Pharmaceutical Gelatin Market Report Scope & Overview:

Get more information on Pharmaceutical Gelatin Market - Request Sample Report

Pharmaceutical Gelatin Market was valued at USD 1.69 billion in 2023 and is expected to reach USD 2.79 billion by 2032, growing at a CAGR of 5.77% from 2024-2032.

The pharmaceutical gelatin market is witnessing substantial growth driven by rising demand for capsules and soft gels. In 2023, global research and development expenditures in the pharmaceutical sector are 300 billion U.S. dollars, indicating significant investment in drug formulations and delivery mechanisms. Consequently, with the spending on prescription medications increasing by 6.0% to 8.0% in 2023, the demand for pharmaceutical gelatin utilized for drug delivery will experience even greater growth. In 2023, it stood at 464,410 tons, establishing a robust foundation for continued growth in the years ahead.

The growing demand for plant-based diets has led to increased interest in gelatin, and pharmaceutical gelatin is no exception. This can be gauged from the fact that the vegan food market globally was valued at nearly USD 25 billion, with 70% of consumers considering plant-based protein healthier than others. Therefore, with pharmaceutical giants now directing their focus more toward vegan-friendly gelatin products, plant-based alternatives are likely to see an increased market share in the forthcoming years.

PHARMACEUTICAL GELATIN MARKET DYNAMICS

DRIVERS

-

Growth in Food and Cosmetics Industries Fuels Gelatin Consumption Worldwide, Driving Market Expansion

The food and cosmetic industries are fast-growing, which has raised tremendous demand for gelatin. In food production, gelatin is used mainly to create confectionery, dairy products, and desserts with the most desired textures in this bid. The rising global beauty market, where retail sales accounted for USD 446 billion in 2023 and had grown by 10%, also spurred interest in gelatin for use in skincare, haircare, and beauty formulations that provide hydrating and texturizing benefits. Aside from this, the international dairy trade is estimated to be at 84 million tonnes in 2023, thereby supporting gelatin demand since the former uses dairy. The gelatin market is further expected to grow shortly with expansion in these industries.

-

Rising Demand for Gelatin from Pharmaceutical and Nutraceutical Industries Drives Market Growth

The pharmaceutical and nutraceutical industries are now the new drivers of the increasing gelatin market. Gelatin has a broad application in the production of capsules and tablets and even other drug delivery systems, as it is a biocompatible, easily digestible product and stabilizes active ingredients. Moreover, in the nutraceutical sector, the usage of gelatin is witnessed in dietary supplements and functional foods mainly for its ability to enhance bioavailability and ensure product consistency. The demand for healthcare products is significantly increasing across the globe, with a particularly significant growing trend in regions that have an aging population. Therefore, application of gelatin-based solutions in pharmaceuticals and nutraceuticals will keep expanding in this market.

RESTRAINTS

-

Presence of Substitute Components Limits Pharmaceutical Gelatin Market Growth

The competitors in the pharmaceutical gelatin market also emerge through other materials, like hydroxypropyl methylcellulose (HPMC), pullulan, and starch-based capsules. Various plant-based alternatives that contribute to the production of vegan, vegetarian, and allergy-free products, which are most predominantly used in the nutraceutical and pharmaceutical industries, are in growing demand. Similarly, with higher demand from customers for products containing no animal-derived ingredients, increasing usage of these alternatives will cause a drag on the growth rate of the gelatin market, particularly in markets where vegans are extremely demanding or dietary restrictions are somewhat stricter. Synthetic and plant-based alternatives continue gaining prospects for further pressure on the gelatin market.

PHARMACEUTICAL GELATIN MARKET SEGMENT ANALYSIS

BY TYPE

Type B gelatin had the largest market share of approximately 63% by revenue in 2023. This is primarily because it enjoyed wide application in soft and hard capsules, besides being more favorable in specific applications due to stability and consistency in the pharmaceutical use of gelatin. Type B is considered a highly cost-effective gelatin product and is sourced from bovines.

Type A gelatin, sourced from porcine, is expected to witness growth at the highest CAGR of 6.39% during the period 2024-2032, driven by enhanced consumer preference for gelatin with higher gelling strength and its increasing application in emerging markets owing to its compatibility with a wide range of pharmaceutical formulations.

BY FUNCTION

The largest share in the Pharmaceutical Gelatin Market in 2023 was seen in stabilizing agents, accounting for around 47%. These agents play a critical role in providing structural stability and continuity to pharmaceutical products, particularly gelatin capsules and tablets. Stabilizing agents prevent gelatin from breaking, thereby providing shelf life, which is highly demanded by pharmaceutical manufacturing.

Gelling agents and functional additives will be the fastest-growing at a CAGR of 6.83% between 2024 and 2032. The advancements in gelatin, with increased strength in gelling, greater versatility in formulations, and the increasing trend of merging multiple functionalities into one product for more effective treatments, would form the basis of this growth.

BY APPLICATION

In 2023, hard capsules held the maximum revenue share at around 43% of the pharmaceutical gelatin market primarily due to widespread usage as part of encapsulating solid drugs, vitamins, and minerals. These are extremely versatile, inexpensive, and more easily scaled up in production, making them preferred for various pharmaceutical applications. The highest growth CAGR is expected to be 6.56% in soft capsules between 2024 and 2032. Growing demand for soft capsules in liquid and semi-liquid formulations will primarily help it stand out as the most demanded form during the forecast period. Soft capsules receive high appreciation due to their ability to enhance bioavailability and the stability of active ingredients, which has an application in nutraceuticals and complex drug delivery systems thereby boosting up.

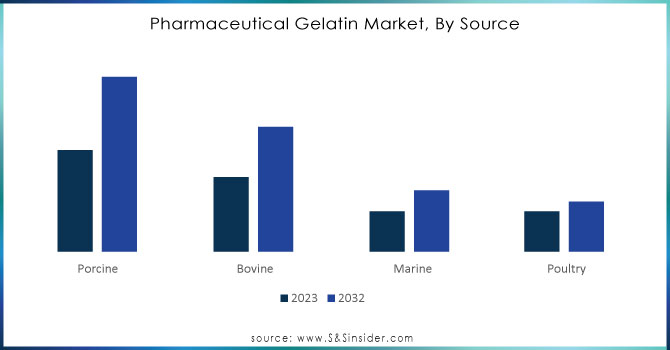

BY SOURCE

The 2023 market share for porcine gelatin was the largest in the pharmaceutical gelatin market and this goes to about 47% due to high availability, cost-effectiveness, and favorable gelling properties aligned to meet the divergent pharmaceutical needs. For these reasons, the main reasons include the fact that it has widely been utilized in capsules, tablets, and other medicinal products of porcine-derived gelatin.

Bovine gelatin is expected to grow at the highest CAGR of about 6.84% from 2024-2032. This is due to the growing demand from regions and applications where non-porcine sources are preferred for cultural, religious, and dietary reasons, thereby upgrading the appeal of bovine gelatin in the global market.

Need any customization research on Pharmaceutical Gelatin Market - Enquiry Now

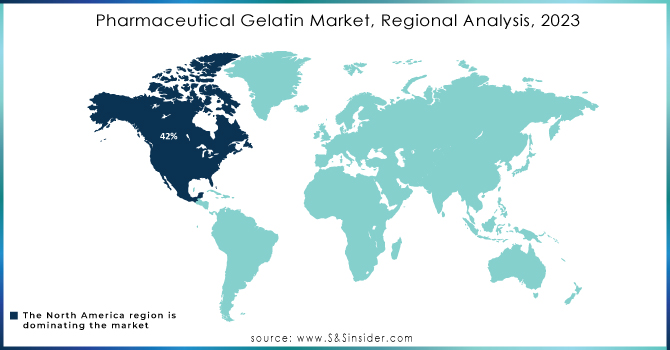

PHARMACEUTICAL GELATIN MARKET REGIONAL ANALYSIS

In 2023, North America dominated the pharmaceutical gelatin market with the highest revenue share at 42%. Its dominant market share can be ascribed to a large and well-established pharmaceutical industry in the region, high demand for advanced drug delivery systems, and sustained investments in the research and development stages. Additionally, the strong emphasis on quality standards and regulatory compliance in the region further increases the demand for pharmaceutical-grade gelatin, particularly as stabilizers in capsules and other medicinal formulations.

The Asia Pacific is poised to lead growth at a high CAGR of 7.31% in the forecast period 2024 to 2032. Growth in the region can be ascribed to increased healthcare spending, growing nutraceutical demand, and the burgeoning pharmaceutical manufacturing sector in developing economies such as China and India. Growing affordable healthcare solutions in the region present opportunities for gelatin-based products in all applications with the pharmaceutical end user, which drives growth in the market.

LATEST NEWS -

1] In 2024, Darling Ingredients launched Nextida™ GC collagen peptide as a bioactive health ingredient for pharmaceutical applications with controlled post-prandial glucose rise support.

2] Alsiano has collaborated with Trobas Gelatine BV in 2024 to build strength in gelatin supply for pharmaceuticals, nutraceuticals, and personal care across the Nordic markets.

KEY PLAYERS

-

Sterling Biotech Limited (Sterling Gelatin Capsules, Sterling Pharmaceutical Gelatin)

-

Gelita AG (Gelita Gelatin, Gelita Pharma Gelatin)

-

Darling Ingredients Inc. (Pharmaceutical Gelatin, Gelatin Capsules)

-

Nitta Gelatin Inc. (Nitta Gelatin Capsules, Nitta Pharmaceutical Gelatin)

-

India Gelatine & Chemicals (India Gelatin Capsules, Pharmaceutical Gelatin)

-

Tessenderlo Group (Tessenderlo Gelatin, Gelatin for Capsules)

-

PB Gelatins GmbH (PB Gelatin for Capsules, PB Pharmaceutical Gelatin)

-

Junca Gelatines S.L. (Junca Gelatin, Pharmaceutical Gelatin)

-

Trobas Gelatine BV (Trobas Gelatin Capsules, Pharmaceutical Gelatin)

-

Weishardt Holding SA (Weishardt Gelatin, Weishardt Pharma Gelatin)

-

Lapi Gelatine S.p.a. (Lapi Pharmaceutical Gelatin, Lapi Gelatin Capsules)

-

Italgel S.r.l (Italgel Pharmaceutical Gelatin, Italgel Gelatin Capsules)

-

Gelnex (Gelnex Gelatin, Gelnex Pharmaceutical Gelatin)

-

Rousselot (Rousselot Pharma Gelatin, Rousselot Gelatin Capsules)

-

Norland Products (Norland Gelatin, Norland Pharma Gelatin)

-

Collagen Solutions (Collagen Gelatin, Collagen Pharma Gelatin)

-

Qingdao Yuantong (Yuantong Pharmaceutical Gelatin, Yuantong Gelatin Capsules)

-

Shandong Tianli Pharmaceutical (Tianli Gelatin Capsules, Tianli Pharma Gelatin)

-

Haide Biochem (Haide Gelatin, Haide Pharmaceutical Gelatin)

-

KIMICA Corporation (KIMICA Pharmaceutical Gelatin, KimiGel Gelatin Capsules)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.69 Billion |

| Market Size by 2032 | USD 2.79 Billion |

| CAGR | CAGR of 5.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Type A, Type B) • By Product (Hard Capsules, Soft Capsules, Tablets, Absorbable Hemostats) • By Source (Porcine, Bovine, Marine, Poultry) • By Function (Stabilizing Agents, Thickening Agents, Gelling Agents & Other Functions) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sterling Biotech Limited, Gelita AG, Darling Ingredients Inc., Nitta Gelatin Inc., India Gelatine & Chemicals, Tessenderlo Group, PB Gelatins GmbH, Junca Gelatines S.L., Trobas Gelatine BV, Weishardt Holding SA, Lapi Gelatine S.p.a., Italgel S.r.l, Gelnex, Rousselot, Norland Products, Collagen Solutions, Qingdao Yuantong, Shandong Tianli Pharmaceutical, Haide Biochem, KIMICA Corporation. |

| Key Drivers | • Growth in Food and Cosmetics Industries Fuels Gelatin Consumption Worldwide, Driving Market Expansion • Rising Demand for Gelatin from Pharmaceutical and Nutraceutical Industries Drives Market Growth |

| RESTRAINTS | • Presence of Substitute Components Limits Pharmaceutical Gelatin Market Growth |