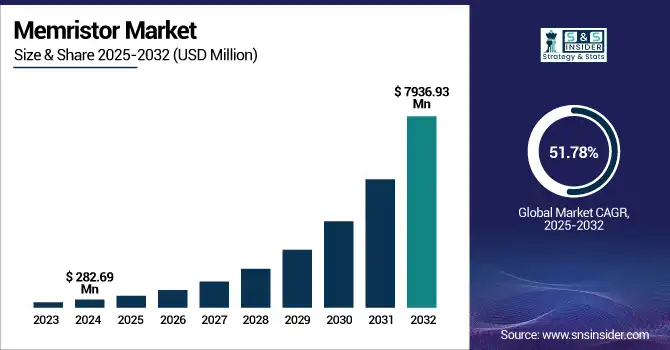

Memristor Market Size & Growth:

The Memristor Market Size was valued at USD 282.69 million in 2024 and is expected to reach USD 7936.93 million by 2032 and grow at a CAGR of 51.78 % over the forecast period 2025-2032.

To Get more information on Memristor Market - Request Free Sample Report

The global memristor market is growing due to the growing demand for high-speed, energy-efficient memory devices in the electronics and computing industries. Their potential for nonvolatile data storage and applications to neuromorphic computing makes them crucial for future devices. Growing in Adoption in AI, IoT, and Edge Computing Space Driving the Market Growth Forward from the Market Side. Moreover, increasing R&D investments and strategic partnerships between key players are propelling innovation and commercialization, which is enabling to memristors to be a disruptive element in contemporary, intelligent, and densely-integrated electronic systems.

According to research, over 40 companies and startups globally are now actively involved in memristor development, ranging from fabless design to materials engineering.

The U.S. Memristor Market size was USD 62.88 million in 2024 and is expected to reach USD 1507.80 million by 2032, growing at a CAGR of 48.82 % over the forecast period of 2025–2032.

The US memristor market growth is fueled by strong demand for next-generation memory devices, and the growing investment in neuromorphic computing, and the presence of semiconductor research institutes. Furthermore, increasing proliferation of AI solutions and IoT devices in the U.S. is driving the growth of the memristor-based architectures for use in various data storage and processing applications.

According to research, U.S. companies and institutions hold over 35% of global memristor-related patents, led by HP, IBM, and Sandia National Labs.

Memristor Market Dynamics

Key Drivers:

-

Rising demand for faster, energy-efficient memory technologies across electronics and computing applications fuels market expansion.

The growing demand for high-performance and low-power memory devices in consumer electronics, data centers, and industrial systems is influencing memristor uptake. Their ability to memorize without power and enable quicker access to data compared to traditional memory types makes them prime applicants in computing systems of the future. This tech advantage is also fitting within the dynamics of AI, IoT and mobile devices today when power efficiency and miniaturization are key. The market requirement for a scalable and reliable non-volatile memory still remains high due to the trends for the edge computing and IoT systems.

According to research, Memristors consume up to 100× less power than conventional flash memory, making them ideal for AI and edge computing systems.

Restrain:

-

Lack of established industry standards and compatibility with conventional systems limits adoption.

Lack of a common standard for memristor design, interface protocols, and integration into existing computing infrastructure is a significant bottleneck. Most software and hardware platforms are normally optimized for conventional memory technologies such as DRAM and flash. To achieve these goals, memristors are usually integrated into the system with architectures changes and compatibility proof, which would rather make the system disturbing. This commensurability mismatch currently hinders utilisation in commercial off-the-shelf products. Furthermore, industry reluctance due to a lack of clear regulatory guidance and interoperability issues is limiting their adoption in vital use cases.

Opportunities:

-

Government funding and research programs are accelerating memristor innovation and ecosystem development.

A number of national governments and research agencies have identified advanced computing research, which includes neuromorphic engineering and non-volatile memory research, as a priority in their funding landscape. These efforts back academics working with industry, pilot production lines, and the establishment of open standards. Early stage technical and commercial barriers are being addressed through effective public-private partnerships, leading towards a stronger memristor technologies ecosystem. Consequently, it is making its mark in overseas markets in terms of credibility and awareness. Continued funding and policy support can significantly boost industry adoption and lead to wider commercialization.

Challenges:

-

Commercial-scale integration into current computing architectures remains technically and economically complex.

Although memristors have theoretical benefits over traditional memory, converting them to current computing architectures is problematic. Computer architecture and operating system designs will need to be substantially changed to take advantage of memristor capabilities, e.g., analog processing or in-memory computing. These changes require high R&D costs, time-consuming verification, and new skill sets to integrate, making it slow and expensive. With no breakthroughs in compatibility or hybrid memory systems, mass deployment will be a significant barrier.

Memristor Market Segment Analysis:

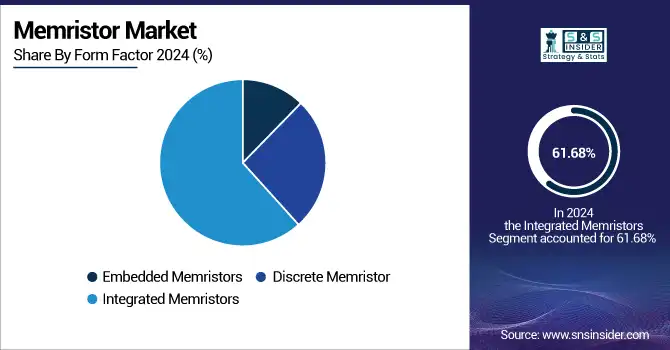

By Form Factor

Integrated memristors dominated the memristor market with a 61.68% revenue share in 2024, because of their substantial potential for CMOS compatible, ultra-low power consumption and good scalability. These are suitable for integration into a variety of complex circuits for advanced electronics and neuromorphic computational architectures. Companies such as HP Inc. are redefining the possibilities of in-memory class computing with extensive development with integrated memristors. The easy and reliable integration of the devices are advantages that make them suitable for fast and stable memory architecture type applications.

Discrete memristors are expected to grow at the fastest CAGR of about 53.79% from 2025 to 2032 because they can be deployed independently, enabling experimental and innovative use. These are used by universities and in research, prototyping, and specialized memory applications. Knowm Inc. is developing discrete memristor-based products specifically for AI and neuromorphic circuits. Flexible and reconfigurable, the tech suits developers experimenting with new materials and designs, which explains their large projected growth.

By Application

Circuit memory segment dominated the memristor market share with a 40.84% in 2024, as they provide high-speed data access, superior retention, and low power consumption versus flash memory. These benefits render them suitable for memory-centric computing devices and hybrid memory systems. Crossbar Inc. has implemented advanced circuit memory with memristor based technology that provides better performance and scalability. Their ubiquitous utilization in consumer and industrial electronics contributes to their supremacy in the application domain.

Neuromorphic computing is expected to grow at the fastest CAGR of about 53.15% from 2025 to 2032, fueled by the rise of AI hardware that can mimic the human brain. Memristors resemble artificial synapses, allowing for quicker computing and learning on the fly. IBM is betting on memristor-based neuromorphic systems to enable next-gen AI and robotics. Their ability to operate with real time pattern based recognition and learning has resulted in a quick uptake of the technology in industries requiring intelligent, automated computing.

By Technology

Resistive memristors dominated the memristor market in 2024 with a 33.74% revenue share, owing to their advanced technology, reliable switching property and applicative characteristics for logic operation and memory operation. They are also cost-effective to manufacturers with the somewhat simpler manufacturing process. Memristor Company like Panasonic Corp., have created resistive memristor models which are presently implemented in hybrid memory chips. They are very popular in consumer and industrial memory systems due to their reliable astringent performance and scalability.

Nano-ionic memristors are projected to grow at the fastest CAGR of about 53.79% from 2025 to 2032, because of their higher switching speed, lower energy loss, and prolonged lifetime. Researchers are investigating these memristors for use in high-density storage and neuromorphic computing. Adesto Technologies is developing nanoparticle-based designs for ultra-low-power edge compute devices. Their nanostructure design provides a very attractive approach to meet the need of ultra-compact, smart and high-speed memory for diverse computing platforms.

By End-Use

Consumer electronics dominated the memristor market in 2024 with a 39.00% revenue share, due to the proliferation of smart devices, wearables, and power-efficient memory devices. The combination of both technologies offers longer battery life and faster data access. Memristor memory could soon power the next generation of mobile devices as companies such as Samsung Electronics investigate these components. Their scalability and energy efficiency are characteristics particularly well suitable for consumer electronics, compact and high-performance mobile appliances.

The automotive segment is projected to grow at the fastest CAGR of about 53.20% from 2025 to 2032, owing to increased adoption of memory system in electric vehicles, ADAS, and autonomous driving systems. The rugged memristors are well suited for vehicle applications in harsh conditions while providing fast sensing response required for real-time automotive data processing. Bosch is also interested in adopting memristor-based devices for automotive electronics and AI related driving systems. They are reliable and compact, making them particularly suitable to the increasingly complexity of car electronics.

Get Customized Report as per Your Business Requirement - Enquiry Now

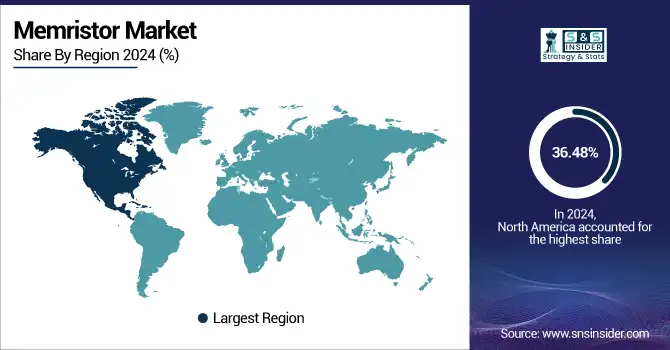

Memristor Market Regional Overview:

North America dominated the memristor market with the highest revenue share of about 36.48% in 2024, due to robust semiconductor resources and government subsidies, and deployment of advanced computing technology at fast pace. The AI, IoT, and neuromorphic computing-centered nature of the region is driving the deployment of memristors in the other sectors. High level of high-tech ecosystem maturity and university – industry linkages continue to keep North America at the forefront of this segment.

-

The United States dominates the North American memristor market due to its strongest R&D infrastructure, the presence of leading semiconductor companies, and government-led AI projects. A high uptake of neuromorphic computing as well as early commercialization of advanced memory solutions also give evidences that this country leads the Domain.

Asia Pacific is expected to grow at the fastest CAGR of about 54.08% from 2025 to 2032, due to growing electronics production, increasing consumer base, and high investments in semiconductor R&D. Nations are racing to invest in AI and memory advancement including China, Japan, South Korea, and India. The increasing requirement of smart devices, electric vehicles, and AI infrastructure are some of the factors driving the growth for memristor across consumer and industrial applications in the region.

-

China leads the Asia Pacific memristor market driven by semiconductor investments, large electronics manufacturing industry, and programs to develop AI. The government’s strategic move toward self-reliant chip production and a surge in demand for consumer and automotive electronics also help it dominate.

Europe represents a promising market for memristors with top-class academic research, political push for digitalization, and increasing AI activities and IoT applications demanding low-energy memories. The biggest takers are Germany, France and the UK. European efforts in neuromorphic computing and green technology will increase the region’s impact in the development and integration of advanced memory components.

-

Germany dominates the European memristor market due of its strong presence in automotive electronics, industrial automation, and advanced semiconductor R&D. Trending collaborations with top universities and automotive majors are detonating speed for the integration of memristors across smart systems, thereby contributing to growth in innovation and market share.

The market in Middle East & Africa and Latin America is at its emerging stage due to the increasing penetration of digital transformation and AI. Efforts are spearheaded in the UAE, Saudi Arabia and Brazil through smart infrastructure and research, and in Argentina and South Africa with academic advancements in neuromorphic and low-power computing.

Memristor Companies are:

Major Key Players in Memristor Market are Samsung Electronics, Intel Corporation, IBM Corporation, Crossbar Inc., Micron Technology Inc., Hewlett Packard Enterprise (HP), Knowm Inc., STMicroelectronics, Toshiba Corporation, Weebit Nano Ltd and others.

Recent Trends:

-

January 2025, Weebit Nano licensed its ReRAM IP to onsemi for integration into its Treo platform, expanding embedded non-volatile memory adoption across industrial applications and enhancing ultra-low power edge computing capability.

-

April 2025, Nature‐inspired ring‑oscillator neural network hardware employed BEOL‑integrated ReRAM arrays to perform associative memory pattern retrieval, marking the first in‑hardware ONN implementation using resistive memory crossbars.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 282.69 Million |

| Market Size by 2032 | USD 7936.93 Million |

| CAGR | CAGR of 51.78% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form Factor (Embedded Memristors, Discrete Memristor, Integrated Memristors) • By Application (Circuit Memory, Neuromorphic Computing, Data Storage, Signal Processing) • By Technology (Nano-ionic Memristor, Resistive Memristor, Quantum Memristor, Spintronic Memristor) • By End-Use (Consumer Electronics, Automotive, Healthcare, Industrial Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Samsung Electronics, Intel Corporation, IBM Corporation, Crossbar Inc., Micron Technology Inc., Hewlett Packard Enterprise (HP), Knowm Inc., STMicroelectronics, Toshiba Corporation, Weebit Nano Ltd. |