Packaged Water Treatment System Market Report Scope & Overview:

To get more information on Packaged Water Treatment SystemMarket - Request Free Sample Report

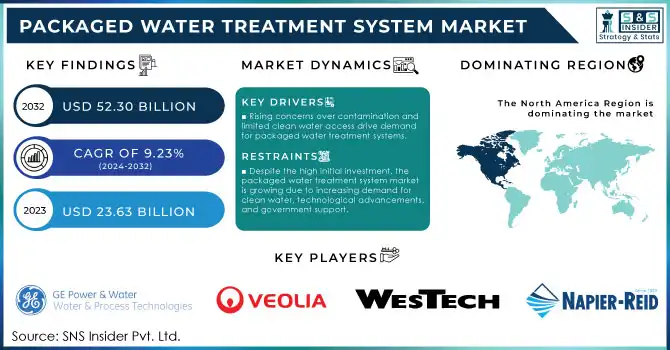

The Packaged Water Treatment System Market Size was valued at USD 23.63 Billion in 2023. It is expected to grow to USD 52.30 Billion by 2032 and grow at a CAGR of 9.23% over the forecast period of 2024-2032.

The packaged water treatment system market has witnessed significant growth due to increasing demand for clean and safe drinking water, alongside rising industrialization and urbanization. These systems, designed for small and medium-scale water treatment applications, offer modular, pre-engineered solutions that are cost-effective and easy to install. Their popularity stems from the ability to cater to a wide range of water sources, such as groundwater, surface water, and wastewater, making them highly versatile for residential, commercial, and industrial uses. The growth of the packaged water treatment market is largely driven by the increasing awareness about water pollution and the need for water recycling. The ongoing water scarcity issues across various regions further fuel the demand for efficient water treatment technologies. Additionally, advancements in filtration technologies, such as reverse osmosis, ultrafiltration, and UV disinfection, have made these systems more efficient, leading to their widespread adoption.

One key trend in the market is the growing shift towards automated and IoT-enabled water treatment systems. These innovations offer remote monitoring and control, reducing the need for manual intervention and improving operational efficiency. Furthermore, the rising trend of sustainability and environmental concerns is pushing industries to adopt water reuse systems, creating a demand for more advanced packaged water treatment solutions that support eco-friendly practices. Moreover, the increasing focus on wastewater treatment for both industrial and residential use is contributing to the growing market. As governments and regulatory bodies tighten water quality standards, the need for reliable and affordable water treatment solutions will continue to grow. These systems are expected to evolve further with advancements in smart technologies, allowing for more efficient, on-demand water purification capabilities.

Packaged Water Treatment System Market Dynamics

DRIVERS

-

The growing demand for clean and safe water, driven by rising concerns over contamination and limited access to clean water, is fueling the growth of the packaged water treatment system market.

The growing demand for clean and safe water is a key driver in the expansion of the packaged water treatment system market. As concerns over water contamination rise, there is a heightened emphasis on ensuring access to safe drinking water, particularly in regions with limited or unreliable water sources. Waterborne diseases, industrial pollution, and agricultural runoff contribute to the contamination of natural water supplies, prompting governments, industries, and consumers to seek effective water purification solutions. Packaged water treatment systems offer a compact and reliable option for treating water on-site, ensuring that it meets health and safety standards. This trend is particularly pronounced in developing countries and rural areas, where traditional water treatment infrastructure may be insufficient or non-existent. Additionally, rising urbanization and population growth further amplify the demand for efficient water treatment systems to meet the needs of expanding communities.

RESTRAIN

-

Despite the high initial investment, the packaged water treatment system market is growing due to increasing demand for clean water, technological advancements, and government support.

The high initial investment required for packaged water treatment systems is a key challenge for their widespread adoption, especially in cost-sensitive regions and among small enterprises. These systems typically involve significant upfront costs due to the advanced technologies and equipment involved in ensuring water quality, such as filtration, reverse osmosis, and UV disinfection units. For small-scale businesses, municipalities, or developing regions, the capital expenditure can be a substantial barrier. While these systems can reduce long-term operational costs by providing efficient and sustainable water treatment solutions, the initial financial outlay may still be prohibitive. Additionally, the cost of installation, including infrastructure and skilled labor, adds to the financial burden. However, with increasing government incentives and financial support, particularly in emerging markets, this challenge is gradually being mitigated. As awareness grows about the long-term benefits of these systems, such as improved water quality and operational efficiency, the market is expected to see steady growth despite this barrier.

Packaged Water Treatment System Market Segmentation Analysis

By Technology Type

The Extended Aeration technology segment dominated with the market share over 38% in 2023, due to its extensive adoption in municipal and industrial wastewater treatment applications. This dominance stems from its cost-effectiveness and operational simplicity, which make it an attractive choice for diverse users. Extended Aeration is particularly efficient in biological treatment, breaking down organic matter effectively while requiring minimal complex equipment or advanced operational expertise. Additionally, its capacity to handle varying loads makes it versatile for applications with fluctuating wastewater volumes, such as seasonal industries or growing urban areas. The technology's reliability and reduced maintenance requirements further enhance its appeal, especially in regions where technical expertise may be limited.

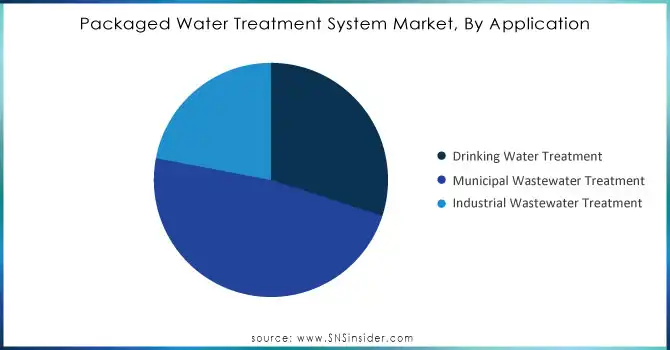

By Application

The Municipal Wastewater Treatment segment dominated with the market share over 48% in 2023. This is attributed to the growing need for efficient and sustainable wastewater management solutions, especially in rapidly urbanizing regions. Municipalities worldwide face mounting pressure to address environmental concerns and comply with stringent water pollution regulations, which has spurred the adoption of advanced packaged water treatment systems. These systems offer compact, cost-effective, and efficient solutions for treating wastewater, ensuring its safe discharge or reuse. Governments and regulatory bodies are implementing strict standards to reduce water contamination and protect natural resources, further boosting the demand for such systems. Additionally, the rise in population and industrial activities has led to an increased generation of wastewater, driving municipalities to invest in scalable and flexible treatment systems.

Need any customization research on Packaged Water Treatment System Market - Enquiry Now

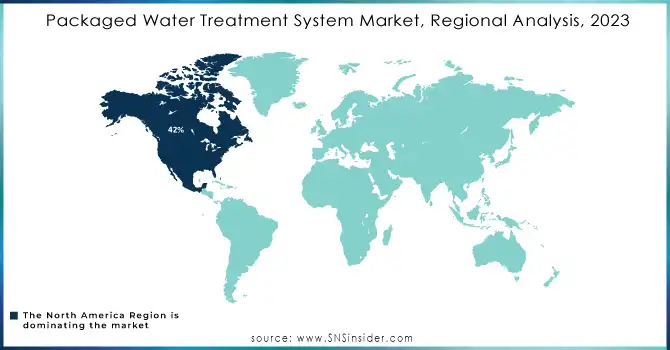

Packaged Water Treatment System Market Regional Overview

North America region dominated with the market share over 42% in 2023. The region’s dominance is primarily driven by stringent water quality regulations enforced by governmental bodies such as the Environmental Protection Agency (EPA), ensuring high standards for safe and clean water. Additionally, North America’s advanced technological infrastructure facilitates the adoption of innovative water treatment solutions, enhancing efficiency and sustainability. Significant investments in water infrastructure projects, especially in the United States and Canada, further bolster the market’s growth. These investments aim to address aging water systems and meet increasing demand for clean and treated water across various industries and municipalities.

The Asia-Pacific region is experiencing rapid growth in the Packaged Water Treatment System Market, driven by multiple socio-economic and environmental factors. Rapid urbanization and industrial expansion across countries like India, China, and Southeast Asian nations have significantly increased the demand for effective water treatment solutions to address the rising water pollution levels. Furthermore, the region's burgeoning population necessitates access to clean and potable water, spurring investments in water infrastructure and treatment systems. Governments in the Asia-Pacific are also implementing stringent regulations and initiatives to ensure sustainable water management, boosting the adoption of advanced packaged water treatment systems.

Key Players in Packaged Water Treatment System Market

Some of the major players in the Packaged Water Treatment System Market are:

-

GE Water & Process Technologies Limited (Reverse Osmosis Systems, Ultrafiltration Systems)

-

Veolia Water Technologies (BIOPAQ Reactor, Actiflo Clarifiers)

-

RWL Water (Nirobox Containerized Treatment Plants)

-

WesTech Engineering, Inc (Microfloc Trident Package Systems, Clarifiers)

-

Smith & Loveless Inc. (FAST Wastewater Treatment Systems, Grit Removal Systems)

-

Napier Reid (Aeration Systems, Clarifiers)

-

Enviroquip (Membrane Bioreactors, Sludge Handling Equipment)

-

Corix Water System (Compact Water Treatment Plants, Filtration Systems)

-

Tonka Equipment Company (Pressure Filters, Aerators)

-

SUEZ Water Technologies & Solutions (ZeeWeed Ultrafiltration, Reverse Osmosis Systems)

-

Fluence Corporation (NIROBOX, Decentralized Treatment Solutions)

-

Evoqua Water Technologies LLC (Memcor Membrane Filtration, Chemical Treatment Systems)

-

Aquatech International LLC (Desalination Systems, Zero Liquid Discharge Systems)

-

Lenntech BV (Ultrafiltration Systems, Ion Exchange Systems)

-

Ecologix Environmental Systems (Dissolved Air Flotation Units, MBBR Systems)

-

Biwater International Limited (Seawater Desalination Plants, Package Sewage Treatment Plants)

-

WPL Limited (Dissolved Air Flotation Systems, Hybrid-SAF™ Systems)

-

ClearFox (Modular Wastewater Treatment Plants, Biological Treatment Systems)

-

CST Wastewater Solutions (Sequencing Batch Reactors, Clarifiers)

-

EnviroChemie GmbH (Biological Wastewater Treatment Plants, Flotation Systems)

Some of the Raw Material Suppliers for Oil Country Tubular Goods Companies:

-

Veolia Water Technologies

-

SUEZ Water Technologies & Solutions

-

Fluence Corporation

-

Xylem Inc.

-

Evoqua Water Technologies

-

Aquatech International

-

Pentair plc

-

Smith & Loveless, Inc.

-

Lenntech B.V.

-

Westech Engineering Inc.

RECENT DEVELOPMENT

-

In September 2024: Napier Reid, a division of Axius Water, acquired MITA Water Technologies, enhancing its wastewater treatment and filtration capabilities. This acquisition bolsters Axius' portfolio with cutting-edge filtration systems, reinforcing its position in the expanding packaged water treatment market and addressing the rising demand for efficient and sustainable solutions.

-

In February 2023: GE Water & Process Technologies (US) unveiled its new AquaSure packaged water treatment system.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 |

USD 23.63 Billion |

| Market Size by 2032 |

USD 52.30 billion |

| CAGR | CAGR of 9.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Technology type (Extended Aeration, Moving Bed Biofilm Reactor (MBBR), Reverse Osmosis (RO), Membrane Bioreactor (MBR), Sequential Batch Reactor (SBR), Others) • by Application (Municipal Wastewater, Industrial Wastewater, Drinking Water) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Water & Process Technologies Limited, Veolia Water Technologies, RWL Water, WesTech Engineering, Inc., Smith & Loveless Inc., Napier Reid, Enviroquip, Corix Water System, Tonka Equipment Company. |

| Key Drivers | • The expanded level of urbanization requires a significant lift in the worldwide business. • One of the central points of the market is that the market items can squeeze into minimized and little places. |

| RESTRAINTS | • The significant expense of packaged water treatment system is a significant restriction of the bundled water treatment framework market. |