Hydrocolloids Market Report Scope & Overview:

Get E-PDF Sample Report on Hydrocolloids Market - Request Sample Report

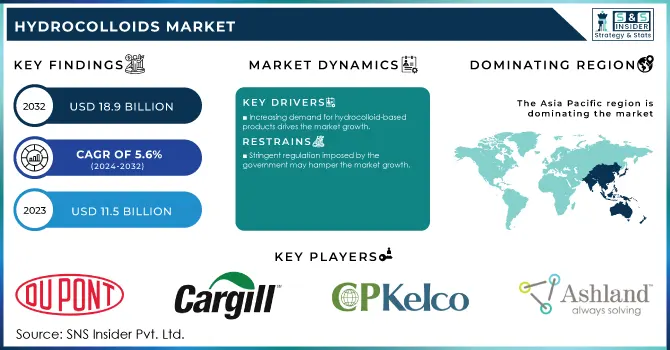

The Hydrocolloids Market was USD 11.5 billion in 2023 and is expected to reach USD 18.9 billion by 2032, growing at a CAGR of 5.6% over the forecast period of 2024-2032.

The hydrocolloids market has witnessed a growing consumer demand for natural ingredients due to an increasing preference for clean-label and plant-based products. With increasing knowledge regarding the health hazards of synthetic additives, consumers now prefer food and drinks with natural ingredients. Hydrocolloids, on the other hand, are more favored since they have a natural origin and functional properties, and these components are obtained from seaweed (carrageenan and agar), plant exudates (gum arabic), and microbial fermentation (xanthan gum). These components improve texture, stability, and shelf life, and have greater stability and shelf life, but they also cater to the trend toward sustainability and environmental responsibility. Growing natural additives acceptance by several regulatory agencies and food safety organizations is also accelerating the hydrocolloids market in various applications including food, beverages, pharmaceuticals, and cosmetics.

The U.S. FDA has enforced stringent guidelines under the Food Allergen Labeling and Consumer Protection Act (FALCPA). This act mandates the declaration of major food allergens on labels, including sesame, which was added as the ninth major allergen in January 2023.

Innovation in food formulation is driving hydrocolloid market for manufacturers who are exploring opportunities for new product functionality, health benefits, and consumer demand for different sensory experiences. Hydrocolloids are widely used for texture modification, stabilization of formulations, and clean-label solutions and are finding new applications in innovative areas, including reduced-calorie and gluten-free products. The progress of technology is allowing the hydrocolloids with specific features, such as temperature-stable or more gelling capacity to be extracted and exploited. Apart from ensuring that food and beverage products are of higher quality, these innovations follow the trend of plant-based diet and sustainability. Furthermore, investigations on blended hydrocolloids are developing synergistic action on textural and shelf-life improvement, thereby broadening the space of utilization of these components in contemporary food formulations. This trend showcases the industry's dedication to satisfying changing consumer preferences while solving technical hurdles.

In 2023, the U.S. Department of Agriculture (USDA) supported research initiatives aimed at enhancing the use of natural hydrocolloids in developing low-fat and gluten-free food products, aligning with dietary trends.

Hydrocolloids Market Dynamics

Drivers

-

Increasing demand for hydrocolloid-based products drives the market growth.

-

Rising demand from the cosmetics industry drives the market growth.

The hydrocolloids market is driven in particular by the rising demand for these ingredients from the cosmetics industry, owing to their multifunctional properties in formulating products. In the cosmetics industry, hydrocolloids like xanthan gum, carrageenan, and alginates are used to stabilize emulsions, improve texture, and as thickeners for creams, lotions, and gels. An increase in demand for sustainable and organic cosmetic products that come from natural origin and are compatible with clean-label formulated products is also helping to drive the above-mentioned trend.

In addition, the increasing applications in cosmetic formulations, such as anti-aging and hydration products, are expected to contribute to the demand for hydrocolloids owing to their hydration and film-forming properties. Hydrocolloids also get the edge because they meet safety and efficacy benchmarks, such as the approximate cosmetic safety standards for masking agents that many cosmetics companies in the E.U. must meet and the E.U. Regulations that mandate the use of safe and sustainable ingredients, making the hydrocolloids adoption mandatory under the government regulations such as in the U.S. FDA. Altogether, these factors play role in the expansion of hydrocolloids integration in cosmetics industry and thus support the market growth.

In 2024, Alland & Robert, launched syndeo gelling, a plant-based texture agent to replace such gelatin-based products while ensuring extreme Vegan ability. The natural and sustainable hydrocolloids for cosmetic formulations market is characterized by the presence of leading companies such as CP Kelco, DSM, and Tate & Lyle focusing on expansion and innovation to establish a high market share

Restraint

-

Stringent regulation imposed by the government may hamper the market growth.

The growth of the hydrocolloids market can be hindered by stringent regulations imposed by the governing bodies. Regulatory frameworks are growing more convoluted, particularly about food safety, labeling, and ingredient approval systems. Hydrocolloids are regulated in several parts of the world, for example, the European Union, and the United States, mainly due to their use in food, cosmetics, and pharmaceutical products. New hydrocolloid-based ingredients require extensive safety assessments and the approval process is costly and time-consuming, heavily regulated by the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA). As an illustration, detailed toxicological assessments are required for new food additives (hydrocolloids included) before they can be commercialized which frequently results in extended lead times for approval. Similarly, it has been stressed over the demand for traceability and "clean-label" products from consumers which have driven an increase in the number of regulations imposed by governments to address labeling, thereby increasing compliance costs for manufacturers.

Hydrocolloids Market Segmentation

By Product

Gelatin held the largest market share segment around 30% in 2023. The hydrocolloids market is saturated with gelatin which is widely used in food and Pharmaceuticals also in cosmetics, there has been high demand for it, which makes it hold the largest share in the hydrocolloids market. As a gelling agent, stabilizer, or thickener, it is considered a widely used ingredient in a variety of products, such as gummy candies, marshmallows, yogurt, and capsules. The unique properties of gelatin such as gel-forming functionality, texture building, and mouthfeel enhancement property make it an unbeatable option for food manufacturers who look for stability, quality & premium formulations.

By Function

The thickening function segment held the largest market share around 28% in 2023. This is because of its critical use in various industries, especially food, cosmetics, and pharmaceuticals industry. In food processing, they play a vital role in providing such texture and consistency to the products which is otherwise hard to achieve; in saucing, dressing, soup, dairy products, drinks, or anything that the commercial sector beautifies. Such hydrocolloids as xanthan gum, guar gum, and gelatin are widely used for these purposes as the hydrocolloids stabilize and change the viscosity and mouthful of products, and date to date have a constant character and quality.

By Application

Food & Beverage held the largest market share around 65% in 2023. It is owing to its crucial role in improving the texture, stability & functional properties of a variety of food products. Hydrocolloids-xanthan gum, guar gum, pectin, gelatin, etc-are essential for thickening, gelling, stabilizing, and emulsifying functions in the food industry, where the desired consistency and mouthfeel are needed in multiple products, including sauces, dressings, beverages, dairy, and confectionery. However, with the changing demand of consumers who have started to prefer cleaner labels, natural ingredients, and functional foods, this will in turn propel the hydrocolloids demand upward. These ingredients are high in demand because of the rising demand for gluten-free, low calories and plant-based food formulations which makes them widely used over food formulations

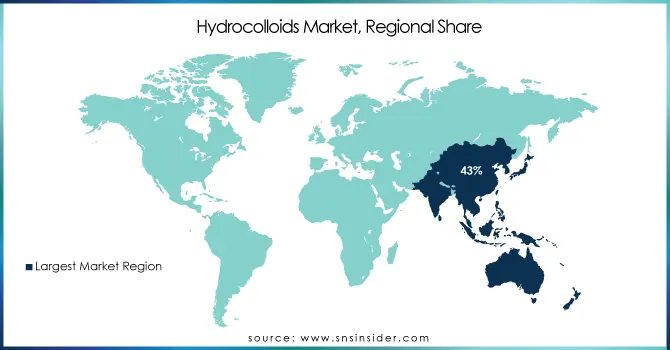

Hydrocolloids Market Regional Analysis

Asia Pacific held the largest market share around 43% in 2023. This is driven by various factors such as the rapid growth in industrial growth, rise in consumer demand for processed and convenience foods, and breakthroughs in food processing technologies. The population in this region is huge with varied demand for different food and beverage products, which will create a need for hydrocolloids used for stabilizers, thickening agents & gelling agents for several applications. China and India are rapidly growing economies having increasing disposable income and a transition phase in dietary habits towards processed, packaged, and convenience foods with high dependency on hydrocolloids for textural, shelf life, and consistency purposes.

Beyond food and beverage, the rising cosmetics and pharmaceutical industries in Asia Pacific further contribute to the market potential for hydrocolloids. Due to increasing consumer familiarity with skincare and personal care products across various countries Japan, South Korea, and China, in particular, the use of hydrocolloids in formulations used in creams, lotions, and gels is on the rise.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

E. I. du Pont de Nemours and Company (Xanthan Gum, Guar Gum)

-

Cargill, Inc. (Hydroxypropyl Distarch Phosphate, Cargill Gelatin)

-

CP Kelco (Xanthan Gum, Gellan Gum)

-

Ashland Inc. (Acrylates Copolymer, Hydroxyethylcellulose)

-

Lubrizol Corporation (Carbopol, Pemulen)

-

Rousselot S.A.S. (Gelatin, Peptan)

-

Kerry Group PLC (Kerry Gelatin, Hydrocolloid Blends)

-

Darling Ingredients Inc. (Gelatin, Collagen Hydrolysates)

-

Fuerst Day Lawson (Agar, Guar Gum)

-

TIC GUMS Inc. (TIC Pretested Gums, TIC Organic Gums)

-

Ingredion Incorporated (Novation, ClearGel)

-

Tate & Lyle PLC (Tate & Lyle Gellan, Litesse)

-

DSM Nutritional Products (Keltrol, Gelatine)

-

Gelita AG (Gelatin, Collagen Peptides)

-

DuPont Nutrition & Biosciences (E464 Hydroxypropyl Methylcellulose, Xanthan Gum)

-

Lonza Group (Methylcellulose, Hydroxypropyl Methylcellulose)

-

The Archer Daniels Midland Company (ADM) (Starch, Xantham Gum)

-

Naturex (Givaudan) (Pectin, Guar Gum)

-

FMC Corporation (Xanthan Gum, CMC)

-

BASF SE (Lupanol, Lupa-Ag)

Recent Development:

-

In 2023, DuPont launched its new portfolio of sustainable, clean-label ingredients for the food and beverage market seeking replicas of synthetic thickeners and stabilizers. The move towards natural and healthier ingredients have become a wider trend.

-

In 2024, CP Kelco introduced innovative hydrocolloid-based products to improve product performance in the clean-label segment. Their ingredients are designed to enhance food texture while using natural products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.5 Billion |

| Market Size by 2032 | US$ 18.9 Billion |

| CAGR | CAGR of 5.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Gelatin, Xanthan Gum, Carrageenan, Alginates, Pectin, Guar Gum, Gum Arabic, Agar, Other) • By Function (Thickening, Gelling, Stabilizing, Fat Replacing, Coating Material, Others) • By Application (Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | E. I. du Pont de Nemours and Company, Cargill, Inc., CP Kelco, Ashland Inc., Lubrizol Corporation, Rousselot S.A.S., Kerry Group PLC, Darling Ingredients Inc., Fuerst Day Lawson, TIC GUMS Inc., Ingredion Incorporated, Tate & Lyle PLC, DSM Nutritional Products, Gelita AG, DuPont Nutrition & Biosciences, Lonza Group, The Archer Daniels Midland Company , Naturex , FMC Corporation, BASF SE, and Others |

| Key Drivers | • Increasing demand for hydrocolloid-based products drives the market growth. • Rising demand from the cosmetics industry drives the market growth. |

| RESTRAINTS | • Stringent regulation imposed by the government may hamper the market growth. |