Premium Messaging Market Report Scope & Overview:

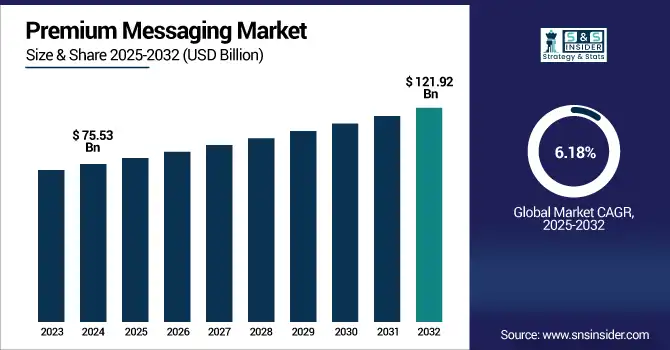

The Premium Messaging Market size was valued at USD 75.53 billion in 2024 and is expected to reach USD 121.92 billion by 2032, expanding at a CAGR of 6.18% over the forecast period of 2025-2032.

To Get more information on Premium-Messaging-Market - Request Free Sample Report

The Premium Messaging Market is experiencing steady growth, spurred by growing demand for communications between companies and end users. A2P (Application-to-Person) messaging services are ruling the market, for example, banking alerts, OTPs, marketing, and customer engagement. The increasingly high ratio of mobile users and the demand for digital services have also contributed to the premium messaging market growth. Added functionality is being implemented with technologies such as AI, cloud communication platforms, and RCS (Rich Communication Services). Adoption is highest in North America and Asia-Pacific, which are buoyed by robust telecom infrastructure. Key players operating in the global market for enterprise A2P SMS are Twilio, Sinch, AT&T, and Orange Business, which are aiming at innovation and global expansion.

According to research, Google RCS had reached 550 million monthly active users globally, while Sinch revealed that 53 percent of its $330 million in Q2 revenue came from messaging, including A2P SMS and MMS, indicating increasing demand.

The U.S. Premium Messaging Market size reached USD 21.93 billion in 2024 and is expected to reach USD 33.07 billion in 2032 at a CAGR of 5.20% from 2025 to 2032.

The US Premium Messaging Market is dominant due to advanced telecom infrastructure, increased smartphone penetration, and growing adoption of digital financial and enterprise communication services. Continued demand for secure, live A2P messaging for verticals such as banking, healthcare, and e-commerce helps the premium messaging market trend grow. Premium SMS has become something of a staple for U.S.-based businesses, used for things like verifying customers when they log in, soliciting their opinions, pinging them with critical updates and alerts, and more. Innovation and reliability are aided by the participation of key players such as Twilio, AT&T, and Sinch. Furthermore, the use of Rich Communication Services (RCS) and cloud-based messaging applications also drives the U.S. market as it is one of the pioneers offering premium messaging services.

Market Dynamics

Drivers:

-

Rapid Adoption of Secure A2P Messaging for Financial, Healthcare, and E-Commerce Transactions.

Increasing need for secure, instantaneous communication in banking, healthcare, and Web-based retail, which is spurring the growth of premium messaging, Juniper said. With A2P SMS and RCS, consumers are depending more on one-time passwords (OTPs), appointment reminders, parcel delivery notifications, and fraud alerts. Two-factor authentication has appeared in mobile wallets and healthcare apps, while cloud platforms have begun including AI-driven chatbots that make messaging at scale personal. These enhancements are resulting in higher levels of engagement and reduced churn, driving increased adoption across the enterprise.

Restraints:

-

High Costs of Regulatory Compliance and Carrier Interconnection Pose Adoption Barriers.

Stringent requirements such as TCPA, GDPR, and HIPAA, along with carrier-level verification and interconnection fees, are not only a deceased cost to businesses, they are an operational nightmare. Subscription messaging providers have to deal with opt-in regulations, content filtering, and the complicated web of information laws, all of which add time to onboarding. Recent changes in the regulatory landscape of both the EU and the U.S. have more stringent consent and privacy requirements, which will result in implementations more resource-consuming.

Opportunities:

-

Expansion of RCS and Rich Media Messaging Creates New Engagement Channels.

Rich Communication Services (RCS), which provides a more engaging experience with tools such as branded conversations, high-quality images, and payment features, represents an exciting opportunity for premium messaging providers. Brands are testing interactive RCS campaigns for marketing, customer care, and transactions with leading carriers in North America and Europe. Recent launches have included RCS-powered appointment booking in the healthcare sector and branded chatbots in retail loyalty programmes.

Challenges:

-

Fragmented Global Messaging Ecosystem Complicates End User Consistency and Scalability.

The coexistence of multiple messaging protocols (SMS, MMS, RCS) across carriers, devices, and regions hampers a consistent user experience. Variability in RCS support among carriers and OS platforms leads to a fallback to plain SMS, diluting user interaction quality. Fragmented global regulations further add to the difficulty. Recent efforts by premium messaging industry alliances, such as the RCS Business Messaging (RBM) Alliance, aim to standardize delivery and branding, but slow adoption by carriers and OEMs limits widespread deployment.

Segment Analysis

By Product

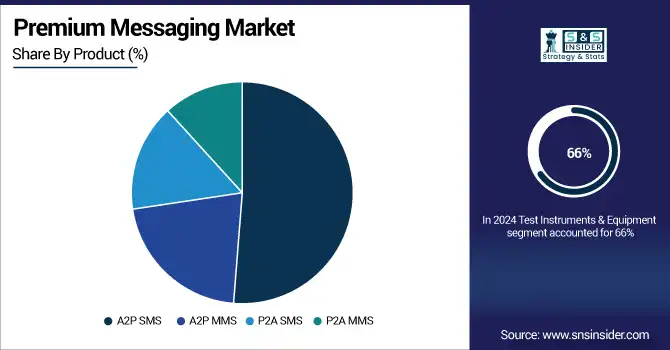

The A2P SMS segment led the product category with 51.26% revenue share in 2024, driven by enterprises’ reliance on one-time passwords (OTPs), account alerts, and transactional confirmations. Providers such as Twilio and Sinch recently launched enhanced SMS APIs with global delivery intelligence and real-time performance analytics. For example, Twilio’s Verify API now supports proactive fraud detection via SMS. These developments align with the growing demand for secure, instantaneous communication in critical sectors.

The A2P MMS segment is projected to grow fastest with a 7.34% CAGR through 2032, driven by enhanced consumer engagement via rich media (images, video, interactive links). Messaging platforms like Sinch and Infobip have rolled out MMS-centric marketing suites, featuring carousel ads and embedded CTAs. Sinch’s recent Multimedia Messaging Campaign Manager enables dynamic media content tailored by user behavior. This reflects a shift towards immersive, branded messaging, inspiring higher click-through rates and purchase intent.

By Application

The BFSI sector held a 28.27% share of the premium messaging market in 2024, underpinned by use cases such as OTPs, fraud alerts, transaction updates, and interactive account services. Premium messaging market companies such as AT&T and Vodafone Business have launched secure OTP and card-notification messaging solutions enhanced with tokenization and two-way communication. This integration of banking security with mobile convenience addresses consumer demand for frictionless yet protected digital experiences.

The Retail sector is expected to experience the fastest growth in premium messaging, with a CAGR of 7.53%, fueled by the rapid expansion of e-commerce, rising demand for personalized marketing, and increased focus on loyalty-based customer engagement strategies. Retailers like Target and Sephora have begun piloting AI-driven SMS and MMS loyalty campaigns featuring interactive coupons and seasonal offers. Twilio’s Segment product now supports rich messaging for targeted retail engagement. These innovations enable consumers to receive immersive, brand-aligned content directly to their devices.

Regional Analysis

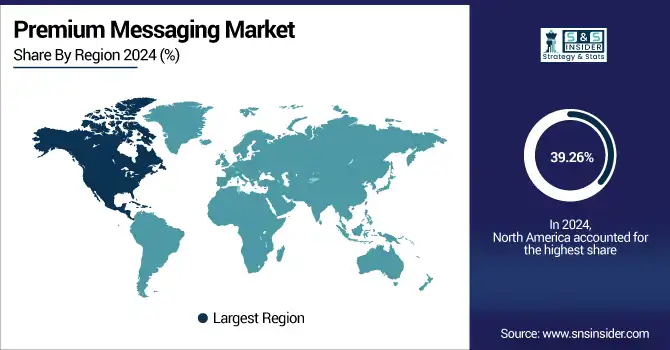

North America accounted for 39.26% of the global premium messaging market share in 2024, making it the dominant region. The market is driven by high mobile penetration, robust telecom infrastructure, and the widespread use of A2P SMS in industries such as BFSI, retail, and healthcare. The United States leads the North American premium messaging market due to a strong telecom ecosystem, high usage of OTP-based verification, and enterprise demand for personalized SMS communication across digital banking and e-commerce platforms.

Europe holds a substantial portion of the premium messaging market, supported by the expansion of RCS messaging, regulatory compliance needs such as GDPR, and growing digital engagement in sectors like banking, transportation, and public services. The United Kingdom dominates the European market due to early adoption of RCS, a vibrant fintech environment, and regulatory focus on secure communication, driving demand for premium messaging across industries.

Asia Pacific is the fastest-growing region, with a CAGR of 27.09%. This growth is driven by high mobile subscriber density, increasing digital commerce, and growing A2P messaging use in countries like China, India, and Japan. China dominates the Asia Pacific premium messaging market due to widespread A2P usage in mobile banking, e-commerce alerts, and public service announcements, supported by large telecom operators and a robust digital economy.

The Middle East & Africa and Latin America are emerging markets for premium messaging, driven by increasing smartphone penetration, digital infrastructure investments, and mobile-first communication strategies. Rising demand in sectors like finance, travel, e-commerce, and government services is accelerating A2P SMS adoption, with the UAE and Brazil leading their respective regions due to rapid digital transformation and enterprise usage.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the Premium Messaging Market are Twilio Inc., Sinch, Vonage America, LLC, AT&T Intellectual Property, Vodafone Limited, NTT DOCOMO, China Unicom (Hong Kong) Limited, Orange Business, Deutsche Telekom AG, KDDI CORPORATION, and others.

Key Developments

-

In May 2025, Clerk Chat, in partnership with Google, Verizon, T-Mobile, and AT&T, launched the first multi-carrier RCS platform in the U.S., introducing interactive, AI-powered messaging features like carousels and concierge-style chat services.

-

In June 2025, Twilio partnered with Orange at Transform London to scale secure, branded RCS messaging across France and other European markets, aiming to enhance enterprise communication through enriched, compliant mobile messaging experiences.

-

In June 2025, Twilio launched a next-generation AI- and data-driven customer engagement platform featuring advanced messaging tools, including integrated RCS and A2P capabilities, to enable richer, real-time interactions for enterprises across various digital channels.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 75.53 Billion |

| Market Size by 2032 | USD 121.92 Billion |

| CAGR | CAGR of 6.18% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (A2P SMS, A2P MMS, P2A SMS, P2A MMS) •By Application (BFSI, Entertainment & Media, Hospitality, Outsourcing, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Twilio Inc., Sinch, Vonage America, LLC, AT&T Intellectual Property, Vodafone Limited, NTT DOCOMO, China Unicom (Hong Kong) Limited, Orange Business, Deutsche Telekom AG, KDDI CORPORATION. |