Ethanolamine Market Report Scope & Overview:

Ethanolamine Market Size was valued at USD 3.76 billion in 2023 and is expected to reach USD 5.82 billion by 2032 and grow at a CAGR of 5.70% over the forecast period 2024-2032.

Get More Information on Ethanolamine Market - Request Sample Report

Increasing demand for surfactant products drives the direct demand for ethanolamine consumption. Ethanolamine plays a vital role in the formulation of surfactants, which is essential ingredients in detergents, cleaning agents, and a wide range of personal care products. Therefore, the rising demand for necessary products is a major driver for ethanolamine consumption.

Moreover, a significant amount of ethanolamines is needed to produce a large number of herbicides, especially those that contain glyphosate. The necessity to produce more food to feed a growing population is driving the agriculture sector's enormous global growth. This, together with the continuous fight against weeds that pose a threat to crop harvests, is driving rising demand for ethanolamines in the market for agricultural herbicides.

For instance, in 2022, BASF invested in a new plant for alkyl ethanolamines in the Antwerp facility, bringing its yearly capacity to 140,000 metric tons worldwide. This investment helped the company to increase production.

Additionally, it is also used in personal care products such as shampoos, conditioners, and skin care formulations. Rising personal care product consumption drives the market growth in the market.

Drivers

-

Rising demand for herbicide intermediate in agrochemicals drives the market growth.

Agricultural products like herbicides and insecticides also include ethanolamine. The main advantage of using ethanolamine is that it increases a pesticide's aqueous solubility. Comparably, one of the essential raw materials required for the synthesis of glyphosate which helps produce high-quality herbicides is diethanolamine. China leads the world in agricultural economy contribution around 19.49 percent of total agricultural output, followed by India at 7.39 percent, according to data from "Statistics Times". Furthermore, ethanolamines can contaminate water by raising the total nitrogen count and chemical oxygen needed when they are introduced into aquatic environments.

Furthermore, new herbicides that target particular weeds without hurting crops have been developed as a result of improvements in agricultural operations and the demand for sustainable farming approaches. This has to increase its research and development activities that drive their demand in the agrochemical sector.

-

Increasing demand for chemical intermediates is driving the market growth.

The ethanolamine market is flourishing due to the ever-increasing demand for chemical intermediates. Ethanolamine, a versatile compound with a wide range of applications, serves as a critical building block across numerous industries. In the realm of cleaning products, ethanolamines are essential for the production of surfactants, which are the key ingredients in detergents and cleaning agents. Their ability to remove dirt and grime makes them irreplaceable in household cleaning solutions and industrial degreasers. Ethanolamines also play a crucial role in gas treatment, where they efficiently capture acid gases like carbon dioxide and hydrogen sulfide from natural gas streams. This purification process is essential for ensuring clean energy production and complying with stringent environmental regulations.

Beyond industrial applications, ethanolamines play a significant role in the booming personal care and cosmetics market. They function as emulsifiers, thickeners, and pH regulators, contributing to the luxurious textures and formulations of many popular personal care products. From shampoos and conditioners to lotions and creams, ethanolamines ensure a smooth and consistent product experience. The rising consumer interest in personal hygiene and self-care further intensifies the demand for ethanolamines in this sector.

Restraint

-

Stringent rules & regulations to use the product may hindrance for the market.

Stringent environmental and safety regulations pose a significant challenge to the ethanolamine market. To comply with these mandates, manufacturers must invest in waste management systems, safety equipment, and process modifications. These investments increase operational costs, including those for compliance audits and certifications. As a result, profit margins for ethanolamine producers are reduced, impacting overall market profitability.

Market segmentation

By Type

In 2023, monoethanolamine dominated the global demand and held a market share of more than 39.19% in the ethanolamine industry. This dominance stems from its multifaceted functionality across diverse industries, well-honed and cost-efficient production processes, and longstanding market presence. Compared to other ethanolamine types, MEA boasts a broader application spectrum, catering to a wider range of needs. Additionally, its established customer base and well-oiled distribution network solidify its leading position.

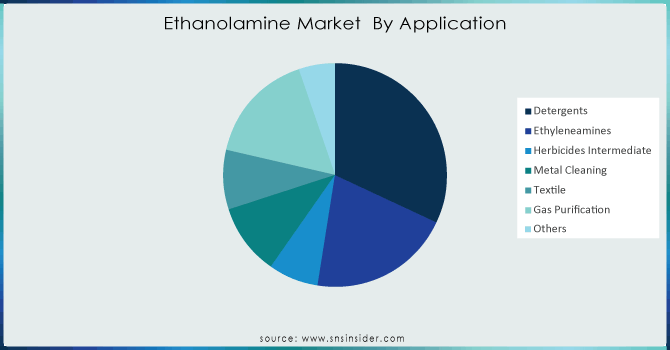

By Application

Based on the application detergents segment held the largest market share of around 32.22% in 2023. Heightened awareness of personal and environmental hygiene, along with rapid urbanization, has led to a significant increase in detergent consumption. This trend is further amplified by the growth of the middle class in many regions, as rising disposable incomes allow for more discretionary spending on household products. Additionally, evolving lifestyles are contributing to the trend. For example, the fast-fashion movement and our increasingly active lives lead to more frequent laundry cycles, necessitating the use of more detergent.

Need any customization research on Ethanolamine Market - Enquiry Now

Regional Analysis

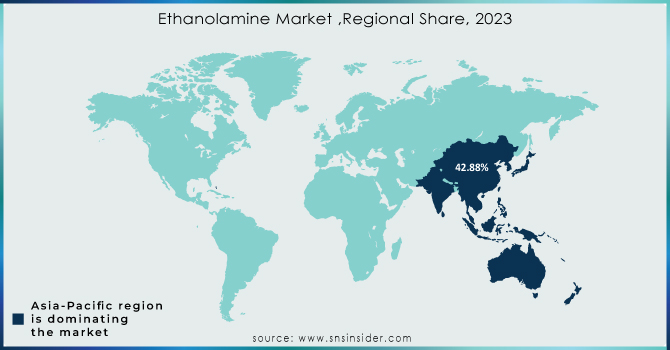

Asia Pacific dominated the ethanolamine market in 2023 with the highest market share around 42.88%. Asia-Pacific's advantageous economic conditions, accessibility to raw materials, and cheaper labor prices make it a major hub for the manufacturing of detergents and cleaning products. Numerous manufacturing facilities that create a wide range of cleaning goods for both domestic and international markets are located in countries like China, India, and Japan. The significant use of ethanolamines, which are essential components of these goods, is driven by this vast manufacturing capacity. The region's vast production infrastructure enables it to produce a large amount of cleaning products and detergents, which in turn fuels the strong need for ethanolamines.North America is estimated the fastest-growing region in the market and more grow in the upcoming times. The demand is increasing due to the rising demand for gas purification and metal cleaning application which it will drive the ethanolamine consumption in the region.

Key Players

The Ethanolamine Market is highly competitive and consolidated there are many companies available in the market. Some of the key players focus on expansion and innovation to enhance the performance of its product. This strategy helps the industry to accelerate its growth in the global market. Some of the key players are listed below:

BASF SE, Dow Chemical Corporation, Akzo Nobel N.V., Huntsman Corporation LLC, SABIC, Kanto Kagaku, Jay Dinesh Chemicals, INEOS, Nouryon, OUCC, and Others

Recent Development:

-

In June 2024, Nouryon announced that its Stenungsund, Sweden facility is now certified to the International Sustainability and Carbon Certification standard ISCC PLUS for producing green ethanolamines, and ethylene amines, as well as the surfactants made from these raw materials.

-

In November 2023, BASF and SINOPEC expanded their production in chemical plants. This expansion will help the BASF to produce high-quality chemicals such as, ethanolamines, propionic acid, and many more.

-

In December 2023, the company and production facilities of LyondellBasell Ethylene Oxide and Derivatives in Bayport, Texas, were acquired by INEOS for a sum of USD 700. The motive of this expansion is to increase its presence in the U.S. market

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.76 Billion |

| Market Size by 2032 | US$ 5.82 Billion |

| CAGR | CAGR of 5.70 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Monoethanolamine Triethanolamine, Diethanolamine), •By Application (Detergents, Ethyleneamines, Herbicides Intermediate, Metal Cleaning, Textile, Gas Purification, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cathay Biotech Inc., Evonik Industries AG, Nantong Senos Biotechnology Co. Ltd, Henan Junheng Industrial Group Biotechnology Co., Ltd, Capot Chemical Co., Ltd., INVISTA, AECOCHEM, Shandong Guangtong New Materials Co., Ltd., Shandong Hilead Biotechnology, DAYANG CHEM, Corvay, and Others. |

| Key Drivers | • Rising demand for herbicide intermediate in agrochemicals drives the market growth |

| RESTRAINTS | •Stringent rules & regulations to use the product may hindrance for the market |