Polyurethane Foams Market Report Scope & Overview:

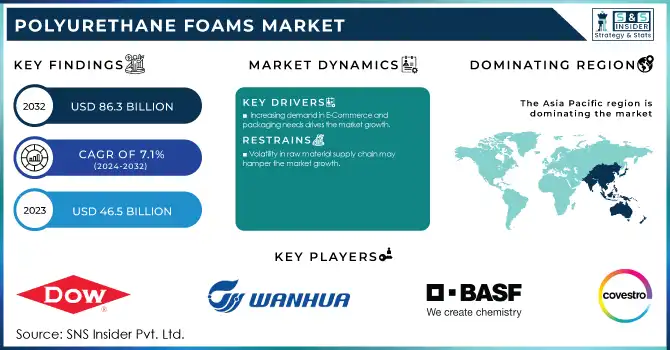

The Polyurethane Foams Market size was USD 46.5 billion in 2023 and is expected to reach USD 86.3 Billion by 2032 and grow at a CAGR of 7.1% over the forecast period of 2024-2032.

Get More Information on Polyurethane Foams Market - Request Sample Report

The key factor driving the growth of the polyurethane foams market is the increasing demand for insulation materials. With the growth of worldwide energy consumption, energy efficiency has become a point of attention within homes and businesses. As governments across the globe are enforcing stricter energy-saving standards, industries need advanced insulation solutions to reduce heat loss thus minimizing energy costs. Polyurethane foam is a highly effective thermal insulator and is most commonly used in construction as insulation in walls, roofs, and floors. It is the best energy-efficient construction material as it serves as an effective insulator with a very low thickness. Furthermore, increasing concerns regarding environmental sustainability are increasing the requirement of materials to reduce carbon footprints, and also polyurethane foam is the most effective form of insulation for energy conservation making it the preferred material for insulation among green building projects. While well entrenched in developed economies such as North America and Europe, where energy-efficient building codes are more rigorously enforced, this trend is also growing rapidly in the developing world, where urbanization and industrial development are advancing quickly.

According to the U.S. Department of Energy, residential and commercial buildings account for nearly 40% of total U.S. energy consumption, with a significant portion of this energy used for heating and cooling. The U.S. government has set ambitious targets to improve energy efficiency, including the Better Buildings Initiative, which aims to make commercial buildings 20% more energy-efficient by 2025. This initiative promotes the use of advanced insulation materials such as polyurethane foams to reduce energy consumption in buildings.

The increase in purchasing power of consumers, they are spending more on better quality durable, and comfortable garments. Polyurethane foam is used in these industries for its versatility, durability, and ease of adaptation to varied firmness and density to make mattresses, cushions, and upholstered furniture more comfortable. Notably in fast-growing-limited economies, urbanization and a rising middle class further spur consumer demand for home products and furniture. Not only does it introduce comfort, but its durability and resilience extend the lifetime of products as well, thus appealing to consumers looking for attractive, value-driven products. This demand for furniture and bedding made with polyurethane foam is being driven by a greater focus on quality of life and home aesthetics in emerging markets as well as improved access to modern home use standards. Additionally, advancements in foam technology, like memory and sustainable foams, are broadening its scope, which greatly supports the growth in these industries.

According to the U.S. Bureau of Economic Analysis, real disposable personal income in the U.S. increased by 3.6% in 2023, supporting higher consumer spending on goods like furniture and bedding. This trend aligns with the growing consumer demand for higher-quality products, including those made with polyurethane foams.

Polyurethane Foams Market Dynamic:

Drivers

-

Increasing demand in E-Commerce and packaging needs drives the market growth.

A major reason for the growth in the polyurethane foams market is their increasing demand from e-commerce and packaging applications. The e-commerce industry is growing rapidly as it has changed the process of buying and shipping products worldwide. As online shopping is on the rise, demand for safe, reliable and lightweight packaging has become even more significant for protecting products from machine, junction and-handling shocks . Some of the most common uses of polyurethanes are in packaging for cushioning purposes, as they are very lightweight and used for shock absorbing to protect delicate goods in transit. In addition, as e-commerce companies are trying to create higher customer satisfaction, they are looking up to innovative packaging solutions that serve dual functionality, providing protection along with sustainability. In response to increasing consumer and regulatory pressure to switch to sustainable packaging solutions, polymeric foams such as polyurethane foam, particularly bio-based versions, are gradually being used. The trend is visible across product categories ranging from electronics and appliances to cosmetics and personal care products. The increase in global e-commerce coupled with the growing trend of sustainable packaging, is creating ample opportunity for polyurethane foams thereby boosting the market.

The European Commission has implemented several policies aimed at improving the sustainability of packaging, including the Packaging and Packaging Waste Directive. This has led to increased interest in eco-friendly packaging materials. The EU is pushing for a 10% reduction in packaging waste by 2025, encouraging the adoption of sustainable and protective materials like bio-based polyurethane foams in the packaging industry.

Restraint

-

Volatility in raw material supply chain may hamper the market growth.

Polyols and isocyanates, which are the key raw materials for polyurethane foam production, are made based on petrochemical products and are directly affected by the crude oil price fluctuations. Since pure unwieldy oil price changes can also instigate unanticipated cost modifications for manufacturers, that can have an effect on their profitability in addition to the overall poker size of polyurethane foams amongst the advertisement lifecycle, any ailment in crude oil supply can motive widespread domino impact. In addition, factors like geopolitics, natural calamities, and trade policy changes can contribute to other aspects of disruption in the upstream supply chain, causing the unavailability of materials and stopping production.

Polyurethane Foams Market Segmentation

By Product

Flexible foam held the largest market share around 59% in 2023. It is due to its versatility, comfort, and its high scope of applications in various industries. Flexible polyurethane foam is recognized for its cushioning and support and is commonly used in mattresses, upholstered furniture, automotive seating, and bedding. It can be produced to suit various specifications of the merchandise, is redoubtable, light-weight, exploitable, and comes up with different firmness levels for varied consumer preferences, providing the user with total flexibility. Given the importance of comfort and durability in the furniture and bedding industries, flexible foam has become a necessary product.

By Application

The bedding & furniture segment held the largest market share around 35% in 2023. It is owing to the importance of the role of polyurethane foam in improving comfort, durability, and functionality in many such products. And, the superior comfort and support offered by polyurethane foams (especially flexible foams) the most common application of these foams is in the making of mattresses, cushions, sofas and other upholstered furniture. Higher disposable incomes and shifting consumer lifestyles have played a critical role in supporting the demand for high quality, sturdy, and long-lasting furniture and bedding products, and the segment benefits from an ability to appeal to consumers across price point tiers. Furthermore, growing knowledge regarding the advantages of good sleep quality has led consumers to seek high-performing mattresses that incorporate advanced polyurethane foams, particularly in memory foam so that they contour to the body for enhanced relaxation.

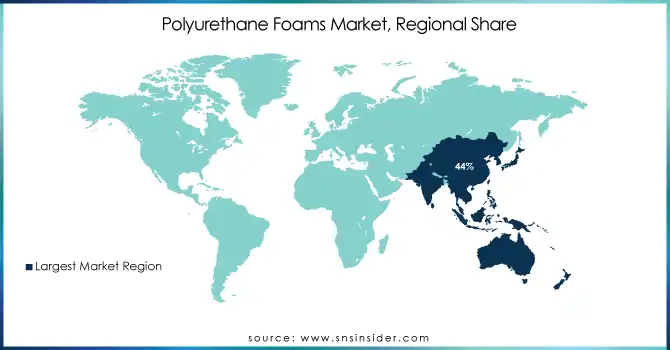

Polyurethane Foams Market Regional Analysis

Asia Pacific held the largest market share around 44% in 2023. This is due the system of high velocity of urgent industrialization, urbanization, and then an incremental consumer demand from several sectors. China, India, and Japan among the fastest-growing economies in the world, which have increased production and consumption of polyurethane foams considerably, are located in this region itself. The construction and automotive sectors, the largest users of polyurethane foams, are buoyant in Asia Pacific due to infrastructure development, urbanization, and growing demand for energy efficient materials in construction sector. Polyurethane foam is rapidly gaining demand as a lightweight and durable materials in the automotive space, especially in countries, such as China, in which vehicle production and sales are soaring. Additionally, the growing population, rising disposable income levels, and changing consumer behaviors towards mattresses, furniture, and electronics are contributing to the high consumption of polyurethane foams in the region. Moreover, Asia pacific is trending towards eco-friendly and sustainable materials, due to this trend, manufacturers are emphasizing on manufacturing bio-based polyurethane foams to match your market demand. Asia Pacific will continue to be the largest market for polyurethane foams worldwide, attributed to the presence of large manufacturers of polyurethane foam, low production cost and rise in the shift towards advanced technologies in the region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Covestro AG (Desmodur, Bayblend)

-

BASF SE (Sodium Nitrite, Master Builders Solutions)

-

Wanhua Chemical Group Co., Ltd. (Methylene Diphenyl Diisocyanate (MDI), Polyurethane System)

-

Dow Inc. (DOWLEX, AFFINITY)

-

Huntsman Corporation (VITON, TIOXIDE)

-

Sekisui Chemical Co., Ltd. (S-LINE, Thermoplastic Elastomers)

-

Saint-Gobain (Abrasives, Gypsum)

-

Deepak Nitrite Ltd. (Nitrobenzene, Aniline)

-

Shijiazhuang Fengshan Chemical Co. Ltd. (Sodium Nitrite, Sodium Nitrate)

-

Ural Chem JSC (Sodium Nitrite, Sodium Nitrate)

-

Linyi Luguang Chemical Co. Ltd. (Sodium Nitrite, Sodium Nitrate)

-

Radiant Indus Chem Pvt. Ltd. (Sodium Nitrite, Potassium Nitrite)

-

Yingfengyuan Industrial Group Limited (Sodium Nitrite, Sodium Nitrate)

-

SABIC (SABIC Polycarbonate, SABIC PP)

-

Merck KGaA (Sigma-Aldrich, Millipore)

-

Solvay (Sodium Carbonate, Soda Ash)

-

LANXESS (Bayferrox, Levasil)

-

Albemarle Corporation (Bromine, Refining Solutions)

-

Mitsubishi Chemical Corporation (Polypropylene, Methacrylate)

-

DSM (Dyneema, Akulon)

Recent Development:

-

In May 2024: Media Fusion and Crain Communications announced the first sustainable Polyurethane and Foam Expo Show in India at the NESCO, Bombay Exhibition Center. With an emphasis on environmentally friendly business practices, this event sought to unite manufacturers and producers of PU materials, products, and technologies.

-

In March 2024, Milliken & Company to improve polyurethane formulations displayed a wide range of colorants and additives. By providing increased recovery yields and boosting post-industrial and post-consumer usage without affecting the color of the recycled polyol, these developments support environmentally friendly foam production methods.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 46.5 Billion |

| Market Size by 2032 | USD 86.3 Billion |

| CAGR | CAGR of 7.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Flexible Foams, Rigid Foams ) • By Application(Bedding & Furniture, Transportation, Packaging, Construction, Electronics, Footwear, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Covestro AG, BASF SE, Wanhua Chemical Group Co., Ltd., Dow Inc., Huntsman Corporation, Sekisui Chemical Co., Ltd., Saint-Gobain, and others. |

| Key Drivers | • Increasing demand in E-Commerce and packaging needs drives the market growth. |

| Restraints | • Volatility in raw material supply chain may hamper the market growth. |