PROPYLENE OXIDE MARKET REPORT SCOPE & OVERVIEW:

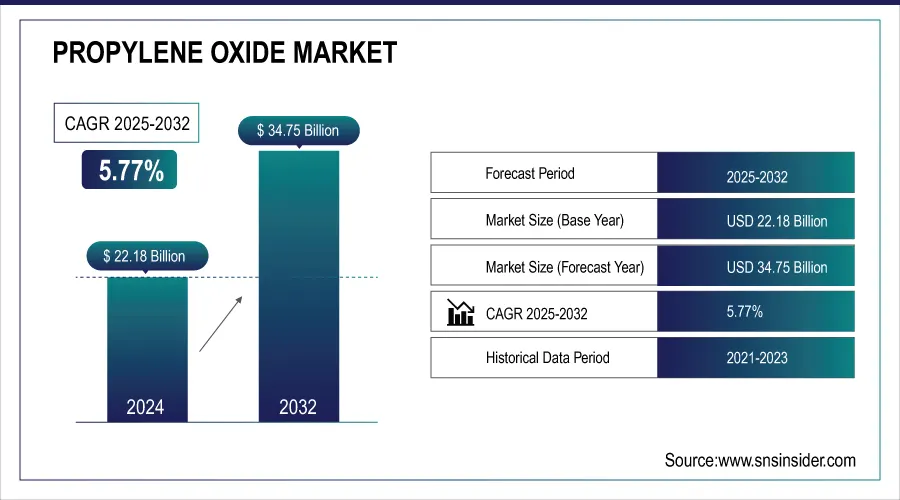

The Propylene Oxide Market was valued at USD 22.18 Billion in 2025E and is expected to reach USD 34.75 Billion by 2033, growing at a CAGR of 5.77% over the forecast period 2026-2033.

The propylene oxide market is growing at a notable rate due to the following factors. One of the key factors driving the market is the rising consumption of polyether polyols utilized in making polyurethane foams. These foams are used in a very wide range of industries, such as automotive, construction, and furniture. Polyether polyols represent 67% of global propylene oxide consumption in 2023, mostly for polyurethane foams. Automotive was the largest consumer at 30-35%, primarily for use in vehicle interiors. With industrial activity strong in China and India, the Asia-Pacific market dominated with a greater than 45% share of global consumption. For propylene glycol, a derivative of propylene oxide, 25–30% of the market demand was for use in the pharmaceutical, food, and cosmetic industries.

Market Size and Forecast:

-

Market Size in 2025E: USD 22.18 Billion

-

Market Size by 2033: USD 34.75 Billion

-

CAGR: 5.77% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get More Information on Propylene Oxide Market - Request Sample Report

The Hydrogen Peroxide Propylene Oxide (HPPO) process has accounted for over 40% of global propylene oxide production, owing to a lower environmental impact than the chlorohydrin process, which still accounts for 60% of production in areas lacking HPPO adoption. Polyurethanes, via polyether polyols, account for 50% of total global propylene oxide demand, and then propylene glycol, an oxygenate used in antifreeze and plastics as well as cosmetics, accounts for 25% of its consumption.

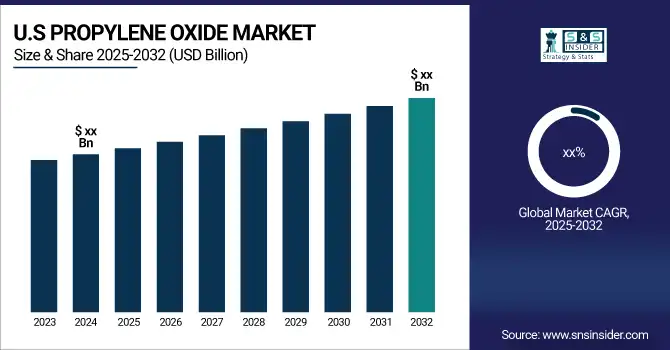

The U.S. Propylene Oxide market size was valued at an estimated USD 8.45 billion in 2025 and is projected to reach USD 13.25 billion by 2033, growing at a CAGR of 5.01% over the forecast period 2026–2033. Market growth is driven by strong demand for propylene oxide in the production of polyurethane foams, propylene glycols, and other chemical intermediates used across construction, automotive, packaging, and furniture industries. Increasing construction activity, rising automotive production, and growing use of lightweight and insulation materials are supporting market expansion. Additionally, advancements in production technologies, stable availability of feedstock, and continuous investments in domestic chemical manufacturing capacity further strengthen the growth outlook of the U.S. propylene oxide market during the forecast period.

Propylene Oxide Market Growth Drivers

-

Sustainable Shift Drives Growth of Bio-based Propylene Oxide with Reduced Emissions and Consumer Demand.

Growing trends for bio-based content and eco-friendly products are two of the prominent drivers aiding the growth of the propylene oxide market as well as producing bio-based propylene oxide is some key innovative aspects in this market recently. With growing attention on sustainability in industries around the world, innovation in sustainable chemistry for greener products creates a trend for using eco-conscious alternatives in manufacturing settings. A good example of an industrial chemical starting to be made from more sustainable sources is propylene oxide, a widely used feedstock in the manufacture of polyether polyols and propylene glycol. Using renewable resources like glycerol to produce bio-based propylene oxide is emerging as a more sustainable alternative than the current methods. The need for bio-based solutions is a result of both regulatory, as well as consumer demand for greener products. Due to the need to mitigate carbon emissions, the eco-friendly propylene oxide market is continuously developing as various players tend to scale out their bio-based results, according to the (R&D) rate. Propylene oxide is presently performed using petrochemicals, but the use of sustainable alternatives such as glycerol is bringing bio-based propylene oxide to the scene with 25–30% lesser carbon emissions by using renewable assets. More than 10% of propylene oxide production in the world is bio-based, and the percentage is on the rise. The change is fueled by consumers, with 72% willing to pay extra for sustainability. Moreover, green versions yield 30% less greenhouse gas emissions than the chlorohydrin process used today.

-

Rising Automotive Production and Electric Vehicle Growth Drive Demand for Propylene Oxide in Foams.

Another key driver is the increasing automotive industry and rising consumption of propylene oxide derivative products for automotive applications. Propylene oxide goes into making polyurethane foams for car interiors, such as seat cushions, headliners, and insulation materials. Polyurethane foams have witnessed a surge in demand due to a complimentary global automotive focus towards fuel-efficient, low-emission vehicles that are increasingly built out of lightweight material. Since propylene oxide is a key raw material in the manufacture of these foams, this friction directly boosts the demand for it. In addition, the rising use of electric vehicles (EVs) that require dedicated components including lightweight seating, insulation, etc. is additionally fueling propylene oxide demand. Propylene oxide is still experiencing sustainable demand driven by the electric mobility boom and the global automotive market driving propylene oxide demand more prominent in regions like North America and Asia Pacific. Worldwide automotive production increased from 15 M vehicles in 2010 to 28 M in 2022 fueling propylene oxide demand in polyurethane foams. With the number of electric vehicles (EVs) more than doubling to over 26 million in 2022, demand for seating and insulation materials at a lower weight also increased. Today, over 30% of global propylene oxide demand is attributed to polyurethane foams, and the 25% increase in lightweight material use in vehicles in turn stimulates demand.

Propylene Oxide Market Restraints

-

Challenges in Propylene Oxide Market Growth Due to Raw Material Price Fluctuations and Production Method Shifts

Fluctuation in prices of raw materials is one of the important restraining factors for the growth of the propylene oxide market. Propylene oxide mainly comes from propylene, which is a by-product of petrochemicals. This means that any instability in the supply chain of propylene which is driven by the fluctuations of supply and price of its key feedstock propylene, subject to the ever-changing prices of oil, and local and international refinery production rates, threatens the sustainability of the production of unsustainable PHA. This can affect propylene oxide production and lead to market volatility. The other issue is that the traditional production methods mainly the chlorohydrin process result in noticeable environmental damage. As high as this process could be useful, it generates hazardous by-products that have raised environmental concerns and regulatory pressures. Transitioning to greener, more sustainable production methods such as the hydrogen peroxide method or bio-based production is a capital-intensive process and a strong demand for large investments to develop these new technologies. For many businesses stuck in outmoded, less eco-friendly production methods, making the transition to these cleaner substitutes can be a daunting task.

Propylene Oxide Market Segment Analysis

BY APPLICATION

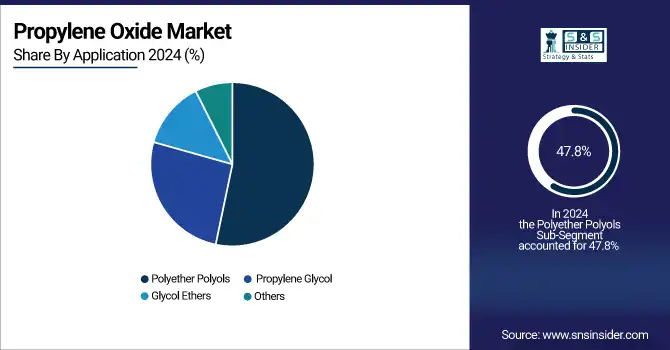

Polyether polyols accounted for the largest market share of 47.8% in 2025 and are projected to witness the fastest growth from 2026 to 2033. In general, the escalating demand for polyurethanes used in automotive, construction, and furniture applications is primarily supporting this growth. The rising demand for flexible & rigid foams, coatings, adhesives, sealants, and elastomers, in line with the industrialization trend and urbanization especially across emerging markets around the globe, has increased the importance of polyether polyols. Especially in the automotive and construction industries as they are looking for solutions that require lesser energy consumption with lower weight, will continue to open up the avenues for polyether polyols, thereby fuelling the industry growth over the forecast duration. Furthermore, the growing focus on sustainability and the use of green products in these applications will boost demand for polyether polyols as these ingredients have the characteristics of sustainable materials and high-performance polyurethane offerings.

BY PROCESS

In 2025, Chlorohydrin led the propylene oxide market with a market share of 34.9%, primarily owing to its extensive history in commercial use, and wide acceptance in the industry. In this technique, the combination of propylene with chloride yields propylene chlorohydrin reactions, which are afterward oxidized into propylene oxide. It is a low-cost, reproducible procedure that is predominantly used for large manufacturing processes, which makes it highly favorable amongst chemical producers. The decades of practical experience and infrastructure have cemented this method as the dominant method. The chlorohydrin process is especially favored where cost competitiveness and high production volumes are big drivers like North America and Asia's petrochemical-centric industries.

The Hydrogen Peroxide subset is projected to have the highest growth rate (CAGR) between 2026 and 2033, due to significant interest in sustainable and eco-efficient forms of process development. Hydrogen peroxides acting as oxidizing agents ultimately provide a means of avoiding chlorine and generating fewer toxic by-products in a process that is significantly cleaner than the chlorohydrin process. With the risk of environmental issues growing throughout the world, industries are being forced to minimize their environmental impact as well as comply with much tighter laws around chemical waste and discharge. The hydrogen peroxide process provides a more sustainable solution because it utilizes less toxic substances and has a less ecological footprint.

BY END USE

The Automotive sector led the propylene oxide market attracting 30.6% of the revenue share, in 2025, owing to higher consumption of polyether polyols produced using propylene oxide in manufacturing polyurethane foams. These flexible foams play essential roles in the automotive industry for use in parts such as seat cushions, headliners, insulation, and bumpers. Focus on material that can reduce the weight of the car has been on the list for many years, so propylene oxide is used in the production of automobile parts and contributes to automotive parts, making the automotive industry drive this market. Furthermore, the surge in consumer interest in electric vehicles (EVs), which rely on lightweight materials to achieve energy efficiency, also increases the consumption of propylene oxide in the automotive industry. Fully dependability of propylene oxide for production of key raw materials makes for the dominance of this application in the market.

Building and Construction is anticipated to have the highest growth rate during the forecast period (2026 - 2033), owing to the increasing usage of propylene oxide-based goods in the industry. With the increase in construction activities across the globe, polyurethane-based products including but not limited to insulation foams, sealants, adhesives, and coatings, are gaining rapid traction. Due to their unique thermal resistance, soundproofing, and durability characteristics, Polyurethane foams are one of the most significant materials in the construction industry both for commercial and residential constructions. From attention towards energy-efficient buildings to sustainable construction practices to green building materials, we can expect heightened demand for such materials. Rising demand for green and energy-efficient solutions and expansion in the construction market in developing economies have established the building & construction sector as the fastest-growing end-use segment for propylene oxide which is expected to fuel tremendous growth in the forthcoming years.

Propylene Oxide Market Regional Analysis

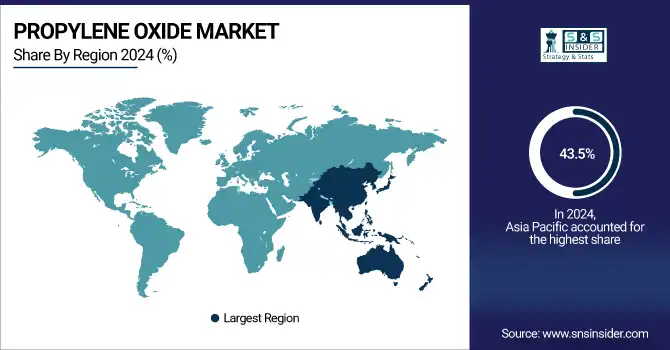

Asia Pacific Propylene Oxide Market Insights

In 2025, the propylene oxide market was dominated by Asia Pacific, which held a 43.5% share, and is expected to grow at the highest CAGR from 2026 to 2033. Fast-growing industrialization, urbanization, and consumerism in the developing countries of China, India, Japan, and South Korea are the major drives behind this growth. The propylene oxide market in Asia-Pacific is led by the region's manufacturing base for key application industries including automotive, construction, electronics, and textiles, which all utilize propylene oxide-based products such as polyurethane foams and propylene glycol and glycol ethers. The rising automotive industry and increasing infrastructure and construction activities in developing nations have also contributed to the growing demand for propylene oxide in the region. The region's booming sustainable production methods and investments in the hydrogen peroxide process further support the dominant share and rapid growth of Asia Pacific. International competition to meet high standards of pollution control between countries can also lead to transfers and innovations of cleaner, greener production technologies, especially in developing countries facing stricter environmental regulations while striving to meet immediate development needs and reduce their carbon footprint. The rising focus on green production technologies has facilitated the use of hydrogen peroxide-based production which is comparatively greener than the old chlorohydrin process.

Get Customized Report as per your Business Requirement - Request For Customized Report

North America Propylene Oxide Market Insights

North America is expected to account for a significant 45.6% share of the global Propylene Oxide market in 2025, led by strong consumption across automotive, construction, packaging, and personal care industries. The U.S. is the largest contributor, with major production hubs in Texas and Louisiana, supported by advanced infrastructure and high investments in polyurethane foams, adhesives, and coatings. Canada is also emerging with increasing demand from insulation materials and industrial applications. The region’s emphasis on sustainable manufacturing, coupled with technological advancements in energy-efficient production processes, reinforces North America’s leadership in the Propylene Oxide market.

Europe Propylene Oxide Market Insights

Europe is expected to account for 28.5% of the global Propylene Oxide market in 2025, driven by strong demand from automotive, construction, and packaging industries. Germany, France, and the UK are leading in polyurethane and propylene glycol production, supported by stringent environmental regulations and innovation in sustainable manufacturing processes. Rising investments in green chemistry and circular economy initiatives further reinforce Europe’s role as a mature and innovation-driven market for Propylene Oxide.

United States Propylene Oxide Market Insights

The United States dominates the Propylene Oxide market with a 42.3% share in 2025, supported by large-scale consumption in the automotive, building materials, and personal care industries. Key states such as Texas and Louisiana are central to production, with strong capacities in polyurethane foam and derivative chemicals. Federal initiatives for clean energy, coupled with private-sector investments in lightweight materials and high-performance plastics, are accelerating the demand for Propylene Oxide across industrial and consumer applications.

Latin America (LATAM) Propylene Oxide Market Insights

Latin America holds 11.4% of the Propylene Oxide market in 2025, fueled by growing demand in construction, refrigeration, and flexible foam applications. Brazil and Mexico are at the forefront, driven by expanding automotive manufacturing and housing development sectors. Supportive government policies and increasing foreign investments in chemical processing facilities are strengthening LATAM’s role as an emerging and steadily growing Propylene Oxide market.

Middle East & Africa (MEA) Propylene Oxide Market Insights

The Middle East & Africa region is projected to hold 18.5% of the global Propylene Oxide market in 2025, driven by infrastructure development, urban expansion, and increasing demand for insulation materials in hot climates. Countries such as Saudi Arabia, the UAE, and South Africa are expanding production capacity and diversifying applications in automotive, coatings, and adhesives. Regional collaborations with global chemical giants, along with investments in energy-efficient and sustainable manufacturing practices, are positioning MEA as a high-potential growth market.

Propylene Oxide Market Competitive Landscape

Dow Chemical

Dow Chemical is a U.S.-based chemical manufacturer specializing in performance materials and industrial chemicals, including Propylene Oxide and derivatives.

-

In May 2024, Dow expanded its propylene oxide production capacity at its Thailand facility to 250,000 tons annually, positioning it as the largest in the Asia-Pacific region. The company also announced plans for ISCC PLUS certification to support sustainable and eco-friendly production practices.

KBR

KBR is a U.S.-based engineering, procurement, and construction company providing advanced chemical technologies and solutions.

-

In May 2024, KBR secured exclusive licensing of Sumitomo Chemical’s eco-friendly Propylene Oxide via Cumene (POC) technology. This technology enables co-product-free production, significantly reducing carbon emissions and wastewater generation.

INEOS

INEOS is a global chemical company headquartered in the U.K., focusing on olefins, polymers, and specialty chemical production.

-

In May 2024, INEOS completed the USD 700 million acquisition of LyondellBasell’s Bayport facility in Texas. The acquisition enhances INEOS’s production capacity for ethylene oxide, glycols, and glycol ethers, strengthening its footprint in North America.

Propylene Oxide Market Key Players

Some of the major players in the Propylene Oxide Market are:

-

Dow Inc. (Polyether Polyols, Propylene Glycol)

-

LyondellBasell Industries Holdings B.V. (Polypropylene, Polyethylene)

-

Royal Dutch Shell PLC (Polyether Polyols, Propylene Glycol)

-

BASF SE (Propylene Glycol, Polyether Polyols)

-

SKC Company (Propylene Glycol, Polyurethane Materials)

-

AGC Inc. (Propylene Glycol, Polyether Polyols)

-

Repsol S.A. (Polyether Polyols, Propylene Glycol)

-

Sumitomo Chemical Co., Ltd. (Propylene Glycol, Polyether Polyols)

-

Tokuyama Corporation (Propylene Glycol, Polyether Polyols)

-

Indorama Ventures Public Company (Polyester, PET Resins)

-

INEOS Oxide (Ethylene Oxide, Propylene Oxide)

-

Jishen Chemical Industry Co. Ltd. (Propylene Glycol, Polyether Polyols)

-

Manali Petrochemicals (Propylene Glycol, Polyether Polyols)

-

Tianjin Dagu Chemical Co., Ltd. (Propylene Glycol, Polyether Polyols)

-

PJSC Nizhnekamskneftekhim (Propylene Glycol, Polyether Polyols)

-

PCC Rokita (Propylene Glycol, Polyether Polyols)

-

Wudi XINYUE Chemical Co., Ltd. (Propylene Glycol, Polyether Polyols)

-

Oltchim S.A. (Propylene Glycol, Polyether Polyols)

-

Wanhua Chemical Group Co. Ltd. (Polyurethane Materials, Propylene Glycol)

-

S–OIL Corporation (Propylene Glycol, Polyether Polyols)

Some of the Raw Material Suppliers for Propylene Oxide companies:

-

The Chemical Co.

-

Emerald Scientific

-

SAE Manufacturing Specialties Corp

-

ChemUniverse, Inc.

-

Del Amo Chemical Co.

-

BariteWorld

-

Mil-Spec Industries

-

Graham Chemical

-

Mallinckrodt, Inc.

-

Balchem Corp

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 22.18 Billion |

| Market Size by 2033 | USD 34.75 Billion |

| CAGR | CAGR of 5.77% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Polyether Polyols, Propylene Glycol, Glycol Ethers, Others) |

| • By Process (Chlorohydrin Process, Styrene Monomer Process, Hydrogen Peroxide Process, TBA Co-Product Process, Cumene-based Process) | |

| • By End Use (Automotive, Building & Construction, Textile & Furnishing, Chemical & Pharmaceutical, Packaging, Electronics, Others) | |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Dow Inc., LyondellBasell Industries Holdings B.V., Royal Dutch Shell PLC, BASF SE, SKC Company, AGC Inc., Repsol S.A., Sumitomo Chemical Co., Ltd., Tokuyama Corporation, Indorama Ventures Public Company, INEOS Oxide, Jishen Chemical Industry Co. Ltd., Manali Petrochemicals, Tianjin Dagu Chemical Co., Ltd., PJSC Nizhnekamskneftekhim, PCC Rokita, Wudi XINYUE Chemical Co., Ltd., Oltchim S.A., Wanhua Chemical Group Co. Ltd., S–OIL Corporation |