Protective Textiles Market Report Scope & Overview:

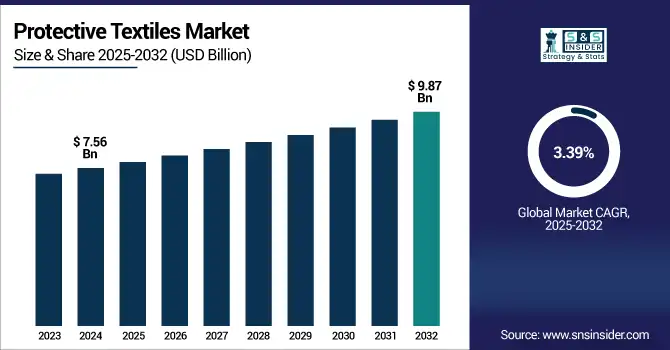

The Protective Textiles Market size was USD 7.56 billion in 2024 and is expected to reach USD 9.87 billion by 2032, growing at a CAGR of 3.39% over the forecast period of 2025-2032.

Protective textiles market analysis highlights the expansion of industrial and manufacturing activities as a key factor propelling market growth. Even as construction, oil & gas, mining, automotive, and other industries become increasingly popular around the world, so does the focus on safety in the workplace and employee protection. As a result, there is a growing demand for protective textiles that provide fire, chemical, abrasion, and mechanical resistance, which drives the protective textiles market growth.

To Get more information on Protective Textiles Market - Request Free Sample Report

OSHA data also shows that from 1972 to 2023, worker injuries and illnesses have shown a remarkable decline from 10.9 incidents per 100 full-time workers, down to 2.4, in part due to greater safety practices and protective measures. This reduction comes as economies have gradually mobilized their manufacturing apparatus to produce millions of units of effective PPE in the form of protective clothing and textiles.

Protective Textiles Market Drivers

-

Stringent Workplace Safety Regulations and Industrial Expansion Drive the Market Growth

The factors driving the protective textiles market growth include how industries increasingly enforce occupational safety regulations. As industrial activities do globally expand, most notably manufacturing, construction, oil & gas and mining, then the demand for high-performance protective clothing increases quite greatly. The market is expanding due to the enforcement of protective equipment by governments and organizations to lower workplace injuries. Innovations in fabric technology, including fire resistance, chemical resistance, and cut protection, have improved the effectiveness of product solutions. Such innovations are promoting wider use of protective textiles across end-use industries.

Protective Textiles Market Restrain

-

High Cost of Advanced Protective Fabrics and Market Fragmentation May Hamper the Market Growth

In spite of encouraging growth, the market is hindered by the high price of sophisticated protective textiles produced with aramid fibers, carbon composites, and other high-performance fabrics. For SMEs, particularly in cost-conscious markets, these prices are expensive. Further, recurring R&D outlays and association with global quality certifications increase the cost of manufacturing. Market fragmentation is also a challenge because the presence of many regional and local players puts pressure on prices and quality consistency. This can lead to uneven product uptake, especially in emerging economies where awareness and affordability could be lacking.

Protective Textiles Market Opportunities

-

Rise in Smart Textiles and Eco-Friendly Innovations Creates Opportunities in the Market

The adoption of smart textiles and wearable protective technologies can be a great opportunity in the protective textiles market. Sensors, thermoregulators, and communication systems integration into textiles is becoming more prevalent in defense, emergency services, and dangerous industries. Furthermore, increased awareness of the environment has led manufacturers to create protective textiles that are sustainable and recyclable. Such developments have an appeal among companies that are interested in achieving ESG requirements and minimizing carbon footprints. Increased application within the medical, military, and aeronautical industries also presents untapped potential. With encouraging government policies and growing R&D investments, these new trends are likely to create new avenues of growth shortly, which will drive the protective textiles market trends.

For Instance, for industrial as well as healthcare applications, 3M has ramped up its R&D investment greatly to develop textiles that are breathable and lightweight for protection.

Protective Textiles Market Segmentation Analysis:

By Application

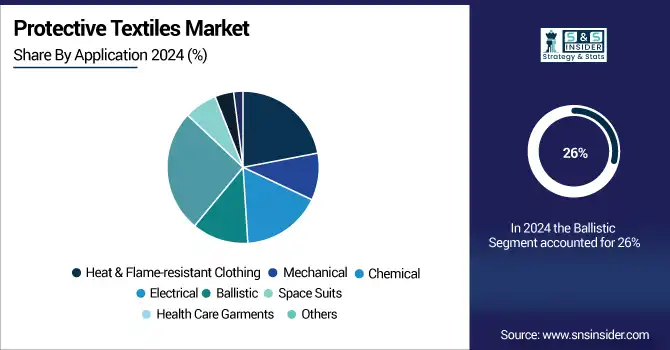

Ballistic held the largest protective textiles market share, around 26%, in 2024. This dominance is mainly due to rising demand from military personnel, law enforcement agencies, and security forces all over the world, who are mainly dependent on ballistic-resistant apparel and equipment like body armor, helmets, and bulletproof jackets. Such fabrics are designed with high-strength materials such as aramid and ultra-high molecular weight polyethylene, which exhibit enhanced impact and penetration resistance. Political tensions, increasing defense spending, and the increased demand for next-generation personnel protection systems continue to spur this demand.

Heat & Flame-resistant clothing held a significant protective textiles market share. It is due to these fabrics are usually constructed from high-tech materials such as Nomex, modacrylics, and aramid fibers, providing not only flame resistance but also durability and comfort. With industrialization increasing worldwide, especially in riskier operations, the need for flame-resistant clothing keeps growing. Also, the increasing concern towards workplace safety and strict regulatory compliance, particularly in North America and Europe, is further enhancing the demand for dependable flame-resistant apparel in both the private and public sectors.

Protective Textiles Market Regional Outlook:

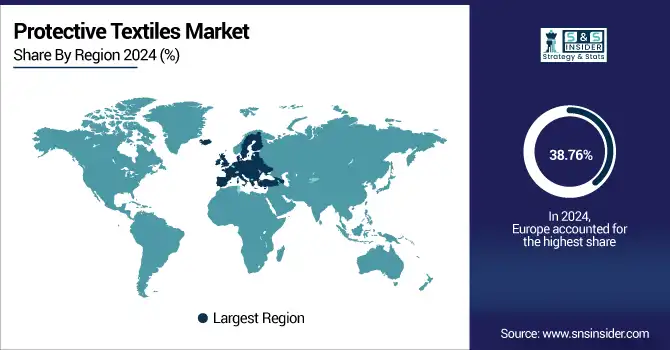

Europe held the largest market share, around 38.76%, in 2024. It is because of its robust regulatory environment, sophisticated industrial base, and elevated safety consciousness in major sectors. The region has strict workplace safety regulations implemented by organizations such as the European Agency for Safety and Health at Work (EU-OSHA), which requires wearing certified protective clothing in manufacturing, oil & gas, chemicals, and firefighting sectors. Europe is also home to some of the world's leading players in protective textile technology, with continued investment in smart and sustainable textile technologies. Furthermore, the availability of a mature defense industry and high government expenditure on public protection and military gear also propels market growth. Germany, France, and the U.K. are major contributors, promoted by sophisticated R&D capabilities, conformity standards, and favorable worker safety culture, which drive the protective textiles industry.

In June 2022, DuPont introduced Nomex Comfort with EcoForce technology in Luxembourg a flame-resistant material with a chemical-repellent, bio-based finish that resists up to 50 wash cycles and meets essential EU safety standards

North America protective textiles market held a significant market share and is the fastest-growing segment in the forecast period. It is owing to its well-established industrial base, stringent safety regulations, in addition to major industry players' strong presence. The U.S., in its turn, has rather stringent occupational safety rules that are implemented by bodies such as OSHA (Occupational Safety and Health Administration) that do mandate the use of some certified protective gear in industries such as construction, oil & gas, defense, healthcare, and manufacturing. The region has high defense spending. This spending implies a consistent demand for flame-resistant and for ballistic materials for law enforcement and defense personnel.

The U.S. protective textiles market size was USD 1.36 billion in 2024 and is expected to reach USD 1.80 billion by 2032 and grow at a CAGR of 4.20% over the forecast period of 2025-2032. It is because of its robust industrial base, strict regulation enforcement, and continuous investment in worker protection and defense. The country has mature safety standards regulated by bodies like OSHA and NFPA, which require use of high-end protective clothing in sectors like oil & gas, chemical manufacturing, construction, and emergency response. The defense sector of the U.S. also drives high demand for ballistic and flame-resistant fabric, supported by one of the world's largest military budgets.

Asia Pacific held a significant market share in the forecast period. It is due to its rapidly growing industrial base, expanding workforce, and increasing emphasis on occupational safety among major economies such as China, India, Japan, and South Korea. Vibrant construction, oil & gas, mining, and manufacturing industries in the region demand enormous amounts of protective clothing and equipment to shield workers in dangerous environments. Government actions to protect workers and increase industrial risk awareness are pushing safety compliance closer, especially among emerging economies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Protective Textiles Market Companies are:

The major Protective textiles companies are DuPont, 3M, Honeywell International Inc., Teijin Limited, TenCate Protective Fabrics, Milliken & Company, Lakeland Industries, Inc., W. L. Gore & Associates, Inc., Glen Raven, Inc., Ansell Limited, and Others.

Recent Development:

-

In 2024, DuPont launched the Tyvek 600 Plus Pro range of pharmacy and cleanroom protective clothing in March 2024. It features better particle barrier performance and ergonomic comfort, with over 80,000 units sold in Europe, and showcasing continued investment in special protective clothing.

-

In 2023, Honeywell introduced SmartWear Defender V2, featuring five typesof sensors to monitor heat and chemical exposure. It was already installed in 900+ industrial sites in North America by end-2023, which reflects heavy investment in smart protective clothing.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.56 Billion |

| Market Size by 2032 | USD 9.87 Billion |

| CAGR | CAGR of 3.39% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Heat & Flame-resistant Clothing, Mechanical, Chemical, Electrical, Ballistic, Space Suits, Health Care Garments, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | DuPont, 3M, Honeywell International Inc., Teijin Limited, TenCate Protective Fabrics, Milliken & Company, Lakeland Industries, Inc., W. L. Gore & Associates, Inc., Glen Raven, Inc., Ansell Limited. |