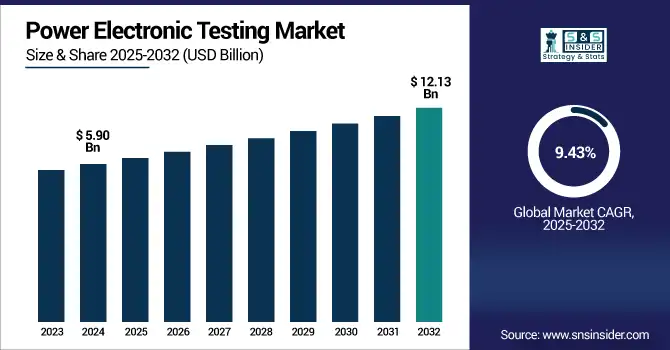

Power Electronic Testing Market Size Analysis:

The Power Electronic Testing Market size was valued at USD 5.90 Billion in 2024 and is projected to reach USD 12.13 Billion by 2032, growing at a CAGR of 9.43% during 2025-2032. The power electronic testing market is experiencing robust growth due to the increasing adoption of electric vehicles, renewable energy systems, and advanced semiconductor materials including SiC and GaN are driving strong growth in the power electronic testing market. Such technologies require deadline-bound testing solutions that accurately characterize the powertrain performance of, and assure safety and optimize energy efficiency in these technologies with relentless efficiency and reliability. The scope of power electronic testing is expanding to include multi-mode, thermal, and high-voltage aspects, driven by the integration of digital control and IoT, increasing system complexity and interdependence.

To Get more information on Power-Electronic-Testing-Market - Request Free Sample Report

Similarly, increasing global focus on energy efficiency standards, regulatory compliance, and product reliability is boosting the market for advanced testing infrastructure. Consequently, this change is also transforming the market landscape, with power electronic testing being an integral aspect in bringing about next-generation mobility and energy solutions.

Geely introducing the Radar super hybrid pickup with 620 miles of range, says 'tech stacked on tech stacked on tech' meets advanced off-road desires with Omni Stack energy and Shuttle IoT platforms Based on the M.A.P. platform, it uses the Thor EM system and an industry-first 3-speed hybrid transmission which have been validated over 25 million miles of endurance testing.

The U.S Power Electronic Testing Market size was valued at USD 1.06 Billion in 2024 and is projected to reach USD 2.28 Billion by 2032, growing at a CAGR of 10.07%during 2025-2032. This Power Electronic Testing market growth is driven by increase in use of electric vehicles, renewable energy systems, and advance semiconductor, such as SiC and GaN. Automotive, energy, and industrial applications are generating strong growth in demand for various testing solutions to ensure efficiency, reliability, and compliance to these technologies that require precise, high-voltage, and high frequency testing.

Power Electronic Testing Market Dynamics:

Drivers:

-

Growing Adoption of Advanced Semiconductors Fuels Demand for Power Electronic Testing

The power electronic testing market is driven by the increasing demand for reliable and efficient testing solutions as advanced semiconductor materials including silicon carbide (SiC) gain prominence in high-performance applications. These materials require rigorous validation to ensure durability, thermal stability, and high-voltage tolerance under extreme conditions. The complexity of modern power electronic systems, used across electric vehicles, renewable energy, and aerospace, further amplifies the need for precise testing to guarantee safety and performance. Additionally, growing regulatory standards and the push for energy-efficient, robust power devices are fueling investments in sophisticated testing infrastructure, making power electronic testing essential for the development and deployment of next-generation technologies.

China successfully orbit tested a new silicon carbide (SiC) power device aboard Tianzhou-8, the spacecraft demonstrating its efficiency and radiation resistance for potential aerospace applications. China's aspirations for advanced lightweight energy systems for its lunar and deep space missions are supported by this breakthrough.

Restraints:

-

High Equipment Costs Limit SME Participation, Slowing Innovation and Competition in Power Electronic Testing

The high price of the latest testing equipment, specifically for systems concerning wide bandgap semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN), is a major restraint in the power electronic testing market. This involves making a big investment in capital-intensive, high frequency, and high-voltage testing platforms that have high-precision measurement capabilities, to say the least. Having such advanced equipment is costly and may not financially appeal to a small or medium-sized enterprise (SME), leading them to be unable to enter the market or compete at all. There are additional expenses, such as the price of specialists and upkeep. Such barriers not only hinder innovation and product development among smaller players, but also play a role in market concentration, with fewer competitors in the space reducing competition and ultimately slowing adoption of the technology overall.

Opportunities:

-

Rising Complexity in High-voltage, Multi-channel Systems Creates Demand for Advanced Power Electronic Testing Solutions

As power electronic systems grow more complex incorporating high-voltage, multi-channel architectures and advanced semiconductor materials the need for precise, high-bandwidth testing tools becomes critical. This shift opens significant market opportunities for testing solutions that offer galvanic isolation, high-frequency accuracy, and parallel testing capabilities. Industries including electric vehicles, renewable energy, and aerospace increasingly require compact, scalable test platforms that can handle diverse voltage and current ranges efficiently. The growing focus on energy recovery, miniaturization, and system integration further drives demand for sophisticated, multifunctional testing equipment. Vendors offering flexible, high-performance test solutions are well-positioned to capitalize on this expanding need across emerging and high-growth applications.

Tektronix’s newest test tools integrate RF-isolated current probes and a triple-channel bidirectional power supply to deliver the ability to perform high-density and high-precision testing in complex electrical systems. This innovation enables higher throughput and efficient validation of high-voltage power devices utilized in electric vehicles (EVs), renewables, and advanced semiconductor applications.

Challenges:

-

Evolving Semiconductor Technologies Demand Advanced Testing Capabilities, Raising Complexity and Compliance Challenges

A major challenge in the power electronic testing market is keeping pace with rapidly evolving technologies and performance standards. As devices increasingly use wide bandgap materials including SiC and GaN, they operate at higher frequencies, voltages, and thermal loads, requiring testing solutions with greater precision, faster response times, and higher isolation. Traditional testing systems often fall short in meeting these demands, leading to inaccurate measurements or system inefficiencies. Moreover, the lack of universally accepted testing standards across global markets complicates compliance and interoperability. Combined with the need for specialized skillsets and rising test system complexity, these factors can delay product validation, increase costs, and hinder time-to-market for manufacturers.

Power Electronic Testing Market Segmentation Analysis:

By Provision Type

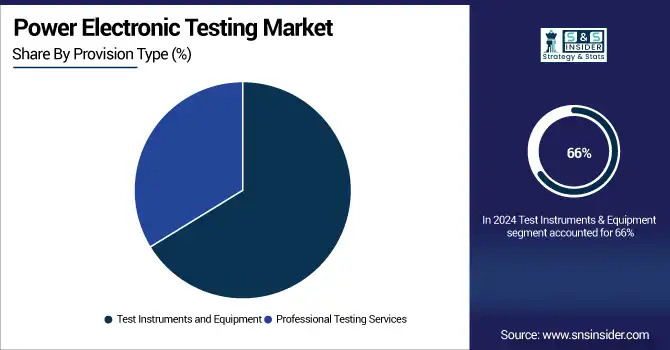

In 2024, the Test Instruments and Equipment segment accounted for approximately 66% of the Power Electronic Testing market share due to the high demand for sophisticated and high precision tools to meet the needs of the latest SiC/GaN technology. To develop novel electric vehicle and renewable energy applications and to validate hardware performance, and other attributes including safety and reliability.

The Professional Testing Services segment is expected to experience the fastest growth in Power Electronic Testing market over 2025-2032 with a CAGR of 13.13% driven by the rising trend of outsourcing complex testing tasks, particularly of SiC and GaN devices, to specialized service providers. It is understandable that companies are preferring third party and outsourced expertise as they help them adhere to the regulations without letting the inner floor consume unnecessary testing expenses and time to react, and get them the fast results for a vigorous product development cycle.

By Device Type

In 2024, the Individual Power Provision Types segment accounted for approximately 61% of the Power Electronic Testing market share, this dominance is attributed to the growing need for component-level testing across diverse applications, enabling precise performance analysis and fault detection. The Power Electronic Testing market trends reflects rising demand for tailored and high-accuracy power testing setups in sectors including EVs, industrial automation, and renewable energy.

The Multi-Device Modules segment is expected to experience the fastest growth in Power Electronic Testing market over 2025-2032 with a CAGR of 16.89%. This expansion is fueled by the continued movement toward the integration of multiple power devices into practical, compact multi-device modules using the unique advantages of SiC for high-power and high-frequency applications in some of the most demanding environments for high-performance devices for EVs, renewable energy systems, and aerospace applications. With systems getting more complex, the ability to test multiple components in a single module at the same time is essential, leading to an increased requirement for advanced multi-device testing solutions.

By End-Use

In 2024, the Automotive and Mobility Solutions segment accounted for approximately 61% of the Power Electronic Testing market share, driven by the rapid shift toward electric and hybrid vehicles. The growing need to test high-performance powertrains, battery systems, inverters, and onboard chargers for safety, efficiency, and regulatory compliance is fueling demand for advanced, automotive-specific power electronic testing solutions.

The Renewable Power and Utility Networks segment is expected to experience the fastest growth in Power Electronic Testing market over 2025-2032 with a CAGR of 18.45%. This growth is fueled by increasing installation of solar, wind, and energy storage drives need for accurate testing of inverters, converters and grid interface electronics enabling the expansion of renewables while driving safety and energy compliance standardization.

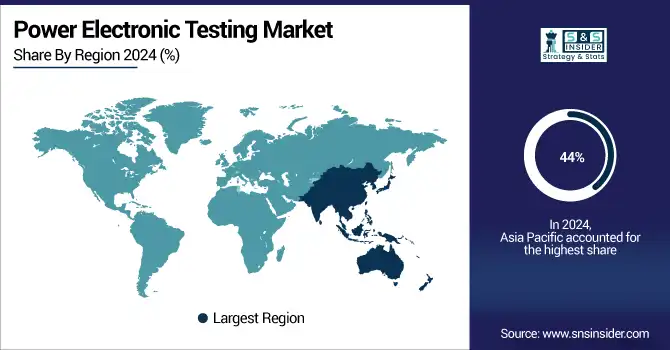

Power Electronic Testing Market Regional Outlook:

In 2024, Asia Pacific dominated the Power Electronic Testing market and accounted for 44% of revenue share, due to the high presence of consumer electronic, electric vehicle production and semiconductor manufacturing in the region. Chinese, Japanese, and South Korean national laboratories are developing multitudes of high-voltage testing infrastructure to keep up with fast-paced developments in power electronics and remain globally competitive.

BYD and Orange Charging have unveiled ultra-fast EV chargers in China, allowing the addition of 100km of range in one minute, as BYD says it will lead the world in EV infrastructure. Those advances are lifting new global standards for not only high-voltage power transfer, but also battery charging speeds.

North America is expected to witness the fastest growth in the Power Electronic Testing over 2025-2032, with a projected CAGR of 11.14%. This growth is fueled by rising investments in EV manufacturing, renewable energy projects, and semiconductor innovation. Supportive policies including the Inflation Reduction Act are accelerating testing demand for high-efficiency power systems across automotive, industrial, and energy sectors.

In 2024, Europe emerged as a promising region in the Power Electronic Testing market, owing to the expansive electric vehicle industry, integration of renewable energy resources, and stringent regulatory standards regarding energy efficiency and safety. Germany, France, and the Netherlands are ramping up the investment in advanced testing infrastructure to facilitate innovation, compliance, and deployment of high-performing infrastructure, and power electronic systems.

Kia’s EV3 launch in Europe, featuring fast-charging and regenerative systems, highlights the growing need for advanced power electronic testing to ensure the performance, safety, and efficiency of modern EVs in the region’s rapidly evolving electric mobility landscape.

LATAM and MEA are experiencing steady growth in the Power Electronic Testing market, due to gradually growing electrification, coupled with industrial automation, and the adoption of renewable energy. The development of grid modernization and EV infrastructure in such regions have become attractive markets for reliable grid testing solutions. The gradual growth in power electronic testing services due to increase in awareness regarding energy efficiency and safety standards is also supporting the growth of power electronic test market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Power Electronic Testing Companies are SGS SA, Bureau Veritas, Intertek Group plc, Advantest Corporation, Teradyne Inc., DEKRA, TÜV SÜD, National Instruments Corp., TÜV Rheinland, TÜV NORD Group, UL LLC, Cohu Inc., Rohde & Schwarz, Keysight Technologies, Chroma ATE Inc., Tektronix, EA Elektro-Automatik, Fluke Corporation, Yokogawa Electric Corporation, Sigma-Aldrich (Merck KGaA), aand Others.

Recent Developments:

-

In Nov 2024, Keysight introduced advanced 3kV wafer-level test solutions for power semiconductors, enhancing defect detection and ensuring reliability in high-voltage applications.This development supports critical sectors including EVs, renewables, and industrial automation by improving early-stage power device validation.

-

In July 2025, Rohde & Schwarz has acquired ZES ZIMMER Electronic Systems GmbH to expand its power electronics testing portfolio.This strategic move strengthens its position in electromobility, industrial electronics, and renewable energy sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.90 Billion |

| Market Size by 2032 | USD 12.13 Billion |

| CAGR | CAGR of 9.43% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Provision Type(Test Instruments and Equipment, Professional Testing Services) • By Device Type(Individual Power Provision Types, Multi-Device Modules, Power Management ICs) • By End Use (Industrial Automation and Machinery, Automotive and Mobility Solutions, Information & Communication Technology (ICT), Consumer Electronics and Devices, Renewable Power and Utility Networks, Aerospace and Defense Applications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Power Electronic Testing companies SGS SA, Bureau Veritas, Intertek Group plc, Advantest Corporation, Teradyne Inc., DEKRA, TÜV SÜD, National Instruments Corp., TÜV Rheinland, TÜV NORD Group, UL LLC, Cohu Inc., Rohde & Schwarz, Keysight Technologies, Chroma ATE Inc., Tektronix, EA Elektro-Automatik, Fluke Corporation, Yokogawa Electric Corporation, Sigma-Aldrich (Merck KGaA).and Others. |