Polyurethane Sealants Market Report Scope & Overview:

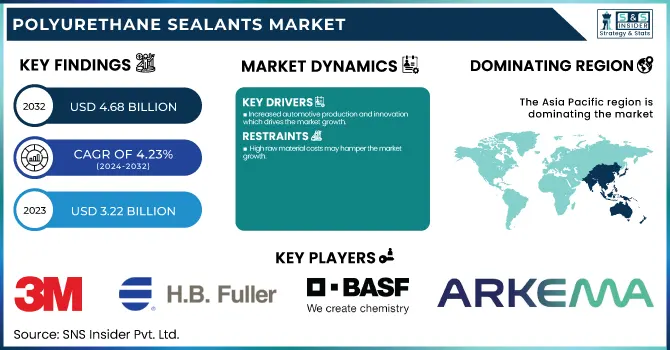

The Polyurethane Sealants Market size was USD 3.22 Billion in 2023 and is expected to reach USD 4.68 Billion by 2032 and grow at a CAGR of 4.23 % over the forecast period of 2024-2032. The report covers key trends in the market include the rising adoption of polyurethane sealants for their superior durability, flexibility, and weather resistance. In construction, the use of polyurethane sealants in both residential and commercial buildings is growing due to their ability to provide long-lasting performance in sealing joints, windows, and doors. We analyze trends in the existing and future market, explore pricing strategies, and examine the key drivers influencing the pricing dynamics. Our report provides a detailed overview of key patents shaping the industry landscape.

To Get more information on Polyurethane Sealants Market - Request Free Sample Report

Polyurethane Sealants Market Dynamics

Drivers

-

Increased automotive production and innovation which drives the market growth.

Rapid growth in automotive production and manufacturing along with automotive innovation is a major propellant for the growth of Polyurethane Sealants Market. In vehicle assembly, these sealants are important sealing materials used for windows, sunroofs, windshields and joints. The right materials for the job; along with their durable, weather-resistant, and adaptable properties across a number of different automotive components, ensure optimal vehicle lifespan and strength. In addition, advances in automotive design such as lightweight materials and more sophisticated vehicle architectures have led to an increased demand for high-performance sealants that are designed to deliver under the most extreme conditions. Additionally, the increased emphasis on fuel economy, safety, and aesthetics leads to increased requirements for advanced sealants that assist with noise, thermal and acoustic insulation, and corrosion resistance. The automotive industry keeps on seeing modern automobile technologies being developed each passing year, for example, independent vehicles, and electric powertrains, and that will prompt more demand for high-performance polyurethane sealants, further driving the development of the referenced market.

Restraint

-

High raw material costs may hamper the market growth.

The significant increases and fluctuations in the prices of these raw materials owing to either disruption of supply chain, astronomical rise in prices of crude oil or limitations in the production capability of the desired chemicals, will lead to the vegan to sustain their profit margins, by increasing the costs of the polyurethane products where these raw materials are required. The changes in those prices affect the total production costs for the manufacturers and, respectively, the pricing of end products. The increase in the price of raw materials may compel the manufacturers to raise the price of polyurethane sealants, which can lead to a decline in demand, especially in price-sensitive regions.

Opportunity

Increasing construction and infrastructure activities which create the opportunity in the market.

The growing number of construction and infrastructure activities create a lucrative opportunity for the Polyurethane Sealants Market. With further development in urbanization, both home and business sectors are moving toward durable, weather-resistant, and energy-efficient materials. Construction professionals appreciate polyurethane sealants for their combination of strong adhesion, flexibility, and durability used for windows, doors, joints, and facade sealing. These fittings help the energy efficiency of the buildings by providing a perfect air-tight seal which is must to avoid temperature loss and furthermore conserving energy. Along with huge infrastructure projects (road, bridge, air, and rail) expansion, polyurethane sealants are more common than ever to ensure the certainty of structural strength, while also preventing wear and corrosion by way of environmental-induced stresses. The rugged characteristics of these sealants, their tolerance to extreme temperatures, moisture, and UV exposure makes it perfectly suitable for construction and infrastructure projects where the conditions are harsh.

Challenges

Complexity in manufacturing and application may create the challenge for the market.

The application versatility and high performance of polyurethane sealants are the largest hindrances to the market owing to their complex nature in both manufacture and application. Polyurethane sealants should be formulated exactly, and knowledge is needed on how to manufacture them in a way that can produce consistent quality and performance of the product. To gain the best results, manufacturers need to control variables like humidity, temperature, and curing times. This complexity increases production costs and drives lead time, challenging manufacturers in the ability to scale production rapidly. Moreover, the application process can also be complicated, since the process involves critical surface preparation, controlled environmental conditions, and careful handling during the installation process for suitable bonding and durability of the product.

Polyurethane Sealants Market Segmentation

By Type

One Component segment held the largest market share around 68% in 2023. It is easy to use, economical, and is suitable for application in wide ranges of applications. One component sealant is like instant coffee; there is no need to mix hardeners or catalysts with the sealants, and therefore are the most convenient type of sealants, for professionals and do-it-yourselfers alike. They gained their popularity among different industries such as construction, automotive, and manufacturing, all due to this simple application. Additionally, they are appealing because, when they cure upon exposure to moisture or air, they can save a lot of time over two-component systems, which require more complex mixing and curing processes. Moreover, One Component sealants have outstanding adhesion, flexibility, and weather resistance which makes them excellent for sealing joints, gaps, and seams in windows, doors, facades, and automotive parts.

By End-Use Industry

The Building & Construction segment held the largest market share around 34% in 2023. Increasing demand for durable, weather-resistant, and energy-efficient materials in construction projects. This industry employs polyurethane sealants relatively frequently since they possess significant adhesion capacity, flexibility, and toughness that make them an excellent choice for moisture, UV, and extreme temperature resistance to ensure durability and structural integrity of buildings. Joint sealants are vital for sealing joints, windows, doors, facades, and other leaks prone areas to avoid the loss of energy-efficient and structural integrity because of air and water leaks. The increasing urbanization across the globe, the growing development of infrastructure, and a surge in the demand for green building practices will contribute to the increasing demand for high-performance sealants.

Polyurethane Sealants Market Regional Analysis

Asia Pacific held the largest market share around 42% in 2023. The growing construction and manufacturing activities in China, India, Japan, South Korea, etc. are anticipated to fuel the demand for high-performance sealants in these countries. Another factor driving residential and commercial construction is the expanding middle class and rising disposable income; this trend has also risen the demand for dependable, weather-resistant sealants for buildings, automotive, and infrastructure. The soaring automotive industry in the region is further helping the demand for polyurethane sealants in vehicle assembly, specifically for electric vehicles (EVs) and lightweight structures. Moreover, polyurethane sealants in Asia-Pacific are benefitting from government initiatives to expand the infrastructure, like smart city projects and the development of large transportation networks.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

3M (Scotch-Weld, 3M VHB Tape)

-

Arkema N.V. (Bostik) (Bostik Thermogrip, Bostik 1000)

-

Sika AG (Sikaflex, Sikadur)

-

H.B. Fuller (ProPoxy, FullerBond)

-

Henkel AG & Co.KGaA (Loctite, Teroson)

-

BASF SE (BASF Elastopor, BASF Polyurethane)

-

The Dow Chemical Company (DOWSIL, DOW Brand Sealants)

-

MAPEI S.p.A (MapeSeal, Mapelastic)

-

Asian Paints Ltd. (Apcolite, Royale Glitz)

-

ITW Polymers Sealants North America, Inc (Polyseamseal, Devcon)

-

Huntsman Corporation (Araldite, Huntsman Epoxy)

-

Momentive Performance Materials (Momentive Silicones, Momentive Epoxies)

-

Wacker Chemie AG (Silicone Sealant, Wacker Silicone Fluid)

-

AkzoNobel N.V. (Dulux, International Paint)

-

RPM International Inc. (Rust-Oleum, DAP)

-

BASF Polyurethanes (BASF PU Systems, Elastopan)

-

SABIC (LEXAN Polycarbonate, SABIC PP)

-

Tremco Incorporated (Tremco Sealants, Tremco Coatings)

-

DowDuPont (Corian, DuPont Tyvek)

-

Saint-Gobain (Weber, Isover)

Recent Development:

-

In November 2023, Henkel launched the first bio-based PUR adhesives for load-bearing timber construction in November 2023. Loctite engineered wood adhesives, HB S ECO and CR 821 ECO reduce CO₂ equivalent emissions by over 60% versus fossil-based solutions, aligning with our customers' growing need of providing sustainable construction materials.

-

In March 2023, Bostik opened a new technology center in Shanghai to increase its capacity for research and development. Bostik's Asia Technology Center (ATC) is expanded by this facility, which seeks to improve the company's capacity to provide cutting-edge adhesive and sealant solutions that are suited to the demands of the Asian market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.22 Billion |

| Market Size by 2032 | USD 4.68 Billion |

| CAGR | CAGR of4.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (One-Component and Two-Component) • By End-Use Industry, (Building and Construction, Automotive, General Industrial, Marine) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, Arkema N.V., Sika AG, H.B. Fuller, Henkel AG & Co.KGaA, BASF SE, The Dow Chemical Company, MAPEI S.p.A, Asian Paints Ltd., ITW Polymers Sealants North America, Inc, Huntsman Corporation, Momentive Performance Materials, Wacker Chemie AG, AkzoNobel N.V., RPM International Inc., BASF Polyurethanes, SABIC, Tremco Incorporated, DowDuPont, Saint-Gobain |