PCI Express Retimer Market Report Scope & Overview:

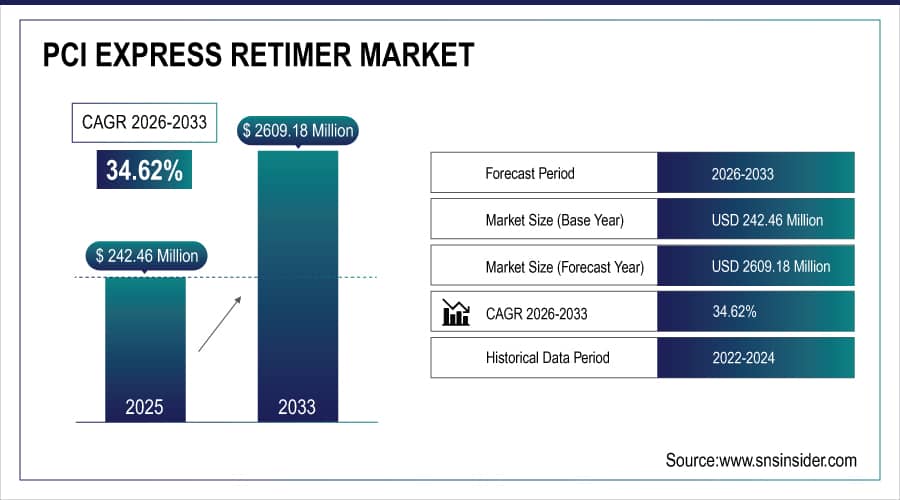

The PCI Express Retimer Market size was valued at USD 242.46 Million in 2025E and is projected to reach USD 2609.18 Million by 2033, growing at a CAGR of 34.62% during 2026-2033.

The PCI Express Retimer Market is growing due to the rising demand for high-speed data transmission in AI servers, data centers, and advanced computing systems. Increasing adoption of PCIe Gen5 and Gen6 interfaces, coupled with the need for enhanced signal integrity over longer distances, is driving widespread deployment of retimer solutions.

Market Size and Forecast:

-

Market Size in 2025E USD 242.46 Million

-

Market Size by 2033 USD 2609.18 Million

-

CAGR of 34.62% From 2026 to 2033

-

Base Year 2024

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

To Get More Information On PCI Express Retimer Market - Request Free Sample Report

Key PCI Express Retimer Market Trends

-

Increasing adoption of PCIe 5.0 and 6.0 standards across data centers, AI accelerators, and high-performance computing systems.

-

Growing integration of retimers into transceivers, PHYs, and modules for compact and power-efficient designs.

-

Rising demand for signal integrity solutions to support ultra-high bandwidth and low-latency data transmission.

-

Expanding collaboration between semiconductor companies and hyperscale service providers for customized PCIe architectures.

-

Accelerated deployment of energy-efficient retimers in automotive, telecom, and industrial AI applications.

The U.S. PCI Express Retimer Market size was valued at USD 68.02 Million in 2025E and is projected to reach USD 700.34 Million by 2033, growing at a CAGR of 33.88% during 2026-2033.

The U.S. PCI Express Retimer Market is growing due to expanding hyperscale data centers, rapid adoption of AI and HPC workloads, and early deployment of PCIe Gen5/Gen6 technologies, which require advanced retimer solutions to maintain signal integrity and optimize high-speed connectivity.

PCI Express Retimer Market Growth Drivers:

-

Rising AI and Cloud Demand Accelerate Global Growth of High Speed PCIe Retimer Market

The global PCI Express (PCIe) Retimer market is primarily driven by the escalating demand for high-speed data transfer and signal integrity in data-intensive applications such as AI, machine learning, cloud computing, and high-performance computing (HPC). As PCIe interfaces evolve to higher generations (Gen5 and Gen6), the need for retimers has surged to overcome signal degradation over longer trace lengths and complex board layouts. The rapid expansion of hyperscale data centers, coupled with the increasing deployment of advanced GPUs, accelerators, and NVMe storage devices, is significantly boosting the adoption of PCIe retimers. Additionally, growing enterprise investments in AI infrastructure, 5G base stations, and edge computing platforms further amplify market growth.

The global hyperscale data centre capacity (facilities > 80 MW) was reported to have doubled over four years as of April 2024; over 1,000 hyperscale data-centres are active with 120-130 new ones expected annually going forward, driven by cloud & AI workloads

PCI Express Retimer Market Restraints:

-

High Design Complexity and Power Challenges Restrain Growth of Next Generation PCIe Retimer Market

The PCI Express (PCIe) retimer market faces restraints due to high design complexity, increased power consumption, and rising development costs for next-generation PCIe 6.0 and 7.0 technologies. Additionally, signal integrity challenges, compatibility issues, and limited availability of advanced testing infrastructure hinder large-scale adoption across diverse computing environments.

PCI Express Retimer Market Opportunities:

-

Next Generation PCIe Retimers Unlock Growth with AI Driven Demand and High Bandwidth Innovation

Opportunities lie in the development of next-generation PCIe 6.0 and 7.0 retimers designed for ultra-high bandwidth and low latency applications. The rising trend of system integration, miniaturization, and the use of retimers in embedded systems present lucrative prospects for manufacturers. Moreover, collaboration between semiconductor vendors and hyperscale service providers to co-design signal management solutions is creating new growth pathways. The shift toward energy-efficient, high-density server architectures and increased adoption of AI accelerators in automotive, industrial, and telecom sectors also promise strong long-term opportunities for PCIe retimer providers.

Marvell Technology, Inc. revealed in May 2024 its “Alaska P” PCIe retimer line built on 5nm PAM4 technology for Gen 6 connectivity between AI accelerators, GPUs and CPUs inside servers illustrating system-integration trends and new architecture demands

PCI Express Retimer Market Segment Analysis

-

By Product Type, Standalone Retimers dominated with 61.75% in 2025E, and Integrated Retimers (embedded in transceivers, PHYs, or modules) is expected to grow at the fastest CAGR of 35.18% from 2026 to 2033.

-

By PCIe Generation / Data Rate, PCIe 4.0 (16 GT/s) dominated with 43.32% in 2025E, and PCIe 6.0 (64 GT/s) is expected to grow at the fastest CAGR of 36.09% from 2026 to 2033.

-

By Application, Servers & Data Centers dominated with 34.42% in 2025E, and AI/ML Accelerator Cards & GPUs is expected to grow at the fastest CAGR of 36.22% from 2026 to 2033.

-

By End-User, Hyperscale Cloud Service Providers dominated with 41.57% in 2025E, and ODMs & Module Manufacturers is expected to grow at the fastest CAGR of 35.82% from 2026 to 2033.

By Product Type, Standalone Retimers Lead PCIe Market as Integrated Solutions Accelerate Next Generation Computing Growth

In 2025E, standalone retimers dominate the PCI Express (PCIe) Retimer Market due to their broad deployment across servers, storage devices, and networking equipment, ensuring signal integrity and flexibility in high-speed designs. However, integrated retimers embedded within transceivers, PHYs, or modules are projected to grow fastest from 2026 to 2033, driven by increasing demand for compact, power-efficient, and high-performance solutions in next-generation computing and AI-driven architectures.

By PCIe Generation / Data Rate, PCIe 4.0 Leads Current Market as PCIe 6.0 Powers Next Generation Data Acceleration

In 2025E, PCIe 4.0 (16 GT/s) dominates the market due to its widespread adoption in servers, GPUs, and storage solutions that balance performance and cost efficiency. However, PCIe 6.0 (64 GT/s) is expected to grow fastest from 2026 to 2033, driven by rising demand for ultra-high bandwidth, low latency, and next-generation data center and AI workloads requiring faster interconnects for massive data processing and real-time analytics.

By Application, Servers and Data Centers Drive PCIe Retimer Market as AI Accelerators Propel Future Growth

In 2025E, Servers & Data Centers dominate the PCIe Retimer market, driven by large-scale data processing, cloud expansion, and increased deployment of high-performance storage and networking infrastructure. However, AI/ML Accelerator Cards & GPUs are projected to grow fastest from 2026 to 2033, fueled by the rapid adoption of generative AI, deep learning workloads, and advanced GPUs requiring high-speed, low-latency connectivity for efficient data transfer and computational acceleration.

By End-User, Hyperscale Cloud Providers Lead PCIe Retimer Market as ODMs Surge with Next Generation Growth

In 2025E, Hyperscale Cloud Service Providers dominate the PCIe Retimer market due to extensive investments in data centre scalability, AI workloads, and high-speed interconnects to support massive data traffic. From 2026 to 2033, ODMs & Module Manufacturers are expected to grow fastest, driven by rising customization of PCIe-based modules, increasing edge deployments, and the growing demand for compact, integrated signal integrity solutions in next-generation computing and networking hardware platforms.

PCI Express Retimer Market Report Analysis

North America PCI Express Retimer Market Insights

North America dominated the PCIe Retimer market in 2025E, accounting for 36.57% of the global share, driven by the strong presence of major semiconductor manufacturers and hyperscale cloud data centers. The region’s rapid adoption of PCIe 5.0 and 6.0 technologies, along with growing investments in AI infrastructure, 5G networks, and high-performance computing (HPC) systems, continues to accelerate demand for advanced retimer solutions ensuring high-speed connectivity and signal integrity.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. PCI Express Retimer Market Insights

The United States dominated the North American PCIe Retimer market in 2025, supported by leading data center operators, semiconductor giants, and AI-driven infrastructure projects. Major tech firms like Intel, NVIDIA, and AMD are driving high adoption of PCIe 5.0 and 6.0 retimer solutions.

Europe PCI Express Retimer Market Insights

Europe accounted for 24.31% of the global PCIe Retimer market in 2025E, driven by rising investments in data centers, AI research, and advanced industrial automation. The region’s growing focus on digital transformation and adoption of PCIe 5.0 and 6.0 interfaces in enterprise servers and networking systems are fueling demand. Additionally, strong semiconductor R&D initiatives and expansion of high-speed computing infrastructure are supporting sustained market growth.

Germany PCI Express Retimer Market Insights

Germany dominated the European PCIe Retimer market in 2025, driven by its advanced industrial automation, strong semiconductor ecosystem, and growing investments in AI and data infrastructure. The country’s focus on high-speed computing and Industry 4.0 technologies continues to accelerate PCIe adoption.

Asia Pacific PCI Express Retimer Market Insights

Asia Pacific is expected to grow at the fastest CAGR of 35.35% from 2026 to 2033 in the PCIe Retimer market, driven by massive data center expansion, rapid AI adoption, and increased semiconductor manufacturing. Rising investments in 5G infrastructure, high-performance computing, and cloud platforms are boosting demand for high-speed interconnects. Additionally, the proliferation of AI accelerators, edge computing, and consumer electronics is driving large-scale integration of PCIe 5.0 and 6.0 retimers across the region.

China PCI Express Retimer Market Insights

China dominated the Asia Pacific PCIe Retimer market in 2025, supported by its expanding semiconductor manufacturing base, rapid data center construction, and strong government focus on AI and digital infrastructure. Major tech companies are accelerating PCIe 5.0 and 6.0 adoption across computing and networking applications.

Latin America (LATAM) and Middle East & Africa (MEA) PCI Express Retimer Market Insights

Latin America and the Middle East & Africa PCIe Retimer market are witnessing steady growth, driven by increasing investments in digital infrastructure, cloud computing, and data center expansion. The rising adoption of advanced servers and AI workloads is boosting the need for high-speed signal integrity solutions. Ongoing technological modernization, coupled with government-led digital transformation initiatives, is creating new opportunities for PCIe 4.0 and 5.0 retimer deployments across both regions.

Competitive Landscape for PCI Express Retimer Market:

Texas Instruments (TI) is a leading semiconductor manufacturer specializing in analog and embedded processing solutions. In the PCIe Retimer market, TI offers high-performance signal integrity and redriver/retimer products that support PCIe 4.0 and 5.0 standards, enabling reliable high-speed data transmission for data centers, AI systems, and advanced computing applications.

-

In March 2024, TI listed the DS160PT801 an 8-lane (16-channel) PCIe 4.0 (16 GT/s) retimer supporting up to 16 GT/s as “active” in its product catalogue.

Broadcom Inc. is a global connectivity-semiconductor leader providing end-to-end high-speed interconnect solutions. In the PCIe Retimer market, Broadcom offers advanced retimers supporting Gen 5/Gen 6 (32 GT/s and 64 GT/s) and CXL, designed for AI infrastructure, data centers, and high-bandwidth servers.

-

In February 2025, Broadcom launched its end-to-end PCIe Gen 6 portfolio including switches and retimers along with an Interop Development Platform (IDP) for AI infrastructure.

PCI Express Retimer Market Key Players:

Some of the PCI Express Retimer Market Companies

-

Texas Instruments

-

Broadcom

-

Renesas Electronics

-

Analog Devices

-

Microchip Technology

-

Astera Labs

-

Parade Technologies

-

Montage Technology

-

Analogix Semiconductor

-

NXP Semiconductors

-

Marvell Technology

-

ON Semiconductor

-

Diodes Incorporated

-

MaxLinear

-

Pericom Semiconductor

-

TE Connectivity

-

Amphenol ICC

-

Samtec

-

GigaDevice Semiconductor

-

Rambus

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 242.46 Million |

| Market Size by 2033 | USD 2609.18 Million |

| CAGR | CAGR of 34.62% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Standalone Retimers, and Integrated Retimers (embedded in transceivers, PHYs, or modules)) • By PCIe Generation / Data Rate (PCIe 3.0 (8 GT/s), PCIe 4.0 (16 GT/s), PCIe 5.0 (32 GT/s), and PCIe 6.0 (64 GT/s)) • By Application (Servers & Data Centers, Enterprise Networking & Switches, Storage Devices (NVMe SSDs, RAID controllers), AI/ML Accelerator Cards & GPUs, and Client/Consumer PCs & Laptops) • By End-User (Hyperscale Cloud Service Providers, OEMs (Server, Storage, and Workstation Manufacturers), ODMs & Module Manufacturers, and Enterprises & Research Institutions) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Texas Instruments, Broadcom, Renesas Electronics, Analog Devices, Microchip Technology, Astera Labs, Parade Technologies, Montage Technology, Analogix Semiconductor, NXP Semiconductors, Marvell Technology, ON Semiconductor, Diodes Incorporated, MaxLinear, Pericom Semiconductor, TE Connectivity, Amphenol ICC, Samtec, GigaDevice Semiconductor, Rambus. |