Synthetic Leather Market Size & Overview:

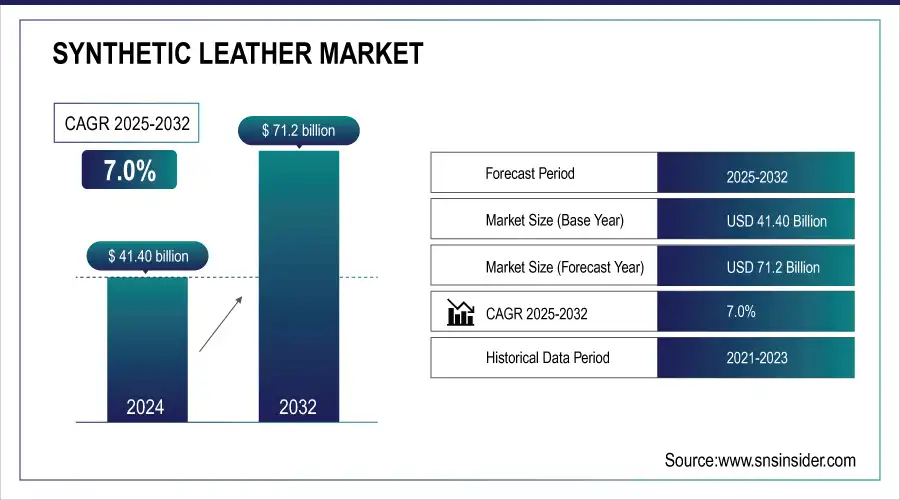

Synthetic Leather Market Size was valued at USD 41.40 billion in 2024, and is expected to reach USD 71.2 billion by 2032, at a CAGR of 7.0% from 2025-2032.

Get more information on Synthetic Leather Market - Request Sample Report

The changing consumer preferences, advancement in the technological process of production, and increasing awareness of animal welfare have driven the growth in the synthetic leather market. Due to its cost-effectiveness and ethical benefits over natural leather, industries like automotive and furniture are vastly adopting synthetic leather. Principal automobile companies like Tesla have started using synthetic leather in the interior of cars and began marketing them as eco-friendly, cruelty-free products, further fuelling demand for the same.

Technological advances have hugely upgraded the quality and diversity of synthetic leather. The development in the field of polymer science has led to the production of materials much like natural leather, with added advantages such as durability, flexibility, and easy maintenance. The new developments in bio-based and biodegradable synthetic leathers—for example, cactus leather, developed by firms like Desserto—are proof that the market is becoming slowly oriented toward sustainability through the elimination of dependence upon sources of petrochemicals and containment of other associated environmental problems. For instance, BASF brings a quantum leap in sustainable synthetic leather with Haptex 4.0. Next-generation PU solution for fully recyclable synthetic leather—due to the new formulation and recycling process, no separating layer is required; hence, it co-recycles the material together with polyethylene terephthalate fabric.

Market Size and Forecast:

-

Market Size in 2024 USD 41.40 Billion

-

Market Size by 2032 USD 71.2 Billion

-

CAGR of 7% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Key Synthetic Leather Market Trends:

• Rising consumer preference for eco-friendly and ethically sourced footwear drives synthetic leather adoption.

• Major footwear brands, like Nike and Adidas, are incorporating recycled synthetic leather in popular product lines.

• Synthetic leather usage is increasing in luxury and electric vehicle interiors for sustainable, premium aesthetics.

• The material’s versatility in textures, colors, and finishes enhances design flexibility for fashion and automotive industries.

• Cost-effectiveness compared to genuine leather supports widespread adoption across high-volume and luxury product segments.

Synthetic Leather Market Growth Drivers:

-

Growing Demand from the Footwear Industry

Growth in demand from the footwear industry promotes the synthetic leather market. With consumers becoming more conscious and concerned about using hides, it presents an attractive substitute for real leather. Due to changing consumer expectations, high-volume leather consumers, such as the footwear industry, move towards synthetic materials. A shift in brands to eco-friendly options and ethical sourcing has resulted in increased use of synthetic leather in almost all kinds of footwear products—from casual to high-end designer shoes. For instance, Nike and Adidas are top global brands that have promised to introduce synthetic leather in their respective lines of shoes. For example, there are lines by Nike known as Air Max and Flyknit Collections, which are made from recycled synthetic material since it best helps to serve the goal of reducing the company's environmental footprint. Adidas has also followed through on the wave, using sustainable synthetic leather in their ever-famous Stan Smith line to reach and appeal to the modern consumer looking for style but with an environmental spin.

-

Rising demand for luxury cars and electric vehicles

The demand for synthetic leather, driven by luxury cars and EV applications, has been high. The change in the automobile industry has also forced manufacturers to use synthetic leather in vehicle interiors for both aesthetic and functional purposes. The main reason for its growing application is the potential of delivering premium looks and feels at much more sustainable levels than traditional animal hides. Synthetic leather helps these very brands—Mercedes-Benz and BMW—answer a rapidly rising consumer demand for high-quality, green materials without giving an inch on luxury. More specifically, this trend is driven by electric vehicles. As the EV market grows, auto manufacturers working on a more sustainable and eco-friendlier brand image also grow, which means synthetic leather—in its most eco-friendly forms, way more than conventional leather—would not sit too badly in such an ethos. Take the case of Tesla, one of the pioneering electric vehicle manufacturers: its cars come lined with synthetic leather as a means of appealing to customers who are sensitive toward the environment. Tesla's use of synthetic materials in its Model S and Model X serves not just the sustainability agenda but the demand for high-quality, modern interior finishes. Synthetic leather has a few practical advantages that very much complement the kind of technological innovation found in luxury and electric vehicles.

Synthetic Leather Market Restraints:

-

Toxicity of PU and PVC to humans hamper the demand for synthetic leather in the market

The toxicity associated with these synthetic leathers, such as polyurethane and polyvinyl chloride, during the manufacturing process is a major cause of concern. This basically limits the growth of the synthetic leather market to a great extent, as all these materials have either PU or PVC and are likely to turn hazardous to health by emitting dangerous chemicals while being produced or decomposed. For instance, in the production process, PVC could release dioxins and phthalates, which are gasses and known to be causative agents of respiratory problems and other diseases. Though less toxic than PVC, PU can emit isocyanates, which can be dangerous in a production line. Such risks raise a red flag with consumers and regulatory agencies, driving the move toward safer substitutions. A greater number of manufacturers have already started embracing eco-friendly and far less harmful materials for bio-based or plant-based synthetic leather manufacturing to lessen serious health and safety issues involved and try to fit into these tightening restrictions.

Synthetic Leather Market Segment Analysis:

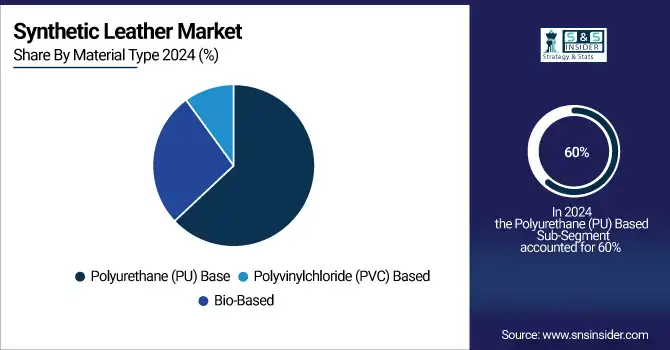

By Material Type

In 2024, polyurethane (PU) based dominated the synthetic leather market, holding a revenue share of 60%. This would show its wide acceptance across multiple industries and growing preference over other alternatives like PVC and bio-based—often having limited application in nature or proving more costly to produce. The use of PU-based synthetic leather in consumer goods is widespread, and it offers the required mix of aesthetics and functionality that is needed, fueling its leading position in the market. This is attributed to the high market share compared to other available materials that exude inferior qualities to PU-based synthetic leather. This segment dominancy can be attributed to the flexibility, durability, and versatility that characterize PU and make it an interesting solution for a variety of industries, spanning from automotive interiors and fashion to upholstery. A high-quality finish, just like that of natural leather, is the reason for the high demand for PU-based synthetic leather. For instance, the interior of leading automobile companies' cars, including Mercedes-Benz and BMW, utilize PU-based synthetic leather to give that luxury feel while upholding their commitment to being 'green'. The ability of this material to deliver a high-end appearance without the high cost associated with natural leather further drives its market share.

By Application

In 2024, synthetic leather dominated its market at 40%. It is this huge percentage that proves the bias in the automotive market towards synthetic leather; such a bias is based on aesthetic appeal, low cost of use, and trends in sustainability. Given the persistence of the automakers in innovation and eco-friendliness in their material choice, synthetic leather's dominance in car interiors will not be threatened anytime soon. This represents the largest share, as synthetic leather finds growing applications in the automotive sector to cater to consumer demand for luxurious and eco-friendly car cabins. Synthetic leather is chosen for the automotive industry due to its durability and low-maintenance properties with a corresponding rich look to be used in interior components of a vehicle such as seats and dashboards. For example, leading automobile companies such as Tesla and BMW have applied synthetic leather on a large scale in vehicle interior to provide a touch of luxury while achieving sustainable objectives. Tesla's use of synthetic leather on some of its models, for example, Model S and Model X, paints the dominance of this segment since it gives the feel of a luxurious car with a lesser carbon footprint by being aligned with the commitment of the company towards causing lesser environmental impact.

By End-Use Industry

The automotive sector dominated the synthetic leather market with a 45% share of the revenues generated in 2024, which is an indication that the sector has huge investments in synthetic leather to enhance interior parts of vehicles to meet consumer preference and regulatory standards on sustainability. It may prevail as long as the automotive sector keeps heading in the general direction of eco-friendliness and high-quality raw materials. Synthetic leather is much beloved in this industry because it can offer a high-quality, durable, and cost-effective alternative to natural leather inside a vehicle. A great deal of car owners goes for synthetic leather because it ensures a good touch and feel while maintaining an attractive option and environmental benefits. For instance, top car brands are already incorporating heavy usage of synthetic leather in automobile interiors. In their Model S and Model X, Tesla uses synthetic leather seats and trims, hence ensuring that the vehicle is green while feeling extremely luxurious. BMW also features the use of synthetic leather in its I Series in order to give an environmentally friendly appeal to the customers without actually giving up on the premium feel inside the car.

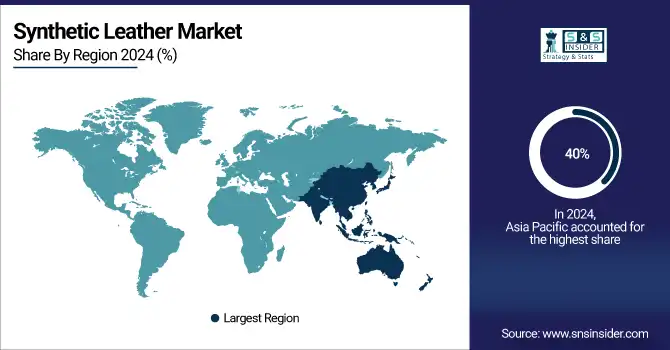

Synthetic Leather Market Regional Analysis:

Asia Pacific Synthetic Leather Market Insights

In 2024, the Asia-Pacific region dominated the synthetic leather market by capturing about a 40% share. This is in line with the robust manufacturing base, rise in consumer demand, and key players existing within this geography. The Asia-Pacific region had already initiated an infrastructure for synthetic leather making through China, India, and South Korea. China is the largest producer of synthetic leather in the world, hence contributing majorly to its regional domination of the market. The easy availability of raw materials and lower production costs, along with continuous improvements in manufacturing technologies, help the region strengthen its position. Further, the rising demand for synthetic leather in various end-use industries, such as automotive, fashion and apparel, and footwear, within the Asia-Pacific region, is also boosting the market. The growth in the automotive industry in both China and India is fast; consumers prefer more cars with premium interiors. Brands like Hyundai and Tata Motors use a considerable quantity of synthetic leather in the interior parts of the vehicle. Further, it is also observed that in countries like China and South Korea, there are growing industries related to synthetic leather in the sectors of fashion and footwear. Consumers there are fast moving towards adopting synthetic leather products because of factors such as low price and sustainability.

Get Customized Report as per your Business Requirement - Request For Customized Report

North America Synthetic Leather Market Insights

Moreover, the fastest-growing region in the synthetic leather market in 2024 is North America with a revenue share of 25%, which has a perceptible growing market share but is not as vast as that of the leading Asia-Pacific region. A rising awareness among consumers about sustainability, technological advancement in manufacturing, and increasing demand from the automotive and fashion industries have been driving North America's synthetic leather market. Synthetic leather is being used by automakers to satiate demands for greener, higher-quality vehicle interiors; the leaders include Tesla, which was the first to offer all-vegetarian car interiors, and General Motors. Fashion brands, such as Michael Kors and Kate Spade, are quickly following in their footsteps by rapid adoption of synthetic leather to meet the growing demand for ethical, sustainable products.

Europe Synthetic Leather Market Insights

The European synthetic leather market is growing due to rising demand for eco-friendly footwear, luxury vehicles, and electric cars. Stringent environmental regulations and consumer preference for sustainable materials drive adoption across fashion and automotive sectors, while innovations in textures, colors, and durability enhance market appeal and product versatility.

Latin America (LATAM) and Middle East & Africa (MEA) Synthetic Leather Market Insights

In LATAM and MEA, synthetic leather adoption is fueled by increasing footwear production, growing automotive industries, and a shift toward sustainable alternatives. Rising consumer awareness about ethical sourcing, combined with investments in electric vehicles and luxury interiors, is driving demand for cost-effective, versatile, and environmentally friendly synthetic materials.

Competitive Landscape for Synthetic Leather Market:

BASF SE plays a vital role in the synthetic leather market by offering advanced polymers, coatings, and performance chemicals that enhance durability, flexibility, and sustainability. Its innovative solutions help manufacturers develop eco-friendly, high-quality synthetic leather for automotive, footwear, and fashion industries, aligning with global demand for sustainable and versatile materials.

-

July 2024: BASF introduces yet another innovation in sustainable synthetic leather by launching Haptex® 4.0, capable of producing synthetic leather that is 100% recyclable.

General Silicones Co., Ltd specializes in silicone-based materials and solutions, contributing to the synthetic leather market with eco-friendly, durable, and versatile alternatives. The company focuses on innovative silicone leather products that meet growing demand in automotive, fashion, and consumer goods, supporting sustainability while delivering high performance, flexibility, and premium aesthetics.

-

April 2023: General Silicones Co., Ltd. of Taiwan launched the Compo-SiL, a synthetic vegan leather targeting bag, wallet, backpack, and shoe manufacturer.

Synthetic Leather Market Key Players:

Kuraray Co. Ltd.

Teijin Limited,

Filwel Co. Ltd.

Alfatex N.V.

Yantai Wanhua Synthetic Leather Group Co. Ltd.

H.R. Polycoats Pvt. Ltd.

San Fang Chemical Industry Co. Ltd.

Zhejiang Hexin Industry Group Co. Ltd.

Toray Industries, Inc.

Asahi Kasei Corporation

Fujian Polytech Technology Corp.

Shandong Jinfeng Artificial Leather Co. Ltd.

Anhui Anli Material Technology Co. Ltd.

Tapis Corporation

Kolon Industries, Inc.

Nilco Synthetic Leathers Pvt. Ltd.

Marvel Vinyls Limited

Rexine India Limited

| Report Attributes | Details |

| Market Size in 2024 | USD 41.40 Billion |

| Market Size by 2032 | USD 71.2 Billion |

| CAGR | CAGR of 7.0% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Bio-Based, Polyvinylchloride (PVC) Based, Polyurethane (PU) Based) • By Application (Clothing, Bags, Shoes, Purses & Wallets, Accessories, Car Interiors, Belts, Sports Goods, Others) • By End-Use Industry (Fashion & Apparel, Automotive, Textiles, Electronics, Sports Industry, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Kuraray Co. Ltd., Teijin Limited, Mayur Uniquoters Limited, Filwel Co. Ltd., Alfatex N.V., Yantai Wanhua Synthetic Leather Group Co. Ltd., H.R. Polycoats Pvt. Ltd., NAN YA Plastics Corporation, San Fang Chemical Industry Co. Ltd., Zhejiang Hexin Industry Group Co. Ltd., Toray Industries Inc., Asahi Kasei Corporation, Fujian Polytech Technology Corp., Shandong Jinfeng Artificial Leather Co. Ltd., Anhui Anli Material Technology Co. Ltd., Tapis Corporation, Kolon Industries Inc., Nilco Synthetic Leathers Pvt. Ltd., Marvel Vinyls Limited, Rexine India Limited. |