in the region.

The Asia Pacific region will be the fastest-growing in the 3D printing materials market based on the provided forecast for the period from 2024 to 2032. In particular, such an increase can be explained by the growing demand for additive manufacturing in various industries, primarily in China and Japan. In China, for instance, SANY Heavy Industry, a company that produces construction machinery, has adopted 3D printing technology to develop large machinery parts. It has helped the firm to accelerate prices and reduce costs hours away from producing Iwabuchi, 2021). As for Japan, the country is one of the leaders in manufacturing and invests greatly in developing advanced technologies of production. For instance, Mitsubishi is now leveraging 3D printing in the production of pieces for its airplanes, which also enhances their efficiency and prospects for customization.

Key Players in 3D Printing Materials Market

Some of the major players in the 3D Printing Materials Market are:

-

Stratasys (ABS, PLA)

-

3D Systems (SLA Resin, Nylon)

-

EOS (PA12, AlSi10Mg)

-

Materialise (Magenta, MJP Resin)

-

HP (Nylon 12, TPU)

-

Formlabs (Tough Resin, Grey Resin)

-

Ultimaker (PLA, Nylon)

-

Sabic (ULTEM 9085, PETG)

-

Arkema (Rilsan, Kepstan)

-

BASF (Ultrafuse PLA, Ultrafuse TPU)

-

SABIC (Lexan, ULTEM)

-

Mitsubishi Chemical (Filament, Resin)

-

LG Chem (Polycarbonate, ABS)

-

Eastman Chemical Company (Tritan, Amphora)

-

RTP Company (RTP 3000, RTP 6000)

-

Nexa3D (Xtreme 8K Resin, XCE White Resin)

-

Xerox (Xerox 3D Printing, Filament)

-

Polymaker (PolyMax PLA, PolySupport)

-

ColorFabb (ColorFabb PLA, ColorFabb PETG)

-

Reprapper (ABS, PLA)

-

Axtra 3D

Some of the Raw Material Suppliers for 3D Printing Materials Companies:

-

BASF

-

Dow Chemical

-

Evonik Industries

-

DuPont

-

Solvay

-

Eastman Chemical

-

PolyOne

-

Mitsubishi Chemical

-

LG Chem

-

Sabic

RECENT TRENDS

-

In 2024, Axtra3D revolutionizes vat polymerization by merging digital light processing with laser stereolithography, achieving precise edges, superior finishes, and high throughput. These capabilities make it a standout choice for applications like molds and casting.

-

At Formnext 2024, HP introduced significant advancements in additive manufacturing (AM), including new materials, workflow optimization tools, and enhanced metal printing capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.8 Billion |

| Market Size by 2032 | USD 20.53 Billion |

| CAGR | CAGR of 24.81% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Outlook (Photopolymers, Thermoplastic, Metals, Others), • By Application (Automotive, Aerospace & Defense, Consumer Products & Industrial, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stratasys, 3D Systems, EOS, Materialise, HP, Formlabs, Ultimaker, Sabic, Arkema, BASF, SABIC, Mitsubishi Chemical, LG Chem, Eastman Chemical Company, RTP Company, Nexa3D, Xerox, Polymaker, ColorFabb, Reprapper |

| Key Drivers | • Driving Innovation in Manufacturing Through 3D Printing Materials and Digital Operations for Future Success • Revolutionizing Manufacturing with Localized 3D Printing for Faster Production and Sustainable Practices |

| Restraints | • Overcoming Material Limitations and Quality Challenges to Unlock 3D Printing's Full Potential in Industries |