Productivity Management Software Market Report Scope & Overview:

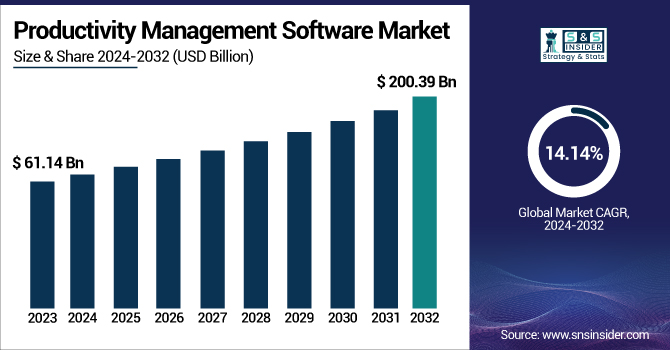

The Productivity Management Software Market was valued at USD 77.11 billion in 2025E and is expected to reach USD 222.14 billion by 2033, growing at a CAGR of 14.14% from 2026-2033.

To Get more information on Productivity Management Software Market - Request Free Sample Report

This report includes key insights on pricing trends, usage frequency, and duration, highlighting the increasing adoption of productivity tools across industries. Employee productivity gains are a significant factor driving this growth, as organizations seek efficient solutions for task management, collaboration, and performance tracking. Additionally, security and compliance features are becoming essential in software offerings, ensuring data protection and regulatory adherence.

Productivity Management Software Market Size and Forecast

-

Market Size in 2025E: USD 77.11 Billion

-

Market Size by 2033: USD 222.14 Billion

-

CAGR: 14.14% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Productivity Management Software Market Trends

-

The Productivity Management Software Market is expanding rapidly as enterprises prioritize workflow efficiency, employee output analysis, and digital collaboration tools.

-

Growing adoption of remote and hybrid work models is accelerating demand for centralized platforms that support task tracking, performance analytics, automation, and project visibility.

-

Increased reliance on cloud-based SaaS solutions is enhancing scalability, cost efficiency, and integration with CRM, ERP, HRM, and communication tools.

-

Workforce analytics, time-tracking, intelligent automation, and AI-driven insights are emerging as core feature differentiators.

-

Rising demand from sectors such as IT & Telecom, BFSI, Healthcare, Retail, and Manufacturing is strengthening market penetration.

-

Organizations are increasingly investing in productivity platforms to reduce operational inefficiencies, improve decision-making, and support cross-functional collaboration.

U.S. Productivity Management Software Market was valued at USD 21.59 billion in 2025E and is expected to reach USD 61.80 billion by 2033, growing at a CAGR of 14.05% from 2026-2033.

The growth of the U.S. Productivity Management Software Market can be attributed to increasing demand for efficient work management tools across industries. Organizations are prioritizing employee productivity and streamlined workflows, driving the adoption of software solutions that enable task management, time tracking, and collaboration. The growing need for data security and compliance in response to evolving regulations further fuels market expansion.

Productivity Management Software Market Growth Drivers:

-

Growing Remote and Hybrid Work Models Drive Demand for Productivity Management Software to Enhance Collaboration, Efficiency, and Workforce Engagement.

The large-scale implementation of remote and hybrid work patterns has contributed immensely to the demand for solid productivity management tools. Companies are focusing on software that facilitates hassle-free collaboration, real-time communication, and effective task management within dispersed teams. With workers working from different locations, companies need software that guarantees workflow transparency, improves team coordination, and maximizes resource allocation. The increasing reliance on cloud-based systems and AI-based analytics adds further traction to this trend, enabling businesses to track performance, automate operations, and drive overall efficiency. With businesses increasingly adopting adaptable work arrangements, the demand for sophisticated productivity management software will continue to gain momentum, fueled by demands for automation, data-informed decision-making, and increased workforce engagement.

Productivity Management Software Market Restraints:

-

Cybersecurity Threats and Compliance Challenges Hinder Adoption of Cloud-Based Productivity Management Software, Raising Data Security and Privacy Concerns.

As businesses increasingly rely on cloud-based productivity management software, concerns over data security and privacy continue to grow. With sensitive company information, employee records, and critical operational data stored online, organizations face heightened risks of cyberattacks, data breaches, and unauthorized access. Strict regulatory requirements, such as GDPR and industry-specific compliance mandates, add complexity to software adoption, requiring businesses to implement robust security measures. Many companies hesitate to adopt new productivity tools due to fears of data leaks, potential legal liabilities, and the cost of ensuring compliance. Additionally, integrating secure authentication methods and encryption protocols adds to operational overhead.

Productivity Management Software Market Opportunities:

-

AI and Automation Transform Productivity Management Software by Enhancing Workflow Efficiency, Task Automation, Predictive Insights, and Decision-Making.

The blending of artificial intelligence and automation in productivity management software is transforming the way companies operate. AI-based tools facilitate smart task automation, minimizing human intervention and minimizing errors while maximizing the efficiency of workflows. Predictive analysis assists companies in predicting project slowdowns, distributing resources optimally, and making better-informed decisions. Machine learning algorithms optimize user experiences, providing intelligent suggestions and automatically performing routine jobs to maximize overall productivity. AI-based chatbots and virtual assistants also optimize communication and task management, maximizing collaboration in remote and hybrid workplaces. While companies try to maximize efficiency and reduce operating expenses, the implementation of AI-driven productivity tools is gaining pace.

Productivity Management Software Market Challenges:

-

Compatibility Issues with Legacy Systems Hinder Adoption of Productivity Management Software, Leading to Integration Challenges, Data Migration Issues, and Higher Costs.

The blending of artificial intelligence and automation in productivity management software is transforming the way companies operate. AI-based tools facilitate smart task automation, minimizing human intervention and minimizing errors while maximizing the efficiency of workflows. Predictive analysis assists companies in predicting project slowdowns, distributing resources optimally, and making better-informed decisions. Machine learning algorithms optimize user experiences, providing intelligent suggestions and automatically performing routine jobs to maximize overall productivity. AI-based chatbots and virtual assistants also optimize communication and task management, maximizing collaboration in remote and hybrid workplaces. While companies try to maximize efficiency and reduce operating expenses, the implementation of AI-driven productivity tools is gaining pace.

Productivity Management Software Market Segment Analysis

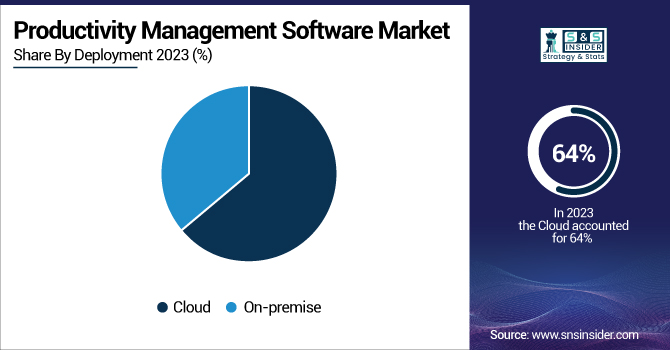

By Deployment, Cloud segment dominated the market, On-premise segment is expected to grow the fastest.

The cloud segment dominated the Productivity Management Software Market in 2025, capturing the highest revenue share of approximately 65%. Its dominance is driven by the increasing adoption of Software-as-a-Service (SaaS) solutions, enabling businesses to access scalable, cost-effective, and remotely accessible productivity tools. Organizations prefer cloud-based platforms for their flexibility, seamless integration with other applications, and AI-driven automation features.

The on-premise segment is projected to grow at the fastest CAGR of approximately 13.18% from 2026 to 2033. This growth is fueled by rising concerns over data security, compliance requirements, and the need for greater control over IT infrastructure. Industries with strict regulatory standards, such as healthcare and finance, are increasingly opting for on-premise solutions to ensure data privacy and minimize cybersecurity risks.

By Enterprise Size, Large enterprises dominated the market, SMEs are expected to grow the fastest.

The large enterprise size segment dominated the Productivity Management Software Market in 2025, holding the highest revenue share of approximately 63%. This dominance is driven by large-scale organizations' need for advanced productivity tools to manage complex workflows, large teams, and multi-departmental collaboration. Enterprises prioritize automation, AI-driven analytics, and cloud-based solutions to enhance operational efficiency.

The small & medium enterprise (SME) size segment is expected to grow at the fastest CAGR of approximately 14.63% from 2026 to 2033. This rapid growth is fueled by the increasing adoption of cost-effective, cloud-based productivity solutions that cater to the agility and scalability needs of SMEs. As digital transformation accelerates, SMEs are leveraging automation and collaboration tools to improve efficiency, compete with larger enterprises, and optimize resource utilization.

By Industry, BFSI dominated the market, Manufacturing is expected to grow the fastest.

The BFSI segment dominated the Productivity Management Software Market in 2025, capturing the highest revenue share of approximately 26%. This dominance is driven by the sector’s need for secure, automated, and compliance-focused productivity solutions. Financial institutions require advanced task management, document automation, and real-time collaboration tools to streamline operations and ensure regulatory adherence.

The manufacturing segment is expected to grow at the fastest CAGR of approximately 16.60% from 2023 to 2033. This rapid growth is fueled by increasing adoption of digital transformation initiatives, Industry 4.0 advancements, and the need for real-time production monitoring. Manufacturers are leveraging productivity software to optimize supply chain operations, enhance workforce collaboration, and automate repetitive tasks.

By Solution, Content Management & Collaboration dominated the market, AI & Predictive Analytics is expected to grow the fastest

The Content Management & Collaboration segment dominated the Productivity Management Software Market in 2025, securing the highest revenue share of approximately 36%. Its dominance is driven by the growing demand for seamless document sharing, workflow automation, and team collaboration across remote and hybrid work environments. Businesses rely on cloud-based platforms to manage, store, and organize digital content efficiently while ensuring real-time access and security.

The AI & Predictive Analytics segment is expected to grow at the fastest CAGR of approximately 15.74% from 2026 to 2033. This growth is fueled by the rising need for data-driven decision-making, process automation, and intelligent insights in business operations. AI-powered productivity tools enhance workflow efficiency by predicting task priorities, automating repetitive functions, and providing real-time analytics.

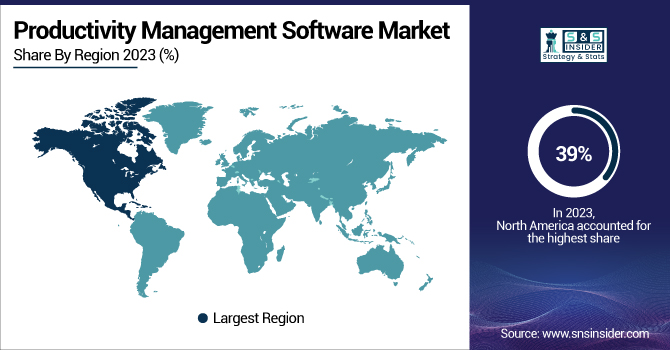

Regional Analysis

North America Productivity Management Software Market Insights

The North America region dominated the Productivity Management Software Market in 2025, holding the highest revenue share of approximately 39%. This dominance is driven by the strong presence of major software providers, high digital adoption rates, and advanced IT infrastructure. Businesses across industries are rapidly integrating AI-driven productivity solutions, cloud-based collaboration tools, and automation platforms to enhance operational efficiency.

Asia Pacific Productivity Management Software Market Insights

The Asia Pacific region is expected to grow at the fastest CAGR of approximately 15.69% from 2026 to 2033. This growth is fueled by rapid digital transformation, increasing adoption of cloud-based solutions, and a booming startup ecosystem. Businesses in the region are embracing productivity software to streamline operations and enhance collaboration amid rising remote work trends.

Europe Productivity Management Software Market Insights

The Europe Productivity Management Software Market is expanding as organizations prioritize efficiency, collaboration, and automation across workflows. Growing adoption of cloud-based platforms, AI-driven analytics, and integrated task management tools is boosting demand. Enterprises are increasingly shifting toward unified solutions for planning, communication, time tracking, and project execution.

Middle East & Africa and Latin America Productivity Management Software Market Insights

The Middle East & Africa and Latin America Productivity Management Software Market is experiencing steady growth as enterprises in both regions embrace digital transformation and modernize workflows. Rising cloud adoption, remote and hybrid work models, and the demand for collaborative, task-tracking, and project management tools are driving market uptake.

Get Customized Report as per Your Business Requirement - Enquiry Now

Productivity Management Software Market Competitive Landscape:

Monday.com

monday.com is a leading work-operating-system (Work OS) provider that enables teams to manage projects, automate workflows, and collaborate in a unified platform. Known for its no-code flexibility, visual UI, and enterprise-grade scalability, monday.com supports cross-functional productivity across IT, marketing, operations, and CRM teams. The company increasingly focuses on AI-driven execution, launching intelligent agents and automation tools that help enterprises move from tracking work to actually completing work, improving speed, accuracy, and data-driven decision-making.

-

2025: monday.com unveiled three AI-powered capabilities — monday magic, vibe, and sidekick enabling intelligent workflow automation, no-code tooling, and task execution.

-

2025: At Elevate, monday.com launched “monday agents” (AI digital workers) and “monday campaigns” for CRM to automate work and enable AI-driven marketing execution.

-

2024: monday.com released a ready-to-use Portfolio Management solution for enterprise-wide visibility across strategic initiatives.

Microsoft

Microsoft is a global technology leader delivering cloud, productivity, and AI solutions through platforms such as Azure, Microsoft 365, Dynamics 365, and Copilot. The company is modernizing workplace collaboration by unifying planning, project management, and analytics. With deep investments in generative AI, Microsoft is consolidating legacy tools, expanding Copilot capabilities, and redefining work orchestration across the enterprise ecosystem. Its strategy centers on simplifying product suites, improving integration, and driving an AI-first approach to organizational productivity.

-

2025: Microsoft will retire Project for the web and the Project/Roadmap apps in Teams by August 2025, consolidating work management into Planner.

-

2025: Microsoft confirmed that Project Online will be retired by 30 September 2026, further centralizing users onto modern Planner-based tools.

Salesforce

Salesforce is a global leader in CRM and enterprise cloud applications, offering AI-first platforms across sales, service, marketing, and commerce. With its Agentforce and Einstein technologies, Salesforce is shifting from CRM systems of record to intelligent automation platforms that execute work autonomously. The company focuses on unifying data, AI agents, and workflow automation to help organizations improve revenue operations, customer engagement, and productivity at scale while maintaining strong integrations across enterprise ecosystems.

-

2025: Salesforce launched Agentforce 3, adding an enterprise command center, open-standard integrations, and more reliable AI digital labor.

-

2024: Salesforce launched Agentforce 2.0, enabling AI agents with prebuilt skills to automate workflows.

-

2024: Salesforce introduced AI-powered productivity enhancements for Sales Cloud, improving planning, forecasting, and prospecting efficiency.

SAP SE

SAP SE is a global enterprise-software provider specializing in ERP, HR, procurement, spend management, supply chain, and industry cloud solutions. The company is embedding generative AI (“Joule”) across its portfolio to automate processes, enhance decision-making, and unify enterprise data. SAP’s strategy emphasizes cloud migration, AI-driven workflow automation, and tightly integrated business applications that support large, complex organizations. Through its ongoing Business AI releases, SAP continues expanding intelligent capabilities across S/4HANA Cloud, SuccessFactors, Ariba, and Fieldglass.

-

2024: SAP embedded its generative AI “Joule” into Ariba, Fieldglass, and Business Network for procurement automation and supplier insights.

-

2024: SAP released S/4HANA Cloud Private Edition 2023 FPS02 with expanded Joule digital-assistant capabilities.

Key Players

-

International Business Machines Corporation (IBM) (IBM Notes, IBM Connections)

-

Microsoft (Microsoft Teams, Microsoft Planner)

-

Monday.Com (Monday.com Work OS, Monday.com CRM)

-

Oracle (Oracle NetSuite, Oracle E-Business Suite)

-

Rockwell Automation (FactoryTalk, Plex Manufacturing Cloud)

-

Sage Group Plc (Sage Business Cloud, Sage 50cloud)

-

Salesforce, Inc. (Salesforce Sales Cloud, Salesforce Service Cloud)

-

Sap Se (SAP Business One, SAP SuccessFactors)

-

Zoho Corporation Pvt. Ltd. (Zoho Projects, Zoho CRM)

-

Trello (Trello, Trello Business Class)

-

Basecamp (Basecamp, Basecamp Personal)

-

Toggl (Toggl Track, Toggl Plan)

-

Harvest (Harvest Time Tracking, Harvest Invoicing)

-

Evernote (Evernote Personal, Evernote Business)

-

OneNote (Microsoft OneNote, OneNote for Education)

-

Slack (Slack Free, Slack Premium)

-

Podio (Podio Project Management, Podio Workflow Automation)

-

ClickUp (ClickUp Task Management, ClickUp Docs)

-

Wrike (Wrike Collaborative Work Management, Wrike Project Management)

-

Smartsheet (Smartsheet Work Management, Smartsheet Control Center)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 61.14 Billion |

| Market Size by 2033 | US$ 200.39 Billion |

| CAGR | CAGR of 14.14% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Content Management & Collaboration, AI & Predictive Analytics, Structured Work Management, Other Solutions) • By Deployment (On-premise, Cloud) • By Enterprise Size (Large Enterprise Size, Small & Medium Enterprise Size) • By Industry (BFSI, IT & Telecom, Healthcare, Manufacturing, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | International Business Machines Corporation (IBM), Microsoft, Monday.Com, Oracle, Rockwell Automation, Sage Group Plc, Salesforce, Inc., Sap Se, Zoho Corporation Pvt. Ltd., Trello, Basecamp, Toggl, Harvest, Evernote, OneNote, Slack, Podio, ClickUp, Wrike, Smartsheet. |