Ultrafast Laser Market Size & Trends:

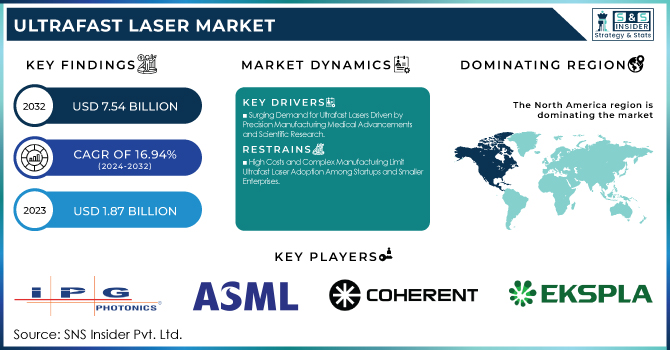

The Ultrafast Laser Market Size was valued at USD 1.87 billion in 2023 and is expected to reach USD 7.54 billion by 2032, growing at a CAGR of 16.94% over the forecast period 2024-2032. The ultrafast laser market is penetrating deeper & being adopted in a wide range of industries such as medicine, electronics, automotive, & scientific research as they are considered fast, accurate & effective tools. Industry Segmentation indicates that advanced manufacturing is very popular in large enterprises but small and medium are also gradually adopting affordable efficient solutions.

To get more information on Ultrafast Laser Market - Request Free Sample Report

Micromachining, medical surgeries, and spectroscopy are particularly notable applications where utilization is extremely high on account of the ultrahigh picture quality & limited thermal damage needed. Revenue is segmented based on applications that are material processing and medical devices, and with steadily developing applications based on scientific research & development (SR&ED), especially in the area of quantum computing and ultra-fast spectroscopy.

Ultrafast Laser Market Dynamics

Key Drivers:

-

Surging Demand for Ultrafast Lasers Driven by Precision Manufacturing Medical Advancements and Scientific Research

Increasing demand for high-precision manufacturing and micromachining in electronics, automotive, and aerospace sectors is expected to drive the ultrafast laser market. They deliver high precision and low heat penetration, which is suitable for the delicate processing of materials. Moreover, the bulk of this end-user is using ultrafast lasers for eye surgeries, dermatology, and cancer treatment driving the overall market growth of ultrafast lasers in the medical and healthcare sector. Femtosecond and attosecond lasers are implemented for scientific research that requires ultrafast phenomena the development of which is also being driven in part by advances in technology. Additionally, increasing applications of ultrafast lasers in spectroscopy, imaging, and diagnostics are also driving up their demand.

Restrain:

-

High Costs and Complex Manufacturing Limit Ultrafast Laser Adoption Among Startups and Smaller Enterprises

High upfront costs and complicated manufacturing processes act as a substantial restraints in the market. Ultrafast lasers are expensive to produce because the components and technology behind them are sophisticated, which means they are typically beyond the reach of startups and small and medium-sized enterprises. In addition, keeping these lasers accurate and consistent requires unique knowledge and facilities, and thus higher ongoing costs. Ultrafast laser systems don't adhere to a standard as such, which means they don't always fit existing manufacturing systems. This may reduce adoption on a larger level, especially in industries with fixed budgets.

Opportunity:

-

Growing Applications and R&D Investments Unlock Lucrative Opportunities for Ultrafast Laser Manufacturers

As an increasing number of applications emphasize miniaturization and precision manufacturing, ultrafast laser manufacturers will benefit from strong growth opportunities. New growth opportunities in biophotonics and advanced material research Furthermore, The market is projected to be driven during the forecast period due to the rise in investment in research and development for the improved efficiency and functionality of attosecond lasers. Ultrafast lasers have potential in the quantum computing and communication technology field, which also seems like a lucrative growth area. In addition, the increasing application of laser in additive manufacturing and 3D printing is creating more opportunities for manufacturers to explore new markets.

Challenges:

-

Skill Shortages Safety Concerns and Competition Challenge Ultrafast Laser Market Growth and Adoption

A common factor hindering the growth of the ultrafast laser market is the lack of personnel that is skilled enough in the design, operation, and maintenance of ultrafast systems. Despite several promising applications, the inherent challenge of the steep learning curve of ultrafast laser technology limits its utility. In addition, the possibility of high-intensity beams creating safety concerns might call for rigorous adherence to regulations that complicate product development and commercialization. Keeping up with the rapid pace of technological advancements is also a challenge because manufacturers face an uphill battle of constant innovation to remain competitive. Furthermore, competition from other technologies like picosecond lasers and precision machining tools may also limit the growth of the market.

Ultrafast Laser Market Segmentation Outlook

By Laser Type

The ultrafast laser market was led by Fiber Lasers, which had a strong share of 41.3% in 2023. This leadership is attributed to their high efficiency and reliability, along with their extraordinary versatility with material processing, medical devices, and all areas of telecommunications. Manufacturers are increasingly opting for fiber lasers due to their favorable quality, reduced maintenance, and cost in comparison to other products. They also further contributed to more market share growth as they were being increasingly adopted in precision manufacturing and micromachining.

Mode-locked lasers are expected to register the fastest CAGR from 2024-2032. Due to this outstanding pulse duration and stability, these lasers are used for advanced scientific, biomedical imaging, and spectroscopy applications, and this growth can be seen. Their widespread expansion is propelled by increasing demands for ultrafast pulses in applications, such as multiphoton microscopy and attosecond physics research.

By Pulse Duration

Femtosecond Lasers hold the dominant share in the ultrafast laser market, accounting for 49.6% in 2023. This leadership is largely due to their high level of adoption in medical and healthcare applications in areas such as eye surgeries and precise cutting of tissue. Femtosecond laser also allows for the shortest pulse, thus generating minuscule thermal heat, making them ideal for micromachining and material processing. Moreover, their market share was increased owing to high versatility in scientific research and spectroscopy.

The attosecond lasers segment is slated to witness the highest CAGR between 2024 to 2032 Such growth comes from their unmatched pulse length, which is ideal for electron dynamic and ultrafast phenomena observations on the atomic scale. Next-Gen Opto-Electronic Plans to Roll Out Most of the rapid uptake is in advanced scientific research, but also quantum computing and attosecond spectroscopy.

By Application

The ultrafast laser market by Application was led by Medical and Healthcare with a share of 39.6% in 2023. This dominance was attributed to their widespread application in ophthalmology, especially LASIK eye surgery and other precision surgical specialties including dermatology and cancer. This allows for greater specificity with less thermal damage to surrounding tissue, leading to improved patient results when a laser is used. Furthermore, the rising uses of these instruments in medical imaging and diagnostics also helped in augmenting their market share.

The Scientific Research and Development segment is anticipated to have the highest CAGR of more than 17.3% over the forecast period from 2024 to 2032. The growth is driven by the increasing demand for advanced laser systems integrated with ultrafast spectroscopy, quantum physics, and attosecond science. Increasing funding for the study of ultrafast phenomena and molecular dynamics in research institutions and collaborations with academic organizations is speeding up such systems' adoption.

Ultrafast Laser Market Regional Analysis

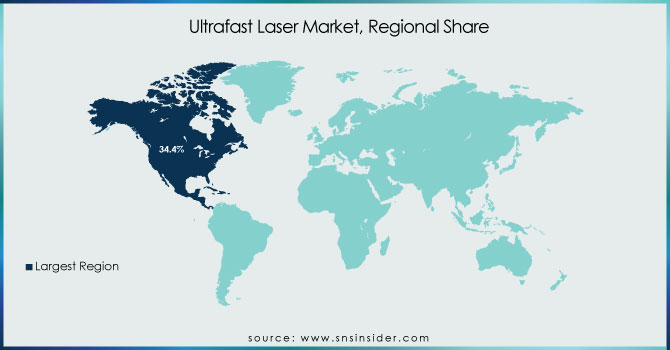

North America accounted for 34.4% of the global share in 2023. Leadership in this field is powered by sophisticated research facilities, strong healthcare infrastructure, and high demand for precision manufacturing in sectors such as aerospace, defense, and electronics. Key market players such as Coherent Inc. and IPG Photonics also enhance the region's market. Femtosecond lasers are utilized in the medical sector in LASIK surgeries and dermatology procedures. Also, many North American research institutes such as MIT and Stanford University are using ultrafast lasers in leading-edge research in the fields of quantum computing and attosecond physics.

Asia Pacific is estimated to show the maximum CAGR from 2024 to 2032. China, Japan, and South Korea are leading the adoption of ultrafast lasers for applications in consumer electronics manufacturing, precision micromachining, and material processing, among others. Japanese companies (Hamamatsu Photonics and Trumpf, for example) are extending their ultrafast laser applications for automotive, as well as for electronics. Moreover, the high emphasis on scientific research with advanced technologies in China and South Korea being leading countries in semiconductor manufacturing is giving a boost to the market growth in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Ultrafast Laser Market are:

-

IPG Photonics (YLPF-100-1-50-R, YLPP-1-150-20-20)

-

ASML Holding (TWINSCAN NXT:1950i, TWINSCAN NXE:3600D)

-

Coherent, Inc. (Monaco, Fidelity)

-

Ekspla (FemtoLux 30, Atlantic Series)

-

Amplitude Laser (Satsuma, Tangor)

-

Light Conversion (PHAROS, CARBIDE)

-

Spectra-Physics (Spirit, InSight)

-

Trumpf (TruMicro Series 2000, TruMicro Series 5000)

-

NKT Photonics (aeroPULSE, SuperK Extreme)

-

Menlo Systems (Orange One, BlueCut)

-

Onefive (Origami 10, Katana 05 HP)

-

Thales Group (Alcor, PetaWatt)

-

EKSMA Optics (NL940 Series, PT403)

-

Quantel Laser (Taranis, EverGreen)

-

Lumibird (Merion C, Centurion)

Recent Trends

-

In January 2025, IPG Photonics will showcase its latest fiber laser innovations for micro-machining, cleaning, and advanced applications, including quantum computing solutions, at Photonics West 2025.

-

In November 2024, Lumibird signed an agreement to acquire the Continuum nanosecond laser product line and its service business from Amplitude Laser Group, enhancing its solid-state laser offerings.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.87 Billion |

| Market Size by 2032 | USD 7.54 Billion |

| CAGR | CAGR of 16.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Laser Type (Fiber Lasers, Solid-State Lasers, Mode-Locked Lasers, Others) • By Pulse Duration (Picosecond Lasers, Femtosecond Lasers, Attosecond Lasers) • By Application (Medical and Healthcare, Material Processing, Scientific Research and Development, Automotive and Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IPG Photonics, ASML Holding, Coherent Inc., Ekspla, Amplitude Laser, Light Conversion, Spectra-Physics, Trumpf, NKT Photonics, Menlo Systems, Onefive, Thales Group, EKSMA Optics, Quantel Laser, Lumibird. |