Food Grade Lubricants Market Report Scope & Overview:

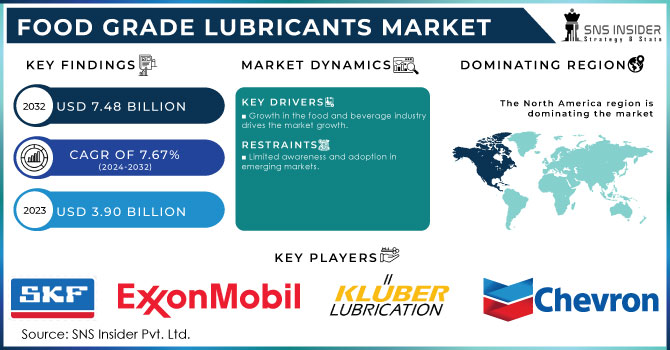

The Food Grade Lubricants Market size was valued at USD 3.90 Billion in 2023 and is expected to reach USD 7.48 Billion by 2032 and grow at a CAGR of 7.67% over the forecast period of 2024-2032.

Get More Information on Food Grade Lubricants Market - Request Sample Report

The defining factor driving the food-grade lubricants market is the escalating demand for processed and packaged food. As more customers become dependent on the ease and convenience of processed food, more and more facilities are emerging to meet these demands. According to the 2023 Food and Agriculture Organization report, global food production experienced a 1.3% increase due to rising popularity and demand for convenience foods. It entails that the need for food-safe lubricants that meet food safety standards is higher than ever because they are vital for minimizing any harmful contaminants into processed food. For example, the U.S. Food and Drug Administration strictly regulates the requirements for non-toxicity and food safety, meaning that all lubricants must comply with these requirements to be implemented into food-processing equipment.

In addition, the European Food Safety Authority reports that the number of regulations concerning machinery that comes into contact with food in one way or another has significantly increased to ensure that it does not come into contact with the product. Thus, it can be assumed that the use of food-grade lubricants increases as a direct consequence of the rising demand for processed food.

Some of the most recent trends indicate that companies attempt to innovate and cater to these needs. For example, the FUCHS Group has released its synthetic line of food-grade lubricants. The products are stated to be able to withstand harsh temperatures and extreme conditions to prolong the lifespan of machinery without risking processed food contamination.

In addition, the entire line of their products is optimized for maximum performance and food safety. On the other hand, in 2022, ExxonMobil has broadened its product range for food-grade lubricants, automation emphasizing environmentally friendly and biodegradable options. The latter can be especially important for businesses and countries as they strive to become greener as part of global sustainability efforts.

The trend having a substantial influence on the food-grade lubricants market is the shift to environmentally friendly and biodegradable lubricants. Such focus on sustainability can be explained by the impact that numerous lubricants cause, which encourages manufacturers to employ greener materials. The reductions in the environmental footprint do not imply that the lubricants have lower-desirable performance, as they are still designed to be effective components for the machinery used in the food and beverage sector. This trend is encouraged by the environmental initiatives of both consumers and the need for the industry to comply with the new standards developed in the regulatory field. For example, the European Green Deal or the initiatives of the U.S. EPA to promote greener lubricants have improved the adoption of biodegradable solutions.

Food Grade Lubricants Market Dynamics:

Drivers:

- Growth in the food and beverage industry drives the market growth.

The food-grade lubricants growth is mainly driven by the expansion of the global food and beverage industry Developing production facilities and use of increasingly automated machinery and equipment in the food processing sector, require safe and high-performance products furnishing minimal contact with food. According to the Food and Agriculture Organization, increased by 2.1% in 2023, driven mostly by growing demand in the processed and packed food, especially on the markets of the Asia-Pacific and Latin America.

Governments are playing a crucial role in shaping the market. For instance, the European Union’s Farm to Fork strategy, introduced in 2020 as part of the European Green Deal, has emphasized the need for safe, sustainable food production, it has accelerated the adoption of food-grade lubricants across Europe. The U.S. Food and Drug Administration (FDA) and other regulatory bodies, such as the National Sanitation Foundation (NSF), continue to strengthen guidelines for lubricant use in food processing, ensuring that manufacturers utilize products that prevent contamination and meet hygiene standards.

This convergence of government regulations, industry innovation, and growing demand in the food and beverage sector is fostering the adoption of advanced food-grade lubricants that can operate efficiently while maintaining product safety and compliance.

Moreover, the overall growth of the food and beverage industry, coupled with government-imposed safety standards, continues to fuel the demand for food-grade lubricants in processing and packaging operations..

Restraints:

- Limited awareness and adoption in emerging markets.

In many developing regions, the adoption of food-grade lubricants remains limited, largely due to less stringent regulatory frameworks and weak enforcement of safety standards. Unlike in developed markets, where strict guidelines from bodies like the FDA and EFSA mandate the use of non-toxic lubricants in food production, many emerging economies do not have the same level of oversight. As a result, manufacturers in these regions often opt for cheaper, non-food-grade lubricants to reduce costs, particularly in price-sensitive markets where profit margins are thin. These conventional lubricants, while cost-effective, pose potential risks of contamination and do not meet the high safety standards required to ensure consumer health.

The lower awareness of food safety regulations and the absence of stringent enforcement contribute to this trend, making it difficult for the food-grade lubricants market to gain traction in these regions. This reliance on non-compliant lubricants can compromise product safety and limit the global adoption of safer alternatives.

Food Grade Lubricants Market Segmentation Analysis

By Type

Synthetic oil-based lubricants held the largest market share around 37.95% in 2023. This dominance is driven by the superior performance characteristics of synthetic oils compared to mineral and bio-based alternatives. Therefore, a dominant position in this market is established through the quality of products, meaning that the industry continues to be dominated by synthetic products. The synthetic Dominance in the food processing/filling equipment market is highly justifiable as these products are superior in terms of performance, particularly compared to bio-based products. Overall, the combination of synthetic lubricants dominant position and their superior performance made this result highly predictable.

By Application

The food industry market share is around 58.23% in 2023. This dominance is due to the stringent safety and hygiene standards required in food processing, where even minimal contamination can have serious health consequences. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) impose strict guidelines for lubricants used in food production, ensuring they meet non-toxicity and food safety requirements. The growth of processed and packaged foods, especially with the rising demand for convenience foods globally, further boosts this segment. Manufacturers are increasingly prioritizing the use of high-performance, food-safe lubricants to comply with regulations and enhance equipment efficiency, making the food industry the largest application segment for food-grade lubricants.

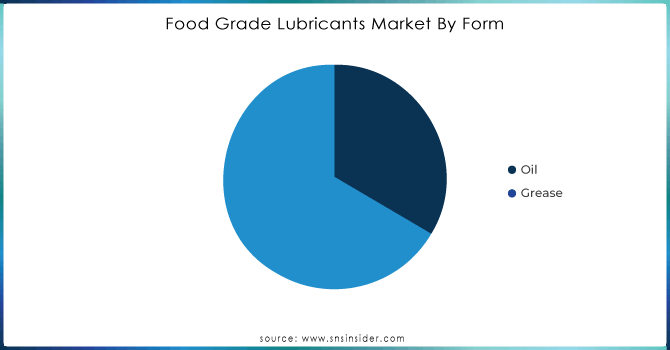

By Form

Grease held the largest market share around 66.54% in 2023. This dominance is largely due to the specific advantages that grease offers in food processing and manufacturing environments. Grease provides superior adhesion and lubrication for industrial lubricant such as, machinery components, reducing the frequency of re-lubrication and offering better protection against wear and corrosion. Its ability to stay in place and perform effectively under high pressure and varying temperatures makes it particularly suitable for equipment that operates in challenging conditions, such as in food processing lines and packaging machinery.

Get Customized Report as per Your Business Requirement - Request For Customized Report

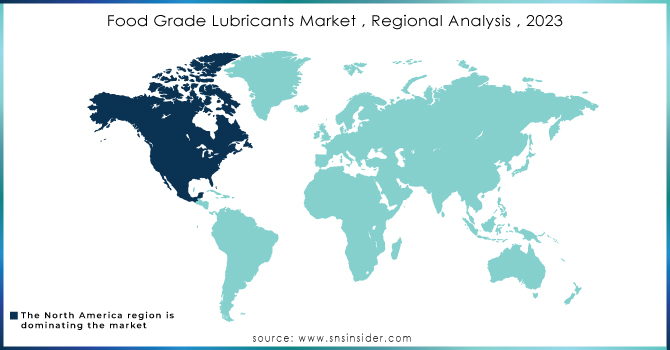

Food Grade Lubricants Market Regional Outlook

North America held the largest market share around 42.23% in 2023. The North America region is leading the food-grade lubricants market primarily due to advanced food-grade infrastructure, high awareness of product safety standards, and rigorous regulatory and safety guidelines. The regulations established by the U.S. Food and Drug Administration and associated regulatory bodies are contributing to the high demand for food-grade lubricants in the region. Recent developments in the North America region indicate the continuous growth of the industry. For example, in 2023, FUCHS Lubricants announced the introduction of its FoodGradePlus range for North America markets. These food-grade lubricants form have been specially designed to cater to the stringent North American food-processing requirements. In the previous year, the U.S. witnessed an unveiling by Kluger Lubrication, a part of Freudenberg Chemical Service that introduced innovative food-grade lubricants to North American markets to promote efficiency in machinery use and address evolving demands in the food and beverage sector.

Key Players:

Some of the Key Players are Chevron Corporation, Kluber SKF, Exxonmobil Corporation, Total Energies SE, BP plc., Lubrication Munchen SE & Co. KG, Petro-Canada Lubricants Inc., FUCHS Petrolub AG, The DOW Chemical Company And Illinois Tools Works Inc., other players.

Recent Development:

- In 2023, FUCHS Lubricants introduced a new range of food-grade lubricants specifically formulated for high performance in demanding food processing environments. This product line focuses on enhancing efficiency and extending the service life of machinery while ensuring compliance with stringent safety standards.

- In 2022, Castrol introduced a new line of biodegradable food-grade lubricants that align with growing sustainability trends. These lubricants are designed to provide reliable performance while minimizing environmental impact, catering to the food industry’s evolving needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.90 Billion |

| Market Size by 2032 | US$ 7.48 Billion |

| CAGR | CAGR of 7.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Synthetic Oil, Mineral Oil, Bio-based) • By Application (Food, Beverages, Pharmaceuticals & Cosmetics, Others) • By Form (Oil, Grease) • By Grade (H1, H2, H3) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Some of the key players are Chevron Corporation, Kluber SKF, exxonmobil Corporation, Total Energies SE, BP plc., Lubrication Munchen SE & Co. KG, total energies SE, Petro-Canada Lubricants Inc., FUCHS Petrolub AG, The DOW Chemical Company And Illinois Tools Works Inc., other players. |

| DRIVERS | • Growth in the food and beverage industry's drives the market growth. • Food safety regulations are very strict. |

| Restraints | • Limited awareness and adoption in emerging markets. |