Polyimide Films and Tapes Market Report Scope & Overview:

Get More Information on Polyimide Films and Tapes Market - Request Sample Report

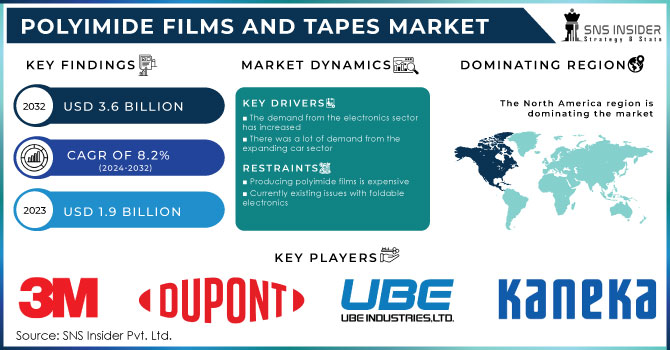

The Polyimide Films and Tapes Market size was valued at USD 1.9 Billion in 2023. It is expected to grow to USD 3.6 Billion by 2032 and grow at a CAGR of 8.2% over the forecast period of 2024-2032.

Polyimide films are increasingly used in solar panel manufacturing due to their ability to withstand environmental stressors. The growing focus on renewable energy solutions and solar technology is contributing to market growth. Moreover, the growth of the polyimide films and tapes industry is likely to be driven by the growth of the electronics and automotive industries. Polyimide films and tapes can withstand extreme temperatures, making them ideal for various automotive applications. In internal combustion engines and electric vehicles (EVs), components such as sensors, wiring, and insulation must endure high heat. The ability of polyimide materials to maintain performance under such conditions is crucial for enhancing vehicle reliability and longevity.

Polyimide films' thermal and mechanical properties are better than other polymers, driving up market demand. The industry is also growing because more and more people want flexible display and optoelectronics transparent polyimide films, and more and more aerospace applications are using them. But things like highs and lows in polyimide film prices and strict environmental rules and regulations will likely slow market growth over the next few years.

In 2023 when DuPont, a leading player in the industry, launched a new line of transparent polyimide films specifically designed for flexible display and optoelectronic applications. This innovation addresses the growing demand for high-performance, durable materials that maintain optical clarity and flexibility, particularly in advanced electronics and aerospace industries.

Moreover, Polyimide films are required in aerospace and defense because they are resistant to heat and capable of functioning under any conditions. These films are ideal for insulation and other vital functions because they are so strong and are not easily damaged by these properties. The aerospace industry is growing, and more advanced materials that can withstand these higher temperatures and harsher conditions are needed. This film is also beneficial because it can be relied on to work as wiring insulation, thermal barriers, and as part of the plane’s structure.

The Federal Aviation Administration states that the aerospace industry in the U.S. will rise by 4.3% every year through 2030 because of higher defense budgets and availability. More growth is expected as commercial air travel keeps increasing. This overall requirement for higher temperatures and harsher conditions propels the need for materials such as polyimide films, as they are stable, long-lasting, and can better protect those materials being applied to them.

Drivers

-

The demand from the electronics sector has increased

-

There was a lot of demand from the expanding car sector

-

It has superior thermal and mechanical qualities in comparison to other polymers

This polymer outperforms its competitors with extraordinary performance qualities, standing out for its superior thermal and mechanical capabilities. It stands out as a strong material option for a variety of applications due to its exceptional resistance to heat, impact, and wear. It stands out in a variety of sectors due to its improved tensile strength, flexibility, and durability. This polymer's exceptional mechanical strength and thermal stability provide a compelling advantage in engineering and manufacturing, enabling the creation of goods and components that can survive challenging conditions and provide dependable performance over protracted periods of usage.

According to the National Institute of Standards and Technology (NIST), polyimide films can withstand temperatures up to 500°F (260°C) without losing their mechanical integrity. This high thermal resilience allows them to outperform many other polymers in critical applications, such as aerospace, where materials must endure extreme temperatures and stress conditions. Additionally, NIST data highlights that polyimide films have an impressive tensile strength of up to 231 MPa, making them exceptionally durable and suitable for applications that require long-term reliability.

Restraint

-

Producing polyimide films is expensive

-

Currently existing issues with foldable electronics

Numerous current issues with foldable electronics prevent its broad use. The lifetime of flexible screens and other components is a major worry, as frequent folding and unfolding can shorten their lifespan. Technical challenges arise when assuring smooth operation and user experience across different form factors, particularly when it comes to software optimization and app compatibility. The complexity and high cost of the foldable display manufacturing process affect the Scalability and cost of manufacturing. To solve these problems, improvements in materials science, engineering, and software development are needed to produce durable, usable, and financially feasible foldable electronic devices that can sustain everyday usage.

Opportunity:

-

It is increasingly being used in aerospace applications

-

Since polyimide films are transparent, they are suitable for flexible displays and optoelectronics

Due to their transparency and superior thermal stability, polyimide films stand out as a top option for flexible displays and optoelectronics applications. Because of their intrinsic transparency, they provide vivid, high-quality images while keeping their structural integrity when twisted or folded. Polyimide films are an excellent choice for the creation of flexible displays, wearable technology, and other cutting-edge display technologies due to their distinctive transparency and flexibility. Their incorporation into several optoelectronic components, including touch sensors, organic light-emitting diodes (OLEDs), and solar cells, is made possible by their longevity and tolerance to high temperatures, which guarantee consistent performance. Because they provide a solid foundation for creating cutting-edge displays and optoelectronic systems, polyimide films therefore play a crucial role in expanding the field of flexible electronics.

Market segmentation

By Application

Flexible printed circuits segment held a market share of about 54% in 2023. The increase in the growth of electronics and the rise of the electrification trend in the automotive sector, keep on increasing the FPC demand, which keeps on attracting the polyimide makers to expand their product portfolio in the application segment. It is widely used as a connector in myriad applications, where the production constraints, space savings, and flexibility restrict the serviceability of the rigid circuit board further contributing to the polyimide films market growth.

Specialty fabricated products are an emerging application segment of polyimide films, which is projected to gain a higher market share at a healthy growth rate. The increase in consumer electronics technology is increasing the new application scope for SFP. The SFP produced by these films of polyimide has a unique ability to operate at low and high operating temperatures.

By End-Use Industry

Automotive held the largest market share around 30% in 2023. Most cars now contain polyimide films, and the increasing production of cars and the increased share of electric cars drive demand. Many automotive applications include EGR valve bushings, thrust washers, seat sensor applications, and traction applications. Powertrain applications are not exposed to high temperatures, which also requires materials to be exposed to high thermal, mechanical, and electrical loads. The reinforced polyimide film is the fastest-growing region of the polyimide film segment, as next-generation compact cars are becoming more and more popular, providing more performance in one relatively small car. The increased emphasis on lightweight vehicles is also driving polyimide market growth and increased use in automotive applications. They are expected to occupy a greater market share in the automotive industry within the estimation period, as their unique features are capable of meeting the challenging demands of the automotive sector.

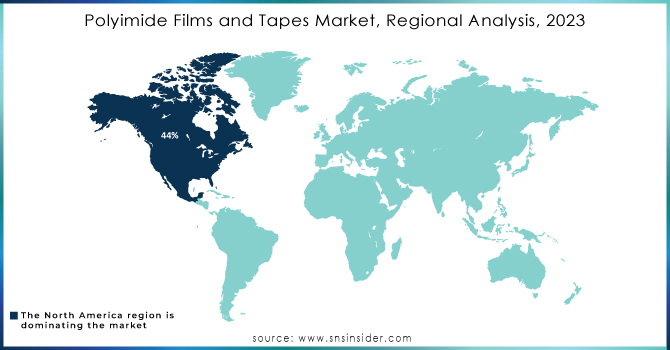

Regional Analysis

North America held the largest market share around 44% in 2023. North America drives the highest market share in the polyimide films market. The presence of major regions such as the US forming part of the leading manufacturers of aerospace platforms and automotive configurations has generated massive demand for polyimide films. The established aerospace industry in North America drives the consumption of sophisticated materials, including polyimide films as the materials can withstand high temperatures and stringent operational conditions. The U.S. aerospace and defense industries contributed over USD391 billion to the economy in 2022, depicting the high level of applications of the aerospace platforms in the region.

Conversely, polyimide film manufacturing companies and leading technologically oriented companies are based in the region, further advancing in material capabilities. In addition, North America built a massive consumption curve of polyimide films, based on the established electronics industry consuming the materials on flexible displays, semiconductors, and optoelectronics. Lastly, government regulations support technological advancements and investments in defense within the region, conducting a sustainable support curve for the polyimide markets.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Raw Key Manufacturers

-

DuPont de Nemours and Company (Kapton)

-

PI Advanced Material Co., Ltd. (PI-8000)

-

Ube Industries Ltd. (UBE Polyimide Film)

-

3M Company (3M Polyimide Film Tape 5413)

-

Kaneka Corporation (Kaneka Polyimide Film)

-

Arakawa Chemicals Industries Inc. (Arofilm)

-

Taimide Tech. Inc. (Taimide PI Film)

-

Flexion Company, Inc. (FLEXcon Polyimide Film)

-

Shinmax Technology Ltd. (Shinmax Polyimide Film)

-

Kolon Industries Inc. (Kolon Polyimide Film)

-

Mitsui Chemicals, Inc. (Mitsui Polyimide Film)

-

Saint-Gobain Performance Plastics (Thermal Insulation Polyimide Films)

-

Sumitomo Bakelite Co., Ltd. (Sumpoly)

-

Heraeus Holding GmbH (Heraeus Polyimide Film)

-

Dongjin Semichem Co., Ltd. (DJC Polyimide Film)

-

Nitto Denko Corporation (Nitto Polyimide Tape)

-

Nippon Steel Chemical Co., Ltd. (NS Polyimide Film)

-

SABIC (SABIC Polyimide Films)

-

Kaptontape (Kaptontape Polyimide Tape)

-

Toray Industries, Inc. (Torayca Polyimide Film)

Key Users in End -Use Industry

-

Boeing

-

Lockheed Martin

-

Samsung Electronics

-

Intel Corporation

-

General Motors

-

Ford Motor Company

-

Verizon Communications Inc.

-

AT&T Inc.

-

Siemens AG

-

General Electric Company

Recent Development:

-

In 2023, Ube unveiled a new range of polyimide films optimized for electric vehicle applications, focusing on enhancing thermal management and electrical insulation in EV batteries.

-

In 2023, Kaneka developed a new lightweight polyimide film that is being utilized in the aerospace industry for insulation applications, contributing to weight reduction in aircraft.

-

In 2022, PI Advanced Material Co., Ltd. introduced a high-performance polyimide film that offers improved thermal stability and flexibility, catering to the growing demands of the semiconductor industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 1.9 Billion |

| Market Size by 2032 | US$ 3.6 Billion |

| CAGR | CAGR of 8.2% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By application (Flexible Printed Circuits, Specialty Fabricated Products, Pressure-Sensitive Tapes, Wires & Cables, Motors/Generators) • By end-use industry (Electronics, Automotive, Aerospace, Labeling, Solar, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | DuPont de Nemours and Company, PI Advanced Material Co., Ltd., 3M Company, Ube Industries Ltd., Kaneka Corporation, Arakawa Chemicals Industries Inc., Taimide Tech. Inc., FLEXcon Company, Inc., Shinmax Technology Ltd., Kolon Industries Inc., and other players. |

| DRIVERS | • The demand from the electronics sector has increased. • There was a lot of demand from the expanding car sector. • It has superior thermal and mechanical qualities in comparison to other polymers. |

| Restraints | • Producing polyimide films is expensive. • Currently existing issues with foldable electronics. |