Penetration Testing Market Report Scope & Overview:

Get More Information on Penetration Testing Market - Request Sample Report

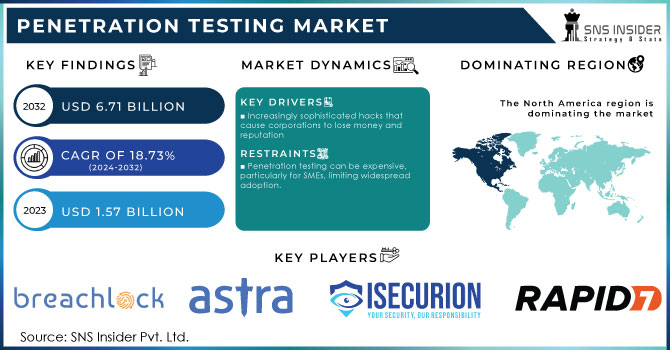

The global penetration testing market, valued at USD 1.57 Billion in 2023, is projected to reach USD 6.71 Billion by 2032, growing at a compound annual growth rate (CAGR) of 18.73% during the forecast period.

The rise in adoption of the cloud technology and increase in number of data centre’s is driving growth for penetration testing market globally. Government regulations are also supporting the increased use of penetration testing tools. The combination of machine learning and artificial intelligence with penetration testing, as well developments around penetration testing as a Service (PTaaS) offerings and remote working security assessments are providing new avenues to growth. In 2023, about 80% of organizations cited regulatory compliance (e.g., GDPR, PCI DSS) as a key driver for conducting penetration testing. Today's IT systems contain a mix of devices and applications which are interconnected, creating vulnerabilities that attackers can take advantage. Penetration testing is critical emulating the actions of outside attackers to expose potential holes that might not have turned up under normal security conditions.

The subscription-based PTaaS model changes the landscape of cybersecurity for small business, making advanced security testing easier and more cost-effective. It spreads costs over time, responds to varying test demands and requires no in-house expertise as service providers take care of all aspects. The rise of cyber-attacks is leading organizations to employ penetration testing services in order to safeguard their networks, endpoints and IT infrastructure. The increased use of the internet and smart devices in various verticals such as healthcare, finance, retail etc. have significantly contributed to this growth on account of rising concerns for cybersecurity. As of 2023, over 70% of organizations worldwide reported increasing their budget allocation for penetration testing due to the growing number of cyber threats and regulatory requirements. According to a 2023 survey, 45% of organizations conduct penetration testing at least quarterly, while 30% perform it annually. A smaller percentage, around 15%, conduct it monthly.

Drivers

-

Increasingly sophisticated hacks that cause corporations to lose money and reputation

-

The demand for penetration testing is growing as more people utilize secured web applications, increasing the risk of cyberattacks and the prevalence of cybercrime across practically all sectors of the economy.

Cyberattacks have considerably expanded in frequency and sophistication over the past few years. Despite the fact that 97.5% of cyberattacks rely on social engineering, hackers are using technology like AI, ML, and analytics to make their attacks more sophisticated. Even when such sophisticated attacks are discovered, the process of recovery becomes significantly prolonged. Shockingly, according to a report by Retarus, a staggering 76.2% of organizations lack a well-defined incident response plan. Furthermore, an alarming 93.1% of healthcare businesses have reported experiencing at least one security breach within the past three years., and nearly 80% of senior IT personnel and security leaders say their organizations are not effectively safeguarded against cyberattacks. These figures demonstrate how poorly prepared corporations are for cyberattacks, opening up new opportunities for them. Cybercriminals are selling data, including login credentials, on the dark web in an effort to make a profit. These data are then bought and utilized by other cybercriminals to launch cyberattacks. Additionally, a number of hacking groups and state-sponsored actors carry out cyberattacks for commercial or political motivations. The price of a data breach is rising as a result of these sophisticated cyberattacks. An organization's reputation is also impacted when there are cyberattacks on it. Preventing cyberattacks is essential to avoid such losses, which is boosting the demand for penetration testing across all sizes of enterprises.

Restrains

-

Penetration testing can be expensive, particularly for SMEs, limiting widespread adoption.

-

Smaller businesses are using fewer penetration testing solutions, which is limiting market expansion.

-

The lack of cybersecurity experts with penetration testing expertise hinders the market's growth.

The cost of excellent penetration testing varies according to the size, scope, complexity, testing method, tester experience, and remediation costs of the firm. All businesses are unable to pay these costs, thus many ends up conducting testing less frequently than is necessary. For instance, SMEs with limited cybersecurity resources may decide to perform penetration tests annually or every two years, despite the law's requirement that they be done every two years. Therefore, the cost of performing penetration testing can prevent the market from growing.

Opportunities

-

Growing acceptance of PTaaS and security evaluation for remote workers

-

The expansion of data centers has witnessed significant growth in recent years.

Segment Analysis

By Type

Based on type the web applications segment held largest share in 2023, mainly because of exponential growth with respect to cloud services and proliferation of threats that are more advanced against these set-ups. With a majority of businesses digitalizing operations and increasing their online presence, web applications have become crucial for customer interaction as well as data interchange, hence are also one of most hunted attack vectors by cybercriminals using SQL injection or RCE (Remote Code Execution), XSS (Cross-Site Scripting) etc. The rise in the number of such attacks has further accentuated the importance of effective security measures, thereby fueling demand for web application penetration testing solutions.

Mobile application sub-segment is anticipated to grow at a significant pace during the forecast period due to an increase in usage of mobile devices and high adoption rate across different industry verticals for various applications. Connected to many of you every day with billions in sales, business applications are the best targets for cyberattacks. With the rising number of mobile platforms and various types as well as amounts of data involved, robust security testing procedures are required. Mobile app development has been on the rise these days and this is why there is a need for penetration testing session be carried out in relation to addressing mobile-specific vulnerabilities that may include fragile data approach, lamentable encryption efforts along with vulnerable authentication sides.

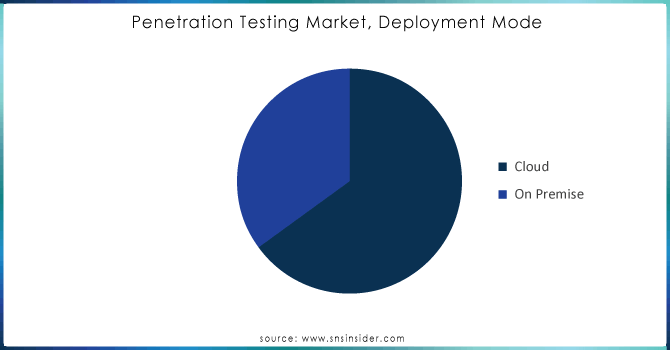

By Deployment Mode

In 2023, the cloud segment dominated the market, reflecting the widespread shift by businesses towards cloud-based infrastructures across various industries. The appeal of the cloud lies in its scalability, flexibility, and cost-effectiveness. However, this transition has brought new security challenges, including misconfigurations, data breaches, and vulnerabilities specific to cloud environments. These issues have underscored the need for thorough penetration testing to maintain strong security measures in cloud-based systems.

The on-premises segment is expected to gain an exponential rise in the market over future-years. The heavily regulated sectors like finance, healthcare & government many organizations still rely upon on-premises infrastructure for better which provides them controls and security over data. This preference is driven by stringent compliance requirements and the need to adhere to strict data protection standards, necessitating detailed and frequent security assessments. On-premises systems often feature legacy applications and complex integrations that can conceal hidden vulnerabilities, making regular penetration testing essential to uncover and address potential security issues. The growing sophistication of cyber threats targeting on-premises environments further highlights the need for robust security measures.

Need any customization research on Penetration Testing Market- Enquiry Now

By Vertical

The BFSI sector accounted for the highest revenue share of market in 2023, owing to vulnerabilities and is a lucrative target for cybercriminals looking at it from financial gain. Testing is very important in the industry which deals with a lot of money and generally holds sensitive personal data. Given that cyber threats are evolving, and the BFSI sector is increasingly under regulatory pressure to keep its security policies updated. It supports penetration testing, and is a way to meet compliance obligations (because of regulation requirements), in order to combat advanced cyber threats targeting availability as well as integrity & confidentiality slightly lowering the risk associated with financial transactions and potential loss or theft of customer data.

During the forecast period, healthcare industry is also expected to experience the fastest CAGR. As the healthcare sector holds extensive personal health information, it has become a prime target for cyberattacks seeking financial profit or data breach. The increased adoption of digital health records and medical devices has further complicated healthcare IT environments, making the industry more susceptible to security vulnerabilities. This is where penetration testing can be the answer, in terms of identifying these vulnerabilities and addressing them to prevent data breaches for a healthcare organization that may otherwise fail its legal or regulatory obligations.

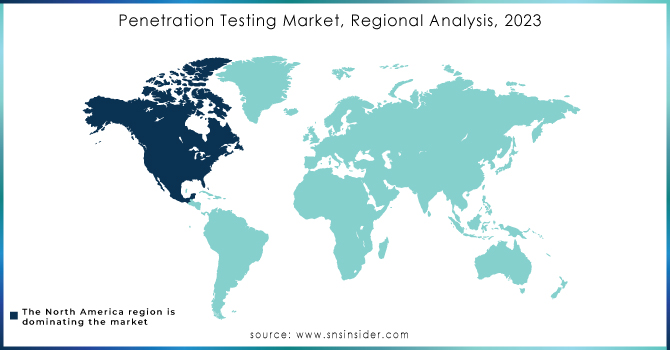

Regional analysis

North America held the largest share in North American penetration testing market with a revenue of more than 36% in 2023. That dominance is encouraged by the region's substantial investment in cybersecurity to protect sensitive data and ensure operational integrity. Larger enterprises and critical industries, such as in the U.S. and Canada are more likely to have advanced requirements for cybersecurity as well. Additionally, the pro-active push by region on addressing grew changing cyber threats and presence of well-established cybersecurity companies & technology hubs contributes to more demanded for penetration testing services. The U.S. penetration testing market would register substantial growth from 2024 to 2032, on account of its advanced technological infrastructure and a large-scale investment in cybersecurity due to the rigorous compliance policies implemented. The number of major companies and critical infrastructure in the U.S. makes it extremely vulnerable to cybersecurity threats, thereby necessitating advanced penetration testing measures to secure its data streams.

Asia-Pacific growing with the fastest annual growth rate in penetration testing market during 2024-2032. The growth in this region is mainly due to the surge in advanced technologies, expansion of digital infrastructures, and extensive use of data centres Increased worries over data security and an influx of new legislation has stimulated the requirement for good protection methods such as penetration testing. With a considerable spike in sophisticated cyberattacks against both large enterprises and small to medium-sized businesses across the region leading to stringent security evaluations, it leads immediate attention into wider expansion of the market.

Key Players:

The major players are Breachlock Inc., Astra Security, Isecurion, NetSPI LLC, Rapid 7, Vumetric Cybersecurity, CovertSwarm, SecurityMetrics, PortSwigger Ltd, Nowsecure, Vairav Technology, Cisco Systems, Inc., Rebot Security, Netragard, Cigniti Technology Ltd., Bugcrowd, Synopsys, TrustWave Holdings, Inc., and others.

Recent Developments:

-

In March 2024, F5, Inc. introduced new penetration testing capabilities and automated reconnaissance for its F5 Distributed Cloud Services as well. They'll also ease application and API runtime protection in multi-cloud environments, thanks to integration with the Heyhack deal. This allows users to scan and detect vulnerabilities more efficiently in their web applications.

-

In December 2023, Chubb, an insurance firm with some public exposure that was publicly traded at the time (and is no longer), linked arms with NetSPI in December of 2023. This partnership will enable Chubb improve the cyber risk management of its customers, by enhancing Attack Surface Management and Penetration Testing solutions.

-

Coalfire released Hexeon in August 2023, a full-stack offensive security solution. Hexeon provides continuous risk monitoring through the vulnerability management lifecycle. enabling meaningful context regarding threat exposures along with a mechanism to interact continually with penetration testers as required at every stage of its exploitation process involving reporting, fixing and revalidation.

-

In August 2023, Appdome Inc., an industry leader of mobile app defense solutions announced Mobile Compliance Project. The over 50 leading mobile app penetration testers around the world are collaborating on this initiative, aimed at advancing DevSecOps for Mobile. It intends to enhance mobile app security, establish stricter defense criteria and deliver rapid validated cybersecurity & anti-fraud services globally for Mobile Apps.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.57 Bn |

| Market Size by 2032 | USD 6.71 Bn |

| CAGR | CAGR of 18.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solutions, Services) • By Organization Size (Large Enterprises, SMEs) • By Type (Web Applications, Mobile Applications, Network Solutions Cloud, Social Engineering) • By Deployment (Cloud, On-premises) • By Vertical (BFSI, Healthcare, IT & IteS, Telecommunication, Retail & eCommerce, Manufacturing, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Breachlock Inc., Astra Security, Isecurion, NetSPI LLC, Rapid 7, Vumetric Cybersecurity, CovertSwarm, SecurityMetrics, PortSwigger Ltd, Nowsecure, Vairav Technology, Cisco Systems, Inc., Rebot Security, Netragard, Cigniti Technology Ltd., Bugcrowd, Synopsys, TrustWave Holdings, Inc. |

| Key Drivers | • Increasingly sophisticated hacks that cause corporations to lose money and reputation • The demand for penetration testing is growing as more people utilize secured web applications, increasing the risk of cyberattacks and the prevalence of cybercrime across practically all sectors of the economy. |

| Market Restraints | • Smaller businesses are using fewer penetration testing solutions, which is limiting market expansion. |