Plant Genotyping Equipment Market Report Scope & Overview:

Get more information on Plant Genotyping Equipment Market - Request Free Sample Report

The Plant Genotyping Equipment Market was valued at USD 751.85 Million in 2023, and it is expected to reach USD 1662.43 Million by 2032, registering a CAGR 9.22% of during the period of 2024-2032.

Agricultural demand is increasing daily as the human population grows. There is a growing need to produce high yielding crops to ensure global food security for the human population. According to United Nations, Over the next 30 years, the global population is projected to grow by almost 2 billion people, reaching 9.7 billion in 2050 and possibly reaching a peak of nearly 10.4 billion in the mid-2080s. One factor conducive to achieving this is to monitor and enhance the tolerance and adaptative capacities of plants grown in or exposed to diverse stressful environments. Characterization of complex plant traits is vital in this context since it triggers an understanding of the environmental factors related to the trait and the corresponding locus about the various genetic mechanisms.

Some important agronomic traits, such as production, tolerance, adaptation, or resistance against the abiotic and biotic stress, are relevant choices to understand the interaction between genotypes and an environment. Thus, understanding the behavior of a certain genotype that is subjected to a given environment is highly vital to the sustainable production of crops and stability. This is, in fact, one of the most influential and legitimate scientific areas of study in plant biology for growing plant varieties that are capable of producing at rates potentially twice that of their ancestors or the existing levels and produce value to those connected with the agricultural industries.

The generation of sequence data from Next-Generation Sequencing technologies facilitates an order of magnitude rise in the rate of discovery of polymorphisms since Sequence Characterized Amplified Region markers were initially developed. The process can be sequenced massively. The application of SNPs is the most preferred choice in polymorphism discovery, and an increase in polymorphic marker resources will eventually build up high-throughput genotyping examines.

DRIVERS

-

Increased pressure to feed a growing population drives demand for plant genotyping equipment to identify traits for higher yield and disease resistance in crops.

Rapid population growth is straining food resources, exerting unprecedented pressure on agricultural systems to achieve higher yields and food security. Plant genotyping equipment is one critical technology in the pursuit to identify crop traits that will enhance yield and resistance to disease. By analyzing the genetic structure of plants, relevant traits can be identified and selected for the rushed development of improved crop types. This genotypic knowledge also allows for the breeding of both high-yield and disease-resistant types of crops that reduce the need for pest control chemicals and promote alternate sustainable farming strategies. The adoption of this advanced equipment results from the need to feed an ever-growing world population that continually encounters such challenges as climate change, land degradation, and inadequate availability of this crucial resource. High rates of food production are only achievable with plant testing genotyping tool, since tens of thousands of plants can be screened quickly and only the best promoted. This technology is therefore critical to the satisfaction of both the food and nutrition demands of the swelling population.

-

Personalized agriculture adoption fuels the plant genotyping equipment market as it allows selection of seeds optimized for specific environments.

Personalized agriculture is becoming increasingly popular as the optimum way to grow crops by fitting the practice into the site-specifics of the environment. It allows for choosing the right crops and their variety types based on the particular condition of the site with its own climate, soil, pests, etc. Personalized agriculture uses plant genotyping equipment to select seeds with specific acclimated characteristics, breeding seeds that will perform best in a specific area. The farmers’ understanding of the plants’ genetic data enables them to know how much fertilizer the plant needs, how much water to provide it with, and how the pest will resist it. It plays a major role in increasing the overall crop yield and sustainability as it reduces the over-use of fertilizers, pesticides, and water. Utilizing the plant genotyping equipment to personalize the crop selection to the local conditions, the technology becomes increasingly essential for more farmers to make the transition toward environmentally friendly farm practices. More and more farmers are becoming environmentally conscious meaning that the demand for the plant genotyping equipment is set to increase in the future.

RESTRAIN

-

Advancements in alternative breeding methods like gene editing could challenge the dominance of plant genotyping equipment in the future.

The advancements in alternative breeding methods, in particular, a new approach, CRISPR-Cas9, has a potential to challenge plant genotyping equipment. Whereas, a new method enables scientists to conduct accurate adjustments to the DNA coding of the plant, making it possible to directly change its characteristics to achieve better yield and resistance to various diseases and stresses. The standard breeding would take dozens of generations to transform the characteristics of the plant. This way, the need in plant genotyping equipment and special technology would diminish due to them not being used to analyze different traits any longer. In addition, a new gene-editing approach can either suppress particular genes or introduce one, whereas plant genotyping does not allow for such a level of specifics. Therefore, simple, and inexpensive gene-editing methods would replace traditional breeding and plant genotyping equipment. Although such a solution is not instantaneous as they still must develop plants, the method would allow for the faster and simpler development of new varieties. The chances are high that simple and cheap options would become preferable to traditional methods. As a result, one would observe a decreased demand for expensive equipment. On the other hand, the integration of both technologies would be highly beneficial as gene editing would be used for the development of innovations. At the same time, plant genotyping technologies and equipment would be used to study the characteristics of cultivated plants.

KEY MARKET SEGMENTATION

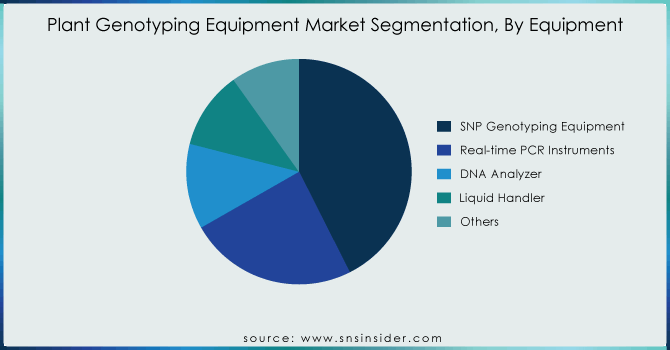

By Equipment

The SNP genotyping equipment segment dominated the market in 2023 and has the largest revenue share of 42.56%. The liquid handler segment is expected to exhibit the highest CAGR of forecasted period. SNPs are small DNA sequence variations that are related to desired plant traits. In combination with QTL mapping, SNPs are used for the delivery of assays to establish marker-supported selection programs aimed at improving or augmenting plant characteristics such as enhanced resistance to pests, better tolerance to stress, or increased yield.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

The breeding segment was leading and has the largest revenue share of 42.29% in 2023 and is expected to retain over the forecast period. Genotype-By-Sequencing has unlocked new opportunities in plant genetics and plant breeding research, as it is a proficient, cost-effective multiplexed sequencing and genome-wide scanning platforms. Further, the recent advances in GBS have led to the development of Marker-Assisted Selection tool to accelerate crop improvement and plant breeding. The tool has been widely used in plant breeding to improve crop quality, yield, or tolerance to abiotic or biotic stresses.

By End Use

The laboratory segment was a leading segment and has the largest revenue share of 40.32% in 2023. The presence of a significant number of research labs using plant genotyping to examine several applied and fundamental aspects of plants.

The greenhouse segment is anticipated to present the highest CAGR of more than 9.42% over the forecast period. A rise in demand for genotyping platforms to be deployed in greenhouses in recent years.

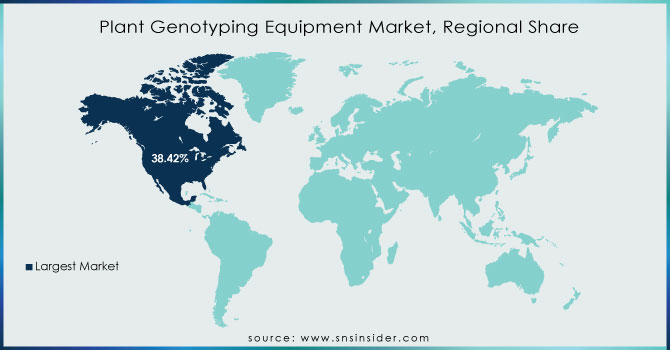

REGIONAL ANALYSIS

North America dominated the market and accounted for the largest revenue share of 38.42% in 2023. The United States, in particular, has a well-hooked up agricultural and biotechnology region, which drives the call for a superior plant genotyping device. The presence of main biotech groups and studies institutions, mixed with considerable investments in agriculture and genomics research, has contributed to North America’s dominance in this marketplace. Additionally, favourable authorities’ guidelines and projects aimed at enhancing crop yield and food safety have, in addition, inspired the adoption of genotyping technology in the vicinity.

Asia-Pacific is expected to register the highest CAGR of 24.44% over the forecast period. In particular, countries like China and India, has emerged because of the fastest-growing vicinity within the world plant genotyping device market. The location’s rapid population growth and increasing meals demand have brought about a focal point on the development of crop productivity and first-rate. Governments and personal companies are investing considerably in agriculture studies and biotechnology, leading to a surge in the adoption of plant genotyping devices.

Key Players

The major Players are Agilent Technologies Inc., BGI Genomics, Eurofins Scientific, Evogene Ltd., Illumina Inc., LGC Biosearch Technologies, Merck KgaA, Oxford Nanopore Technologies Limited, PerkinElmer Inc., Promega Corporation, Thermo Fisher Scientific and others.

Recent Developments

-

In April 2023: PerkinElmer Inc. Released the Genotyper Flex for Plants, an excessive-throughput SNP genotyping instrument for plant breeding and research. The device makes use of the Genotyper Flex platform to genotype up to 1,000 SNPs in an unmarried response.

-

In May 2023: Eurofins Scientific launched the Plant Genotyping Services, a set of genotyping services for plant breeding and studies. The services encompass SNP genotyping, DNA sequencing, and bioinformatics analysis.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 751.85 Million |

| Market Size by 2032 | US$ 1662.43 Million |

| CAGR | CAGR of 9.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment (SNP Genotyping Equipment, Real-time PCR Instruments, DNA Analyzer, Liquid Handler, Others) • By Application (Plant Research, Breeding, Product Development, Quality Assessment) • By End Use (Greenhouse, Field, Laboratory) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Agilent Technologies Inc., BGI Genomics, Eurofins Scientific, Evogene Ltd., Illumina Inc., LGC Biosearch Technologies, Merck KgaA, Oxford Nanopore Technologies Limited, PerkinElmer Inc., Promega Corporation, Thermo Fisher Scientific |

| Key Drivers | • Increased pressure to feed a growing population drives demand for plant genotyping equipment to identify traits for higher yield and disease resistance in crops. • Personalized agriculture adoption fuels the plant genotyping equipment market as it allows selection of seeds optimized for specific environments. |

| RESTRAINTS | • Advancements in alternative breeding methods like gene editing could challenge the dominance of plant genotyping equipment in the future. |