Potassium Soap Insecticides Market Report Scope & Overview:

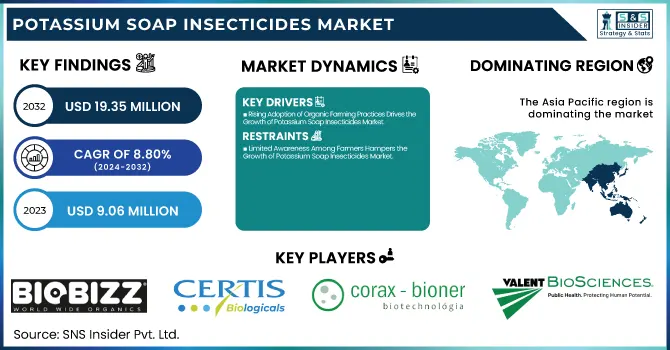

The Potassium Soap Insecticides Market Size was valued at USD 9.06 Million in 2023 and is expected to reach USD 19.35 Million by 2032, growing at a CAGR of 8.80% over the forecast period of 2024-2032.

To Get more information on Potassium Soap Insecticides Market - Request Free Sample Report

The potassium soap insecticides market is gaining momentum as demand for eco-friendly pest control rises across agriculture and horticulture. Our report explores the investment and funding landscape, showcasing financial trends driving research, innovations, and market growth. A detailed supply chain & raw material analysis highlights sourcing challenges, pricing trends, and regional dependencies. The production & consumption analysis examines manufacturing capacities, trade flows, and regional demand. A comprehensive industry & regulatory framework outlines government policies, compliance norms, and environmental standards shaping the market. Additionally, the labeling & certification requirements section deciphers organic approvals, eco-labeling, and global safety standards ensuring product credibility. This structured analysis offers key insights into the evolving potassium soap insecticides market.

Potassium Soap Insecticides Market Dynamics

Drivers

-

Rising Adoption of Organic Farming Practices Drives the Growth of Potassium Soap Insecticides Market

The increasing shift towards organic farming has significantly propelled the demand for potassium soap insecticides. With consumers becoming more conscious about food safety and environmental sustainability, organic farming is gaining widespread adoption across the globe. Farmers are actively seeking natural alternatives to synthetic pesticides, and potassium soap insecticides have emerged as a preferred choice due to their biodegradable nature and minimal environmental impact. Regulatory authorities in various countries are also promoting organic farming by offering subsidies and incentives, further fueling market growth. Additionally, the rising number of organic certifications and stringent regulations on chemical pesticide usage have encouraged growers to adopt potassium soap insecticides. As agricultural sustainability becomes a priority, the demand for eco-friendly pest control solutions is expected to increase, creating lucrative opportunities for market expansion.

Restraints

-

Limited Awareness Among Farmers Hampers the Growth of Potassium Soap Insecticides Market

Despite the numerous benefits of potassium soap insecticides, many farmers, especially in developing regions, remain unaware of their effectiveness and applications. Traditional reliance on chemical pesticides continues to dominate the agricultural sector, as synthetic solutions are often perceived to be more potent and readily available. Lack of technical knowledge regarding the correct application methods, dosage, and pest-specific efficacy further limits the adoption of potassium soap insecticides. Additionally, marketing efforts from large agrochemical companies that manufacture synthetic pesticides overshadow the promotion of eco-friendly alternatives. Governments and industry players need to implement awareness campaigns, training programs, and demonstration trials to educate farmers on the benefits of potassium soap insecticides. Without adequate knowledge dissemination, the market potential remains underutilized, restricting growth opportunities.

Opportunities

-

Growing Popularity of Home Gardening and Urban Farming Creates New Opportunities for Potassium Soap Insecticides Market

The rising trend of home gardening, urban farming, and indoor plant cultivation has opened new growth avenues for the potassium soap insecticides market. As more individuals engage in growing their own fruits, vegetables, and ornamental plants, the demand for safe and non-toxic pest control solutions has surged. Home gardeners and small-scale urban farmers prefer organic and chemical-free pesticides to ensure the health and safety of their produce. Additionally, the expansion of community gardens and rooftop farming initiatives has further fueled the need for sustainable pest control methods. Online retail platforms and garden centers have also contributed to the increased availability of potassium soap insecticides, making them accessible to a broader consumer base. This shift towards self-sustained food production and greener living is expected to drive the market forward.

Challenge

-

Competition from Synthetic Pesticides Poses a Challenge for the Growth of Potassium Soap Insecticides Market

Despite the increasing demand for eco-friendly pest control solutions, synthetic pesticides continue to dominate the global agricultural sector. Many farmers still prefer chemical-based pesticides due to their immediate and long-lasting effects on pest populations. Synthetic insecticides often provide broad-spectrum control, which potassium soap insecticides may lack, leading to concerns about their overall effectiveness. Additionally, aggressive marketing strategies and widespread availability of synthetic pesticides make it challenging for organic alternatives to gain market share. Educating farmers and stakeholders about the long-term benefits of potassium soap insecticides, such as reduced environmental impact and improved soil health, is essential to overcome this challenge.

Potassium Soap Insecticides Market Segmental Analysis

By Crop Type

Fruits & Vegetables dominated the Potassium Soap Insecticides Market in 2023 with a 38.5% market share. The widespread cultivation of fruits and vegetables, particularly in organic farming, has driven the demand for potassium soap insecticides due to their efficacy in controlling soft-bodied pests without toxic residues. Regulatory bodies such as the European Union’s Farm to Fork Strategy and the United States Department of Agriculture (USDA) have emphasized reducing chemical pesticide use in fruit and vegetable production, favoring organic alternatives. Organizations like the Organic Trade Association (OTA) report a rising preference for pesticide-free produce, further bolstering the adoption of potassium soap insecticides. Additionally, major agribusinesses and cooperatives have increasingly promoted sustainable pest management solutions for fruits and vegetables, strengthening this segment's dominance.

By Formulation Type

Liquid Concentrate dominated the Potassium Soap Insecticides Market in 2023 with a 65.3% market share. This formulation is preferred due to its cost-effectiveness, ease of dilution, and suitability for large-scale agricultural applications. The Food and Agriculture Organization (FAO) has highlighted the growing adoption of liquid organic insecticides in integrated pest management (IPM) programs, particularly in sustainable agriculture initiatives. Governments worldwide, including Canada and the European Union, have encouraged farmers to transition from synthetic to liquid organic pesticides for improved efficacy. Moreover, leading manufacturers have expanded their production of concentrated formulations to meet the rising demand from commercial farmers, reinforcing this segment’s market leadership.

By Pest Type

Aphids dominated the Potassium Soap Insecticides Market in 2023 with a 28.6% market share. Aphids are among the most destructive agricultural pests, infesting a wide range of crops, including fruits, vegetables, and ornamentals. The University of California Integrated Pest Management (UC IPM) Program and the European Plant Protection Organization (EPPO) have reported that aphid infestations cause significant yield losses, prompting farmers to seek eco-friendly control methods. Potassium soap insecticides are highly effective against aphids due to their ability to disrupt the pests' protective waxy layer, leading to desiccation. Additionally, government initiatives promoting organic farming and banning neonicotinoids—previously used against aphids—have further fueled the demand for potassium soap-based solutions in aphid control.

By Distribution Channel

Agrochemical Stores dominated the Potassium Soap Insecticides Market in 2023 with a 30.7% market share. These stores are a primary source for farmers and commercial growers seeking pest control solutions tailored to their specific agricultural needs. The increasing awareness of sustainable farming practices has led agrochemical retailers to expand their offerings of bio-based insecticides, including potassium soap formulations. Reports from the National Pesticide Information Center (NPIC) indicate that professional consultation at agrochemical stores plays a crucial role in influencing farmers’ purchasing decisions. Additionally, government agricultural extension programs often collaborate with these stores to promote environmentally friendly pesticide alternatives, reinforcing their position as the leading distribution channel.

Potassium Soap Insecticides Market Regional Outlook

Asia Pacific dominated the Potassium Soap Insecticides Market in 2023 with an estimated market share of 42.6%. The region's leadership is driven by its vast agricultural base, high reliance on eco-friendly pest control solutions, and government initiatives promoting organic farming. Countries like China, India, and Japan have been key contributors to this dominance. China, the world's largest agricultural producer, has implemented stringent regulations on synthetic pesticides, boosting demand for bio-based alternatives like potassium soap insecticides. According to the Ministry of Agriculture and Rural Affairs of China, organic farming in the country has expanded significantly, creating substantial market opportunities. India, with its growing organic farming sector and government-backed programs such as the National Programme for Organic Production (NPOP), has witnessed a surge in demand for potassium-based pesticides. Japan, a leader in sustainable agriculture, has seen increasing adoption of potassium soap insecticides, with the Japan Organic & Natural Foods Association (JONA) reporting a rise in organic-certified farms. Additionally, favorable trade policies and increasing awareness among farmers regarding the harmful effects of chemical pesticides have further driven market expansion in Asia Pacific.

On the other hand, North America emerged as the fastest-growing region in the Potassium Soap Insecticides Market during the forecast period, with a significant CAGR in the forecast period. The rapid growth is fueled by increasing consumer demand for organic food, stringent pesticide regulations, and advancements in sustainable farming practices. The United States dominates the regional market due to strong government support for organic agriculture, with the U.S. Department of Agriculture (USDA) allocating significant funds for research and development in biopesticides. According to the Organic Trade Association (OTA), organic food sales in the U.S. surpassed $60 billion in 2023, driving the need for eco-friendly pesticides like potassium soap insecticides. Canada is also witnessing robust growth, supported by initiatives like the Canadian Organic Standards (COS), which encourage the use of biopesticides in organic farming. Mexico, a major exporter of organic produce to the U.S., has seen rising adoption of potassium soap insecticides as farmers comply with stringent pesticide residue limits set by international trade regulations. The increasing presence of organic farming cooperatives, along with a shift toward integrated pest management (IPM) strategies, is further accelerating the market’s growth across North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Ankor S.A.S.

-

Biobizz Worldwide S.L.

-

Certis USA L.L.C.

-

Corax Bioner Co.

-

Ecospray Limited

-

Ecoworm Limited

-

Green Earth Agro Science

-

Kriya Biosys Private Limited

-

Kao Corporation

-

OHP, Inc. (AMVAC Chemical Corporation)

-

PROMISOL S.A.

-

Sineria Agricola

-

SPAA SRL

-

Valent BioSciences LLC

-

Vellsam Materias Bioactivas S.L.

-

Victorian Chemical Company Pty Ltd.

-

W. Neudorff GmbH

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.06 Million |

| Market Size by 2032 | USD 19.35 Million |

| CAGR | CAGR of 8.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Crop Type (Fruits & Vegetables, Small Trees & Shrubs, Ornamental Plants, Greenhouse Crops, Herbs & Spices, Others) •By Formulation Type (Liquid Concentrate, Ready-to-Use Spray) •By Pest Type (Aphids, Whiteflies, Thrips, Mites, Others) •By Distribution Channel (Supermarkets, Specialty Stores, Agrochemical Stores, Garden Centers/Nurseries, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BONIDE Products LLC, Certis USA L.L.C., Kao Corporation, OHP, Inc. (AMVAC Chemical Corporation), W. Neudorff GmbH, Corax Bioner Co., PROMISOL S.A., SPAA SRL, Vellsam Materias Bioactivas S.L., Victorian Chemical Company Pty Ltd. and other key players |