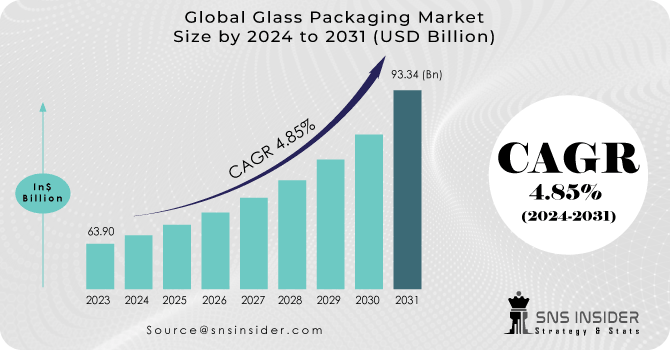

Glass Packaging Market Key Insights:

The Glass Packaging Market size was valued at USD 63.90 billion in 2023 and is expected to Reach USD 93.34 billion by 2031 and grow at a CAGR of 4.85 % over the forecast period of 2024-2031.

Glass packaging is a rigid packaging technique that helps to safeguard the contents by encasing it in various densities, sizes, and shapes of glass packaging products. The various types of glass packaging materials that are offered in the market include containers and bottles, among others. These components have no impact on the taste, texture, or composition of the material already in the jar. This kind of packaging is widely used for alcoholic and non-alcoholic beverages, food, pharmaceuticals, personal care, cosmetics, and other products.

Get Sample Copy of Glass Packaging Market - Request Sample Report

One of the key factors fueling the growth of the glass packaging market is the rising consumer demand for safe and healthier packaging. The development of new techniques for shaping, embossing, and applying artistic finishes to glass, as well as the rising acceptance of glass packaging among consumers as one of the most reliable forms of packaging for environmental, health, and gastronomic safety, are driving the growth of the glass packaging market. Increased demand for environmentally friendly goods, a rise in food and beverage demand, and a preference for lightweight glass due to its higher stability and lower volume of CO2 emissions are all factors that are influencing the glass packaging market. The market for glass packaging is also benefited by the recyclable nature of glass, the high demand for beer, soft drinks, and cider, evolving lifestyles, urbanization, and the rising disposable income of consumers.

On the other hand, the expansion of the glass packaging market is anticipated to be hampered by the increase in operational costs. The glass packaging market is expected to face challenges due to the rising use of substitute products like plastic and tin.

MARKET DYNAMICS

KEY DRIVERS:

-

Glass has no risk factor in food packaging and is widely accepted in food and beverage industry

Glass ensures the purity and integrity of the packaged goods because it is an inert substance that does not react with the contents it holds. Due to its capacity to preserve flavors and stop chemical leaching, it is frequently used for food and beverage packaging. The preference for glass packaging among consumers, particularly for goods like organic baby food, medications, and beverages, is a result of their concerns about health and safety.

-

Glass packaging is highly regarded as an eco-friendly material which has given growth to the market.

RESTRAIN:

-

Environmental Impact of Glass Manufacturing

Despite the fact that glass can be recycled, the manufacturing process itself can have an effect on the environment, even though glass packaging is thought to be environmentally friendly. High levels of energy are consumed during the production of glass, which also produces greenhouse gas emissions. Environmental damage can also result from the extraction and processing of the raw materials used to make glass.

-

Compared to packaging made of plastic or aluminum, glass is more fragile and heavier.

OPPORTUNITY:

-

To increase their market share, glass packaging producers can look into working with other sectors.

Innovative packaging solutions and shared expertise can result from collaborations with beverage companies, pharmaceutical companies, or cosmetic brands. Through these partnerships, manufacturers can learn about particular industry requirements and develop custom packaging to satisfy a range of customer demands.

-

Glass packaging has an opportunity to enter into the premium goods and luxury brands market.

CHALLENGES:

-

Fragility and Breakage Concerns related to glass packaging

Due to its inherent fragility, glass packaging is prone to breaking while being handled, transported, and stored. Breakage not only leads to product losses but also increases costs for replacement and causes unhappy customers. To reduce breakage risks, manufacturers must make investments in sturdy packaging designs, safe handling practices, and efficient transportation strategies.

IMPACT OF RUSSIA-UKRAINE WAR

The entire glass industry is being impacted by the rising energy supply uncertainties because melting sand, soda ash, and limestone requires energy, and in Europe, the energy to generate the necessary temperatures has primarily come from Russian gas. Duralex International, a French glass producer, has joined the growing list of European businesses that are cutting back on or stopping production as a result of the skyrocketing energy prices brought on by Russia's conflict in Ukraine.

European companies are already preparing for a potential glass shortage, including automakers, bottlers, and skyscraper builders. The German automaker Volkswagen AG, whose brands include Audi and Porsche, has expanded its supplier network outside of Europe and increased its stock of glass-using parts like windows and windshields.

It is difficult for Ukraine to restore glass manufacturing volumes to the level they were before the war because of ongoing Russian shelling, rising energy prices, and severed trade ties. Glass suppliers estimate that because of the increased demand and higher production costs, the price of glass has increased by a factor of two to three over what it once was.

On the Ukrainian market, there are between 50 and 65 manufacturers of double-glazed windows and between 300 and 400 manufacturers of windows. Production has already resumed in more than 70% of these plants. Nearly all window manufacturing components are produced in Ukrainian factories: 60–75 percent of the market's needs are met by window profile manufacturers, and 40 percent of the market's needs are met by window fitting manufacturers.

IMPACT OF ONGOING RECESSION

In an effort to combat rising prices, many consumers are altering their spending patterns.

One of the tactics is to switch meals outside for meals inside. According to the survey, 40% of respondents said they planned to spend less money eating out while 45% said they planned to spend more money on groceries.

Consumers around the world intend to keep up their newly acquired habits, particularly increasing their home cooking and cocktail syrups making. These habits were accelerated by the 2020 pandemic. Consumers still want meals that are similar to those at restaurants for these at-home experiences, and they want to drink less of better-quality alcohol. They desire ingredients like spreads, seasonings, and sauces. With wine and spirits, they're making cocktails. Brands heavily rely on glass packaging because of its inert and protective qualities as well as its power to build brands in the categories that cautious consumers gravitate toward in uncertain times.

Brands search for areas where they can cut costs during economic uncertainty. Large players in the spirits industry, however, assert that they are doubling down on their strategies because they understand the importance of premiumization in trying times.

When it comes to spirits packaging, glass is the undisputed market leader; the category's volumes increased by 5% globally. Premium-priced brands are expected to continue growing faster than the overall category over the next five years as consumer demand for "better drinking" persists.

KEY MARKET SEGMENTATION

By Raw Material

-

Cullet

-

Cobalt Oxide

-

Limestone

-

Others

By Product Type

-

Bottle & Jars

-

Container

-

Vials

-

Others

By Application

-

Alcoholic Beverages

-

Cosmetics

-

Others

Get Customized Report as per Your Business Requirement - Enquiry Now

REGIONAL ANALYSIS

Asia Pacific has become dominant in the glass packaging market. The expanding use of glass across a range of end-use industries, such as food and beverage, pharmaceuticals, and alcoholic beverages in China and India, is expected to drive regional market growth. It is also anticipated that the high availability of raw materials, such as silica, will spur industry growth.

India and China are the two countries with the largest consumer bases in the Asia Pacific region, and as a result, they dominate the glass packaging industry. The rising urban population and increased demand for beverages are both factors in this region's industry growth. China is a significant consumer of products with glass packaging on a global scale.

Based on revenue, Europe was the second-largest region. The expansion of the beer industry in Germany and France is one factor responsible for the high market growth. Furthermore, it is anticipated that the high consumption of glass packaging in Russia and Turkey will spur growth.

Due to technological advancements and the region's significant manufacturing base, North America is predicted to experience rapid growth in the pharmaceutical packaging industry. On account of the expanding pharmaceutical industry over the forecast period, Saudi Arabia is anticipated to experience tremendous growth potential.

REGIONAL COVERAGE:

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin American

Key Players:

Some major key players in the Glass packaging market are Borosil Glass Works Ltd, Allied Glass Containers Ltd, Owen Illinois Inc, Gallo Glass Company, Amcor Plc, Consol, Gerresheimer AG, Saint Gobain SA, Hindustan National Glass & Industries Limited, Orora Packaging Australia Pty Ltd, and other players.

Allied Glass Containers Ltd-Company Financial Analysis

RECENT DEVELOPMENTS

-

SGD Pharma, Due to "explosive" domestic demand and an aggressive expansion strategy in the America, glass packaging supplier SGD Pharma intends to increase the capacity of its Zhanjiang plant in China by 15%.

-

Baralan, A new line of glass bottles called the Lilibet Series has been unveiled by Baralan, a consolidated player in primary packaging for the cosmetics and beauty industries.

| Report Attributes | Details |

| Market Size in 2023 | US$ 63.90 Bn |

| Market Size by 2031 | US$ 93.34 Bn |

| CAGR | CAGR of 4.85% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Cullet, Cobalt Oxide, Limestone, Others) • By Product Type (Bottle & Jars, Container, Vials, Others) • By Application (Alcoholic Beverages, Non-Alcoholic Beverages, Cosmetics, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Borosil Glass Works Ltd, Allied Glass Containers Ltd, Owen Illinois Inc, Gallo Glass Company, Amcor Plc, Consol, Gerresheimer AG, Saint Gobain SA, Hindustan National Glass & Industries Limited, Orora Packaging Australia Pty Ltd |

| Key Drivers | • Glass has no risk factor in food packaging and is widely accepted in food and beverage industry |

| Market Opportunities | • To increase their market share, glass packaging producers can look into working with other sectors. |