Plastic Injection Molding Machine Market Report Scope & Overview:

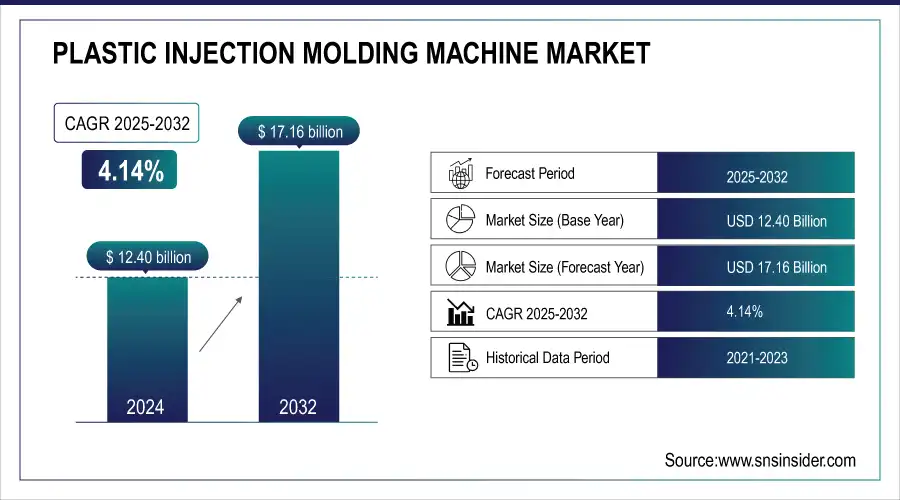

The Plastic Injection Molding Machine Market Size was estimated at USD 12.40 billion in 2024 and is expected to arrive at USD 17.16 billion by 2032 with a growing CAGR of 4.14% over the forecast period 2025-2032.

To Get more information on Plastic Injection Molding Machine Market - Request Free Sample Report

The Plastic Injection Molding Machine Market is growing due to increasing demand from automotive, packaging, consumer goods, and medical industries. These machines enable mass production of complex and lightweight plastic components with high precision and efficiency. Rising focus on automation, energy-efficient machinery, and sustainable manufacturing is further driving adoption. Additionally, the expansion of e-commerce, healthcare innovations, and electric vehicles is boosting market growth. Continuous technological advancements, such as AI-integrated and all-electric machines, are enhancing productivity and fueling global market expansion.

Market Size and Forecast:

-

Plastic Injection Molding Machine Market Size in 2024: USD 12.40 Billion

-

Plastic Injection Molding Machine Market Size by 2032: USD 17.16 Billion

-

CAGR: 4.14% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Plastic Injection Molding Machine Market Trends

-

Growing demand in automotive lightweighting and electric vehicle components is driving high-performance injection molding machine adoption.

-

Expansion in medical device manufacturing requiring precision molding for components like syringes, vials, and implants.

-

Rising use in packaging industry, especially for sustainable and recyclable plastics.

-

Increasing adoption of energy-efficient and servo-hydraulic machines to reduce operational costs and carbon footprint.

-

Integration of Industry 4.0, IoT, and smart factory solutions for process optimization and predictive maintenance.

-

Growing demand for micro and ultra-precision injection molding in electronics and consumer goods.

-

Shift toward multi-material and multi-color injection molding for complex, high-value components.

Plastic Injection Molding Machine Market Growth Drivers

-

The plastic injection molding machine market is growing due to rising demand for lightweight automotive components, sustainable packaging, and advanced manufacturing technologies.

The plastic injection molding machine market is witnessing significant growth, driven by increasing demand from the automotive and packaging industries. In the automotive sector, a surge in demand for lightweight, durable, and low-cost components has been generated by increasingly stringent fuel economy and emission regulations. More and more manufacturers are replacing metal components with high-performance plastic parts, lowering the weight of the vehicle and improving efficiencies. At the same time, in the food, beverage, and e-commerce sectors, the rising consumption of flexible, rigid, and biodegradable plastic packaging is adding to a boom in its packaging industry. As manufacturers increasingly focus on sustainability, there is a shift towards recyclable and bio-based plastics, impacting market dynamics. Further demand is driven by an increase in the adoption of high-speed, energy-efficient and automated injection molding machines. Moreover, Integration of Industry 4.0 and smart molding technology is maximizing production efficiency and molding quality control a strategy for long-term growth. Growing economies across Asia-Pacific and Latin America hold significant opportunities for market participants.

Plastic Injection Molding Machine Market Restraints

-

The high capital and maintenance costs of plastic injection molding machines hinder market growth, especially for SMEs and cost-sensitive industries.

The high initial investment and maintenance costs of plastic injection molding machines pose a significant challenge for manufacturers, particularly small and medium-sized enterprises (SMEs). These machines demand large investments for purchase, installation, and configuration, thus deterring new entrants from starting operations. Moreover, the ongoing maintenance, repair and operations costs add up the financial burden. High-end injection molding machines, particularly electric and hybrid types, are more efficient but also far more expensive. Nothing more like the sound of routine servicing, mold replacements, and other technology upgrades to add to the expenses that impact the bottom line. Having to employ skilled labor to run and maintain these machines is adding additional costs to operations as well. These financial constraints can restrict expansion and adoption for businesses in cost-sensitive markets. Consequently, several companies look for economical alternatives such as outsourcing of production of plastic components, which affects the growth of the plastic injection molding machine market.

Plastic Injection Molding Machine Market Opportunities

-

The integration of Industry 4.0 in injection molding enhances efficiency, precision, and quality through IoT, automation, and predictive maintenance.

The integration of Industry 4.0 and smart manufacturing in plastic injection molding is revolutionizing production processes by leveraging IoT, automation, and predictive maintenance. IoT-enabled sensors capture real-time information related to machine performance, material flow, environmental conditions, etc., to ensure remote monitoring and proactive decision-making based on predictive analysis. Automation improves accuracy, speed and replicability while minimizing human participation and operational costs. AI and machine learning are utilized in the development of predictive maintenance to help prevent machine failure by catching warning signs ahead of time, preventing costs associated with machine downtime and repair. Moreover, production workflows are optimized through digital twins and cloud-based analytics, guaranteeing effective quality control. Efforts include enhancing energy efficiency, minimizing material loss, and allowing for tailored manufacturing to adapt to changing market needs. Injection molding powered by Industry 4.0 further improves traceability and compliance, allowing manufacturers to meet stringent regulations more easily. Consequently, smart manufacturing enables companies to be competitive with better productivity, reduced costs and higher quality of products.

Plastic Injection Molding Machine Market Challenges

-

Intense competition in the plastic injection molding machine market drives price wars, squeezing profit margins and challenging smaller players.

The plastic injection molding machine market is highly competitive, with numerous global and regional manufacturers vying for market share. Established companies are constantly innovating to get ahead, including launching energy-efficient, high-precision, and automated machines. But, this fierce competition often result in aggressive pricing strategies & pricing wars, which can erode the profit margins of manufacturers. Smaller players find it hard to compete against industry giants who benefit from economies of scale and powerful distribution networks. Moreover, companies are also pressured to reduce production cost while maintaining quality and performance because of growing demand for cost-effective solutions. In addition, market consolidation through mergers and acquisitions increases competitive pressure and creates barriers for the next wave of entrants in the industry. Raw material prices and changing customer preferences are also creating pressure on manufacturers to offer high-value solutions at competitive prices. Hence, sustenance of growth in this dynamic market would require companies to emphasize technologies, strategic alliances, and customer friendly innovations.

Plastic Injection Molding Machine Market Segment Analysis

By Technology

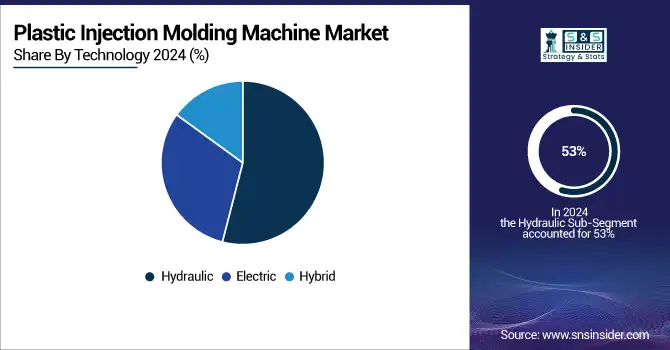

The hydraulic segment dominated with a market share of over 53% in 2024, due to its superior power density, durability, and ability to handle heavy loads with high precision. Hydraulic systems are widely used in industries like construction, manufacturing, and material handling, providing immense force output and efficiency in various demanding applications. Both excelling in extreme conditions that make it inconvenient to use, versatile enough to be adapted on multiple machines. While electric and hybrid are making advances, hydraulics remain central to applications with continuous high power and rugged performance. Nonetheless, hydraulic systems are constantly under pressure from more stringent environmental regulations and the demand for energy-efficient systems, which have led to alternative technologies, such as electric and hybrid systems, emerging as potential challengers to hydraulic dominance in niche markets.

By End-use

The Automotive segment dominated with a market share of over 32% in 2024, due to the rising demand for lightweight, durable, and high-precision plastic components in vehicle manufacturing. Injection molding is being used by automakers to produce complex parts with high efficiency, which is cost-effective over the manufacturing process, and lightweight materials that help improve fuel efficiency. Notable applications are dashboards, bumpers, lighting components, door panels, and under-the-hood components. Increasing Electric vehicles (EVs) usage is also helping boosting the demand for plastic injection molding as Manufacturers are looking for innovative designs and cost-effective production techniques. Innovations in injection molding technologies like multi-component molding and automation also improve product quality, thereby bolstering the automotive industry's firm stake in this space.

Plastic Injection Molding Machine Market Regional Analysis

Asia Pacific Plastic Injection Molding Machine Market Insights

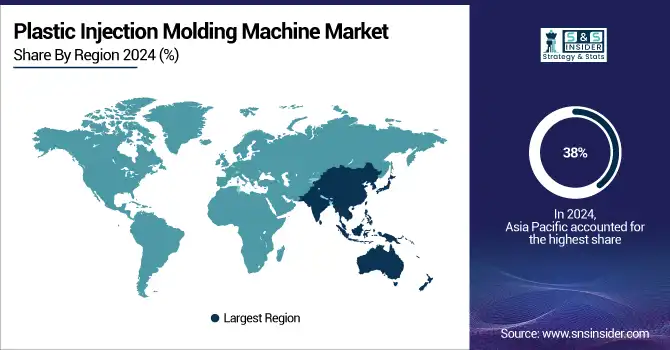

Asia-Pacific region dominated with a Market share of 38% in 2024, due to its robust manufacturing sector and high demand across industries such as automotive, packaging, and consumer goods. China is the largest producer and consumer of injection molding machine, and countries such as China, Japan, and India act as important regions. Low production costs, skilled labor, and progressive government initiatives promoting industrial investment contribute to the region's success. Moreover, the market is gaining strength with the onset of rapid urbanization, increased disposable income, and successive investments in automation and energy-efficient equipment. This allows for technological advancements and innovations fostered by the proximity of major manufacturers and suppliers in the region. Asia-Pacific continues to dominate the market for plastic injection molding machines, owing to industrialization and increasing end-use industries.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Plastic Injection Molding Machine Market Insights

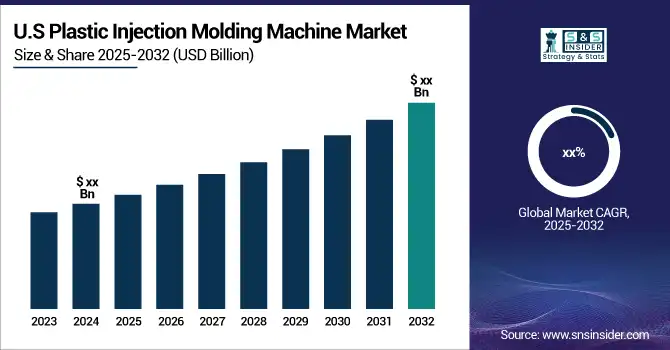

North America is experiencing rapid growth in the Plastic Injection Molding Machine Market, driven by advancements in technology and increasing automation. The Industry 4.0 and smart manufacturing emphasis in the area has resulted in utilizing the AI-based and IoT competent machines to get better efficiency and accuracy. In addition to this, the growing demand for sustainable and energy-efficient solutions are compelling the manufacturers to introduce eco-friendly and electric injection molding machines. Furthermore, the growing automotive, healthcare, and packaging industries also drive market growth. The establishment of major industry players in conjunction with government initiatives promoting domestic manufacturing and sustainability is propelling the market forward. The North America region will remain the fastest growing market over the forecast period, as companies are looking for cost-effective and high-performance options.

Europe Plastic Injection Molding Machine Market Insights

The Europe Plastic Injection Molding Machine Market is witnessing steady growth in 2024, driven by the region’s mature manufacturing ecosystem, advanced automotive and packaging industries, and strong focus on sustainable production. Key markets such as Germany, France, and the U.K. are adopting plastic injection molding machines extensively for automotive parts, medical devices, packaging, and electronics applications. Strict environmental regulations and EU directives on energy efficiency are encouraging the use of energy-saving, high-performance machines. Moreover, the presence of leading global manufacturers and continuous innovations in automation, AI integration, and smart factory solutions are further propelling market growth across the region.

Latin America (LATAM) Plastic Injection Molding Machine Market Insights

The LATAM Plastic Injection Molding Machine Market is gradually expanding in 2024, fueled by increasing industrialization, infrastructure projects, and growing automotive and packaging demand. Countries such as Brazil, Mexico, and Argentina are emerging as major adopters of injection molding machines for automotive components, household products, and construction materials. Investments in renewable energy and local manufacturing capabilities are also driving demand. Additionally, government initiatives to modernize industrial facilities and enhance production efficiency are stimulating the adoption of advanced, high-precision plastic injection molding machines across the region.

Middle East & Africa (MEA) Plastic Injection Molding Machine Market Insights

The MEA Plastic Injection Molding Machine Market is gaining momentum in 2024, driven by rapid urbanization, industrial diversification, and growth in the automotive, packaging, and construction sectors. Countries like the UAE, Saudi Arabia, and South Africa are increasingly deploying injection molding machines for infrastructure development, medical devices, and consumer goods production. Regional focus on energy-efficient, sustainable, and automated manufacturing solutions is encouraging the adoption of advanced machinery. Furthermore, government-led initiatives to boost industrial capacity, renewable energy projects, and modern manufacturing standards are accelerating market growth across the region.

Plastic Injection Molding Machine Market Competitive Landscape

ARBURG GmbH + Co KG

ARBURG is a global manufacturer of injection molding machines, known for high precision and automation-ready solutions.

-

In March 2024, ARBURG GmbH + Co KG introduced the ALLROUNDER 720 E GOLDEN ELECTRIC, an electric injection molding machine featuring a compact design for higher output efficiency. It offers precise operation and process stability, making it ideal for applications like medical device production. The machine is also designed for seamless automation with ARBURG’s robotic systems, providing a cost-effective solution for technical injection molding.

Haitian International Holdings Ltd.

Haitian is a leading global supplier of injection molding machinery for automotive, packaging, and industrial applications.

-

In February 2024, Haitian launched its 5th generation injection molding machinery, integrating AI algorithms and advanced sensors. This innovation enables intelligent process control, allowing the machines to recognize, adapt, make decisions, and optimize operations autonomously.

Plastic Injection Molding Machine Market Key Players

-

Arburg GmbH + Co KG (ALLROUNDER series)

-

HAITIAN INTERNATIONAL (MA Series, JU Series)

-

KraussMaffei (GX Series, PX Series)

-

Milacron (Cincinnati Series, Magna T Series)

-

NISSEI PLASTIC INDUSTRIAL CO., LTD. (FNX Series, NEX Series)

-

ENGEL AUSTRIA GmbH (e-motion, duo series)

-

Chen Hsong Holdings Limited (JETMASTER series, SUPERMASTER series)

-

UBE Machinery Inc. (U-MHI Series, eHV Series)

-

Husky Technologies (Hylectric, HyperSync)

-

WITTMANN Technology GmbH (EcoPower Series, SmartPower Series)

-

Sumitomo (SHI) Demag (IntElect, Systec Series)

-

JSW (Japan Steel Works Ltd.) (J-AD Series, J-ELII Series)

-

Toyo Machinery & Metal Co., Ltd. (Si-6S Series, ET Series)

-

Battenfeld-Cincinnati (SmartPower, EcoPower)

-

Shibaura Machine (Toshiba Machine) (EC-SXII Series, ISG Series)

-

Fu Chun Shin (FCS Group) (LA-SV Series, HB Series)

-

HPM North America Corporation (Next Generation Series)

-

Negri Bossi S.p.A. (Vigna Series, Nova Series)

-

Borch Machinery Co., Ltd. (Bi Series, BH Series)

-

Shuangsheng Injection Molding Machine (SSE Series, SSF Series)

Suppliers for Plastic Injection Molding Machine Market

-

Haitian International Holdings Limited

-

Engel Austria GmbH

-

Sumitomo (SHI) Demag Plastics Machinery GmbH

-

Arburg GmbH + Co KG

-

Milacron

-

Chen Hsong Holdings Limited

-

Nissei Plastic Industrial Co., Ltd.

-

KraussMaffei Group GmbH

-

Shibaura Machine

-

Electronica Plastic Machines

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.40 Billion |

| Market Size by 2032 | USD 17.16 Billion |

| CAGR | CAGR of 4.14% From 2025 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Hydraulic, Electric, Hybrid) • By End-use (Automotive, Consumer Goods, Packaging, Electronics, Construction, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Arburg GmbH + Co KG, HAITIAN INTERNATIONAL, KraussMaffei, Milacron, NISSEI PLASTIC INDUSTRIAL CO., LTD., ENGEL AUSTRIA GmbH, Chen Hsong Holdings Limited, UBE Machinery Inc., Husky Technologies, WITTMANN Technology GmbH, Sumitomo (SHI) Demag, JSW (Japan Steel Works Ltd.), Toyo Machinery & Metal Co., Ltd., Battenfeld-Cincinnati, Shibaura Machine (Toshiba Machine), Fu Chun Shin (FCS Group), HPM North America Corporation, Negri Bossi S.p.A., Borch Machinery Co., Ltd., Shuangsheng Injection Molding Machine. |