Polycarbonate Diols Market Key Insights:

Get More Information on Polycarbonate Diols Market - Request Sample Report

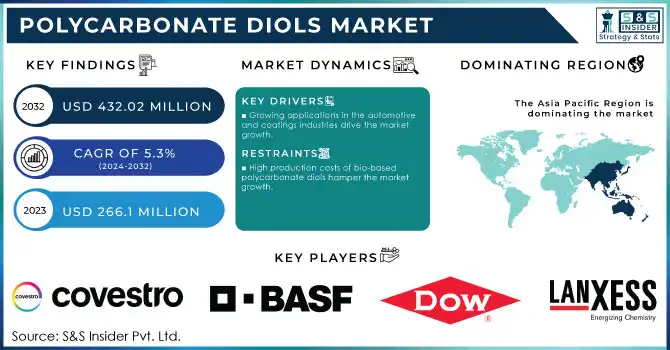

The Polycarbonate Diols Market Size was valued at USD 266.1 Million in 2023 & expected to reach USD 432.02 Million by 2032 and grow at a CAGR of 5.3% over the forecast period of 2024-2032.

Increasing demand for ecological materials is one of the prominent factors driving growth in the Polycarbonate Diols (PCD) market. With industries around the world feeling the heat to become more sustainable, they are beginning to see a demand for less environmentally harmful materials. Polycarbonate diols are widely utilized in the synthesis of bio-based polyurethanes and offer a biodegradable substitute for petroleum-based resources. The need for sustainability is majorly driven by stricter environmental regulations as well as growing consumer awareness.

The EPA has been increasingly focused on reducing toxic chemicals and promoting greener alternatives. As of 2022, the EPA is expanding its Safer Choice Program, which helps companies select products that are safer for human health and the environment. Bio-based and eco-friendly chemicals, including polycarbonate diols, are increasingly a part of this initiative, fostering market demand.

The development of technology and new product developments are also contributing to the growth of the Polycarbonate Diols (PCD) market. There have recently been considerable advancements in the production and characteristics of polycarbonate diols that are encouraging their broader incorporation into the industry. Such innovations also improve the functional properties of PCDs including higher molecular weight, greater durability, thermal and chemical resistance, and/or other attributes for use in more aggressive applications.

The U.S. government set a target for automakers to achieve an average fuel economy of over 50 miles per gallon by 2026, further driving demand for high-performance, lightweight materials like polycarbonate diols.

Polycarbonate Diols Market Dynamics

Drivers

-

Growing applications in the automotive and coatings industries drive the market growth.

PCD (Polycarbonate diols) are used in increasing applications in automotive and coatings. The demand for polycarbonate diols is growing in the automotive sector, which is primarily due to their superior strength, elasticity, and heat and chemical resistance properties and their use in lightweight parts, coatings, and adhesives. These characteristics render PCDs perfect as automotive coatings that defend against wear, corrosion, and environmental damage. The demand for polycarbonate diols is increasing due to the necessity to reduce the weight of the vehicle and achieve increased fuel economy as the automotive industry strives to meet stringent fuel efficiency standards and CO2 targets. Additionally, coatings, are preferred to prolong the performance of paints and coatings, which are required for protecting automotive parts in all weather and chemical conditions. On top of that, as the whole coatings industry is moving towards more sustainable and eco-friendly solutions, so are polycarbonate diols and the bio-based ones that fit even better. Cumulatively, these factors have led to larger application areas across automotive and coatings sectors, along with higher regulatory pressure subsequently seeking lower emissions and a tide of high-performance materials for addressing these, in driving the uptake of polycarbonate diols across industries.

The Safer Choice Program by the EPA, which identifies and promotes safer chemical alternatives, has certified thousands of products that meet environmental and health safety criteria. As of 2022, the Safer Choice program recognized over 2,000 chemical products, including eco-friendly polycarbonate diols, for use in paints and coatings.

Restraint

-

High production costs of bio-based polycarbonate diols hamper the market growth.

One of the major restraints to the growth of the bio-based polycarbonate diols market is the high production costs. It obtained from renewable feedstock like plant oils or carbon dioxide has a lower carbon footprint than similar products made from petrochemical resources. On the other hand, their production involves advanced, developmental-stage technologies and processes that require higher capital investment. However, methods to transform CO2 into polycarbonate diols or to extract bio-based oils can be energy-intensive and complicated, resulting in higher production expenses. Due to these elevated costs, bio-based PCDs are often more expensive than their traditional, petroleum-based equivalents leading to limited market uptake, specifically in cost-sensitive industries such as automotive manufacturing or construction.

Polycarbonate Diols Market Segmentation Analysis

By Molecular Weight

1000 g/mol to below 2,000 g/mol held a dominant revenue share of 46%in 2023. It provides the optimum balance between physical and mechanical properties over a wide range of applications. Polycarbonate diols within this molecular weight range provide a good balance of flexibility, strength, and toughness that may be suitable for a range of industries, including automotive, coatings, and adhesives. This segment offers suitable viscosity and molecular structure essential for high-performance materials resisting extreme environmental conditions that are required in automotive coatings and industrial applications. Furthermore, potassium carbonate diols on this molecular weight have better processability and be applied in formulations with both high resilience and more healthy value. Their ability to provide this performance-practicality balance has led manufacturers to use them to take advantage of their improved material properties at a competitive cost. Strong demand for polycarbonate diols in this molecular weight range is anticipated to continue as industries strive to improve sustainability and performance, maintaining its strong market share.

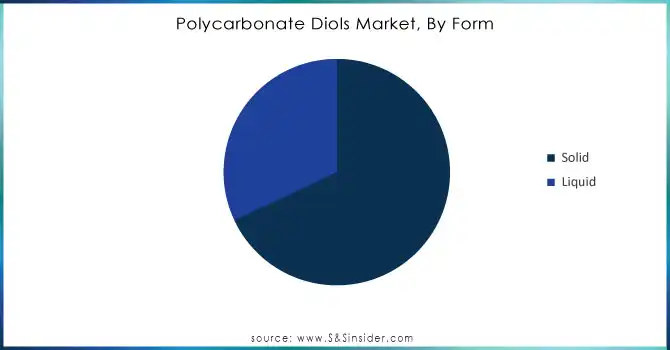

By Form

The solid form segment held the largest market share around 48% in 2023. The polycarbonate diols solid form experiences the highest market share owing to the ultimate marking stability, relatively easier handling, and robustness across the diverse applications in end-use industries. Unlike traditionally lower-melting diols that may remain in the liquid phase, the delivery of solid polycarbonate diols significantly facilitates storage, shipping, and processing; therefore, they are especially appealing for scale-up. Solid polycarbonate diols provide superior product performance with consistent quality that is highly valued when precision and performance directly relate to fighting the wear and tear of the automotive, tank, and other coatings industries.

Need Any Customization Research On Polycarbonate Diols Market - Inquiry Now

By Application

Synthetic leather held the largest market share around 28% in 2023. It is used in numerous industries, such as automotive, fashion, furniture, and footwear. Polycarbonate diols impart greater flexibility, wear resistance, and durability to the synthetic leather synthesized from these diols. Increasing demand for synthetic leather to meet the demand for eco-friendly alternatives to traditional leather, as consumption of synthetic leather is contributed by synthetics tend to be made from sustainable, less resource-depleted material. Polyurethane composites can also enhance the properties of synthetic leather, e.g., they have improved cracking resistance, improved texture, and extended service lifetime, which attracted their application to high-value and long-life goods.

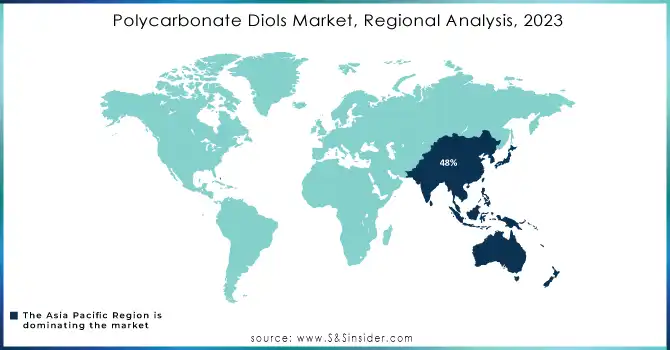

Polycarbonate Diols Market Regional Overvioewo

Asia Pacific held the largest market share around 48% in 2023. It can be attributed to rapid industrialization, an increase in automotive and construction materials requirements, and strong manufacturing capabilities. High automotive production along with construction and consumer goods in the APAC regions will escalate the demand for polycarbonate diols as these factors are prevailing in countries like China, India, Japan, and South Korea. Through the extensive manufacturing infrastructure as well as cost-competitive manufacturing processes the region allows the location of polycarbonate diol production attractive. Moreover, the automotive and construction industries are also experiencing a trend of using sustainable and eco-friendly materials across Asia-Pacific, which is another factor increasing the demand for bio-based polycarbonate diols. The region also has a large consumer base, increased urbanization, and increasing awareness related to environmental issues, which drive the polycarbonate diol-based products demand including synthetic leather, coatings, and adhesives. In addition, government regulations focusing on sustainability and green chemistry, along with the presence of significant global and regional manufacturers, establish a diversified polycarbonate diols market in the APAC region. Thus, Asia-Pacific will continue to lead the global polycarbonate diols market.

Key Players in Polycarbonate Diols Market

-

Covestro AG (Cardura, Desmodur)

-

BASF SE (Desmodur N, Bayhydur)

-

DSM Engineering Plastics (Arnitel, ForTii)

-

Dow Chemical Company (Voranol, VORANOL 10500)

-

Lanxess AG (Cardura, Baytec)

-

Shell Chemicals (Shellsol, Caradol)

-

Mitsubishi Chemical Corporation (Durabio, Urethane Polycarbonate)

-

Evonik Industries AG (Dynacoll, Vestoplast)

-

Huntsman International LLC (Vitamins, Polyketones)

-

LG Chem Ltd. (LG Chem Urethane, Polycarbonate Polyols)

-

SABIC (Ultem, Lexan)

-

Wanhua Chemical Group (Polycarbonate Diols, Polyether Polyols)

-

Kraton Polymers (Kraton G, Kraton D)

-

Mitsui Chemicals (Urethane Polymers, Milastomer)

-

Hexion Inc. (Polyurethane, Aromatic Isocyanates)

-

Maire Tecnimont Group (Tecnoelastomeri, Poliuretani)

-

Sika AG (Sikaflex, Sikasil)

-

Tosoh Corporation (Toresin, Polyurethane-based Products)

-

Kraton Polymers (Kraton G, Kraton D)

-

Toyobo Co., Ltd. (Toyoglide, Toyobo Polycarbonate)

Recent Developments:

-

In 2023, Covestro AG expanded its portfolio of sustainable materials by launching a new line of bio-based polycarbonate diols for use in automotive coatings and adhesives. This launch is part of the company's strategy to increase the availability of high-performance, eco-friendly solutions.

-

In 2022, BASF SE introduced a new generation of polycarbonate diols made from renewable resources. These bio-based diols are designed to offer the same high performance as their traditional counterparts while reducing carbon emissions associated with production.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 266.1 Million |

| Market Size by 2032 | US$ 432.02 Million |

| CAGR | CAGR of5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Molecular Weight (Below 1,000 g/mol, 1000 g/mol - below 2,000 g/mol, 2000 g/mol and above) • By Form (Solid, Liquid) • By Application (Synthetic leather, Paints & Coatings, Adhesives & Sealants, Elastomers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Covestro AG, BASF SE, DSM Engineering Plastics, Dow Chemical Company, Lanxess AG, Shell Chemicals, Mitsubishi Chemical Corporation, Evonik Industries AG, Huntsman International LLC, LG Chem Ltd., SABIC, Wanhua Chemical Group, Kraton Polymers, Mitsui Chemicals, Hexion Inc., Maire Tecnimont Group, Sika AG, Tosoh Corporation, Toyobo Co., Ltd. and Others |

| Key Drivers | • Growing applications in the automotive and coatings industries drive the market growth. |

| Restraints | • High production costs of bio-based polycarbonate diols hamper the market growth. |