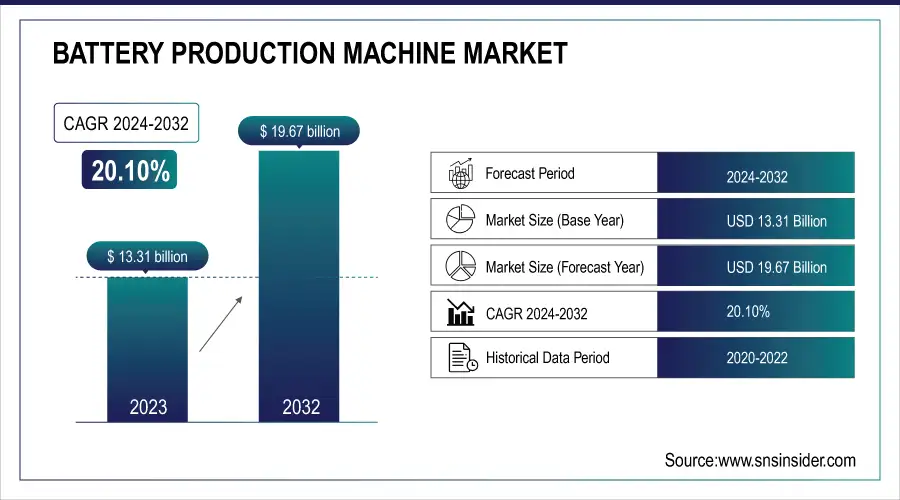

Battery Production Machine Market Size & Growth Analysis:

The Battery Production Machine Market was worth USD 13.31 Billion in 2023 and is anticipated to reach USD 19.67 Billion in 2032, growing at a CAGR of 20.10 % during the period from 2024 to 2032. The market for battery production machines is witnessing huge growth due to the worldwide upsurge in demand for electric vehicles (EVs), renewable energy storage systems, and portable electronics. While the industries shift to clean energy and electrification, manufacturers are putting immense investment in cutting-edge battery manufacturing technologies to boost output, save costs, and improve quality. The market represents a broad scope of machines such as coating and drying machines, stackers, slitting machines, and formation systems, each having a vital role to play in the battery assembly line.

To Get more information on Battery Production Machine Market - Request Free Sample Report

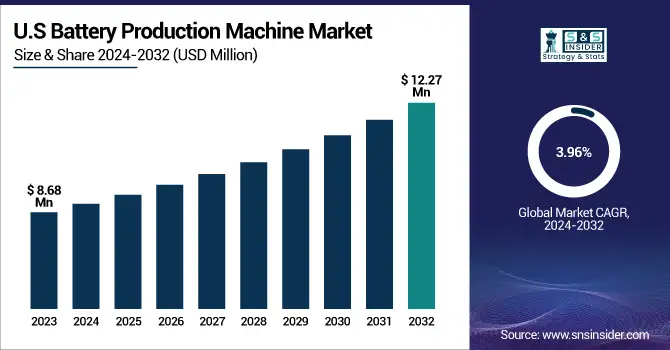

In the United States, the market for battery production machines was USD 8.68 million in 2023 and is anticipated to grow to USD 12.27 million by 2032, expanding at a CAGR of 3.96%. This expansion is triggered by rising investments in local battery production to drive electric vehicle manufacturing, renewable energy storage, and grid modernization initiatives. Government incentives and collaborations on strategic terms with battery technology firms are hastening technological leaps in automation as well as production efficiency. With the U.S. looking to minimize its dependence on imported batteries and enhance energy security, demand for high-end battery manufacturing equipment is growing steadily across industry sectors.

Battery Production Machine Market Dynamics

Key Drivers:

-

Surging Demand for High-Performance Batteries in Electric Vehicles Drives Growth of the Battery Production Machine Market

The widespread uptake of electric vehicles (EVs) worldwide is generating a huge demand for high-performance, long-lasting, and energy-efficient batteries. This demand is driving investments in mass-scale battery production, thus fueling the need for battery manufacturing equipment. Governments and private entities are scaling up gigafactories to achieve production volumes, with automation and precision machinery at the center of these plants. This trend is strongly driving the battery production machine market, as companies are looking for efficient, scalable, and high-throughput equipment to address changing battery technology requirements, especially in lithium-ion and next-generation solid-state battery applications.

Restrain:

-

Stringent Environmental Regulations and High Initial Equipment Costs Restrain Growth of the Battery Production Machine Market

As a demand for batteries persists, the adoption of battery manufacturing machines is challenged by environmental protection policies and massive capital outlay. Adherence to emissions regulations and safe handling of hazardous materials necessitates extra safety elements and qualifications in equipment, subjecting businesses to higher initial costs. Smaller and mid-sized producers frequently have issues meeting the financial outlay required to implement automated or cleanroom-compliant systems. In addition, changing regulations for battery materials and disposal impact the production process by delaying investments and new machine installations. All of these factors prevent market penetration in developing economies or for companies that have limited infrastructure or funding.

Opportunity:

-

Expansion of Renewable Energy Storage Infrastructure Creates Lucrative Opportunities for Battery Production Machine Market Players

The growing trend towards renewable energy sources, including solar and wind, is creating high demand for efficient and scalable energy storage technologies. Production machines for batteries are critical in the production of large-format batteries employed in grid-level storage systems. Governments and utilities are investing in enormous storage facilities to levelize power supply and lower fossil fuel dependence. This trend opens the door for machine manufacturers to leap forward and offer machines that are tailored to suit flow batteries, lithium-iron-phosphate, and other chemistries focused on storage alone. As power management is where energy storage gets crucial, there will be skyrocketing demand for manufacturing equipment within this sector.

Challenges:

-

Technological Complexity and Skill Shortages Pose Operational Challenges in the Battery Production Machine Market

The introduction of high technologies like AI, robotics, and precision automation into battery production equipment has highly boosted the level of complexity in operation. Though they increase efficiency, their adoption requires highly trained manpower and technical expertise. Most regions, especially emerging economies, suffer from a lack of skilled human resources to handle and maintain such advanced machines. In addition to that, equipment downtime as a result of unsuitable handling or insufficient technical services can interrupt the production cycles and result in loss. This capability shortage and operating risk are the significant challenges to manufacturers looking forward to scaling manufacturing with next-gen battery technologies.

Battery Production Machine Industry Segmentation Outlook

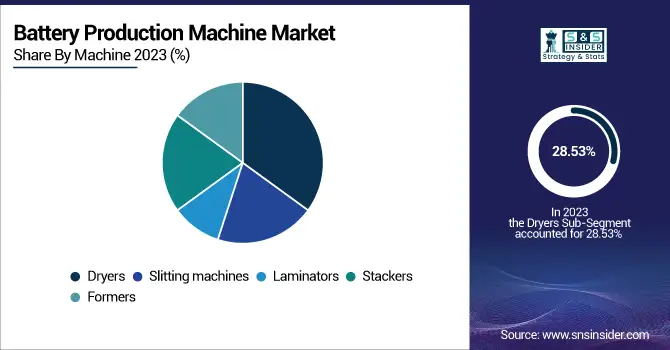

By Machine

In 2023, the dryers segment accounted for the largest market share in the battery production machine industry with 28.53% of total revenue. Dryers are a significant part of removing moisture during the manufacturing of electrodes, having a direct impact on battery efficiency and longevity. Market leaders such as Dürr Group and Hitachi Zosen have brought to the market cutting-edge energy-efficient and vacuum-based drying systems to cater to increased lithium-ion battery production needs. Dürr, for example, introduced ecoDry systems specifically for EV battery production lines, improving drying accuracy and conserving energy. Increasing demands for EV batteries and storage systems further reinforce the dominance of dryers in this sector.

The stackers segment is expected to advance at the highest CAGR of 7.24% over the forecast period, fueled by growing automation in battery cell assembly. Stackers provide precise layering of electrodes, a key process in pouch and prismatic cell configurations. Players such as Manz AG and Shenzhen Yinghe Technology have introduced high-speed, AI-enabled stacking machines to enhance precision, minimize defects, and increase throughput. For example, Manz's newest intelligent stacking solution enables solid-state battery production lines. As investment in next-generation batteries and precision manufacturing increases, stackers are becoming critical for enhancing production scalability, making this segment the market's fastest-growing.

By Battery

In 2023, the lithium-ion batteries segment was leading the market for battery production machines with a 63.20% share in terms of revenue owing to skyrocketing demand in electric vehicles, consumer electronics, and energy storage systems. Key players such as Tesla, CATL, and Panasonic have increased gigafactories, triggering mass adoption of battery manufacturing equipment. Players like Wuxi Lead Intelligent and Manz AG are progressively introducing high-end, high-throughput lithium-ion cell manufacturing equipment with inbuilt automation and artificial intelligence. The trend fits a growth trajectory backed by increasing EV infrastructure and grid-scale storage investment worldwide, establishing lithium-ion batteries as the linchpin in driving battery production machine growth.

The flow batteries market is anticipated to expand with the highest CAGR of 7.85% over the forecast period due to growing demand for long-duration energy storage. Flow batteries, with their long lifecycle and scalability, are finding applications in utility-scale renewable energy projects. Organizations such as ESS Inc. and Invinity Energy Systems have developed advanced commercial deployments, which are driving machinery developers to design specialized equipment for modular stack assembly and electrolyte handling. Recent advancements in vanadium and iron flow technologies are accelerating adoption, hence the demand for production machinery tailored to their specific requirements. This market segment's growth is an indicator of increasing demand for grid stabilization and green energy storage solutions.

By Application

In 2023, the automotive industry sector dominated the battery production machine market with a strong 41.50% share in revenue due to the world-wide increase in electric vehicle (EV) production. Large automotive manufacturers such as Tesla, Ford, and Volkswagen have increased battery production through the opening of new gigafactories and strategic alliances with machine producers such as Dürr, Wuxi Lead, and Siemens. These firms are building automated manufacturing lines for dense lithium-ion batteries designed to EV specifications. With mounting regulatory backing for zero-emission automobiles and swift fleet electrification, market demand for high-throughput and high-precision battery manufacturing machines continues to expand, cementing the segment's market leadership.

Consumer electronics is poised to register the maximum CAGR of 6.55% for the forecast period, led by the increased penetration of smartphones, wearables, and laptops. Miniaturization of batteries and growing requirements in terms of energy density are influencing companies to spend on advanced equipment for compact cell manufacturing. Companies such as Panasonic and Samsung SDI are creating next-generation batteries, while equipment makers such as Manz AG are providing micro-stacking and precision coating machines. As devices in consumers' hands become more sophisticated and power-intensive, manufacturers are ramping up production with efficient, high-speed machines—fueling significant growth for this category within the larger battery production machine market.

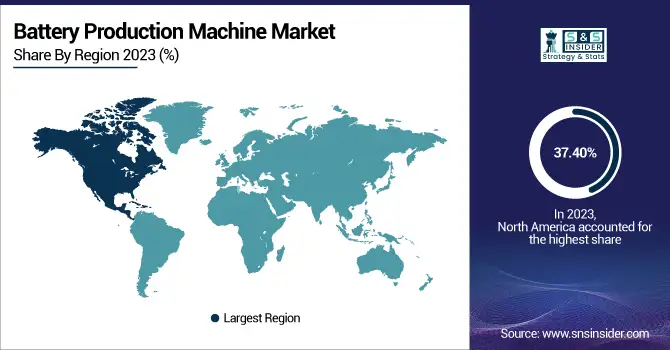

Battery Production Machine Market Regional Analysis

North America held the highest revenue share of 37.40% in the battery-making machine market in 2023 due to the peak electric vehicle (EV) production, investments in energy storage, and government-supported domestic battery manufacturing initiatives. The U.S. leads the way, with industry leaders Tesla, Ford, and General Motors cooperating with battery machine suppliers such as Wuxi Lead and Dürr to produce automated gigafactory lines. The Inflation Reduction Act has further driven local battery production investment. These technologies are driving high-precision coating, stacking, and drying equipment demand, adding to North America's leadership in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific is expected to register the highest CAGR of 6.45% over the forecast period due to huge battery manufacturing expansions in China, South Korea, and Japan. These countries have leading global players such as CATL, LG Energy Solution, and Panasonic, who are expanding operations and implementing advanced production equipment. CATL has particularly partnered with automation suppliers to construct high-speed, AI-enabled battery production lines. As demand skyrockets for electric cars and battery storage systems throughout nascent Asian economies, demand for clean, mass-scale battery fabrication machines is picking up speed very quickly, and the region of Asia Pacific is the fastest-growing sector in the global marketplace.

Key Players Listed in the Battery Production Machine Market are:

-

ZSK Stickmaschinen GmbH – ( CHALLENGER SGR 0218, Roll2Basket System)

-

Manz AG – ( LightAssembly Platform, Battery Production Solutions)

-

DMG MORI AG – ( ULTRASONIC Series, LASERTEC Series)

-

Fristam Pumpen AG – ( FP Series Pumps, FZ Series Self-Priming Pumps)

-

Hanwha Precision Machinery Co., Ltd – ( CNC Swiss Lathe, Chip Mounter)

-

Tesla, Inc. – ( Model 3, Powerwall )

-

KUKA AG – ( KR QUANTEC Series, KUKA Mobile Platforms (KMP) )

-

Fives Syleps – ( Syleps WMS, Syleps AGV )

-

Giga Presse GmbH – ( Giga Press 6100, Giga Press 8400)

-

Arvigon AG – ( Solar Modules, Inverters )

Recent Trends

-

February 2025, Tesla announced plans to acquire parts of the insolvent German high-tech parts maker Manz AG, including over 300 employees at its Reutlingen site. This acquisition aims to expand Tesla's footprint in Germany.

-

December 2024, Shibaura Machine Co., Ltd. invested in AM Batteries, Inc., a U.S.-based battery startup, reflecting the company's interest in expanding into the battery manufacturing sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.31 Billion |

| Market Size by 2032 | USD 19.67 Billion |

| CAGR | CAGR of 20.10 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Machine – (Slitting machines, Laminators, Stackers, Dryers, Formers) •By Battery -(Lithium-ion batteries, Lead-acid batteries, Nickel-cadmium batteries, Nickel-metal hydride batteries, Flow batteries) •By Application – (Automotive industry, Consumer electronics, Energy storage, Marine applications, Medical devices) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | LG Energy Solutions Ltd., Saft Groupe SA, Gelion PLC, Sion Power Corporation, Johnson Matthey, Giner, Inc., Lynntech, Inc., Ilika Technologies, Williams Advanced Engineering, Guang Dong Xiaowei New Energy Technology Co., Ltd. |