Thrombosis & Hemostasis Biomarkers Market Report Size Analysis:

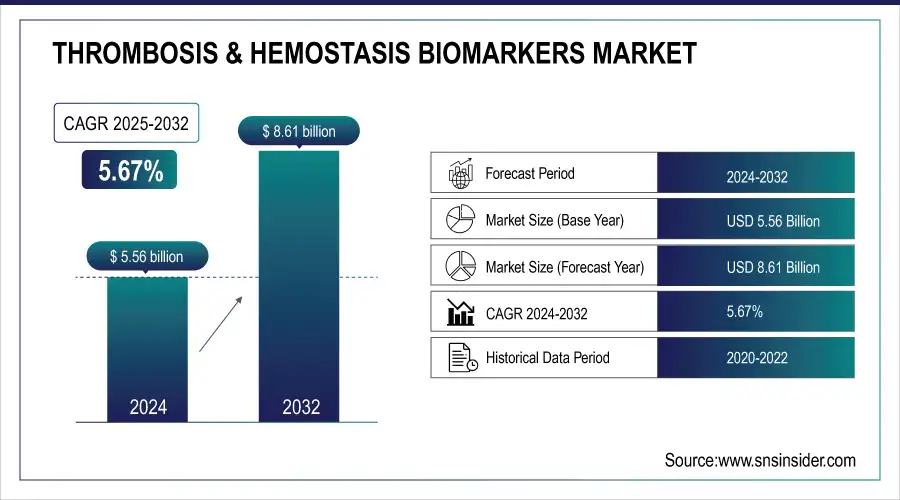

The Thrombosis & Hemostasis Biomarkers Market size was valued at USD 5.56 billion in 2024 and is expected to reach USD 8.61 billion by 2032, growing at a CAGR of 5.67% over the forecast period of 2025-2032.

The thrombosis & hemostasis biomarkers market is expanding rapidly because of the rising worldwide incidence of coagulation disorders such as deep vein thrombosis, pulmonary embolism, and disseminated intravascular coagulation. Growing awareness regarding early diagnosis, improvement in biomarker-based testing, and the use of automated analyzers are driving the thrombosis and hemostasis biomarkers market growth. Moreover, the increasing number of elderly people and the rise in cardiovascular ailments are fueling the need for quick and precise diagnostic tools, especially in clinical laboratories and point-of-care environments globally.

To Get more information on Thrombosis & Hemostasis Biomarkers Market - Request Free Sample Report

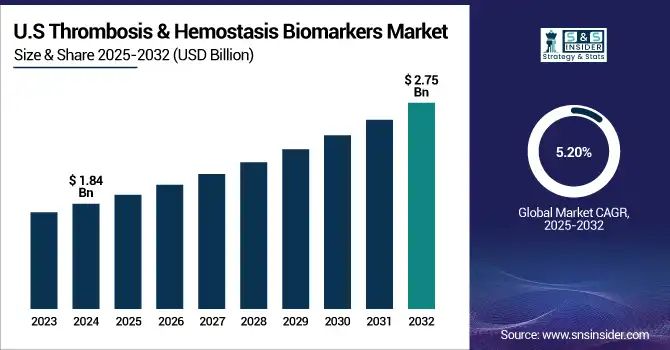

The U.S. thrombosis & hemostasis biomarkers market size was valued at USD 1.84 billion in 2024 and is expected to reach USD 2.75 billion by 2032, growing at a CAGR of 5.20% over the forecast period of 2025-2032. The U.S. dominates the North American thrombosis & hemostasis biomarkers market due to its sophisticated healthcare infrastructure, rising incidence of cardiovascular and clotting disorders, and extensive use of biomarker-based diagnostic technologies. The presence of major market players and research activities also plays a significant role in the country's dominance in the regional market.

Thrombosis & Hemostasis Biomarkers Market Dynamics:

Drivers

-

The Rise in Cardiovascular and Thrombotic Disorders is Propelling the Market Growth

Increasing global prevalence of thrombotic and cardiovascular diseases, such as DVT, PE, stroke, and atrial fibrillation, is one of the strongest drivers for this market. For Instance, the World Health Organization indicates that cardiovascular diseases (CVDs) account for more deaths globally than any other condition, and this results in about 17.9 million deaths per year. These diseases tend to be fatal and need urgent diagnosis and constant monitoring of coagulation status. Biomarkers of hemostasis, including D-dimer, prothrombin time (PT), and activated partial thromboplastin time (APTT), are invaluable tools in the early detection of clotting disorders. The expanding epidemic of lifestyle diseases, physical inactivity, obesity, and smoking also plays a role in the rising risk of thrombotic events, thereby fueling the need for accurate diagnostic markers to enhance outcomes and avoid complications.

-

Technical Developments in Biomarker Testing Are Propelling the Market Growth

Advances in diagnostic technology have significantly improved the performance and accessibility of hemostasis and thrombosis biomarker testing. Technical developments consist of high-sensitivity assays, fully automated coagulation analyzers, and point-of-care testing (POCT) platforms with faster results of high precision. Such advances allow real-time monitoring and faster clinical decision-making, particularly in intensive care units. Newer analyzers, for instance, can analyze several parameters at one time, decreasing turnaround time and enhancing efficiency. Also, microfluidic and lab-on-a-chip technology are pushing the boundaries for miniaturized, decentralized testing, most notably in remote or emergency care centers. All these advancements not only increase the diagnostic capacity but also facilitate the broader application of these tests in hospitals, clinics, and diagnostic centers.

In April 2024, Haemonetics Corporation was granted FDA 510(k) clearance for the TEG 6s hemostasis analyzer system assay cartridge to further increase its ability to diagnose diseases in the thrombosis and hemostasis biomarkers field.

Restraint

-

Complexity of Diagnostic Tests Hinder the Thrombosis & Hemostasis Biomarkers Market Growth

The diagnostic tests that detect thrombosis and hemostasis biomarkers usually necessitate special equipment and very experienced laboratory staff to ensure effective testing and correct interpretation of the test results. These tests might be technically sophisticated, requiring precise handling of the samples, calibration, and analysis. Most smaller clinics, diagnostic laboratories, or medical facilities, particularly in developing or resource-poor areas, might not have the required expertise or equipment to conduct these tests accurately. This complexity restricts the uptake and use of such biomarker tests, hindering thrombosis and hemostasis biomarkers market trends and limiting availability to only well-equipped healthcare facilities.

Thrombosis & Hemostasis Biomarkers Market Segmentation Analysis:

By Product

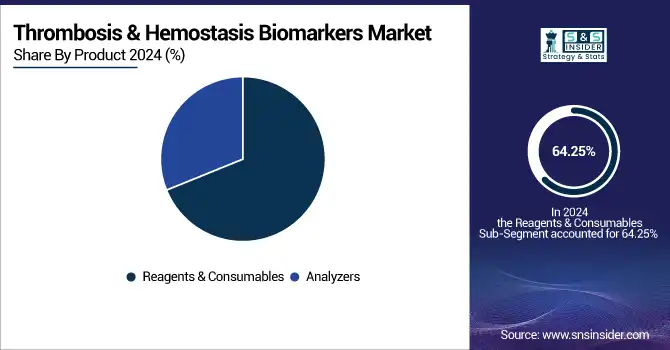

In 2024, the reagents & consumables segment dominated the thrombosis and hemostasis biomarkers market share with a 64.25%, as a result of their critical use in regular testing and frequent usage rates in clinical laboratories, as well as diagnostic centers. These products play an essential role in performing coagulation assays, including D-dimer, PT, and APTT tests, and are used for each test run; therefore, they are repeat-order items. Similarly, the prevalence of cardiovascular diseases, venous thromboembolism, and coagulation disorders together has contributed to the rising incidence of the aforementioned tests, which in place has resulted in a constant demand for reagents and consumables.

The analyzers segment will register the fastest growth during the forecast years. Key reasons for this include the adoption of automated and semi-automated diagnostics platforms on a large scale, which provide increased workflow efficiency and offer rapid and accurate results. Issues around technology-based advancements in hemostasis analyzers, such as the integration of various testing functions and data management connectivity options, are driving investments to upgrade diagnostic setups by hospitals. Targeted therapeutic and rising need for high-throughput and automation analysis is also expected to propel the growth path of this segment.

By Test Location

The clinical laboratory tests segment dominated the thrombosis & hemostasia biomarkers market with a 31.18% market share in 2024, due to coagulation tests depend on the wide usage of central lab facilities that are capable of accurate and effective testing. High volume, compliance with standard methodology, and highly trained staff trained to interpret complex biomarker data, such as PT, APTT, and D-dimer, can be offered only by clinical laboratories. Hospitals and diagnostic centers still prefer laboratory testing due to its precision and ease of integration with electronic health record systems, especially in cases requiring confirmatory testing or specialty coagulation panels.

The POCT segment will expand at the fastest CAGR over the forecast period. It is led by the increased demand for quick tests that are delivered at or near the bedside of the patient, allowing clinicians to make faster clinical decisions for stroke, deep vein thrombosis, and pulmonary embolism. The expanding availability of portable and easy-to-use POCT instruments, combined with increasing use in outpatient facilities, ambulances, and home care, is revolutionizing the testing environment. Additionally, the global trend towards decentralized delivery of healthcare and increasing demand for rapid results in critical care are fueling the adoption of POCT solutions.

By Test Type

The prothrombin time (PT) segment led the thrombosis & hemostasis biomarkers market in 2024 with a market share of 18.40% due to its crucial role in evaluating the extrinsic and common coagulation pathway. PT finds widespread usage in monitoring anticoagulated patients (e.g., warfarin) as well as pre-operative assessment to identify risks of bleeding. Its standardized testing method, clinical applicability, and widespread use in both inpatient and outpatient environments explain its supremacy. PT tests are also inexpensive and readily incorporated into routine coagulation panels, further propelling widespread use.

The Fibrin/Fibrinogen segment is expected to grow at the fastest rate during the forecast period. This is fueled by its increasing role in the detection of hypercoagulable states, disseminated intravascular coagulation (DIC), and other thrombotic conditions. Fibrinogen testing is also becoming increasingly popular as a primary marker for cardiovascular diseases, perioperative risks of bleeding, and inflammatory disorders. With more investigations done on the association of fibrinogen with adverse clinical outcomes in thrombotic conditions, its demand has grown.

By Application

In 2024, the deep vein thrombosis (DVT) segment led the thrombosis & hemostasis biomarkers market with a 42.18% market share due to the high global incidence and clinical priority in the diagnosis and treatment of DVT. DVT tends to be an early warning sign of venous thromboembolism and can cause serious complications such as pulmonary embolism if not treated. Consequently, early diagnosis using biomarkers such as D-dimer and PT is given great importance in day-to-day clinical practice. Moreover, rising awareness, increased population aging, and the increasing prevalence of sedentary lifestyles have helped increase the patient base at risk for DVT, further cementing the segment's leadership position.

The segment of pulmonary embolism (PE) is expected to register the fastest growth throughout the forecast period. This mainly owes to mounting sensitivity towards the fatal effects of PE and improvement in diagnostic strategies with emphasis on rapid and accurate biomarker-based detection. PE often arises as a complication arising out of undiagnosed DVT and hence results in a holistic strategy towards thrombosis screening. The expanding use of point-of-care testing and biomarker-supported imaging is improving PE diagnosis efficiency. Moreover, the rising prevalence of cardiovascular and respiratory diseases is increasingly driving the demand for effective PE diagnostics, further driving the strong future growth of the segment.

By End-Use

In 2024, the thrombosis & hemostasis biomarkers market was led by the diagnostic centers segment with a market share of 45.16% due to its state-of-the-art infrastructure and facilities to carry out high-volume, complicated biomarker testing. The Diagnostic Centers have sophisticated analyzers and trained personnel who can work on complicated coagulation profiles, allowing proper and timely diagnosis of thrombotic disorders. In addition, the growing trend of medical practitioners referring patients to diagnostic laboratories for sophisticated testing, combined with mounting demand for routine coagulation tests, has been supporting the critical role of diagnostic centers in this industry.

The clinics & hospitals segment is expected to experience the fastest growth over the forecast period, upon the increasing uptake of in-house diagnostic capability and the rising number of emergency and surgical cases needing rapid hemostatic evaluation. Point-of-care and rapid testing are being employed by clinics and hospitals to enhance patient management within critical care and perioperative settings.

Regional Analysis:

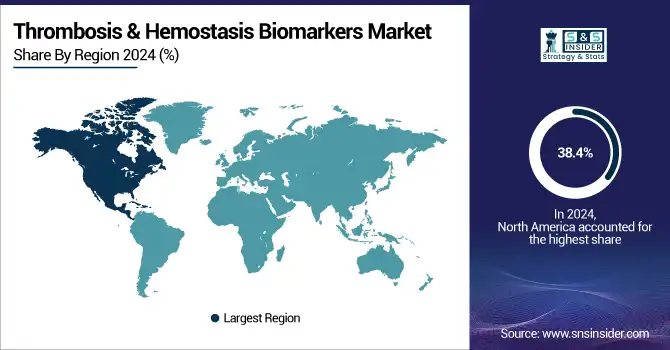

North America dominated the thrombosis & hemostasis biomarkers market with a 38.4% market share in 2024, due to its well-developed healthcare infrastructure, strong coagulation disorders awareness, and early inroads for biomarker-based diagnostic methods. It is supported by large diagnostics, thrombosis, and hemostasis biomarkers companies and research institutes committed to developing and selling hemostasis biomarkers. Moreover, the increasing burden of chronic diseases such as cardiovascular disease, obesity, and cancer, which are associated with thrombotic complications, drives demand for early and precise diagnostic solutions in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific is becoming the fastest-growing region in the thrombosis & hemostasis biomarkers market with 6.39% market share. This growth is fueled by enhanced access to healthcare, rising government expenditures on diagnostic testing, and an aging population at risk for clotting disorders. China, India, and Japan are facing accelerated uptake of advanced medical diagnostics as a result of urbanization, growth in healthcare infrastructure, and enhanced awareness of thrombosis conditions. Additionally, rising clinical trials and collaboration in research are propelling biomarker development in the region.

Europe is witnessing significant growth in thrombosis & hemostasis biomarkers market owing to a variety of factors. The established healthcare infrastructure of the region and high priority on early diagnosis and preventive medication are the major drivers for market growth. Germany, France, and the United Kingdom are investing in sophisticated diagnostic machines such as automated coagulation analyzers and point-of-care machines. In addition, rising awareness campaigns and government programs to strengthen disease control are propelling test volumes.

Latin America is witnessing moderate expansion in the thrombosis & hemostasis biomarkers market, mainly due to of steady progress in healthcare infrastructure and growing awareness about thrombotic and bleeding disorders. Brazil and Argentina are seeing increasing diagnostic testing owing to an increasing prevalence of cardiovascular diseases and government efforts to expand access to healthcare services.

The Middle East & Africa (MEA) region is witnessing consistent, moderate growth in the thrombosis and hemostasis biomarkers market analysis. This is being driven by greater investment in the modernization of healthcare, particularly in countries such as Saudi Arabia, the UAE, and South Africa. Rising prevalence of lifestyle diseases, combined with heightened demand for accurate diagnostic machines in hospitals and clinics, is driving the demand for hemostasis biomarkers.

Thrombosis & Hemostasis Biomarkers Market Key Players:

bioMérieux SA, F. Hoffmann-La Roche Ltd., Biomedica Diagnostics Inc., Siemens Healthineers AG, Abbott Laboratories, HORIBA Ltd., Werfen S.A., QuidelOrtho Corporation, Diazyme Laboratories, Inc., Thermo Fisher Scientific Inc., and other players.

Recent Developments in the Thrombosis & Hemostasis Biomarkers Market:

-

April 2024 – Sysmex Corporation and Siemens Healthcare Diagnostics Inc. (New York, U.S.A.) announced the start of independent distribution of their respective combined hemostasis testing solution portfolios in the United States and certain EU countries. This distribution is being done under their respective brand names, as part of a mutual OEM supply agreement between the two firms.

-

June 25, 2024 – HORIBA expanded its line of compact hematology analyzers with the introduction of three new models: Yumizen H550E (autoloader), Yumizen H500E CT (closed tube), and Yumizen H500E OT (open tube). These instruments now feature onboard erythrocyte sedimentation rate (ESR) testing, allowing combined analysis of complete blood count (CBC) with differential and ESR from whole blood in 60 seconds.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.56 Billion |

| Market Size by 2032 | USD 8.61 Billion |

| CAGR | CAGR of 5.61% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Analyzers, Reagents & Consumables) • By Test Location (Clinical Laboratory Tests, Point of Care Tests) • By Test Type (D-Dimer, Anti-Thrombin III, Plasminogen, Fibrin/Fibrinogen, Soluble Fibrin, Selectins, Factor VIII, PT, APTT, Others) • By Application (Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Disseminated Intravascular Coagulation (DIC), Others) • By End-Use (Hospitals & Clinics, Academic & Research Institute, Diagnostic Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | bioMérieux SA, F. Hoffmann-La Roche Ltd., Biomedica Diagnostics Inc., Siemens Healthineers AG, Abbott Laboratories, HORIBA Ltd., Werfen S.A., QuidelOrtho Corporation, Diazyme Laboratories, Inc., Thermo Fisher Scientific Inc., and other players. |