Point-of-Sale (POS) Market Key Insights:

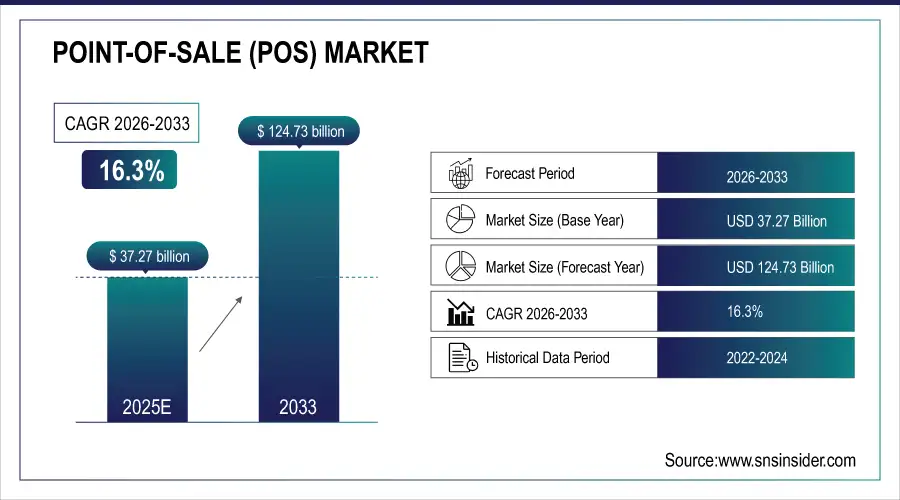

The Point-of-Sale (POS) Market was valued at USD 37.27 billion in 2025E and is expected to reach USD 124.73 billion by 2033, growing at a CAGR of 16.3% from 2026-2033.

The Point-of-Sale (POS) market growth is driven by the increasing adoption of digital payment solutions, rising demand for contactless and mobile payment technologies, and the shift toward cloud-based and integrated POS systems. Additionally, growing e-commerce penetration, the need for enhanced customer experience, and advanced analytics for inventory and sales management are fueling market expansion, enabling businesses across retail, hospitality, and BFSI sectors to streamline operations and improve efficiency.

Point-of-Sale (POS) Market Size and Forecast

-

Market Size in 2025E: USD 37.27 Billion

-

Market Size by 2033: USD 124.73 Billion

-

CAGR: 16.3% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Point-of-Sale (POS) Market - Request Sample Report

Point-of-Sale (POS) Market Trends

-

Rising demand for seamless and efficient retail transactions is driving the point-of-sale (POS) market.

-

Growing adoption of cloud-based and mobile POS solutions is boosting market growth.

-

Expansion of e-commerce, omnichannel retail, and contactless payment systems is fueling demand.

-

Advancements in AI, analytics, and integrated inventory management are enhancing operational efficiency.

-

Increasing focus on improving customer experience and personalized services is shaping adoption trends.

-

Stringent data security and compliance requirements are influencing POS technology development.

-

Collaborations between software providers, hardware manufacturers, and financial institutions are accelerating innovation and market penetration.

Point-of-Sale (POS) Market Growth Drivers:

-

Growing Demand for Cloud-Based and Mobile POS Solutions Enhances Market Growth

Growing demand for cloud-based and mobile POS solutions is therefore significantly transforming the Point-of-Sale market. Business needs to adapt to the changing tastes of customers who now insist on seamless and flexible payment options. These systems automatically empower retailers with the ability to track data anywhere they are, hence productive inventory management, customer relationship management, and analytics. The ease of access and flexibility with which businesses can work lead to increased efficiency, thus improved customer satisfaction. Last but not least, mobile POS solutions enable retailers to reach their customers in any environment, such as in events outdoors or in pop-up shops.

-

Technological Advancements Driving Innovations in POS Systems

Technology is the primary driver of major innovation in the Point-of-Sale market using more complex and efficient systems. It is expected that with the aspirations of retailers to create and enhance their customer's experience while streamlining different operations, they would invest in the most innovative frontier technologies such as artificial intelligence, machine learning, and advanced data analytics. These technologies better POS systems by incorporating functionalities for such features as real-time inventory management and customized marketing. Predictive analytics can also allow for company decision-making that is more effective and based on the knowledge of customer behavior. Security technology improves as encryption and biometric authentication are incorporated about higher concerns about the security of data and increasing fraud cases.

Point-of-Sale (POS) Market Restraints:

-

Data Security Concerns Hamper the Growth in the POS Market

Although there has been an array of enhancements in the Point-of-Sale market, data security issues are the most significant restraint affecting its growth. More and more transactions are shifting online, and with the increasing data breach occurrences, people are cautious about letting their personal and financial information out on the web. Alarms have been sounded through high-profile breaches regarding the vulnerabilities of various payment processing systems, and hence the consumers lack trust. This uncertainty leads to lesser adoption rates of new POS technology as a result of protecting sensitive customer information.

Point-of-Sale (POS) Market Opportunities:

-

Integration of AI and Machine Learning in POS Systems Creates New Opportunities in the Point-of-Sale Market

Huge growth opportunities for Point of Sale abound as the integration of AI and machine learning into the POS systems will enhance the performance efficiency to fulfill customers' needs through richer analytics insights from the AI-driven analytics-the points regarding consumer behavior, purchasing patterns, and market trends that these insights hold can create customized offerings, optimal pricing structures, and personalized marketing campaigns on behalf of the retailers. In addition, AI-based POS systems can automatically execute mundane tasks, such as tracking sales and managing inventory, freeing more time for higher-level strategic initiatives among employees.

Point-of-Sale (POS) Market Challenge:

-

Adapting to Rapid Technological Changes in the POS Market Poses a Significant Challenge in Point-of-Sale Market

Adapting to the fast-changing times in technology is one of the significant challenges that stakeholders in the Point-of-Sale market face. Since technology evolves so fast, a business enterprise must dedicate considerable time and money to upgrading its Point-of-Sale systems to be competent in the marketplace. This is relatively challenging to small and medium-sized enterprises that have little resources to engage in availing new technologies or training employees on them. The constant need to upgrade can destabilize and make systems inefficient, which can have a cumulative impact on the overall performance of the business. In addition, as the technology is advanced, employees must continue training in the usage of the latest features of the POS and keep their knowledge continually updated regarding the newer technologies; this can result in heavy loads on resources and time.

Point-of-Sale Market Segments Overview

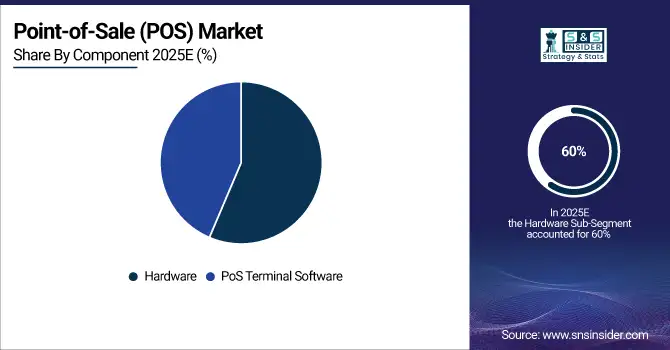

By Component, Hardware dominated the Point-of-Sale Market in 2025

In 2025, the hardware segment dominated the point-of-sale market, with an estimated market share of approximately 60%. This is largely because in-shop POS terminals with the ability to execute actual face-to-face transactions are highly demanded within the retail and hospitality industries. The hardware products, such as card readers, cash drawers, barcode scanners, and receipt printers, have been the most sought after solutions for companies that would want to offer timely and safe payments. Some of the specific examples of this trend include the equipping of most retailers with contactless payment terminals that are becoming highly popular lately through customers demanding contactless transactions.

By Type, Fixed POS led the Point-of-Sale Market in 2025

Fixed POS dominated the Point-of-Sale market in 2025, with an estimated market share of around 65%. This is because the established market consumes traditional point-of-sale systems in retail environments-these include grocery stores, restaurants, and large retail chains-all of which require reliability and functionality. Fixed POS systems do usually provide strong features, including sophisticated inventory management functionality, detailed sales reporting, and customer relationship management features, which most businesses processing an enormous volume of transactions require. For example, market leaders NCR and Toshiba are still leading in providing full fixed POS solutions tailored for various industries.

By Deployment Mode, Cloud-based deployment mode dominated the Point-of-Sale Market in 2025

Cloud-based deployment mode dominated the Point-of-Sale market in 2025, holding an estimated market share of more than 70%. This is due to the increased use of cloud-based solutions by retail and service providers in search of greater flexibility, scalability, and cost-effectiveness in their operations. Businesses that implement cloud-based POS systems can access real-time data from anywhere and update such applications to enhance inventory management, sales tracking, and customer relationship management. Examples include Shopify and Square, which are cloud POS providers that were able to be very successful because they are easy to use and accessed by small and medium-sized businesses to manage both transactions and analytics.

By Organization Size, SMEs led the Point-of-Sale Market in 2025

In 2025, the small and medium enterprise (SME) segment dominated the Point-of-Sale market, with an estimated market share of about 60%. With a significant rise in SMEs taking up POS systems for improved efficiency and customer experience, this share is held to be huge. In this dynamic retail environment, small businesses will need to compete effectively; towards this goal, they are starting to look for low-cost, scalable POS solutions that offer all the functionality they need without the layers of complexity and cost traditionally inherent in systems for large enterprises.

By End-user, Retail segment dominated the Point-of-Sale Market in 2025

The retail segment dominated the Point-of-Sale market in 2025 with an estimated market share of around 50%. This leading presence was heavily influenced by the underlying factor of increasing adoption rates among retailers who embrace advanced POS systems to improve customer experience levels and workflow. Retail businesses, from small boutiques to huge department stores, utilize POS systems not only to process transactions but also to manage inventory, loyalty schemes, and sales analytics. For instance, giant retailers such as Walmart and Target have developed highly advanced POS solutions that are synchronized with their e-commerce solutions, thus offering seamless omnichannel shopping experiences to consumers.

Point-of-Sale Market Regional Analysis

North America Point-of-Sale (POS) Market Insights

In 2025, the North American region dominated the Point-of-Sale market with an estimated market share of around 40%. This is because of the sort of high, technological basis of infrastructure set up by the electronic payment solutions of the businesses in the region. Major POS providers names include Square, Clover, and Verifone-have become significant drivers of growth in the market, largely through innovative solutions tailored to specific industries, hospitality, and health, among others.

Need any customization research on Point-of-Sale (POS) Market - Enquiry Now

Asia Pacific Point-of-Sale (POS) Market Insights

Additionally, the fastest growth was led by the Asia-Pacific region, increasing by about 15% CAGR. This is mainly due to the fast-growing adoption of mobile payment solutions as well as smartphone penetration across China, India, and Japan. Increasing retail in the region leads to growing demand for efficient, flexible, and capable POS systems to support large volumes of transactions. For instance, the easy mobile POS solutions provided by companies like Paytm in India to enable small businesses to accept digital payments seamlessly can be used as a good example.

Europe Point-of-Sale (POS) Market Insights

Europe in the Point-of-Sale (POS) Market is characterized by strong adoption of digital payment infrastructure, expansion of contactless transactions, and increasing migration from legacy systems to cloud-based POS. Retail, hospitality, and quick-service restaurants are rapidly upgrading to integrated POS platforms for better inventory, billing, and customer engagement. Stringent data security regulations and growing preference for omnichannel commerce further accelerate POS modernization across both SMEs and large enterprises in the region.

Middle East & Africa and Latin America Point-of-Sale (POS) Market Insights

Middle East & Africa and Latin America are experiencing steady POS market expansion driven by rising digital payment adoption, growth of SMEs, and increasing demand for mobile and cloud-based POS solutions. Retail, hospitality, and foodservice sectors are modernizing their payment infrastructure to support faster transactions and better customer engagement. Government-led cashless initiatives, improving internet connectivity, and growing fintech activity further accelerate POS penetration across both regions.

Point-of-Sale (POS) Market Competitive Landscape:

NCR Corporation

NCR Corporation is a global technology company providing hardware, software, and services for banking, retail, hospitality, and self-service sectors. It offers point-of-sale (POS) systems, ATMs, self-checkout solutions, and software platforms that streamline operations, enhance security, and improve customer experiences. NCR focuses on combining hardware innovation with robust software, maintenance, and support services to enable scalable, secure, and reliable transaction processing for enterprises worldwide.

-

NCR announced a deal with Ennoconn Corporation to outsource POS and self-checkout hardware design and manufacturing, while retaining software and maintenance services. The transition is effective 2025.

Square, Inc.

Square, Inc., now part of Block, Inc., develops financial technology and POS solutions for merchants, enabling payment processing, financial services, and business management tools. Square’s hardware and software integrate seamlessly to provide secure, easy-to-use payment solutions for small and medium enterprises. Its innovations include mobile POS devices, contactless payments, and robust encryption, helping businesses streamline transactions, enhance security, and improve customer experiences across digital and physical storefronts.

-

Square Handheld launched: a pocketable, durable POS device supporting tap-to-pay, card payments, and built-in encryption for secure transactions.

-

Square emphasized end-to-end encryption and cryptographic controls in its POS systems, ensuring no raw card data is stored on client devices.

Shopify POS (by Shopify, Inc.)

Shopify POS is part of Shopify, Inc.’s commerce platform, enabling merchants to manage sales, inventory, and customer data both online and in physical stores. The system emphasizes secure, integrated payment processing, with support for multi-channel sales, mobile payments, and inventory management. Shopify continuously improves security through updates, best-practice guidance, and compliance with global standards, helping retailers maintain safe, efficient operations while providing seamless customer experiences across digital and physical channels.

-

Shopify published POS security best-practices, recommending software updates, encryption, PCI-DSS compliance, two-factor authentication, and network security to ensure secure deployment.

Clover Network, Inc.

Clover Network, Inc. develops cloud-connected POS hardware and software solutions for merchants, offering flexibility, security, and ease of use. Its product portfolio includes POS terminals, mobile devices, and developer APIs to integrate payments, reporting, and business tools. Clover emphasizes continuous security updates, operational reliability, and adaptability to diverse merchant environments, supporting efficient payment processing, compliance, and business insights for small-to-medium enterprises worldwide.

-

Clover published updates to its developer platform and Clover Go devices, fixing bugs and improving global payment-processing endpoints.

Key Players

-

Clover Network, Inc. (Clover Station, Clover Mini, Clover Flex)

-

H&L POS (H&L POS, H&L Online Ordering, H&L Reporting)

-

IdealPOS (IdealPOS, IdealPOS Cloud, IdealPOS Mobile)

-

Lightspeed (Lightspeed Retail, Lightspeed Restaurant, Lightspeed eCommerce)

-

NCR Corporation (NCR Silver, NCR FastPay, NCR Counterpoint)

-

Oracle Micros (Oracle Micros Simphony, Oracle Micros OPERA, Oracle Micros Cloud Services)

-

Revel Systems (Revel POS, Revel Kitchen Display System, Revel Loyalty)

-

Shopify (Shopify POS, Shopify Retail Kit, Shopify Payments)

-

Square Inc. (Square POS, Square Register, Square Reader)

-

SwiftPOS (SwiftPOS Front of House, SwiftPOS Back of House, SwiftPOS Loyalty)

-

Toast (Toast POS, Toast Go, Toast Kitchen Display System)

-

TouchBistro (TouchBistro POS, TouchBistro Reservations, TouchBistro Payments)

-

Vend (Vend POS, Vend Inventory Management, Vend eCommerce)

-

Verifone (Verifone VX 820, Verifone P400, Verifone Engage Series)

-

Windcave (Windcave Payment Gateway, Windcave SmartPay, Windcave In-Store Solutions)

-

Zettle (Zettle Reader, Zettle Go, Zettle for eCommerce)

-

Squirrel (Squirrel POS, Squirrel Mobile, Squirrel Loyalty)

-

PayPal Zettle (Zettle Reader, Zettle App, Zettle Online Payment)

-

Moka (Moka POS, Moka Inventory Management, Moka Analytics)

-

Epicor (Epicor ERP, Epicor Retail, Epicor Point of Sale)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | US$ 29.0 Billion |

| Market Size by 2033 | US$ 112.6 Billion |

| CAGR | CAGR of 16.3% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Hardware, PoS Terminal Software) •By Type (Fixed PoS, Mobile PoS, Others) •By Deployment Mode (Cloud, On-premise) •By Organization Size (Large Enterprise, Small and Medium Enterprise (SME)) •By End-user (Restaurant, Hospitality, Healthcare, Retail, Warehouse, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Clover Network, Inc., H&L POS, IdealPOS, Lightspeed, NCR Corporation, Oracle Micros, Revel Systems, SwiftPOS, Square Inc., TouchBistro and other key players |