Refrigeration Packaging Market Report Scope & Overview:

Get More Information on Refrigeration Packaging Market - Request Sample Report

The Refrigeration Packaging Market Size was valued at USD 9.75 Billion in 2023 and is expected to reach USD 15.7 Billion by 2032 and grow at a CAGR of 5.46% over the forecast period 2024-2032.

The refrigeration packaging market is experiencing substantial growth driven by the rising demand for fresh and frozen foods, as consumers increasingly prioritize quality and convenience in their dietary choices. The shift toward healthier eating habits has led to a heightened focus on fresh produce and frozen food options, significantly increasing the need for effective refrigeration packaging solutions. This trend is further accelerated by the expansion of online food delivery services, which require reliable packaging to ensure the safe transportation of perishable items. , highlighting the urgency for innovative packaging solutions in the market. Additionally, initiatives like the Greater Boston Food Bank's expansion of refrigeration facilities demonstrate the importance of enhanced cold chain logistics to meet growing consumer needs for fresh food accessibility. Technological advancements are also playing a crucial role in shaping the refrigeration packaging landscape. Companies are increasingly adopting eco-friendly materials and energy-efficient refrigeration units, aligning with the growing consumer preference for sustainable products. The importance of refrigeration for preserving food quality cannot be overstated; effective refrigeration ensures that food remains safe and fresh for consumption, ultimately reducing food waste. Furthermore, the pharmaceutical sector's reliance on cold chain logistics for transporting temperature-sensitive products further boosts market demand. As regulatory requirements for food safety and quality continue to tighten, the need for robust refrigeration packaging solutions will become even more critical. Overall, the refrigeration packaging market is poised for significant expansion, driven by consumer trends, technological innovations, and increasing regulatory pressures.

With the increasing need to store and transport temperature-sensitive drugs, vaccines, and biologics, the demand for specialized refrigeration packaging solutions has surged. Global pharmaceutical expansions, such as Brazilian giant EMS's international push, have heightened the need for advanced packaging to ensure the safe transit of sensitive products. Companies like Elopak are responding with investments, including a USD 25 million expansion, to meet rising demand. Cold chain logistics play a crucial role in the effective distribution of vaccines, particularly in times of health crises, and the growing pharmaceutical sector's development of biologics only amplifies the need for robust packaging solutions. In the U.S., this demand is spurring innovations in materials and technologies. Regulatory pressures to maintain temperature control, as seen with potential new California regulations, are further intensifying the focus on cold storage solutions. As pharmaceutical companies expand into new markets, the need for reliable refrigeration packaging will continue to grow, especially in regions with limited infrastructure. This trend is driving market growth, with a growing emphasis on eco-friendly, energy-efficient solutions to meet sustainability goals.

Refrigeration Packaging Market Dynamics

Drivers

-

E-commerce and Online Grocery Delivery Growth Driving Refrigeration Packaging Demand

The rapid rise of e-commerce and online grocery delivery platforms significantly drives growth in the refrigeration packaging market.This shift is particularly evident among consumers aged 25 to 44, who prioritize the convenience of shopping for groceries online. Notably, this demographic accounts for 76% of regular online grocery shoppers in the UK, indicating a strong preference for digital shopping options. The widening gap between e-commerce and brick-and-mortar growth underscores the importance of adapting to changing consumer behaviors. As traditional retail faces budget constraints and challenges, online grocery platforms are flourishing, demonstrating a clear preference for digital shopping. The demand for efficient refrigeration packaging is driven by the need for reliable solutions that ensure perishable goods reach consumers in optimal condition. Innovative packaging solutions are essential for maintaining product freshness during transit, especially as last-mile delivery becomes a focal point for e-commerce retailers. Carton packaging, like Tetra Recart, is gaining popularity due to its compact design and ability to maintain shelf stability, eliminating the need for extensive cold-chain distribution. This logistical efficiency is crucial in meeting growing consumer expectations for fast and reliable delivery. In conclusion, the booming grocery e-commerce market represents a lasting shift in consumer behavior, driving the demand for advanced refrigeration packaging solutions that ensure the safe and efficient delivery of perishable goods. As digital platforms continue to grow, the need for innovative packaging will be paramount to sustaining this momentum.

Restraints

-

Limited Availability of Raw Materials in the Refrigeration Packaging Market

The refrigeration packaging market faces significant challenges due to the limited availability of raw materials, particularly plastics, metals, and insulation materials. Fluctuations in the supply and pricing of these essential components can profoundly impact production capabilities. For instance, supply chain disruptions—exacerbated by global events—often lead to increased costs and delays, which hinder manufacturers' ability to meet rising market demand. Furthermore, the reliance on specific materials, such as polystyrene and polyethylene, poses risks as their availability can fluctuate based on environmental regulations and market trends. According to recent studies, this volatility can also lead to compromised product quality, pushing companies to seek alternative materials that may not meet performance standards for temperature control and insulation. As manufacturers strive to maintain sustainability, the shift toward eco-friendly materials could further complicate raw material availability. Consequently, these challenges necessitate strategic sourcing and inventory management solutions to mitigate the impacts of raw material shortages on the refrigeration packaging market. Addressing these constraints is critical for ensuring efficient supply chains and maintaining competitive advantage in a rapidly evolving industry landscape.

Refrigeration Packaging Market Segmentation Overview

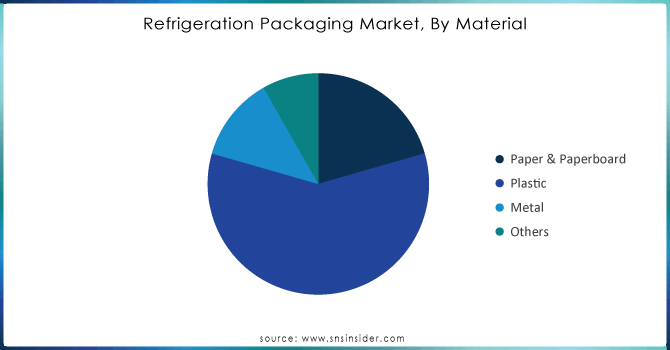

By Material

The refrigeration packaging market is largely dominated by plastic, which accounted for approximately 59% of total revenue in 2023. This leading position is driven by several key factors. First, plastic materials like polyethylene and polystyrene are lightweight and versatile, allowing manufacturers to create customized packaging solutions for various products, including perishable foods and pharmaceuticals. This flexibility enhances transportation efficiency and helps reduce shipping costs. Additionally, plastic offers excellent thermal insulation, which is crucial for maintaining the required temperature of refrigerated goods during transit. This capability ensures the quality and integrity of food items, making plastic an ideal choice for both producers and consumers. Plastic is generally more cost-effective than alternatives such as metal or glass, enabling manufacturers to produce refrigeration packaging at lower costs. This affordability helps businesses maintain competitive pricing, thus driving demand for plastic-based solutions. However, the market is also witnessing a growing emphasis on sustainability, with manufacturers increasingly exploring biodegradable and recyclable plastic options to cater to environmentally conscious consumers. While plastic remains dominant, alternative materials like paper, metal, and glass are gaining attention for their recyclability and biodegradability, although they currently hold a smaller market share due to higher costs and less effective insulation properties.

Need Any Customization Research On Refrigeration Packaging Market - Inquiry Now

By End User

Based on End User, Food & Beverages is captured the largest share revenue in refrigeration packaging market of around 75% in 2023. A key driver for this dominance is the growing demand for perishable food items that require effective packaging to ensure freshness and safety during transport. Refrigeration packaging is crucial for maintaining the quality of various food products, including dairy, meat, fruits, and vegetables, guaranteeing they arrive at consumers in optimal condition. As health-conscious consumers increasingly seek fresh, high-quality items, the need for reliable refrigeration packaging solutions grows stronger. The surge in e-commerce within the food and beverage sector has further fueled demand for effective refrigeration packaging. The rise of online grocery shopping and meal delivery services requires packaging capable of withstanding transport challenges while ensuring temperature control. This shift towards convenience and accessibility is influencing consumer preferences and driving the development of refrigeration packaging designed specifically for food and beverages. Advancements in packaging materials and technologies, such as smart packaging and temperature-controlled solutions, are improving the efficiency and effectiveness of refrigeration packaging. As this sector continues to evolve, manufacturers are focusing on creating sustainable, efficient, and cost-effective solutions to meet changing consumer needs and maintain their competitive edge.

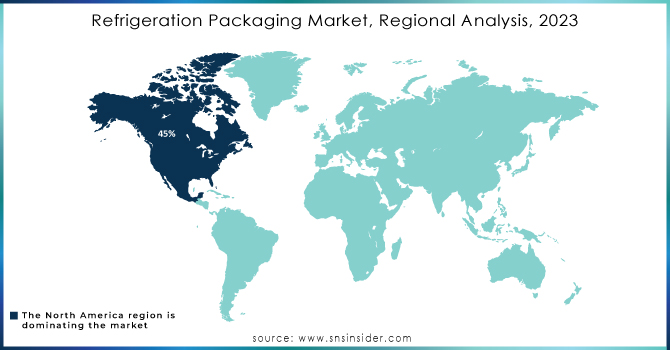

Refrigeration Packaging Market Regional Analysis

In 2023, North America led the refrigeration packaging market, capturing about 45% of total revenue. This dominance stems from the high demand for perishable goods, especially in the food and beverage sector, supported by a robust cold chain infrastructure. The growth of e-commerce, with increased online grocery shopping and meal delivery services, has also driven demand for effective refrigeration solutions. Additionally, rising environmental concerns are pushing manufacturers toward eco-friendly packaging options. The diverse food industry, including dairy, meat, and plant-based products, further fuels the need for specialized refrigeration packaging, prompting continued innovation and sustainability efforts among manufacturers.

In 2023, the Asia Pacific region emerged as the second fastest-growing market for refrigeration packaging, driven by several key factors that highlight its dynamic nature. Rapid urbanization in countries such as China, India, and Indonesia has led to a surge in demand for processed and packaged food products. As populations increasingly shift to urban areas, the necessity for effective refrigeration packaging to maintain food quality during transport and storage becomes paramount. Furthermore, the expanding middle class in the region is elevating disposable incomes and altering consumption patterns, with consumers actively seeking fresh and high-quality food options that require reliable refrigeration solutions. The e-commerce boom is another significant driver, especially in countries like China and India, where online grocery shopping and food delivery services have skyrocketed. These services demand packaging that ensures temperature control and product integrity throughout transit. Additionally, substantial investments in cold chain infrastructure by governments and private entities are enhancing the storage and distribution capabilities for perishable goods. A growing emphasis on sustainability is prompting manufacturers to explore biodegradable and recyclable materials, aligning with the rising consumer preference for environmentally friendly packaging. Together, these factors position the Asia Pacific region for continued growth in the refrigeration packaging market.

Key Players in Refrigeration Packaging Market

Some of the major key players in Refrigeration Packaging Market who provide provide product and solution:

-

Thermo Fisher Scientific (Thermo Scientific Refrigerators)

-

Carrier Global Corporation (Carrier Transicold PrimeLINE Units)

-

Dometic Group (Dometic Refrigeration Solutions)

-

Panasonic Corporation (Panasonic Cooling Systems)

-

Daikin Industries, Ltd. (Daikin Refrigeration Units)

-

Sidel Group (Sidel Refrigerated Packaging Solutions)

-

Crown Holdings, Inc. (Crown Refrigerated Containers)

-

Rehrig Pacific Company (Refrigerated Containers and Pallets)

-

Tetra Pak (Tetra Pak Refrigerated Packaging)

-

Sealed Air Corporation (Cryovac Refrigerated Packaging Solutions)

-

Unilever (Unilever Cold Chain Solutions)

-

Sonoco Products Company (Sonoco Refrigerated Packaging)

-

IMA Life (IMA KryoAir Refrigeration Systems)

-

MIRAI Intex (Turbo-Compressor-Expander Systems)

-

Ahlstrom (LeafSaver Specimen Collection Cards)

-

Cold Chain Technologies (Thermal Packaging Solutions)

-

Great Northern Corporation (Great Northern Refrigerated Packaging)

-

Cargill, Incorporated (Cargill Cold Chain Solutions)

-

Lineage Logistics (Lineage Refrigerated Transportation)

-

Emergent Cold (Emergent Cold Chain Solutions)

List of Cold Chain Services Providers:

-

DHL Supply Chain

-

UPS Cold Chain Solutions

-

FedEx Temperature Control

-

XPO Logistics

-

Kuehne + Nagel

-

Lineage Logistics

-

Americold Logistics

-

Martens Transport

-

C.H. Robinson

-

Agro Merchants Group

-

Cold Chain Technologies

-

TLD Logistics

-

Thermo King

-

United States Cold Storage (USCS)

-

Eimskip

Recent Development

-

On June 21, 2024, IMA Life announced a collaboration with MIRAI Intex and ACT to develop KryoAir, an innovative air-based refrigeration system specifically designed for freeze dryers. This system enhances efficiency by utilizing air cycle technology and avoids high-GWP gases, ensuring consistent cooling output across varying temperatures in freeze-drying applications.

-

On October 14, 2024, Emirates Shipping Line (ESL) announced the acquisition of 300 Carrier Transicold PrimeLINE container refrigeration units to enhance its refrigerated shipping capabilities. This move aims to improve ESL's efficiency in transporting temperature-sensitive goods, leveraging Carrier Transicold's advanced refrigeration technology.

-

On August 14, 2024, Delta H Innovations unveiled the 'Cool>Can,' a revolutionary self-cooling can that can chill beverages in under two minutes. Developed by James Vyse, this innovative packaging solution aims to enhance consumer convenience by providing a chilled drink on the go.

-

On April 19, 2024, Ahlstrom introduced LeafSaver, a specimen collection card that preserves DNA samples from various organisms at ambient temperatures, eliminating the need for refrigeration. This innovative solution aims to reduce the environmental impact and costs associated with cold chain transportation while ensuring the integrity of nucleic acid samples for genetic research.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.75 Billion |

| Market Size by 2032 | USD 15.7 Billion |

| CAGR | CAGR of 5.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Paper & Paperboard, Plastic, Metal, and Others) • By Packaging Type (Bags & Pouches, Boxes & Cartons, Bottles & Cans, Films & Wraps, and Others) • By End Use (Food & Beverages, Pharmaceuticals, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Carrier Global Corporation, Dometic Group, Panasonic Corporation, Daikin Industries, Ltd., Sidel Group, Crown Holdings, Inc., Rehrig Pacific Company, Tetra Pak, Sealed Air Corporation, Unilever, Sonoco Products Company, IMA Life, MIRAI Intex, Ahlstrom, Cold Chain Technologies, Great Northern Corporation, Cargill, Incorporated, Lineage Logistics, and Emergent Cold. |

| Key Drivers | • E-commerce and Online Grocery Delivery Growth Driving Refrigeration Packaging Demand |

| RESTRAINTS | • Limited Availability of Raw Materials in the Refrigeration Packaging Market |