Pharmaceutical Glass Packaging Market Report Scope & Overview:

The Pharmaceutical Glass Packaging Market size was USD 19.82 billion in 2023 and is expected to Reach USD 42.02 billion by 2031 and grow at a CAGR of 9.85 % over the forecast period of 2024-2031.

Market growth is expected to be driven by the widespread use of generic intravenous medicines, together with strong demand from the pharmaceutical industry. According to the United States Centres for Medicare & Medicaid Services, America's national health care expenditure is projected to grow at an annual rate of 5.5% by 2030 and reach $6250 billion.

Get More Information on Pharmaceutical Glass Packaging Market - Request Sample Report

As India is a prominent and growing market in the world of medicines, glass packaging demands are estimated to increase rapidly. India is the largest supplier of generic pharmaceuticals in the world, accounting for 20% of all production and meeting over 62% of overall vaccine demand, as indicated by data provided on the Indian Brand Equity Foundation's website. India is the world's largest pharmaceutical market with a value of 42.6 billion USD. In August 2021, the Indian pharmaceutical market increased by 17.8% YOY, compared to 13.7% in July 2020. The revenue of the Indian pharmaceutical industry will increase by more than 13% in FY22.

MARKET DYNAMICS

KEY DRIVERS:

-

The rise in the pharmaceutical industry and drug development

Due to rapid growth, there is an increasing demand for packaging of medicinal products around the world. The demand for reliable and secure containers such as glass is growing in view of pharmaceutical companies' continued innovation and development of new medicines.

RESTRAIN:

-

Increased Manufacturing and transportation costs

Compared to some of the plastic alternatives, glass containers can be more costly to produce. The total cost of glass packaging, which affects its competitiveness in the market, can be substantially affected by manufacturing costs, as well as Raw Material and Transport Costs.

OPPORTUNITY:

-

Technological developments and smart packaging

Safety, security and monitoring of pharmaceutical products may be enhanced by incorporating advanced technology such as smart labels, tamper evident features and digital tracking systems into glass packaging. The opportunity for more patient adherence and transparency in the supply chain is offered by smart packaging solutions.

-

Rising demand for biopharmaceutical products and specialty medicines

CHALLENGES:

-

Challenges in the field of logistics and supply chains

Careful handling and specialised logistics, which may have added costs to the supply chain, are necessary due to the fragility of glass. In order to minimise logistical challenges, proper packing, storage and transportation solutions are needed.

IMPACT OF RUSSIAN UKRAINE WAR:

The conflict between Russia and Ukraine is having a negative impact on energy supplies of gas and electricity to European glass manufacturers, which has been compounded by the economic crisis in Europe. The temperatures needed for the melting of the mixture, depending on the energy obtained from Russian gas, are driven by the production of glass made out of limestone, soda ash and sand. As a result of the gas shortage, manufacturers in Europe were forced to stop manufacturing bottles, cars and skyscrapers. As Russia is one of the world's largest oil exporters, the sanctions have upset global energy markets, where oil prices are set. Since the day that Russia invaded last year and on June 14, prices of gasoline in the USA have risen by $1.50 per gallon, or 43%, reaching an all time high of $5.04.

IMPACT OF ONGOING RECESSION:

Recessions can result in decreasing demand for medicinal products because of the fact that people have fewer funds to pay for healthcare. This could have an adverse effect on the packaging of medicinal products in glass, as there will be decreased demand for such packaging. In comparison with other packaging materials like plastic or aluminium, pharma glass packaging is more expensive. In times of recession, pharmaceutical companies are more likely to replace the costly packaging material with cheaper ones in order to reduce costs.

KEY MARKET SEGMENTS

By Product Type

-

Bottles

-

Cartridges & Syringes

-

Vials

-

Ampoules

In terms of global revenue, bottles were the largest segment of the market, accounting for more than 34.5% in 2022. The market for pharmaceutical glass containers has been divided by product as ampoule, bottle, vial, syringe and cartridge. Vials have the best analytical capabilities and are highly sustainable, making them an important growth driver in a segment that is also destined to grow more quickly than ampoules. In the forecast period, from 33.5 % in 2022, the vials segment is expected to increase its market share.

By Drug Type

-

Branded

-

Generic

-

Biologic

The generic drug category accounted for more than 73.2% of global revenue in 2022. In recent years, the global generic drugs market has been growing due to increasing cases of chronic diseases, an ageing population and a rising number of patent expirations.

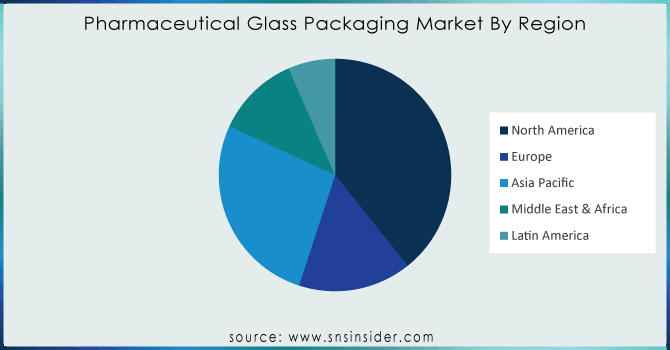

REGIONAL ANALYSIS

In 2022, North America was the dominant market and held more than 36.5% of global revenue. In the coming years, it is anticipated that developing countries will be experiencing a surge in spending on pharmaceuticals. The United States is expected to remain a key driving force and the most important market for growth of the pharmaceutical industry in this region, driven by innovative products. The development of generics in the region which are projected to see a consistent strong demand for both product volumes and sales is foreseen to contribute to this growth.

In 2022, Europe held a volume share of over 20%. A major factor in the EU's economic growth is its research based pharmaceutical industry. In view of the increasing rate of medical progress using research, development and introduction of new medicines to improve health and quality of life in this region, the pharmaceutical glass packaging sector is growing.

In terms of revenue growth, the Asia Pacific region has been expected to be one of the most rapidly increasing regions. The presence of a large number of small and medium sized production units in the region is an indication of that increase in demand. In addition, the region enjoys favourable regulatory regimes, which help manufacturers and attract foreign investments. In view of rapidly increasing consumer base and spending, developing countries are expected to grow at a faster rate than developed markets. The growth of developing economies in the Asia Pacific is likely to be supported by increasing cases of chronic diseases, growing healthcare awareness and higher income levels. As a result of increased awareness, governments in the Asia Pacific region are increasingly expanding private and public health coverage. An increase in the number of pharmaceutical products is expected as a direct result of government efforts aimed at promoting low-cost generic medicines and reducing health care costs in developing countries, further fuelling market growth.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Pharmaceutical Glass Packaging market are Nipro Corporation, SGD S.A., West Pharmaceutical Services, Inc, Gerresheimer AG, Arab Pharmaceutical Glass Co., Schott AG, Corning Incorporated, Owens-Illinois, Inc, Shandong Medicinal Glass Co., Ltd, Bormioli Pharma S.p.A and other players.

RECENT DEVELOPMENT

-

June 2023, The construction of a pharmaceutical glass tube factory in Mahabubnagar, near Hyderabad, was launched by a joint venture between US multinational Corning and SGD Pharma.

-

May 2023, Nipro Japan buys Croatian glass pharmaceutical packaging manufacturer.

| Report Attributes | Details |

| Market Size in 2023 | US$ 19.82 Bn |

| Market Size by 2031 | US$ 42.02 Bn |

| CAGR | CAGR of 9.85 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Bottles, Cartridges & Syringes, Vials, Ampoules) • by Drug Type (Branded, Generic, Biologic), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Nipro Corporation, SGD S.A., West Pharmaceutical Services, Inc, Gerresheimer AG, Arab Pharmaceutical Glass Co., Schott AG, Corning Incorporated, Owens-Illinois, Inc, Shandong Medicinal Glass Co., Ltd, Bormioli Pharma S.p.A |

| Key Drivers | • The rise in the pharmaceutical industry and drug development |

| Key Restraints | • Increased Manufacturing and transportation costs |