Single-Use Packaging Market Report Scope & Overview:

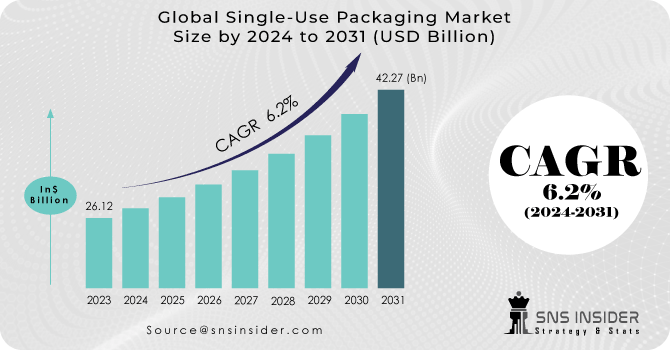

The Single-Use Packaging Market size was USD 26.12 billion in 2023 and is expected to Reach USD 42.27 billion by 2031 and grow at a CAGR of 6.2% over the forecast period of 2024-2031.

Demand for single use packaging will probably increase as a result of growing online sales, especially in emerging countries such as China and India.

Get More Information on Single-Use Packaging Market - Request Sample Report

Public concerns about packaging waste, in particular plastics packaging waste, have been met by governments around the world. Regulations to reduce environmental waste and improve the management of waste are being implemented. This could have an adverse effect on market growth.

Market demand has been fuelled by the increased demand for online food delivery services, as well as use of a new packaging option that allows meal to be delivered in one package. In addition, even though they have significant impact on the environment, single use plastics continue to be used because of their light weight and durability in comparison with other materials. However, once alternatives to single use plastics begin to gain substantial market acceptance, the impact of this driver will gradually decrease.

MARKET DYNAMICS

KEY DRIVERS:

-

Cost-Effectiveness and Affordability of single use packaging to drive the market

Single use packaging is often more cost effective than durable or reusable packaging, making it an attractive option for both consumers and manufacturers.

RESTRAIN:

-

Waste Generation and Landfill Overflow

Waste generation and landfill fill up are significant contributors to single use packaging, raising a challenge for the management of wastes as well as environmental sustainability.

OPPORTUNITY:

-

Demand for environmentally friendly and sustainable packaging materials is increasing

A large number of opportunities have been opened up to manufacturers for the development and supply of bioplastics, compostates, recycling or reusability which replace conventional single use plastics due to increased demand for ecofriendly and sustainability packaging materials.

CHALLENGES:

-

Waste Management and Recycling Infrastructure

In order to collect, sort, and recycle single use packaging materials efficiently, there is a shortage of strong waste management and recycling facilities as well as inadequate public awareness.

IMPACT OF RUSSIAN UKRAINE WAR:

In 2023, the revenue of the global Single Use Packaging Market is expected to fall by 3.5%. The war caused interruptions in the supply chain of raw materials and components used to produce single use packaging, for example plastics, paper or metals. This resulted in higher prices for these materials, with a corresponding increase in the cost to produce Single Use Packaging.

Since the start of the war, prices for PET have risen by more than 30% across America, which is a type of plastic that makes single use water bottles and other beverage containers. This is leading to increased prices for single use containers of beverages. The EU has banned the sale of many single plastic products such as straws, stirrers and cotton bud in Europe. The ban was initially intended to take effect in July 2021, but due to the COVID 19 epidemic, it had been postponed until January 2022. When the EU is concentrating on securing food security and energy independence, the war in Ukraine makes it more difficult to implement this ban.

IMPACT OF ONGOING RECESSION:

The single use packaging market is expected to be affected by the current recession in a moderate way. First, there may be a higher likelihood that consumers will buy only useable packaging products in order to save money. They may choose to use cheap, disposable products rather than recycled ones for example. By contrast, consumers can become more concerned about their spending during the recession and will also be less inclined to buy solely used packaging products.

In addition, the recession could result in a rise in government regulation of single use packaging. This trend towards reducing plastic waste has already been undertaken by many governments and could be accelerated by the recession. For instance, the EU has banned single use plastic bags and straws, and several other countries are considering similar bans.

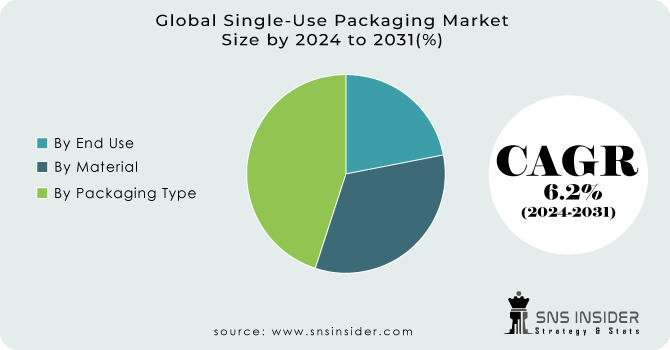

KEY MARKET SEGMENTS

By Material

-

Polypropylene (PP)

-

Low Density Polyethylene (LDPE)

-

Polyethylene Terephthalate (PET)

-

Polystyrene (PS)

-

Expanded Polystyrene (EPS)

By Packaging Type

-

Bags

-

Pouches

-

Films

-

Sachets

-

Bottles

-

Cups

-

Others

By End Use

-

Pharmaceutical

-

Electronics & Electricals

-

Personal Care & Cosmetics

-

Others

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

Asia Pacific is expected to dominate the market with the largest market share. Thanks to a number of end user industry organisations, this sector is one of the major investors and stakeholders in the single use packaging market. The increasing trend towards packaged meals, an increase in the number of restaurants and supermarket chains as well as a higher consumption of bottles for drinking water and beverages are major growth drivers across the region. The Indian Brand Equity Foundation forecasts that in 2026 the nation's e commerce market will reach USD 200 billion. In this part of the world, demand for packaging is largely driven by a growing use of internet and mobile phones.

India is the world's biggest provider of generic pharmaceuticals, making up 20% of global supply and meeting more than 60% of global demand for vaccines, as outlined in data from an Indian Brand Equity Foundation website. There is a value of USD 42 billion in India's pharmaceutical industry.

Europe is experiencing steady growth over the forecast period. This is due to rapid expansion of technology and increased retail stores.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Single-Use Packaging market are Ardagh Group SA, Bemis Company Inc, Snapsil Corporation, Coveris SA, Winpak Limited, Sealed Air Corporation, Ukr Plastic, Ampac Holding, Transcontinental Inc, Flextrus AB and other players.

Bemis Company Inc-Company Financial Analysis

RECENT DEVELOPMENT

-

In March 2022, Ardagh Group entered into an agreement with the constellation brands in inc. to design and produce new, highly decorated wine bottles for its Craftman's Union brand.

-

Winpak and Pure Cycle Technologies Inc. entered into a collaboration in March 2022.

| Report Attributes | Details |

| Market Size in 2023 | US$ 26.12 Bn |

| Market Size by 2031 | US$ 42.27 Bn |

| CAGR | CAGR of 6.2 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (High Density Polyethylene (HDPE), Polypropylene (PP), Low Density Polyethylene (LDPE), Polyethylene Terephthalate (PET), Polystyrene (PS), Expanded Polystyrene (EPS)) • by Packaging Type (Bags, Pouches, Films, Sachets, Bottles, Cups, Others) • by End Use (Pharmaceutical, Electronics & Electricals, Food & Beverages, Personal Care & Cosmetics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Ardagh Group SA, Bemis Company Inc, Snapsil Corporation, Coveris SA, Winpak Limited, Sealed Air Corporation, Ukr Plastic, Ampac Holding, Transcontinental Inc, Flextrus AB |

| Key Drivers | • Cost-Effectiveness and Affordability of single use packaging to drive the market |

| Key Restraints | • Waste Generation and Landfill Overflow |