Companion Diagnostics Market Size & Trends:

The Companion Diagnostics Market Size was valued at USD 8.57 billion in 2025E and is expected to reach USD 21.15 billion by 2033, growing at a CAGR of 11.9% over the forecast period 2026-2033.

Companion Diagnostics Market Size and Forecast:

-

Market Size in 2025E: USD 8.57 Billion

-

Market Size by 2033: USD 21.15 Billion

-

CAGR: 11.9% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on the Companion Diagnostics Market - Request Sample Report

The market for companion diagnostics is on the rise, and this is observed to be fueled by the increasing prevalence of cancer globally, particularly the steady growth in demand for personalized medicine. Although the cancer rates continue growing relentlessly, such diagnostics are fast gaining acceptance because of the critical role they play in providing tailored treatment solutions ensuing from individual patient profiles. Advances in biomarker research directly advance precision diagnostics and particularly help oncology through more accurate detection of individual mutations and corresponding therapies.

The U.S. Companion Diagnostics market size was valued at an estimated USD 3.25 billion in 2025 and is projected to reach USD 8.10 billion by 2033, growing at a CAGR of 11.8% over the forecast period 2026–2033. Market growth is driven by the increasing adoption of precision medicine, rising prevalence of cancer and chronic diseases, and growing integration of companion diagnostics with targeted therapies. Strong investments in oncology research, advancements in molecular diagnostics and next-generation sequencing technologies, and favorable regulatory approvals are accelerating market expansion. Additionally, collaborations between pharmaceutical and diagnostic companies, along with robust healthcare infrastructure and reimbursement support, continue to strengthen the growth outlook of the U.S. companion diagnostics market during the forecast period.

Key trends shaping the Companion Diagnostics Market:

-

Rising Precision Medicine Adoption – Growing use of targeted therapies is boosting demand for companion diagnostics to match treatments with patient-specific biomarkers.

-

Oncology Dominance – Cancer treatment remains the largest application area, with increasing approvals of CDx tests linked to immunotherapies and targeted drugs.

-

Regulatory Support – Favorable guidelines from the FDA and EMA are accelerating the co-development of drugs and diagnostic tests.

-

Next-Generation Sequencing (NGS) Integration – NGS-based companion diagnostics are gaining traction for multi-gene profiling and broader clinical applications.

-

Pharma-Diagnostics Partnerships – Strategic collaborations between pharmaceutical companies and diagnostic developers are driving innovation and market expansion.

The companion diagnostics market analysis also highlights co-development partnerships between diagnostic developers and pharmaceuticals have accelerated the speed of commercialization for new companion diagnostic products. Such collaborations are essential to ensure that the introduction of new therapeutics is accompanied by appropriate diagnostics, which in turn drives demand and supply in the market. Continued and increasing awareness of personalized medicine means the development of new tests guarantees the companion diagnostics market will continue to grow at a high speed over the coming year.

| Company | Product Name | Indication | Technology Type | Approval Status (as of Sept 2024) |

|

Roche Diagnostics |

FoundationOne CDx |

Various solid tumors |

NGS |

FDA Approved |

|

Qiagen |

QIAseq |

Gene expression analysis |

NGS |

CE Marked, FDA Approved |

|

Agilent Technologies |

HaloPlex |

Tumor profiling |

Targeted enrichment |

FDA Approved |

|

Illumina |

TruSight |

Cancer genomics |

NGS |

FDA Approved |

|

Myriad Genetics |

BRACAnalysis |

Breast and ovarian cancer |

Genetic testing |

FDA Approved |

Companion Diagnostics Market Drivers:

-

Advances in Next-Generation Sequencing and Increasing Cancer Prevalence to Drive Market Growth

Advances in technology in Next-Generation Sequencing are offering the impetus to the companion diagnostics market. Next-Generation Sequencing allows testing thousands of genes associated with cancer development which can be tested in a wide range of genes. The results of Next-Generation Sequencing are high throughput and rapid, and continuous improvement in technology is enhancing its clinical applications. According to the CDC, NGS has undergone a transition from research to clinical use in recent times. The leading companies are making available their latest testing technology, and are partnering strategically to help perfect the NGS workflow. For example, last November 2023, QIAGEN partnered with Element Biosciences to develop NGS workflows for the AVITI System, which it said would help reduce costs in genomic research while making it more efficient. Similarly, Illumina, Inc. collaborated with SomaLogic in January 2022 to combine the SomaScan proteomics assay with Illumina's high-throughput NGS platforms.

The rising incidence of cancer is also an important driver for the companion diagnostics market growth. The growing cases of cancer across the globe have increased the demand for companion diagnostics owing to the extensive knowledge obtained regarding the tumor of a patient and its use in targeted therapy selection. According to a report given out by the American Cancer Society, there were about 1.9 million new cancer diagnoses in the U.S. in 2024. At the same time, the World Health Organization also reported that 2.26 million new breast cancer cases and 2.21 million new lung cancer cases were diagnosed globally in that year. The development of new tests, such as Guardant360 CDx, has been the result of effective CDx assays. It was recently cleared by the FDA in August 2020 as the first liquid biopsy companion diagnostic using NGS to detect EGFR mutations in metastatic NSCLC.

Expansion into other indications accompanied by clearances of new companion diagnostics is being pushed into the market. Key players are heavily investing in new tests gaining regulatory approvals, thus enhancing adoption of the assays. Regulatory approvals continue to increase, such as in the case of the U.S. The VENTANA PD-L1 (SP263) assay for NSCLC has received FDA approval in March 2023. This is likely to fuel the growth of the global companion diagnostics market significantly during the forecast period.

For instance, Illumina achieved the CE mark for its comprehensive test TruSight Oncology in May 2023 and Agilent Technologies' PD-L1 IHC 22C3 pharmDx assay has been approved for cervical cancer patients as well within the same period.

Companion Diagnostics Market Segmentation Analysis:

By Technology, Polymerase Chain Reaction Leads, While Next-Generation Sequencing Emerges as the Fastest-Growing Technology

Polymerase Chain Reaction dominated the companion diagnostics market with a 23.4% share in 2025 as the technique has significantly been in demand in various clinical disciplines, particularly in cancer diagnostics. Although an expensive technique, Polymerase Chain Reaction is considered the gold standard for precision in the amplification of particular genetic materials, which leads to the identification of causes of mutations and the development of targeted therapies for the treatment of cancer. Both in research and clinical practices, Polymerase Chain Reaction is robust and vibrant enough to be the market leader.

Next-Generation Sequencing is increasingly becoming the fastest-growing technology in companion diagnostics. This can examine tens of thousands of genes in a single experiment and provides an altogether comprehensive understanding of the genomic profiles of any patient, making it revolutionize precision medicine, especially in cancer treatment. Increased adoption of NGS in personalized cancer therapies and its applications in other diseases are driving its exponential growth in the market.

By Indication, Cancer Dominates Companion Diagnostics, While Infectious Diseases Drive Fastest Growth

Cancer indication segment led the companion diagnostics market share of 35.4% in 2025, owing to the massive worldwide disease burden and the burgeoning need for targeted, personalized treatments. In oncology, companion diagnostics is very significant for the guidance of targeted therapies personalized for a patient's specific genetic attributes. The emphasis on precision medicine, coupled with new cancer therapies, continues to place cancer as the market leader in terms of revenue.

The fastest-growing segment in the companion diagnostics market is infectious diseases. The segment’s growth is driven by the increasing need for accurate diagnostics to recognize pathogens and facilitate the proper application of antiviral and antimicrobial treatments. The COVID-19 pandemic reinforced the role played by companion diagnostics in controlling infectious diseases, thereby upping the demand for these tests throughout the healthcare spectrum.

By End-User, Pharmaceutical and Biopharmaceutical Companies Lead End-User Segment with Strong Market Share

The pharmaceutical and biopharmaceutical companies are the most prominent in the companion diagnostics market in terms of end-user applications with a 43.2% share in 2025. Pharmaceutical and biopharmaceutical companies are some of the major contributors in terms of developing new drugs and therapies, and companion diagnostics ensure that these treatments are safe and effective. The pharmaceutical company along with the diagnostic manufacturer plays in tandem and hence this segment is dominated.

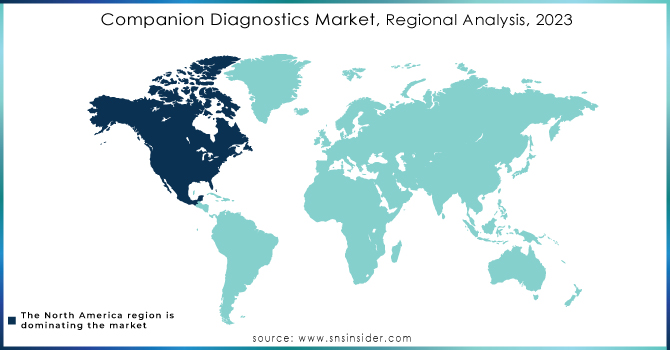

Companion Diagnostics Market Regional Analysis

North America dominates the Companion Diagnostics Market in 2025

In 2025, North America holds an estimated 41% share of the Companion Diagnostics market, driven by advanced healthcare infrastructure, high adoption of precision medicine, and substantial investments in molecular diagnostics. The region benefits from the presence of leading pharmaceutical and biotechnology companies, coupled with favorable regulatory policies supporting personalized therapies. Rising cancer prevalence, combined with strong collaborations between pharma firms and diagnostic developers, further cements North America’s leadership position, ensuring robust growth momentum across the region.

-

United States leads North America’s Companion Diagnostics Market

The United States dominates the North American market due to its mature healthcare system, advanced technology infrastructure, and high investments in R&D for personalized medicine. The growing burden of cancer and other chronic diseases fuels demand for targeted therapies supported by companion diagnostics. U.S. regulatory bodies encourage innovation, while reimbursement frameworks strengthen adoption. Additionally, collaborations between pharmaceutical firms and diagnostic manufacturers expand access to next-generation sequencing and biomarker-based testing. With its strong ecosystem and leadership in precision oncology, the U.S. is the largest contributor to North America’s Companion Diagnostics revenues.

Asia-Pacific is the fastest-growing region in the Companion Diagnostics Market in 2025

The Asia-Pacific market is projected to expand at an estimated CAGR of 14.2% from 2026 to 2033, driven by growing awareness of precision medicine and improvements in healthcare infrastructure. Rising cancer incidence, government-backed genomic initiatives, and greater accessibility to advanced diagnostic tools support rapid market growth. Expanding pharmaceutical pipelines and regional partnerships further accelerate adoption of companion diagnostics, positioning Asia-Pacific as the fastest-growing regional market over the forecast period.

-

China leads Asia-Pacific’s Companion Diagnostics Market

China dominates the Asia-Pacific region due to strong government investment in genomics, rising cancer prevalence, and the rapid expansion of precision medicine programs. The country’s growing pharmaceutical industry collaborates extensively with diagnostic firms to integrate companion diagnostics into targeted therapy development. Increasing affordability and adoption of next-generation sequencing technologies further boost demand. China’s large patient population, combined with proactive healthcare reforms and precision oncology initiatives, enables the country to remain the leading contributor to Asia-Pacific’s Companion Diagnostics market revenues.

Europe Companion Diagnostics Market Insights, 2025

Europe demonstrates steady growth in 2025, supported by strict regulatory frameworks, rising cancer cases, and strong focus on personalized healthcare solutions. The region’s adoption of precision medicine is bolstered by government initiatives and collaborations between diagnostic providers and pharmaceutical companies.

-

Germany leads Europe’s Companion Diagnostics Market

Germany dominates the European market due to its advanced healthcare infrastructure, robust cancer research ecosystem, and early adoption of precision oncology. Strong regulatory emphasis on molecular diagnostics integration, coupled with active collaborations between hospitals, research institutions, and pharmaceutical firms, strengthens Germany’s market position. Consumer demand for innovative treatments and broad implementation of companion diagnostics in oncology drive the country’s leadership role in Europe.

Middle East & Africa and Latin America Companion Diagnostics Market Insights, 2025E

The Middle East & Africa and Latin America show moderate but steady growth in 2025E. In the Middle East, countries such as the UAE and Saudi Arabia are investing heavily in precision medicine and oncology diagnostics as part of healthcare modernization. Africa is gradually adopting molecular diagnostics due to rising cancer prevalence and growing awareness of targeted therapies. In Latin America, Brazil and Mexico dominate adoption, fueled by expanding healthcare access, government programs in oncology, and partnerships between pharmaceutical firms and diagnostic companies. Rising demand for affordable diagnostics supports continued regional growth.

Need any customization research on Companion Diagnostics Market - Enquire Now

Competitive Landscape for the Companion Diagnostics Market:

F. Hoffmann-La Roche Ltd.

F. Hoffmann-La Roche Ltd. (Roche) is a Switzerland-based global leader in diagnostics and oncology, offering integrated companion diagnostic solutions that link biomarker detection to targeted therapies. The company develops molecular assays, tissue-based tests, and laboratory platforms that guide therapy decisions and support clinical trial endpoints. Roche collaborates closely with pharmaceutical partners to co-develop CDx tests alongside novel oncology drugs, enabling faster patient stratification and regulatory submissions. Its role in the companion diagnostics market is central, providing end-to-end diagnostic workflows that align laboratory capabilities with precision-medicine treatment pathways.

-

In 2024, Roche expanded its oncology companion diagnostic portfolio with new biomarker assays and streamlined lab deployment options to support precision therapy trials.

Abbott Laboratories

Abbott Laboratories is a U.S.-based diversified healthcare company that delivers companion diagnostic assays, point-of-care testing, and molecular platforms used across oncology and infectious disease applications. Abbott’s offerings combine robust assay chemistry with scalable instrumentation, enabling clinical labs and hospitals to run targeted tests that inform treatment selection and monitoring. The company emphasizes rapid, decentralized diagnostic capabilities that accelerate clinical decision-making and support trial feasibility at diverse sites. Abbott’s role in the CDx market is to make high-quality, clinically validated tests broadly accessible for both routine care and drug development.

-

In 2024, Abbott introduced enhancements to its molecular testing lineup, improving turnaround times and expanding companion test availability for oncology and infectious indications.

QIAGEN N.V.

QIAGEN N.V. is a Netherlands-based molecular diagnostics and sample-preparation specialist, providing companion diagnostic assays, NGS workflows, and biomarker analysis solutions. The company supports drug developers and clinical laboratories with end-to-end molecular workflows—from sample extraction to targeted sequencing and data interpretation—facilitating biomarker discovery and CDx implementation. QIAGEN’s strength lies in scalable reagent kits and validated workflows that integrate with major sequencing and PCR platforms, helping translate genomic insights into actionable diagnostic tests. Its role in the market is to enable reliable, reproducible molecular testing that underpins precision-medicine strategies.

-

In 2024, QIAGEN launched expanded NGS and PCR companion diagnostic workflows to accelerate biomarker testing in multi-site oncology studies.

Thermo Fisher Scientific Inc.

Thermo Fisher Scientific is a U.S.-based powerhouse in laboratory instruments, reagents, and clinical sequencing solutions, supporting companion diagnostics through high-throughput NGS platforms, pathology instrumentation, and bioinformatics. The company supplies the hardware and informatics that enable large-scale genomic profiling, tumor profiling panels, and centralized lab services critical for CDx deployment. By offering integrated sequencing systems and data analysis pipelines, Thermo Fisher helps labs and sponsors scale companion testing from clinical trials to routine clinical use. Its role is foundational—powering the laboratory infrastructure that turns molecular assays into clinically actionable diagnostics.

-

In 2024, Thermo Fisher upgraded its clinical NGS portfolio and analytics tools to streamline companion diagnostic workflows for laboratory and trial environments.

Companion Diagnostics Market Key Players:

-

F. Hoffmann-La Roche Ltd.

-

Abbott Laboratories

-

QIAGEN N.V.

-

Thermo Fisher Scientific Inc.

-

Agilent Technologies, Inc.

-

Illumina, Inc.

-

Myriad Genetics, Inc.

-

BioMérieux SA

-

Guardant Health, Inc.

-

Foundation Medicine, Inc.

-

Siemens Healthineers AG

-

Danaher Corporation

-

Invitae Corporation

-

Almac Diagnostics

-

Leica Biosystems

-

Bio-Rad Laboratories, Inc.

-

MolecularMD

-

Quidel Corporation

-

ARUP Laboratories

-

Epic Sciences

| Report Attributes | Details |

| Market Size in 2025E | US$ 8.57 billion |

| Market Size by 2033 | US$ 21.15 billion |

| CAGR | CAGR of 11.9% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Technology (Polymerase Chain Reaction, Immunohistochemistry, In-situ Hybridization, Next Generation Gene Sequencing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

F. Hoffmann-La Roche Ltd., Abbott Laboratories, QIAGEN N.V., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Illumina, Inc., Myriad Genetics, Inc., BioMérieux SA, Guardant Health, Inc., Foundation Medicine, Inc., Siemens Healthineers AG, Danaher Corporation, Invitae Corporation, Almac Diagnostics, Leica Biosystems, Bio-Rad Laboratories, Inc., MolecularMD, Quidel Corporation, ARUP Laboratories, Epic Sciences |