Flexible Foam Market Report Scope & Overview:

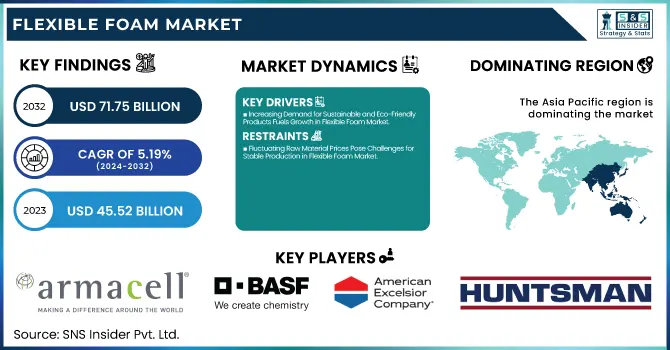

The Flexible Foam Market Size was valued at USD 45.52 Billion in 2023 and is expected to reach USD 71.75 Billion by 2032, growing at a CAGR of 5.19% over the forecast period of 2024-2032.

To Get more information on Flexible Foam Market - Request Free Sample Report

The versatile and lightweight properties of flexible foam materials contribute to their growing adoption in various sectors, as the Flexible Foam Market expands further. In this report, we outline the Regulatory Framework, which includes policies influencing both production and disposal. It also studies consumer behaviour, trends such as sustainability. The supply chain analysis outlines pivotal stages ranging from sourcing to distribution, and the Cost Analysis sheds light on pricing dynamics. Raw material sourcing discusses the implications of models of petrochemical and bio-based materials, while export/import analysis examines the global trade forces at play in shaping market growth.

Flexible Foam Market Dynamics

Drivers

-

Increasing Demand for Sustainable and Eco-Friendly Products Fuels Growth in Flexible Foam Market

Sustainable and eco-friendly products are gaining traction which has initiated itself as a primary driver for Flexible Foam Market. Automotive, construction and furniture are some industries that are making a move towards sustainability with their materials. As a result, flexible foam manufacturers are rising to this demand, creating bio-based and recyclable foam options to meet consumer desires to be greener. This trend is driven not only by regulatory pressure but also by the growing consumer awareness about the environmental footprint of their purchases. Disruptive technologies and the sustainability of the market are being accomplished by combining materials that are not harmful to the environment. Moreover, with rising end-user companies focusing on sustainability goals while reducing their carbon footprints, the demand for flexible foam materials manufactured using sustainable practices is expected to increase, thus contributing to the growth potential of flexible foam market.

Restraints

-

Fluctuating Raw Material Prices Pose Challenges for Stable Production in Flexible Foam Market

The Flexible Foam Market's primary restraint is the price volatility of raw materials, specifically petroleum-based goods that are used to make a wide range of flexible foam products. Prices can fluctuate wildly on such chemicals, like polyurethane and polyethylene, with changing crude oil prices and global supply chain disruptions. These uncertainties can make it challenging for manufacturers to accurately predict production costs, creating price fluctuations that can impact profitability. Furthermore, the scarcity of raw materials in certain areas or the lack of availability of sustainable alternatives only adds to the problem. Raw material price changes may potentially restrict the capacity of the manufacturers to scale the production and attain the market share as they strive to keep the price competitive, subsequently impeding the long-term growth of the market.

Opportunities

-

Rising Demand for Bio-Based and Recyclable Materials Creates Growth Potential in Flexible Foam Market

The increasing demand for bio-based and recyclable materials presents a significant opportunity for growth in the Flexible Foam Market. Due to decreased environmental concerns, industries and consumers alike are searching for alternative materials that lessen environmental impact. Bio-based flexible foams that come from renewable resources like plant-based oils (biomass) present a more sustainable choice compared to their petrochemical-derived counterparts. Some foams are even reusable due to improvements made in recycling technologies, further fostering a circular economy. Manufacturers who are willing to innovate and work with these sustainable alternatives will find themselves in a good position to meet the growing demand for environmentally friendly materials. Smart flexible polymer polyurethanes that are bio-based and/or recyclable have the potential to grow tremendously with the shift towards sustainability, opening doors for further innovation and the exploration of new market types.

Challenge

-

Intense Competition and Market Saturation Hinder Profit Margins in Flexible Foam Market

One of the major challenges faced by flexible foam market participants is rising competition and market saturation as flexible foam market players work towards developing niche markets. The competition is intense, with many experienced players as well as new players battling for market share, causing price wars and lower profit margins. As more and more companies provide similar products, differentiation becomes more challenging and competitive pressures can eat into profits. Moreover, competition is heating up from low-cost manufacturers, especially in developing economies. Businesses that do not start innovating or streamline their way of producing goods will find it increasingly difficult to compete, causing a potential revenue decrease in the long term. Consequently, companies need to improve product quality, minimize operational costs, and offer differentiating features while adhering to value-added features.

Flexible Foam Market Segmental Analysis

By Type

Polyurethane (PU) segment dominated the flexible foam market and accounted for the largest share of 45.2% in Flexible Foam Market in 2023. This dominance can be attributed to the excellent versatility, durability, and comfort-enhancing properties of PU, which have led to its use in various applications including furniture, bedding, automotive, and packaging. PU foams provide excellent cushioning, insulation, and resilience that make them the most important material in industries demanding high-performance and lightweight solutions. According to the American Chemistry Council (ACC) and the European Association for Flexible Polyurethane Foams (EUROPUR), PU foams are still critical to fuelling innovations in consumer and industrial products. Moreover, the surging consumer inclination towards comfort and durability resulting in a rise in the demand for products including cushions, mattresses, and automotive seat padding continues to strengthen the appetite for polyurethane-based foams in the long run.

By Application

The Furniture and bedding segment dominated the flexible foam market and held the largest share of around 31.2% in 2023. The growth is primarily driven by the increasing demand for comfortable and supportive furniture, especially in the mattress and home furnishings market. Though several types of materials are available as mattress solutions, consumer preference for memory foam and other types of polyurethane foams in bedding solution has been at the forefront, driving the characteristic to capture significant market share in this segment. According to a report from the International Sleep Products Association (ISPA), memory foam continues to lead growth in mattress sales, which represents comfort and sustainability. Furthermore, rising disposable income levels and the growth of the global real estate industry is fueling the demand for premium furniture, home and bedding products, significantly contributing to the growth of this application.

By End-use

The Residential segment dominated the flexible foam market and held the highest market share of around 41.5% in 2023. This dominance was significantly due to consumers spending more on home improvements and home appliances like furniture, mattress and insulation material. Because of the increasing demand for comfortable and durable home furnishing products such as mattresses, cushions, and furniture upholstery, stricter regulations, and government laws pushed the adoption of flexible foams in the residential sector. According to the National Association of Home Builders (NAHB), the growing housing sector worldwide has driven the need for flexible foam in the construction of and interiors of homes. The lifestyle trend toward personalized home decor and increased awareness of health and wellness also explains the segment’s sustained growth.

Flexible Foam Market Regional Outlook

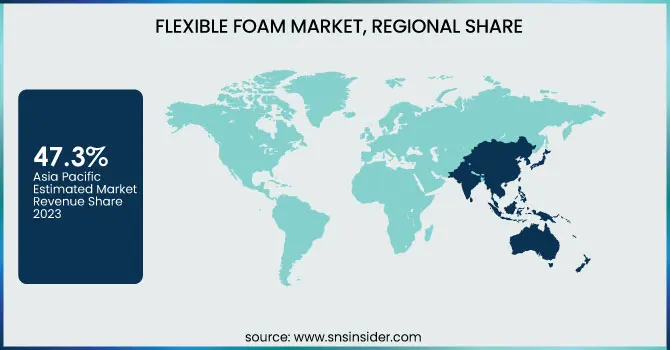

In 2023, Asia Pacific dominated the flexible foam market and accounted for the largest market share of about 47.3%. Several factors contributing to the region's prominence include rapid industrialization, population growth, and urbanization in countries such as China, India, Japan, and South Korea. Flexible foam market Overview China, the most extensive buyer and crating of flexible foam, by and large owns the most critical share of the market. Given the country’s thriving furniture, automotive and construction sectors, China is the leading driver for flexible foam consumption. China's demand for polyurethane-based foams has grown rapidly, especially in the automotive industry, as the demand for overall energy-efficient vehicles has risen, according to the China National Chemical Information Centre. Growing disposable incomes and increasing urbanization in India are expected to propel the market growth for flexible foam for household furniture and bedding applications. Japan stands out in the region as well, with robust demand in the automotive and electronics sectors. Moreover, encouraging government policies in regions such as China, India, etc. regarding infrastructure and housing construction have also induced the key factor enforcing the growing flexible foam consumption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

American Excelsior Company (Excelsior Foam, GeoFoam)

-

Armacell (Armaflex, ArmaSound)

-

BASF SE (Elastoflex, Neopolen)

-

Carpenter Co. (Comfort U, Cellufoam)

-

Changzhou Xingang Plastic Products Co., Ltd. (PE Foam, EVA Foam)

-

Covestro AG (Desmopan, Bayflex)

-

Dow Inc. (DOWTHERM, Styrofoam)

-

Foamcraft, Inc. (Polyurethane Foam, Microfoam)

-

Future Foam Inc. (Future Foam, Soft Touch)

-

Greiner AG (Greiner Foam, Greiner Packaging)

-

Huntsman International LLC (Versathane, Flexthane)

-

Huebach Corporation (Huebach Foam, Huebach Insulation)

-

INOAC CORPORATION (INOAC Polyurethane Foam, Acoustic Foam)

-

Interfoam Ltd. (FoamCore, Polyfoam)

-

Kaneka Corporation (Kaneka Biofoam, Kaneka Polyurethane)

-

Neveon Holding GmbH (Neveon Foams, Neveon Comfort)

-

Recticel Group (Recticel Insulation, Comfort Foam)

-

Rogers Foam Corporation (Rogers Polyurethane Foam, BioFoam)

-

UBE Corporation (UBE Polyurethane Foam, Urethane Foam)

-

Zotefoams Plc (Zotefoam, Zotefoams PE Foam)

Recent Highlights

-

December 2024: Dow introduced VORANOL WK5750 Polyol in North America to help customers meet growth demand for high-performance foams in the furniture and mattress markets. This acquisition also bolsters Dow's advanced Polyol portfolio but might face supply constraints of propylene upstream.

-

September 2024: BASF and Future Foam partnered to develop the first flexible foam bedding to use Biomass Balance Lupranate T 80 TDI, a milestone in the sustainable foam conversion of renewable feedstocks. This project aligns with BASF's own target of being carbon-neutral by 2030.

-

April 2024: Huntsman launched SHOKLESS polyurethane systems to help safeguard electric vehicle battery modules against impact and thermal events. The systems provide improved flexibility and thermal protection, which supports the growing demand for electric vehicle solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 45.52 Billion |

| Market Size by 2032 | USD 71.75 Billion |

| CAGR | CAGR of 5.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Polyurethane (PU), Polyethylene, Polypropylene, Others) •By Application (Furniture and Bedding, Transportation, Packaging, Automotive, Building and Construction, Others) •By End-Use (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Covestro AG, Dow Inc., Huntsman International LLC, JSP Corporation, Recticel Group, Zotefoams Plc, Woodbridge, INOAC CORPORATION, UBE Corporation and other key players |