Preclinical CRO Market Report Scope & Overview:

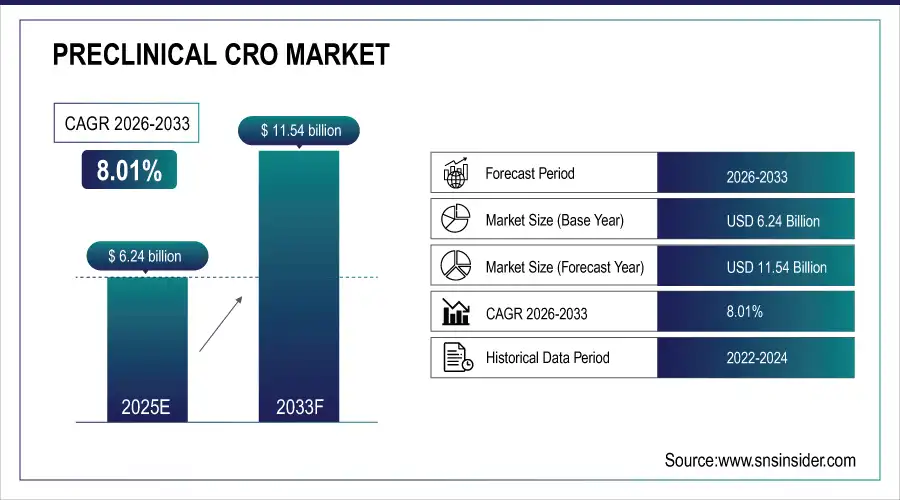

The Preclinical CRO Market Size was valued at USD 6.24 Billion in 2025E and is expected to reach USD 11.54 Billion by 2033 and grow at a CAGR of 8.01% over the forecast period 2026-2033.

The Preclinical CRO Market analysis growth, owing to the Rising outsourcing of preclinical research from pharma, and biotech companies. With the rapid expansion of drug development pipelines, companies are keen to reduce operational costs, and thus using specialist CROs to accelerate time-to-market for key services such as toxicology, bioanalysis and compound management. According to study, Patient-Derived Organoids (PDOs) and Xenograft (PDX) models are utilized in nearly 40% of oncology preclinical studies, improving predictive accuracy for clinical trials.

Market Size and Forecast:

-

Market Size in 2025: USD 6.24 Billion

-

Market Size by 2033: USD 11.54 Billion

-

CAGR: 8.01% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Preclinical CRO Market - Request Free Sample Report

Preclinical CRO Market Trends

-

Increasing pharmaceutical outsourcing enhances efficiency, reduces costs, and accelerates drug development.

-

Adoption of advanced models like PDOs and PDX improves predictive trial outcomes.

-

Biotechnology companies are prioritizing external partnerships for specialized preclinical research services.

-

Expansion into emerging markets drives CRO growth and regional service adoption.

-

Strategic collaborations between CROs and local institutes strengthen global market presence.

-

Rising complexity of drug candidates’ fuels demand for sophisticated preclinical testing platforms.

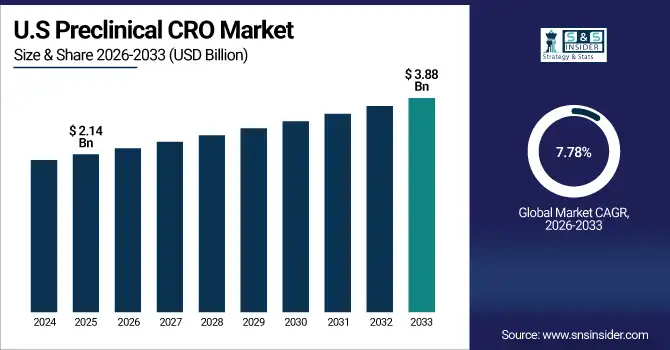

The U.S. Preclinical CRO Market size was USD 2.14 Billion in 2025E and is expected to reach USD 3.88 Billion by 2033, growing at a CAGR of 7.78% over the forecast period of 2026-2033, due to strong pharmaceutical R&D investment, advanced laboratory infrastructure, and high demand for outsourced toxicology and bioanalysis services. Regulatory compliance, innovation in drug discovery, and biotech expansion further accelerate market growth.

Preclinical CRO Market Growth Drivers:

-

Outsourcing Preclinical Research Accelerates Drug Development and Enhances Study Efficiency

The Preclinical CRO Market growth driven by, increasing outsourcing of preclinical research activities from pharmaceutical and biotechnology companies. Outsourcing strategy helps the companies to minimize operational pressures, access specialized expertise, and speed up the overall drug development process. The more modern therapeutic options becoming available, including biologics and gene therapies, led to internal laboratories not necessarily having the infrastructure or skill sets to run the most complex studies looking at toxicology, bioanalysis, and compound management. The advanced testing models provided by CROs such as Patient-Derived Organoids (PDOs) and Xenograft (PDX) models can improve the predictive accuracy of clinical trial outcomes and increase the success rate of drug development pipelines.

Companies leveraging CROs can achieve 20–25% faster preclinical study timelines compared to fully in-house research.

Preclinical CRO Market Restraints:

-

High Operational Costs of Advanced Models Challenge Market Expansion Globally

A major restraint limiting market growth is the high operational cost associated with advanced preclinical models. PDOs and PDX models are expensive; they require unique laboratory infrastructure and personnel with extensive scientific training and experience and that also needs to comply with regulatory requirements. These requirements may be difficult for smaller biotech firms and startups to meet and can restrict access to cutting-edge testing platforms. Furthermore, compliance with Good Laboratory Practice (GLP) and other regulatory standards makes it even more complex and operationally heavier and results in a lower market adoption, especially by new or emerging market players.

Preclinical CRO Market Opportunities:

-

Emerging Markets Offer Strategic Growth Potential for Preclinical CRO Services

The Emerging regions such as Asia-Pacific and Latin America provide significant opportunities for the Preclinical CRO market. This trend is further supported by their growing pharmaceutical and biotechnology R&D activities, availability of skilled workforce, and favorable regulatory policies, making them attractive markets for CROs. CROs are able to address a fresh set of clienteles as those with regional footprints and local partnerships are able to shorten the lead times and expand adoption of services to geographies where preclinical outsourcing is only now gaining traction. The geographic expansion helps CROs diversify their business and capitalizes on growth.

Emerging regions provide a talent pool, with an estimated 35–40% of global preclinical scientists based in Asia-Pacific and Latin America.

Preclinical CRO Market Segmentation Analysis:

-

By Service: In 2025, Toxicology Testing led the market with a share of 30.45%, while Bioanalysis and DMPK Studies is the fastest-growing segment with a CAGR of 8.50%.

-

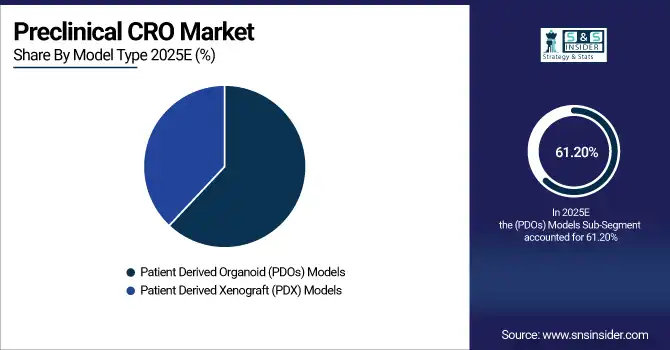

By Model Type: In 2025, Patient Derived Organoid (PDOs) Models led the market with a share of 61.20%, while Patient Derived Xenograft (PDX) Models is the fastest-growing segment with a CAGR of 9.10%.

-

By Application: In 2025, Oncology led the market with a share of 32.06%, while Neurology is the fastest-growing segment with a CAGR of 9.20%.

-

By End Users: In 2025, Biopharmaceutical Companies led the market with a share of 55.60%, while Research Institutes and Universities is the fastest-growing segment with a CAGR of 10.10%.

By Service, Toxicology Testing Leads Market and Bioanalysis and DMPK Studies Fastest Growth

The Toxicology Testing lead the market in 2025, owing to its fundamental importance in assessing the safety and potential hazards of new drug candidates prior to their clinical testing. The dominance is attributed to the growing complexity of pharmaceutical and biotechnology pipelines and the demand for extensive toxicological evaluation to comply with regulatory standards. Meanwhile, the Bioanalysis and DMPK Studies is fastest growing segment, driven by the increasing need of precise pharmacokinetic and metabolic profiling of new compounds. Robust growth, making this segment a key focus area for the CROs related to the introduction of advanced analytical techniques coupled with high demand to accurately measure drug concentration and metabolism from biological systems.

By Model Type, Patient Derived Organoid (PDOs) Models Lead Market and Patient Derived Xenograft (PDX) Models Fastest Growth

The Patient Derived Organoid (PDOs) Models lead the market in 2025, as they are highly representative of human tissue architecture and expected to provide high level of predictive insights related to drug efficacies and safety. They are especially popular in oncology research, where faithful tumor biology modeling is essential to moving candidates forward to the clinic. However, Patient Derived Xenograft (PDX) Models segment is projected to grow at the highest rate due to the growing requirement for an in vivo model that mimic human tumor responses. PDX studies are gaining traction as innovations in the technologies that support model development drive an increase in preclinical oncology studies and the growing interest in personalized medicine (PM) fuels PDX study adoption, which presents vast potential for CROs.

By Application, Oncology Leads Market and Neurology Fastest Growth

The Oncology leads the market in 2025, driven by high prevalence of cancer and the Growing investments in drug development for oncology. Oncology is the highest revenue-generating application, where CROs are highly involved in preclinical profession that assesses the mechanism of action, safety and toxicity of new anticancer compounds. Meanwhile, Neurology is the fastest growing segment driven by the growing prevalence of neurological disorders including Alzheimer, Parkinson and multiple sclerosis and the increasing attention to developing new drugs. Complex neural pathways are not only critical to neurological disorders but are also rapidly driving the adoption of advanced preclinical models that in turn can help accelerate the drug discovery process and make neurology a big growth area for CROs.

By End Users, Biopharmaceutical Companies Lead Market and Research Institutes and Universities Fastest Growth

The Biopharmaceutical Companies leads the market in 2025, owing to their extensive drug development pipelines and reliance on outsourced preclinical research to reduce operational costs and accelerate time-to-market. Extensive use of CRO services for toxicology, bioanalysis, and larger preclinical models make this companies together account the highest share of the market revenue. Meanwhile, the Research Institutes and Universities segment is expected to register the fastest growth during the forecast period, owing to rising academic research activities, funding by various government agencies, and increasing accessibility to advanced preclinical models for drug discovery purposes. This segment is witnessing rapid growth, owing to the increasing partnerships between academia and CROs to access advanced technologies, and high-quality preclinical data.

Preclinical CRO Market Regional Analysis:

North America Preclinical CRO Market Insights:

The North America dominated the Preclinical CRO Market in 2025E, with over 47.50% revenue share, owing to increased presence of major pharmaceutical and biotechnology companies, comprehensive research infrastructure, and high R&D investments. This region has leading laboratory infrastructure, heavily types system and the willingness to embrace new preclinical models like Patient-Derived Organoids (PDOs) and Xenograft (PDX) models earlier in the line. Factors such as the high demand for outsourcing of preclinical studies high, and growing focus on oncology, neurology and rare disease research enhance its leadership status in the global market. Moreover, collaboration of CROs with leading biopharmaceutical companies to deliver advanced services and improve operational efficiencies further establishes North America as the largest and most matured preclinical CRO market worldwide.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Preclinical CRO Market Insights

The U.S. and Canada dominate the Preclinical CRO market due to advanced research infrastructure, high pharmaceutical R&D investment, early adoption of innovative preclinical models, and strong demand for outsourced drug development services.

Asia Pacific Preclinical CRO Market Insights:

The Asia Pacificis expected to have the fastest-growing with a CAGR 8.98%, driven by the accelerating pharma and biotechnology R&D throughout this region. Available at a lower cost for services, coupled with a readily available skilled workforce, and a favorable environment of regulatory policies that foster preclinical outsourcing are why the region is no stranger to outsourcing the services. Growth is being driven by increased adoption of advanced preclinical models, such as PDOs and PDX, in oncology and neurological research. An increased number of CRO platforms and an increased number of partnerships with global biopharmaceutical companies allow for quicker study turnaround times and quicker adoption of service. All these factors laid together make Asia Pacific a significant growth potential area in global preclinical CRO market.

-

China and India Preclinical CRO Market Insights

China and India drive the Preclinical CRO market due to cost-effective operations, skilled workforce availability, supportive regulatory policies, increasing R&D activities, and growing adoption of advanced preclinical models in drug development.

Europe Preclinical CRO Market Insights

Europe holds a significant position in the Preclinical CRO market due to its robust pharmaceutical and biotechnology industry, mature research infrastructure, and favorable regulatory climate. The area has well-developed lab infrastructures, application of refined preclinical models such as PDOs and PDX, and focus on disease-specific therapeutic areas including but not limited to oncology, neurologic, and cardiology. Market growth is driven by high demand for outsourced preclinical studies coupled with strategic collaborations between contract research organizations (CROs) and biopharmaceutical companies in domestics. Moreover, the focus on quality standards and compliance with Good Laboratory Practice (GLP) in Europe result in reliable and efficient preclinical research, thereby proving its position as a significant regional market.

-

Germany and U.K. Preclinical CRO Market Insights

Germany and the U.K. lead the Preclinical CRO market due to strong pharmaceutical sectors, advanced research infrastructure, high-quality standards, regulatory compliance, and growing demand for specialized preclinical testing across therapeutic areas.

Latin America (LATAM) and Middle East & Africa (MEA) Preclinical CRO Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) Preclinical CRO markets are gradually expanding, driven by increasing pharmaceutical R&D investments and growing interest in outsourcing clinical and preclinical activities. In LATAM, countries are witnessing a rise in collaborations between local research institutes and global pharmaceutical firms, enhancing the region’s capabilities in toxicology and bioanalysis services. Meanwhile, the MEA region is emerging as a potential outsourcing hub, supported by improving healthcare infrastructure and regulatory frameworks. Both regions offer cost advantages and access to diverse patient populations, attracting global CROs aiming to establish a stronger presence in underpenetrated and high-potential markets.

Preclinical CRO Market Competitive Landscape

Charles River Laboratories plays a leading role in the Preclinical CRO market by offering a comprehensive suite of discovery and safety assessment services. The company’s strong capabilities in toxicology, bioanalysis, and advanced models such as PDO and PDX make it a trusted partner for global pharma and biotech firms seeking accelerated and compliant drug development.

-

In September 2025, Charles River Laboratories collaborations with the Parker Institute for Cancer Immunotherapy and Children’s Hospital Los Angeles to enhance its oncology manufacturing and cell & gene therapy capacities.

Parexel International is a key player in the Preclinical CRO market, focusing on integrated research solutions that bridge early-stage studies with clinical trials. Its growing emphasis on AI-driven data management, regulatory consulting, and oncology preclinical testing enhances operational efficiency and decision-making, enabling pharmaceutical clients to reduce R&D timelines and improve drug pipeline success rates.

-

In September, 2025, Parexel entered a partnership with Weave Bio to leverage AI in accelerating regulatory submission processes and reduce time-to-market for new therapies.

Frontage Laboratories contributes significantly to the Preclinical CRO market through its expertise in bioanalytical, DMPK, and CMC services. The company’s expansion into CRDMO facilities and strategic partnerships strengthens its global service network. Frontage’s integrated laboratory solutions support preclinical and early clinical phases, ensuring high-quality, compliant data generation for pharmaceutical and biotechnology clients worldwide.

-

In June 2025, Frontage launched a new 46,300 square-foot CRDMO facility in Exton, Pennsylvania, including GMP suites, formulation labs, and analytical labs to expand manufacturing & development services.

Preclinical CRO Market Key Players:

Some of the Preclinical CRO Market Companies are:

-

Charles River Laboratories

-

Eurofins Scientific

-

Labcorp Drug Development

-

Parexel International

-

ICON plc

-

Medpace, Inc.

-

Syneos Health

-

WuXi AppTec

-

Envigo

-

Covance (Labcorp)

-

PRA Health Sciences

-

SGS Life Sciences

-

MPI Research

-

Toxikon

-

BioReliance (Merck)

-

Pharmaron

-

Frontage Laboratories

-

Vium

-

Absorption Systems

-

Clinipace

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.24 Billion |

| Market Size by 2033 | USD 11.54 Billion |

| CAGR | CAGR of 8.01% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Bioanalysis and DMPK Studies, Toxicology Testing, Compound Management, Chemistry, Safety Pharmacology, Others) • By Model Type (Patient Derived Organoid (PDOs) Models, Patient Derived Xenograft (PDX) Models) • By Application (Oncology, Neurology, Cardiology, Infectious Diseases, Metabolic Disorders, Others) • By End Users (Biopharmaceutical Companies, Government and Academic Institutes, Medical Device Companies, Research Institutes and Universities, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Charles River Laboratories, Eurofins Scientific, Labcorp Drug Development, Parexel International, ICON plc, Medpace, Inc., Syneos Health, WuXi AppTec, Envigo, Covance (Labcorp), PRA Health Sciences, SGS Life Sciences, MPI Research, Toxikon, BioReliance (Merck), Pharmaron, Frontage Laboratories, Vium, Absorption Systems, Clinipace., and Others. |