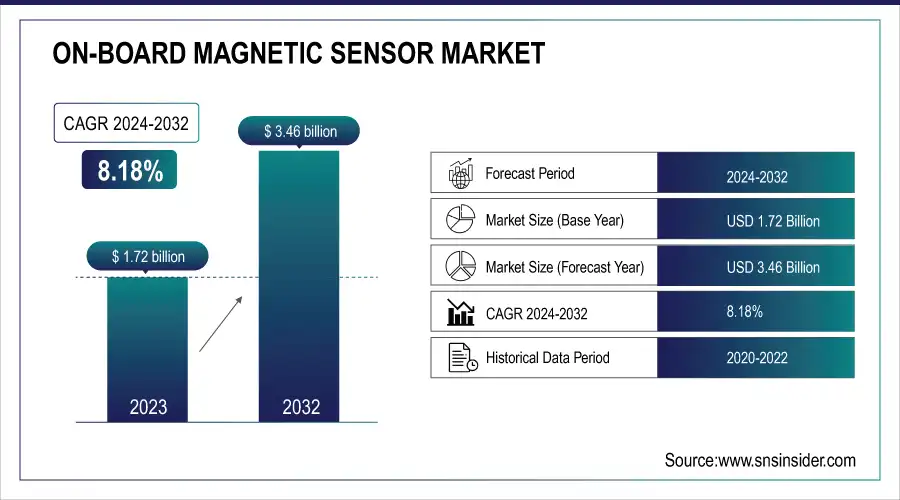

On-Board Magnetic Sensor Market Size & Growth:

The On-Board Magnetic Sensor Market was valued at USD 1.72 billion in 2023 and is expected to reach USD 3.46 billion by 2032, growing at a CAGR of 8.18% over the forecast period 2024-2032.

The global onboard magnetic sensor market is experiencing ongoing changes in sensor design aspects and magnetic material selection. Elements like extra sensitivity and compactness are pushing manufacturers towards magnetoresistive, 3D sensing technologies in this space. High fab and assembly capacity utilization is due to strong automotive and industrial demand. Sensitivity distribution in the bias field range shows that bias field sensors are right in the ballpark for good performance. Moreover, increased integration with IoT devices also facilitates the application of MEMS sensors in fields such as smart navigation, asset tracking, and gesture recognition, among others, which expands the domain of these sensors in connected ecosystems and their respective industry verticals.

To Get more information on On-Board Magnetic Sensor Market - Request Free Sample Report

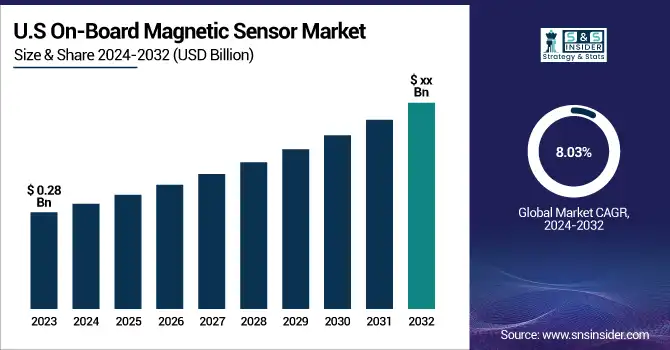

The U.S. On-Board Magnetic Sensor Market is estimated to be USD 0.28 Billion in 2023 and is projected to grow at a CAGR of 8.03%. Increasing usage of these sensors in safety systems, electric vehicles, and autonomous technologies by the automotive industry is majorly propelling the growth of the U.S. onboard magnetic sensor market. This demand is further being driven by the growth in the consumer electronics sector, more so IoT products. Furthermore, the growing demand for a better level of precision in wearable health monitors and diagnostic equipment in the healthcare sector also aids the market growth.

On-Board Magnetic Sensor Market Dynamics

Key Drivers:

-

ADAS EV Adoption and Industrial Automation Fuel Rising Demand for On-Board Magnetic Sensors

Growing adoption of advanced driver assistance systems (ADAS) and electric vehicles (EVs) in the automotive industry is primarily driving the on-board magnetic sensor market growth. These sensors are used for essential automotive systems such as position sensing, current measurement, and rotational speed detection. Furthermore, rising automation in all industrial sectors with growing penetration of magnetic sensors in robots, factory equipment, and smart meters is further driving the growth of the market. The continued movement of miniaturization and low-power components in electronics also plays in favor of using the Hall effect and magnetoresistive sensors in consumer and IoT electronics.

Restrain:

-

Environmental Challenges and Sensor Limitations Hinder Integration of On-Board Magnetic Sensors in Critical Systems

The technical scale regarding the accuracy and sensitivity in extreme environmental conditions is one major restraint in the onboard magnetic sensor Market. For example, magnetic sensors in automotive and aerospace applications need to operate under large temperature changes, high-vibration environments, and heavy electromagnetic interference (EMI), which can degrade their performance and longevity. Furthermore, magnetic hysteresis and non-linearity in sensor output could impair accurate readings, and possibly also undermine the reproducibility of output performance in critical mission environments. That has technical complexity that can stall integrations and require heavy QA testing.

Opportunity:

-

Emerging Wearables and Smart Devices Create New Opportunities for Advanced Magnetic Sensor Technologies

Some of the major opportunity potentials for low-field and earth-field magnetic sensors include emerging applications in healthcare/medical wearables, proximity/navigators, and biomedical devices. Moreover, the rising deployment of smartphones, smartwatches, and augmented reality (AR) gadgets which require small high-sensitivity sensors further elevates the overall market scope. In addition, the development of tunneling magnetoresistance (TMR) and 3D magnetic sensing technology promise unique opportunities for new products and differentiation. With industries evolving towards Industry 4.0 and smart infrastructure, the need for enhanced precision sensing solutions will provide hazy opportunities for magnetic sensor manufacturers to diversify offerings and penetrate new verticals.

Challenges:

-

Competing Sensor Technologies and Integration Complexities Challenge Growth of On-Board Magnetic Sensor Market

A big challenge is the competition from other sensing technologies: optical and capacitive sensors have started replacing some of the piezoelectric sensors. These alternatives provide advantages in some applications (such as better accuracy, or resistance to magnetic interference) that can draw demand away from magnetic solutions. Adding to this, using magnetic sensors also involves extensive magnetization calibration and compatibility validation within miniaturized or multi-statistic settings typical of compact electronic design settings such as smartphones or medical devices. The challenge is further compounded by the fact that different industries require custom solutions such as specific sensing ranges, and form-factor leading to market fragmentation, and standardization across different sensor types and applications is yet to be solved as well. For manufacturers that aim to expand their footprint across high-growth verticals, overcoming these integration and performance hurdles becomes pivotal.

On-Board Magnetic Sensor Market Segment Analysis

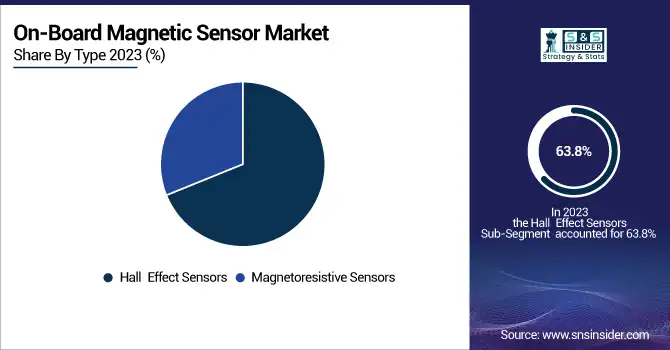

By Type

in 2023, the Hall Effect Sensors held the largest market share of the total on-board magnetic sensors market at 63.8%. The popularity of MR sensors can also be attributed to their low cost, high reliability, and suitability over a wide range of applications including automotive (ignition systems, speed sensing, current detection, etc.). Widely used in electric vehicles and industrial automation because of their reliability in extreme environments, and compatibility with integrated circuits.

Magnetoresistive Sensors are estimated to experience the highest CAGR during, 2024—2032. The primary factors contributing to this growth are their higher sensitivity improved spatial resolution and lower power requirements relative to conventional sensing technologies. Such features make it suitable for precision-based application margins in consumer electronics, robotics, or new IoT devices. Thereby, the growing demand for miniaturized and high-performance sensors will provide a lucrative opportunity for manufacturers/developers of magnetoresistive sensors and will play a decisive role in the next generation of sensing solutions.

By Magnetic Density

In 2023, >10 Gauss (Bias Magnetic Field Sensors) had the largest market share in the onboard magnetic sensor market, with 53.9% of the total market share. This makes these sensors ideal for high-strength magnetic field applications such as automotive systems, industrial automation, and power electronics – where strong performance and reliability are critical. This precision while operating in high-magnetic surroundings makes them perfect for current sensing, motor control, and proximate detection duty.

The 1 Microgauss to 10 Gauss (Earth Field Sensors) segment is expected to grow at the highest CAGR during the period 2024 2032. Wide adoption is fueled by increasing requirements for miniaturized, low-power, and high-accuracy sensors in consumer electronics, wearables, and navigation. Earth field sensors are especially important in applications that need precise orientation and motion detection like smartphones, AR/VR systems, and portable health monitors – making them a prominent growth sector in the sensor landscape of the future.

By Vertical

In 2023, the onboard magnetic sensor market for the automotive sector contributed 45.3% of the overall market share. This high demand is driven primarily by the ongoing penetration of magnetic sensors in EVs, ADAS, and transmission systems. These sensors are used for applications like speed detection, position sensing, and current sensing, which require high importance for vehicle safety, efficiency, and performance. The automotive segment has continued to be a leading contributor to overall market revenue with the growing adoption of EVs and autonomous technology.

From 2024 to 2032, consumer electronics is projected to achieve the highest CAGR. The demand is completely impacted by rapidly evolving smartphones, wearable devices, AR/VR systems, and gaming consoles. MEMS are the primary sensors used for onboard motion tracking and play a critical role in orientation tracking, sensor fusion with magnetometer for gesture, and motion sensing. With this vertical benefiting from a continuing miniaturization and multipurpose trend in electronic devices, sensors are expected to see even greater adoption here as well.

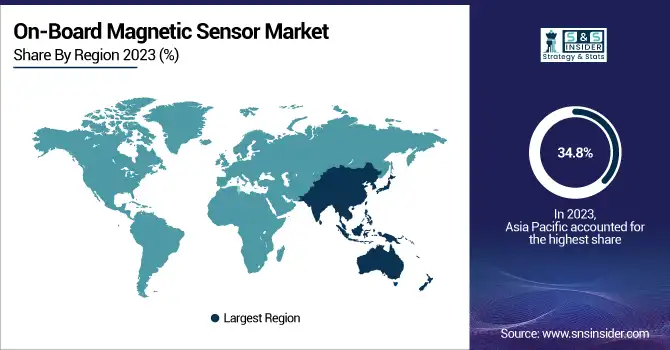

On-Board Magnetic Sensor Market Regional Overview

The on-board magnetic sensor market in 2023 was dominated by the Asia Pacific region which garnered the maximum share of 34.8%, and this region is expected to grow with the highest CAGR between the forecast period of 2024 and 2032. The high market share for the US and Canada can be attributed to the presence of mega electronics and automotive manufacturing hubs like China, Japan, South Korea, and India. High Demand for Magnetic Sensors Due to Rapid Growth in electric vehicles, industrial automation, and consumer electronics in these countries the growing adoption of electric vehicles, industrial automation, and consumer electronics in these countries considerably drives the demand for magnetic sensors. In addition, the presence of government initiatives encouraging smart manufacturing as well as IoT development augments the market expansion. With a strong semiconductor ecosystem and increasing investment in advanced sensor technologies, the region is likely to remain the leader while also witnessing rapid growth in revenue over the forecasting period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players in the On-Board Magnetic Sensor Market are:

-

Allegro MicroSystems (A1335)

-

Infineon Technologies AG (TLE4998C4)

-

Texas Instruments (DRV5055)

-

AMS OSRAM (AS5172A)

-

Honeywell International Inc. (SS495A1)

-

NXP Semiconductors (KMZ60)

-

TE Connectivity (MS32xx)

-

TDK Corporation (TAD2141)

-

Analog Devices, Inc. (AD22151)

-

Melexis NV (MLX90393)

-

Robert Bosch GmbH (SMI130)

-

Murata Manufacturing Co., Ltd. (MRMS50 Series)

-

Panasonic Industry Co., Ltd. (AN48841B)

-

Sensitec GmbH (AAH002)

-

STMicroelectronics (AIS2IH)

On-Board Magnetic Sensor Market Trends

-

In November 2024, Allegro MicroSystems launched advanced magnetic and inductive position sensors, including the A17802/A17803 and APS11753/APS12753, offering high accuracy and ultra-low power for EV, industrial, and consumer applications.

-

In May 2023, Analog Devices launched the ADAF1080, a high-precision single-axis AMR magnetic field sensor designed for contactless current sensing up to 600A.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.72 Billion |

| Market Size by 2032 | USD 3.46 Billion |

| CAGR | CAGR of 8.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hall Effect Sensors, Magnetoresistive Sensors, SQUID Sensors, Others) • By Magnetic Density (<1 Microgauss (Low-Field Sensors), 1 Microgauss to 10 Gauss (Earth Field Sensors), >10 Gauss (Bias Magnetic Field Sensors)) • By Vertical (Automotive, Consumer Electronics, Healthcare, Aerospace & Defense, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Allegro MicroSystems, Infineon Technologies AG, Texas Instruments, AMS OSRAM, Honeywell International Inc., NXP Semiconductors, TE Connectivity, TDK Corporation, Analog Devices, Inc., Melexis NV, Robert Bosch GmbH, Murata Manufacturing Co., Ltd., Panasonic Industry Co., Ltd., Sensitec GmbH, STMicroelectronics. |