Packer Bottle Market Report Scope & Overview:

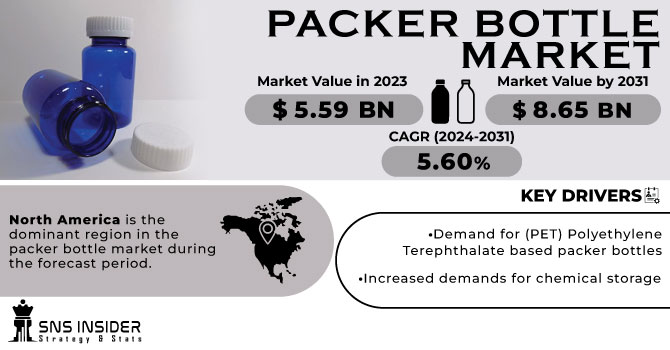

The Packer Bottle Market size was USD 5.59 billion in 2023 and is expected to Reach USD 8.65 billion by 2031 and grow at a CAGR of 5.60% over the forecast period of 2024-2031.

In pharmaceutical, chemical, food and cosmetic sectors, packer bottles with their flexibility and durability have gained in popularity. Due to the fact that they are capable of safely storing and transporting liquid, powder or tiny solids, demand is increasing in the market.

Get More Information on Packer Bottle Market - Request Sample Report

There are a number of factors responsible for this growth, including the increasing emphasis on sustainable and green packaging solutions. In line with global sustainability goals, Packer Bottles are frequently produced from recycled materials. Furthermore, the improvement in packaging technology has resulted in improved design, materials and manufacturing processes that increase packer bottle's efficiency and attractiveness.

Furthermore, packer bottles are being increasingly adopted due to increasing awareness of health and hygiene in particular the pharmaceutical and food sectors. It offers added safety and integrity for storage of sensitive products, thanks to its features like tamper evident seals and child resistant closures. With a view to meeting specific needs, market players continue to innovate and this has resulted in continued growth of the packer bottle market.

MARKET DYNAMICS

KEY DRIVERS:

-

Demand for (PET) Polyethylene Terephthalate based packer bottles

Packaging bottles made from PET are used in a wide variety of sectors where PET stands for polyethylene terephthalate. PET exhibits a distinction of being capable of appearing in both highly crystallised and alkaloidal conditions. PET is widely used for beverage containers, traditional oven plates and microwave ovens. Due to their low weight and convenience of transport, PET packaging is mainly used.

-

Increased demands for chemical storage

RESTRAIN:

-

A key restraint on packer bottle market is the price of raw materials, production and packaging processes.

The total cost structure and profitability for manufacturers may be affected by fluctuations in raw material prices, especially those of plastic or glass. In addition, the profit margins can be limited by competitive pricing pressure from less costly alternatives or alternative packaging solutions.

OPPORTUNITY:

-

A major factor which increases the growth of the market and also leads to an increasing demand for packer bottles is advances in packaging technology.

The market for package bottlers will continue to be encouraged by innovative products and advances in packaging over the forecast period. In the years ahead, there will be an increased sales of packer bottles on day to day life packaging applications as well as increasing lucrative package solutions and preferences for lightweight in both industrial and non industrial sectors.

CHALLENGES:

-

With a large number of players offering similar products, the market is highly competitive.

IMPACT OF RUSSIAN UKRAINE WAR

In December 2021, when reports of a possible Russian invasion of Ukraine reached fever pitch, the volatility of energy commodity prices began to rise. In the two weeks following the invasion, prices for oil, coal and gas have gone up by roughly 40%, 30% and 18% respectively.

The war also led to an increase in energy costs. It was very difficult to produce Airless Packaging due to the energy intensive nature of the process. Higher energy costs led to an increase in the cost of production of airless packaging.

IMPACT OF ONGOING RECESSION

One of the major factors which are expected to have an adverse effect on the market for Insulated Packaging in the course of the economic downturn is a drop in consumer demand. Airless packaging has been widely accepted but could be affected by a recession and is likely to decrease demand for those products, particularly from the pharmaceutical and cosmetic sectors.

Another factor that is expected to have an effect on the market for airless containers is increased competition with other packaging materials. In times of recession, it may be that airless packaging is more expensive for firms to use cheaper materials in their products due to the fact that they are not available on a similar scale as plastic and aluminium.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Glass

By Capacity

-

Below 100 cc

-

200 cc

-

300 cc

-

400 cc

By Application

-

Powder & Granules

-

Tablets & Capsules

-

Liquid

By End Use

-

Food & Beverages

-

Pharmaceuticals

-

Chemicals

-

Others

REGIONAL ANALYSIS

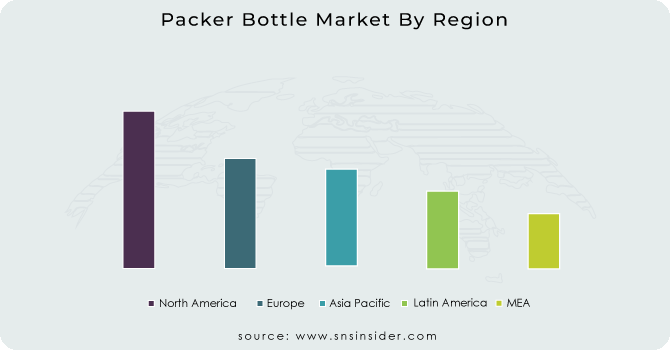

Based on market share and revenue, North America is the dominant region in the packer bottle market during the forecast period. In this region, this is due to the increasing demand for packer bottles. The North American market for packing bottles has been led by technological progress and easy availability of petroleum raw materials, which resulted in increasing demand for bulk plastic material at a cheaper price within this region.

Europe is expected to be the fastest growing region over the projected period, due to strong consumer attitudes, rising sales for plastic and glass packaging containers as well as increased expenditure and awareness of healthcare in this sector.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Packer Bottle market are O Berk Company LLC, Graham Packaging Company, Amcor Plc, Gerresheimer AG, Alpha Packaging Inc, CL Smith, Clarke Container Inc, Maynard & Harris Plastics, Comar LLC, United States Plastic Corporation and other players.

Gerresheimer AG-Company Financial Analysis

RECENT DEVELOPMENT

-

Berry Global Inc., announced that it has entered into a joint venture with Bhoomi to produce cold pressed sugarcane juice in bottle entirely made from sugar cane.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.59 Bn |

| Market Size by 2031 | US$ 8.65 Bn |

| CAGR | CAGR of 5.60% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Glass) • by Capacity (Below 100 cc, 200 cc, 300 cc, 400 cc) • by Application (Powder & Granules, Tablets & Capsules, Liquid) • by End Use (Food & Beverages, Pharmaceuticals, Chemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | O Berk Company LLC, Graham Packaging Company, Amcor Plc, Gerresheimer AG, Alpha Packaging Inc, CL Smith, Clarke Container Inc, Maynard & Harris Plastics, Comar LLC, United States Plastic Corporation |

| Key Drivers | • Demand for (PET) Polyethylene Terephthalate based packer bottles • Increased demands for chemical storage |

| Key Restraints | • A key restraint on packer bottle market is the price of raw materials, production and packaging processes. |