Sterile Tubing Welder Market Size Analysis:

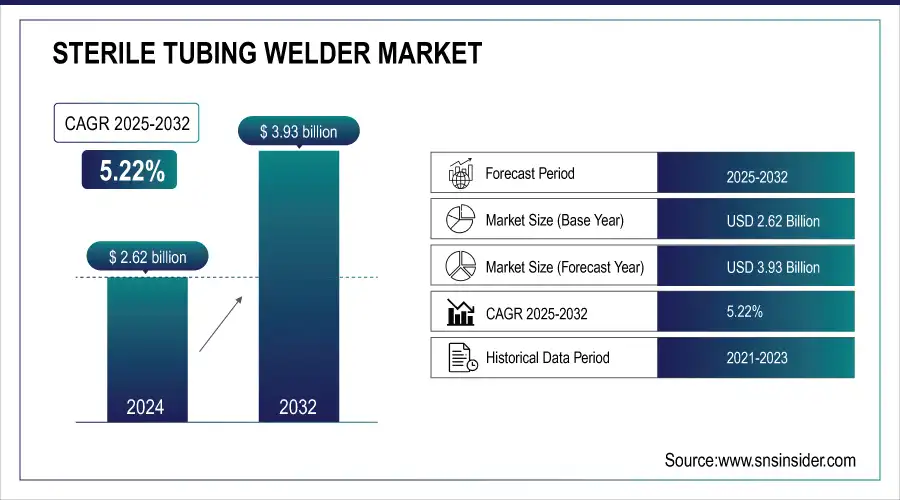

The Sterile Tubing Welder Market size was valued at USD 2.62 billion in 2024 and is expected to reach USD 3.93 billion by 2032, growing at a CAGR of 5.22% over the forecast period of 2025-2032.

Increasing demand for sterile fluid transfer in cell and gene therapies, biopharmaceuticals, and blood processing fuels the sterile tubing welder market growth. The augmenting application of cGMP-compliant single-use tubing systems and aseptic processing for cleanroom manufacture has rendered the sterile tube welder a key device for generating contamination-free connections. Closed-system bioprocessing of Terumo BCT's TSCD-Q systems and Genesis BPS RapidWeld reduces the infection risk in biologics and infusion treatments.

For instance, MicroCNX sterile connectors introduced by CPC at BioProduction 2021 help to simplify biopharmaceutical fluid transfer systems with quicker assembly times. CPC's single-use, sterile CPC MicroCNXTM, and other connectors reduced human handling and made them suitable for automated systems.

Sterile Tubing Welder Market Size and Forecast

-

Sterile Tubing Welder Market Size in 2024: USD 2.62 Billion

-

Sterile Tubing Welder Market Size by 2032: USD 3.93 Billion

-

CAGR: 5.22% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

To Get more information on Sterile Tubing Welder Market - Request Free Sample Report

Sterile Tubing Welder Market Trends

-

Rising demand for contamination-free fluid transfer in biopharmaceutical and healthcare industries is driving the sterile tubing welder market.

-

Growing adoption in single-use systems for cell therapy, vaccines, and biologics is boosting market growth.

-

Integration with automation and advanced monitoring technologies is enhancing precision, safety, and operational efficiency.

-

Expansion of pharmaceutical manufacturing, contract manufacturing, and research labs is fueling adoption.

-

Increasing focus on regulatory compliance, sterility, and process validation is shaping market trends.

-

Advancements in compact, portable, and user-friendly welding systems are improving workflow efficiency.

-

Collaborations between equipment manufacturers, biotech firms, and healthcare providers are accelerating innovation and deployment.

Automated sterile tube welding machines are more imperative as institutions such as the FDA and CDC (e.g., regulations on sterilization and disinfection) become increasingly regulative. Supported by developments in tube welding equipment for bioprocessing, investments in medical tubing welding systems have exploded with R&D in cell therapy and customized medicine. Adoption across hospitals and biomanufacturing also influences government and institutional support, like Project Firstline (CDC) and WHO infection control policies.

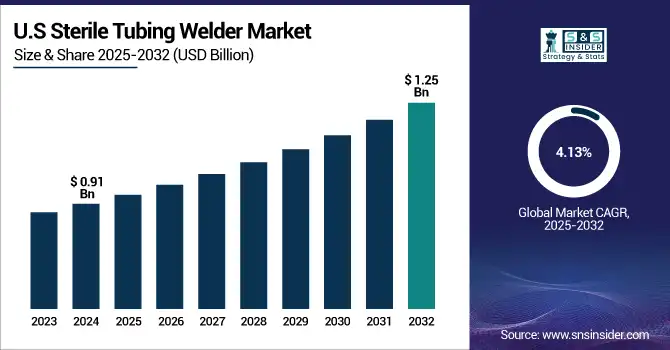

The U.S. sterile tubing welder market size was valued at USD 0.91 billion in 2024 and is expected to reach USD 1.25 billion by 2032, growing at a CAGR of 4.13% over the forecast period of 2025-2032, driven by strong adoption of automated sterile tubing welding machines in blood banks, hospitals, and biologics manufacturing.

Sterile Tubing Welder Market Growth Drivers:

-

Rising Demand for Contamination-Free Processing and Biopharma Expansion

The sterile tubing welder market growth is driven by the biopharmaceutical industry's shift toward closed, aseptic processing environments, with the adoption of single-use technology (SUT) becoming the standard in the industry. The AIChE says that more than 85% of biopharma manufacturers have incorporated single-use systems to eliminate cross-contamination and batch failure risks. Since sterile fluid transmission heavily depends on welders, the trend heavily boosts the value of the sterile tube welder market. With more and more new biologics, monoclonal antibodies, and gene therapies gaining popularity, solid, contamination-free tube joints are needed more than ever. The adoption of sterile welding techniques is driven by automated, proven sterilization technologies, adherence to U.S. FDA cGMP regulations, and compliance with CDC infection control guidelines.

Sterile Tubing Welder Market Restraints:

-

High Equipment Costs and Skill-Intensive Operation Limits the Growth

Smaller biotech companies or labs with tighter resources would find a typical automated sterile tube welder system inaccessible, ranging from USD 10,000 to USD 30,000. Although the market is growing worldwide, entrance restrictions still exist in constrained environments where hand techniques are still preferred.

Manufacturing schedules have also been delayed by supply chain interruptions for components such as silicone tubing or medical-grade PVC. Moreover, the absence of coordinated global regulatory guidelines for sterile tube welding reduces scalability for global applications. Unlike biologics, traditional pharmaceutical companies with legacy systems oppose using expensive biopharmaceutical fluid transfer equipment, so they restrict the sterile tubing welder market share in conventional pharma segments. These limitations draw attention to the need for low-cost, portable solutions and simplified user interfaces in upcoming-generation welders.

Sterile Tubing Welder Market Segmentation Analysis:

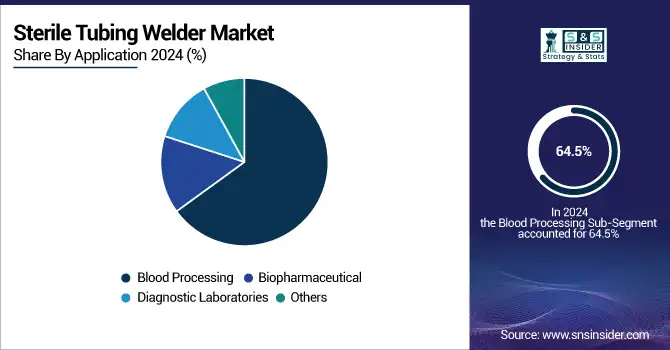

By Application, Blood Processing dominated in 2024 with 64.5% revenue share, Biopharmaceutical industry expected fastest growth due to rising biologics production.

With more than 64.5% of the revenue share, blood processing held the majority of the sterile tubing welder market share in 2024. Widespread use of sterile tube welders in transfusion services, blood bag preparation, and apheresis systems, where sterility must be maintained, contributes significantly to their dominant position. Increasing global blood donation needs and an expanding requirement for clean blood products indicate that this segment will drive future sterile tubing welder market growth.

The biopharmaceutical industry is expected to see the highest growth due to the sudden growth of biologics production and the incorporation of closed-system processing in R&D and production workflows. This is an indication of the increasing market size in pharmaceutical fluid handling and sterile transfers.

By Mode, Automatic sterile tube welders led in 2024 with 89.3% revenue share, Manual mode growing in small labs and emerging regions.

Automatic sterile tube welders accounted for a significant 89.3% of the sterile tube welder market share in 2024, highlighting a general industry move towards automation. Key elements in cGMP-compliant and cleanroom manufacturing settings, their popularity, result from improved process uniformity, lower contamination concerns, and higher operational efficiency. These technologies are extensively embraced in biopharmaceutical and blood processing facilities where safe fluid transfer depends on sterility and accuracy. Growing demand for high-throughput, contamination-free processes in controlled environments drives the increasing dependence on automated sterile tube welding machines.

Manual mode is gaining traction in small-volume laboratories and regions still in development despite representing a relatively smaller share of the sterile tubing welder market. Its cost-saving and portable design makes it highly desirable where automatic budgetary controls are tight. This segment reflects an upgrowth opportunity, particularly as more lightweight and flexible-sized sterile tube welders become accessible to serve decentralized process requirements and market diversification purposes.

By End Use, Hospitals accounted for 47.8% of the market in 2024, Blood centers expected fastest growth driven by investments in blood banks and donor processing.

Hospitals represented 47.8% of the sterile tubing welder market share in 2024. Backed by their central role in transfusion operations, IV fluid preparation, and sterile fluid management, hospitals continue to make investments in medical tubing welding systems to meet increasing surgical and ICU needs and infection control standards.

Blood centers are likely to register the highest growth, fueled by growing public and private investments in blood banks and donor processing. The demand for contamination-free blood collection and processing systems is directly impacting the market growth, especially in nations expanding national transfusion safety programs and advanced tube welding equipment for bioprocessing.

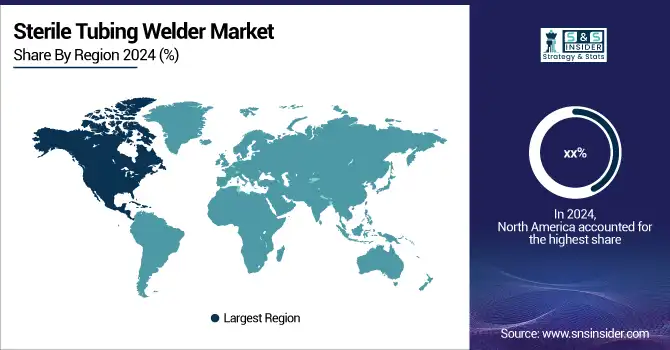

Regional Insights:

North America Sterile Tubing Welder Market Insights

North America dominated the global sterile tubing welder market in 2024, largely due to advanced healthcare infrastructure, extensive biopharmaceutical production, and stringent regulatory frameworks supporting cGMP manufacturing compliance. The U.S. is a global hub for sterile fluid transfer technologies, with major sterile tubing welder companies like Terumo BCT and GE Healthcare headquartered here. Moreover, high R&D spending and ongoing investment in closed-system bioprocessing reinforce its leadership. Canada, while smaller in market size, is witnessing steady adoption due to growth in cleanroom manufacturing and transplant services.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Sterile Tubing Welder Market Insights

Europe held the second-largest market share in 2024, supported by growing demand for aseptic processing in biotech, especially in countries like Germany and the UK. The region’s strength lies in its robust pharmaceutical and biologics sector, harmonized safety regulations, and investments in disposable tubing systems and sterile process automation. Germany leads the region due to its strong manufacturing base and increasing implementation of biopharmaceutical fluid transfer devices in clinical and R&D environments. France and the UK are advancing in tube welding equipment for bioprocessing, particularly for vaccine and gene therapy development.

Asia Pacific Sterile Tubing Welder Market Insights

Asia Pacific is the fastest-growing region in the sterile tubing welder market analysis, driven by rapidly expanding pharmaceutical industries, increased investment in healthcare infrastructure, and a surge in local production of biologics and cell therapies. China dominates the regional market, owing to large-scale biologics manufacturing, aggressive industrial investment in automated sterile tubing welding machines, and government support for healthcare modernization. The growing number of blood centers and transplant units in China has significantly boosted the demand for sterile tube welders and thermoplastic tube welding systems. India and South Korea are emerging as key contributors, with increased production of single-use sterile connectors and sterile transfer systems supported by favorable regulatory reforms and increased clinical research activity.

Middle East & Africa and Latin America Sterile Tubing Welder Market Insights

The LAMEA region shows steady yet developing potential in the sterile tubing welder market, primarily driven by rising demand for safe blood transfusion services, healthcare expansion, and increased adoption of sterile medical technologies. Brazil is the largest market in Latin America, supported by expanding national healthcare programs and the need for contamination-free tube welding in blood banks. In the Middle East, the UAE and Saudi Arabia are investing heavily in healthcare automation and pharmaceutical sterile tube welder systems to support growing medical tourism and specialty hospitals. South Africa leads Sub-Saharan Africa in terms of sterile tubing welder market trends, driven by rising cases of blood disorders and infections requiring transfusion therapies.

Sterile Tubing Welder Market Competitive Landscape:

Sterile Tubing Welders & Thermoplastic Tube Welding Systems

Sterile tubing welders and thermoplastic tube welding systems are critical technologies in biopharmaceutical manufacturing, enabling secure, sterile connections for cell therapy, fill-finish processing, and liquid transfer. These systems ensure contamination-free workflows under challenging conditions and are increasingly automated to enhance speed, reliability, and operational efficiency. By supporting precise tube joining and flexible processing, these technologies help manufacturers maintain compliance, improve productivity, and safely scale advanced therapies.

-

2024: Bioprocess International highlighted a shift to portable sterile tube welders and thermoplastic tube welding systems that protect in challenging conditions. Automated sterile tubing welders play a crucial role in speeding up fill-finish processing and tube joining for cell treatment.

CPC (Colder Products Company) – AseptiQuik G DC Series Connector

Colder Products Company (CPC), founded in 1962 and headquartered in St. Paul, Minnesota, specializes in quick disconnect couplings and connectors for medical, biopharmaceutical, and industrial applications. CPC focuses on solutions that simplify sterile connections, maintain system integrity, and streamline fluid handling in regulated environments. Its technologies enhance safety, reduce contamination risk, and improve efficiency for biopharmaceutical processing and other precision fluid transfer applications.

-

May 2022: CPC launched the AseptiQuik G DC Series Connector, a gender-free, one-time-use connection technology featuring both sterile connection and disconnection. This innovation streamlines closed-system liquid processing for the biopharmaceutical industry.

Sterile Tubing Welder Market Key Players

-

Terumo BCT

-

GE Healthcare

-

MGA Technologies

-

Vante Biopharm/Sebra

-

Biomen Biosystems Co.

-

SynGen Inc.

-

Sentinel Process Systems

-

Flex Concepts

-

Shanghai Le Pure Biological Technology

-

Pall Corporation

-

Sartorius Stedim Biotech

-

Parker Hannifin Corporation

-

Thermo Fisher Scientific

-

Asahi Kasei Medical

-

Lonza Group

-

Eppendorf AG

-

IDEX Health & Science

-

Saint-Gobain Performance Plastics

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.62 Billion |

| Market Size by 2032 | USD 3.93 Billion |

| CAGR | CAGR of 5.22% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Biopharmaceutical, Blood Processing, Diagnostic Laboratories, and Others) • By Mode (Manual, Automatic) • By End Use (Hospitals, Research Clinics, Blood Centers, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Sartorius AG, Terumo BCT, GE Healthcare, MGA Technologies, Vante Biopharm/Sebra, Genesis BPS, Biomen Biosystems Co., SynGen Inc., Sentinel Process Systems, Flex Concepts, Shanghai Le Pure Biological Technology, Pall Corporation, Sartorius Stedim Biotech, Parker Hannifin Corporation, Thermo Fisher Scientific, Asahi Kasei Medical, Lonza Group, Eppendorf AG, IDEX Health & Science, Saint-Gobain Performance Plastics |