Asthma Treatment Market Report Scope & Overview:

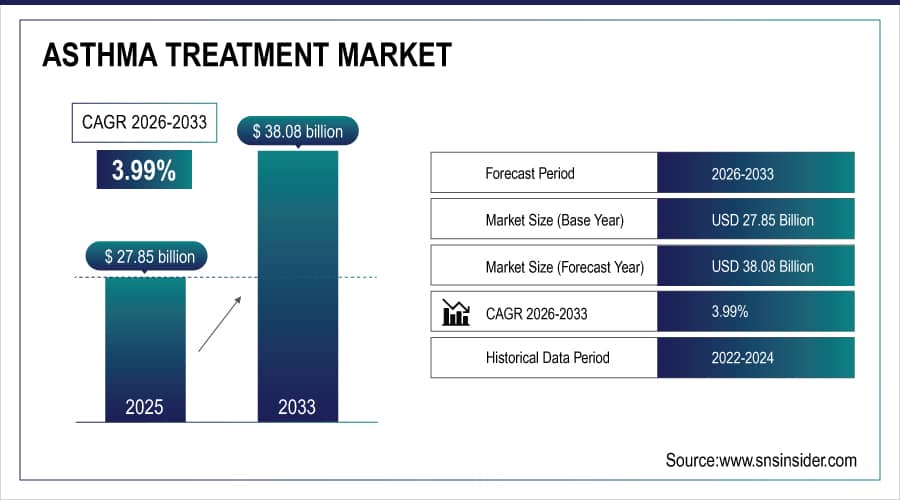

The Asthma Treatment Market size is estimated at USD 27.85 billion in 2025 and is expected to reach USD 38.08 billion by 2033, growing at a CAGR of 3.99% over 2026-2033.

The global asthma treatment market trends include the increasing prevalence of respiratory disorders, environmental pollution, allergen exposure, and sedentary lifestyles, which is further augmenting the market growth globally. Surging awareness and advanced diagnostics are some of the other catalysts to this market trend as patients become increasingly aware of symptoms and are more willing to pursue treatment promptly, which will lead to growth in the controller medications, biologics, and inhaler therapies market, both domestically and globally.

For instance, in April 2024, growing awareness and improved diagnosis drove a 12% increase in asthma-related hospital visits in North America, boosting early intervention and inhaled corticosteroid adoption.

Asthma Treatment Market Size and Forecast:

-

Market Size in 2025E: USD 27.85 billion

-

Market Size by 2033: USD 38.08 billion

-

CAGR: 3.99% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Asthma Treatment Market - Request Free Sample Report

Asthma Treatment Market Trends.

-

Rising cases of chronic, allergic, and exercise-induced asthma are increasing demand for targeted therapies.

-

Focus on patient-specific treatments using phenotype analysis, biomarkers, and severity evaluation to improve outcomes.

-

Adoption of biologics, smart inhalers, and combination therapies to enhance lung function, reduce flare-ups, and boost adherence.

-

Integration of digital health tools, mobile apps, remote monitoring, and telemedicine for real-time tracking and virtual care.

-

Growing use of metered-dose inhalers, dry powder inhalers, and nebulizers for portable and effective drug delivery.

-

Strategic collaborations among pharma companies, biotech firms, and research institutes to advance biologics and clinical research.

-

Support from FDA, EMA, and regional regulators for standardized trials, safety, efficacy, and greater asthma awareness.

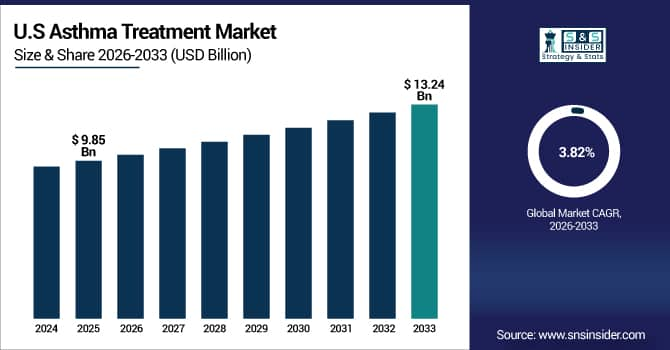

The U.S. Asthma Treatment Market is estimated at USD 9.85 billion in 2025 and is expected to reach USD 13.24 billion by 2033, growing at a CAGR of 3.82% from 2026-2033.

Due to a well-established healthcare system, increased exposure to air pollution, and the high prevalence of respiratory illnesses, the U.S. has the greatest market share. Increased healthcare spending on respiratory care, robust access to prescription and over-the-counter medications, and sophisticated diagnostics all contribute to growth. Additionally, the U.S. is positioned as the world's top regional market due to favorable regulations and early uptake of biologic medicines and smart inhalers.

Asthma Treatment Market Growth Drivers:

-

Innovation in Biologic Therapies is Driving the Asthma Treatment Market Growth

With the use of monoclonal antibodies, targeted immunotherapies, and individualized treatment plans that enhance effectiveness and patient outcomes, innovative biologic medicines are a major growth driver for the market share of asthma treatments. These cutting-edge treatments for severe and uncontrollable asthma are boosting hospital and specialty pharmacy usage, bolstering market demand, and facilitating international market expansion.

For instance, in July 2025, biologic therapies for severe asthma represented 22% of total U.S. asthma prescription sales, highlighting rising physician preference and wider market adoption.

Asthma Treatment Market Restraints:

-

High Treatment Costs and Limited Access are Hampering the Asthma Treatment Market Growth

The expansion of the asthma treatment market is hampered by high treatment costs and restricted access to cutting-edge therapies, as many patients in underdeveloped nations continue to receive inadequate care or rely on over-the-counter medications that do not effectively control their condition. In regions with poor cost and inadequate healthcare coverage, this may lead to treatment failure, frequent exacerbations, and a lower quality of life, all of which could have a detrimental impact on patient outcomes and restrict market expansion.

Asthma Treatment Market Opportunities:

-

Smart Inhaler Technology and Digital Health Integration Drive Future Growth Opportunities for the Asthma Treatment Market

Connected devices, AI-based monitoring systems, and patient engagement platforms present opportunities for smart inhaler technology and digital health integration in the asthma treatment sector. Remote patient monitoring, customized therapy modifications, and real-time adherence tracking are made possible by these systems. These technologies can improve outcomes, lower hospitalization rates, and facilitate market expansion by enhancing medication compliance, facilitating early exacerbation identification, and bolstering patient-provider communication, particularly in underserved areas.

For instance, in May 2024, the CDC reported that 8.4% of U.S. adults and 6.5% of children were diagnosed with asthma, underscoring the ongoing disease burden and rising demand for effective treatment options.

Asthma Treatment Market Segment Analysis:

-

By treatment type, long-term control medications led with 58.42% share in 2025E, while biologics are projected to grow fastest at a CAGR of 6.87%.

-

By route of administration, inhalers dominated with 64.15% share in 2025E, while injectables are expected to witness the highest growth at a CAGR of 6.52%.

-

By medication type, controller medications held a leading 61.38% share in 2025E and are projected to grow at a CAGR of 4.21%.

-

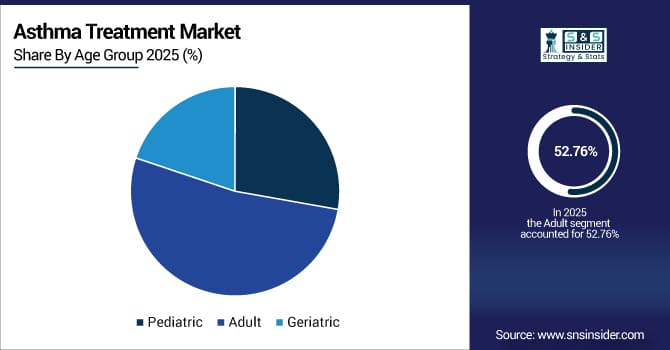

By age group, adults accounted for 52.76% share in 2025E, while the geriatric segment is expected to grow rapidly at a CAGR of 4.45%.

-

By distribution channel, retail pharmacies led with 48.93% share in 2025E, while online pharmacies are forecast to grow fastest at a CAGR of 5.38%.

-

By end user, hospitals and clinics held 54.21% share in 2025E, while homecare is anticipated to register the highest growth at a CAGR of 4.87%.

By Treatment Type, Long-Term Control Medications Lead the Market, While Biologics Register Fastest Growth

The long-term control medications segment held the largest revenue share of about 58.42% in 2025, supported by the widespread use of inhaled corticosteroids, LABAs, and leukotriene modifiers for routine asthma control and exacerbation prevention. Key trends include the rising prevalence of persistent asthma and strong physician preference for controller therapies.

The biologics segment within long-term control is projected to record the fastest CAGR of nearly 6.87% during 2026–2033, driven by growing adoption of targeted therapies for severe and uncontrolled asthma, expanding insurance coverage, and demonstrated effectiveness in reducing hospitalizations. Growth is further supported by increasing diagnoses of eosinophilic and allergic asthma and the availability of advanced monoclonal antibodies.

By Route of Administration, Inhalers Dominate, while Injectable Segment Shows Rapid Growth

The inhalers segment held the largest revenue share of around 64.15% in 2025, due to the ease of metered-dose and dry powder inhalers, portability, direct lung delivery, and fast symptom relief. Growth is driven by patient preference for non-invasive use, broad availability, and physician recommendations as first-line asthma treatment.

The injectable segment is expected to grow at the highest CAGR of about 6.52% during 2026–2033, supported by rising use of biologic injections for severe asthma, improved clinical results, and longer-lasting effects. Key drivers include greater awareness of targeted immunotherapy, better safety profiles, and specialist guidance for patients with poor response to inhalers.

By Medication Type, Controller Medications Lead, and Register Significant Growth

The controller medications accounted for the largest share of the asthma treatment market at about 61.38%, driven by their critical role in long-term asthma control, symptom prevention, and inflammation reduction. Key factors supporting the controller medications market include rising patient awareness of preventive care, stronger physician focus on daily maintenance therapy, and clinical guidelines endorsing controller drugs as first-line treatment.

The segment is also expected to grow at a notable CAGR of around 4.21% during the forecast period of 2026–2033, as inhaled corticosteroids, combination inhalers, and biologics deliver sustained symptom relief, improved lung function, and fewer exacerbations. Growing emphasis on effective disease management and proactive therapy supports adoption, as controller medications offer safer, more reliable long-term outcomes compared to sole dependence on reliever drugs.

By Age Group, Adult Segment Leads, While Geriatric Segment Grows Rapidly

The adult segment held the largest revenue share of around 52.76% in the asthma treatment market in 2025, driven by a high incidence of occupational asthma, adult-onset asthma, and environment-related respiratory disorders. Growth is supported by rising exposure to pollutants and allergens, along with smoking-related asthma complications.

The geriatric segment is projected to register a notable CAGR of around 4.45% during 2026–2033, due to aging populations, greater vulnerability to respiratory infections, and a rising prevalence of comorbidities needing tailored asthma care. Growth factors include higher healthcare utilization, availability of age-specific formulations, and increased physician focus on complication prevention in elderly patients.

By Distribution Channel, Retail Pharmacies Lead, While Online Pharmacies Segment Grows the Fastest

The retail pharmacies held the largest revenue share of around 48.93% in the asthma treatment market in 2025, due to easy accessibility, immediate medication dispensing, and pharmacist counseling services. Growth is driven by the rising availability of prescription drugs through retail outlets and patient preference for locally purchasing inhalers and controller medications.

The online pharmacies segment is predicted to register the highest CAGR of around 5.38% during 2026–2033, supported by increasing e-commerce adoption, home delivery convenience, and competitive pricing of maintenance therapies. Key drivers include expanded digital health integration, subscription-based refill services, and growing demand for discreet, hassle-free medication access.

By End User, Hospitals and Clinics Lead, While Homecare Segment Registers Highest Growth

The hospitals and clinics segment held the largest revenue share of around 54.21% in the asthma treatment market in 2025, as these facilities manage acute exacerbations, provide emergency care, and offer specialized pulmonology services. Drivers include the high volume of asthma-related emergency visits, comprehensive diagnostic capabilities, and availability of advanced biologic therapies requiring clinical administration.

The homecare segment is anticipated to register the highest CAGR of around 4.87% during the forecast period of 2026-2033, owing to increasing preference for self-management, availability of portable nebulizers and inhalers, and telehealth-enabled remote monitoring. Key factors were improved patient education, cost-effectiveness of home-based treatment, and technological advancements in connected devices supporting at-home asthma care.

Asthma Treatment Market Regional Highlights:

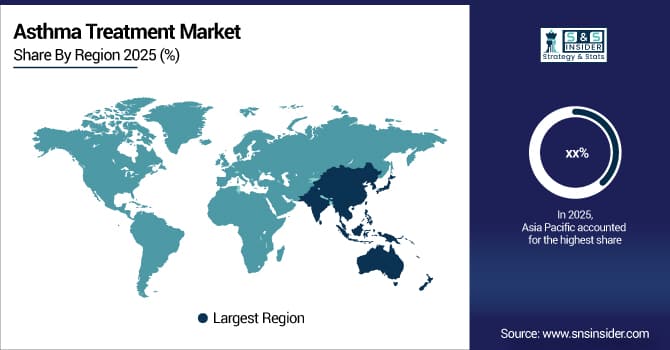

Asia Pacific Asthma Treatment Market Insights:

Asia Pacific is the fastest-growing segment in the asthma treatment market with a CAGR of 4.68%, driven by rising awareness of respiratory health, increasing pollution, and improving healthcare infrastructure in developing nations. The market is expanding because to rapid urbanization, population growth in industrial areas, and increased use of biologics and inhaler treatments. Access to care is becoming better because to telemedicine platforms and mobile health apps, especially in rural and semi-urban areas. Early diagnosis and prompt treatment are encouraged by government initiatives and respiratory health awareness campaigns. Growth in the Asia Pacific region is also being driven by reduced treatment costs compared to Western markets, and easier access to the affordability of generic inhalers and oral drugs.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Asthma Treatment Market Insights:

North America held the largest revenue share of about 41.24% in 2025 in the asthma treatment market, driven by high prevalence of chronic asthma and allergic respiratory disorders, advanced healthcare infrastructure, and strong awareness of pulmonary health. The widespread availability of smart inhalers and sophisticated biologics, high diagnostic rates, advantageous insurance coverage, and the growing use of targeted immunotherapies are important growth factors. Furthermore, the region's market leadership and revenue contribution are further strengthened by encouraging government initiatives, air quality monitoring programs, and higher healthcare spending on respiratory disorders.

Europe Asthma Treatment Market Insights:

The asthma treatment market in Europe is the second-largest globally, behind North America as respiratory allergies are becoming more common, environmental triggers are becoming more common, healthcare infrastructure is becoming stronger, and people are becoming more knowledgeable of how to manage asthma effectively. The continuous rise of the industry in key European countries is also being helped by more people using controller medications and biologic therapies, better spirometry and diagnostic tools, government-backed respiratory health programs, and regulations that help pay for them.

Latin America (LATAM) and Middle East & Africa (MEA) Asthma Treatment Market Insights:

In Latin America and the Middle East & Africa, the rising incidence of respiratory infections and improved healthcare awareness with better access to essential asthma medications support asthma treatment market growth. The growing adoption of affordable generic inhalers and telehealth respiratory consultations, along with public health campaigns, supports early diagnosis and treatment adherence. Rapid urbanization and rising disposable income in these regions continue to drive market growth.

Asthma Treatment Market Competitive Landscape:

GlaxoSmithKline (GSK) plc (est. 2000) is a global pharma and biotech leader focusing on respiratory medicines for better patient outcomes. It leverages R&D and partnerships to deliver innovative asthma treatments with comprehensive management solutions.

-

In February 2025, expanded its respiratory portfolio with a Phase III trial for a novel triple-combination inhaler for severe asthma, aiming to improve lung function and reduce exacerbations.

AstraZeneca plc (est. 1999) is a global biopharmaceutical company specializing in respiratory, oncology, and cardiovascular medicines. It invests in biologics and inhaler innovations to advance targeted and effective asthma therapies.

-

In April 2024, received FDA approval for an extended-release biologic injection for severe eosinophilic asthma, enhancing dosing convenience and patient adherence.

Teva Pharmaceutical Industries Ltd. (est. 1901) is a leading global generic and specialty pharma company. Its respiratory portfolio emphasizes affordable inhalers and biosimilars, with strong presence in emerging and developed markets.

-

In September 2024, launched a generic version of a popular dry powder inhaler in the U.S. and Europe, improving affordability and access for millions of asthma patients.

Asthma Treatment Market Key Players:

-

GlaxoSmithKline plc

-

AstraZeneca plc

-

Teva Pharmaceutical Industries Ltd.

-

Boehringer Ingelheim International GmbH

-

Novartis AG

-

Merck & Co., Inc.

-

Sanofi S.A.

-

Roche Holding AG

-

Pfizer Inc.

-

Mylan N.V. (Viatris Inc.)

-

Cipla Ltd.

-

Chiesi Farmaceutici S.p.A.

-

Vectura Group Ltd.

-

Sunovion Pharmaceuticals Inc.

-

Genentech, Inc. (Roche)

-

Regeneron Pharmaceuticals, Inc.

-

Amgen Inc.

-

Circassia Pharmaceuticals plc

-

Orion Corporation

-

Hikma Pharmaceuticals PLC

-

Lupin Limited

-

Sun Pharmaceutical Industries Ltd.

-

Dr. Reddy's Laboratories Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 27.85 Billion |

| Market Size by 2033 | USD 38.08 Billion |

| CAGR | CAGR of 3.99% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Treatment Type (Long-Term Control Medications, Quick-Relief Medications (Rescue Medications), Others) • By Route of Administration (Inhalers, Nebulizers, Oral, Injectable) • By Medication Type (Controller Medications, Reliever Medications, Preventive Medications) • By Age Group (Pediatric, Adult, Geriatric) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) • By End User (Hospitals & Clinics, Homecare, Specialty Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GlaxoSmithKline plc, AstraZeneca plc, Teva Pharmaceutical Industries Ltd., Boehringer Ingelheim International GmbH, Novartis AG, Merck & Co., Inc., Sanofi S.A., Roche Holding AG, Pfizer Inc., Mylan N.V. (Viatris Inc.), Cipla Ltd., Chiesi Farmaceutici S.p.A., Vectura Group Ltd., Sunovion Pharmaceuticals Inc., Genentech, Inc. (Roche), Regeneron Pharmaceuticals, Inc., Amgen Inc., Circassia Pharmaceuticals plc, Orion Corporation, Hikma Pharmaceuticals PLC, Lupin Limited, Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd. |