Proactive Services Market Report Scope & Overview:

The Proactive Services Market size was valued at USD 8.04 billion in 2025 and is expected to reach USD 35.64 billion by 2035, expanding at a CAGR of 20.9% over the forecast period of 2026-2035.

Predictive IT support is the new buzzword, and the Proactive Services Market is growing rapidly. Services like design & consulting, managed services, and technical support etc. that leverage AI, analytics, and automation to fix problems before they happen. Enterprises in sectors such as BFSI, healthcare, retail, etc., leverage predictive/ preventive services for better uptime, efficiency, and customer experience. Large enterprises have paved the way in adoption, but small and medium businesses are quickly coming online too. Work-from-anywhere, digital-first world demands performance, which is why proactive services are becoming essential for organizations.

According to research, more than 48% of proactive service deployments incorporated AI or machine learning technologies, enabling predictive maintenance capabilities that effectively prevented up to 65% of potential IT system failures.

Market Size and Forecast: 2025

-

Market Size in 2025 USD 8.04 Billion

-

Market Size by 2035 USD 35.64 Billion

-

CAGR of 20.9% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

To Get more information On Proactive Services Market - Request Free Sample Report

Proactive Services Market Trends:

• Growing integration of AI and IoT is enabling real-time monitoring, predictive insights, and proactive issue resolution across service environments.

• Rising demand for proactive, outcome-based service models is shifting organizations from reactive to preventive operations.

• Increasing adoption of cloud-based and automated proactive service platforms is improving scalability and cost efficiency.

• Rapid digitalization in emerging markets is expanding demand for affordable, AI-driven proactive service solutions.

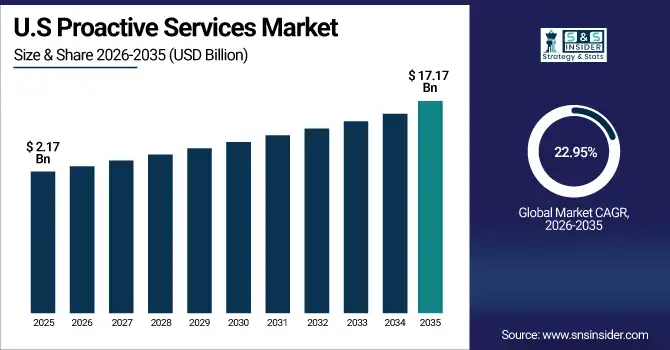

The U.S Proactive Services Market size reached USD 2.17 billion in 2025 and is expected to reach USD 17.17 billion in 2035 at a CAGR of 22.95% from 2026 to 2035.

The largest share of the overall market lies with the U.S. The dominance can be attributed to advanced IT infrastructure, the early adoption of emerging technologies such as AI and analytics, and the strong presence of leading service providers within the country. Key market drivers are the growing Need for 24/7 Digital Operations, the Increase in Cloud Adoption, and the Requirement for Real-Time Examination and Assistance of Systems are driving the Growth of the Market. In a competitive digital landscape where operational efficiency, compliance, and the delivery of superior customer experiences must be continuously monitored, enterprises across BFSI, healthcare, manufacturing, and other sectors are realizing the need to invest in proactive services.

Market Dynamics

Proactive Services Market Growth Drivers:

-

Increasing Penetration of Predictive Capability through Combination of AI and IoT Technologies in Services.

Artificial Intelligence (AI) and Internet of Things (IoT) are two futuristic technologies that hold great significance in the prediction accuracy of overriding implementations. IoT devices offer real-time data from various sources in a user-friendly. AI algorithms observe HUGE databases, looking at patterns, events, and predicting problems before they happen. The integration of this data makes it possible for organizations to predict issues, streamline processes, and minimize downtime. This is driving different industries to proactive services to improve operational efficiency and customer service experience.

Proactive Services Market Restraints:

-

High Implementation Costs and Complexity Hinder Adoption of Proactive Service Solutions.

While proactive strategies are preferred, the inertia of the classical nature of reactive strategies leads to reluctance amongst organizations to transition from one to another, limiting the market. Large cost and complexity are common reasons for organizations to steer away from this adoption path of proactive service solutions. Such solutions demand large capital investment in modern technology, human resources, and infrastructure upgrades. What is more, adding proactive services to the existing systems might be difficult, especially for small and medium-sized companies with fewer resources.

Proactive Services Market Opportunities:

-

Expansion of Proactive Services into Emerging Markets Presents Growth Opportunities for Providers.

The potential Proactive Services Market growth is huge, and proactive service providers can benefit from the ever-increasing digitalization and adoption of the latest digital technologies in these regions. The growing demand for proactive services will continue to grow as businesses in these regions strive to improve operational efficiency and customer experience. In developing nations, the clouds of proactive solutions and AI-driven automation are set to get thicker. Providers that tailor scalable, cost-effective solutions to meet these markets' needs will be best positioned to seize opportunities and expand their global presence.

Proactive Services Market Regional Analysis:

By Services

The Managed Services segment leads the Proactive Services Market, capturing a 37.50% revenue share in 2025. The dominance of this sector is mainly due to enterprises outsourcing IT functions to increase productivity, decrease operational costs, and comply with regulations. Also, with the growing prominence of cloud computing along with big data analytics, this segment is expected to grow at a higher pace. AI-focused IT service management products, including those offered by ServiceNow, have expanded, with their subscription revenue expecting tripling, further suggesting a shift towards integrated managed services-based solutions. The Technical Support segment is expected to grow at a CAGR of 25.02%, owing to organizations' growing demand for technical support to comply with constantly changing regulations and security threats. Technical Support Service Demand Continuous Updates/Upgrades Maintenance The rapid pace of technological advancements requires constant updates in order to increase the functionality of existing technology systems, which the one of the major factors driving demand for technical support services.

By Enterprise Size

Large enterprise revenues are projected to account for 58.28% of the overall market in 2025, with proactive services being used to drive coverage and expel risk through digital strategies. The BFSI sector specifically is improving customer engagement through more proactive services. This investment by large enterprises in proactive service solutions is evident from Tech Mahindra increasing its revenue share in the BFSI segment & establishing its strategic focus. Small and medium enterprise (SME) segment is projected to register a CAGR of 24.97%, as cloud-based proactive services as which are scalable and cost-efficient, are being rapidly adopted by this segment. SMEs are dealing with issues such as a shortage of skilled workforce and budgeting concerns, so cloud deployment is often an appealing answer. An increasing number of vendors providing customized solutions for small and medium enterprises are propelling this growth with improved network performance and customer retention.

By Technology

The Analytics segment commands 41.41% revenue share. organizations across industries are adopting advanced analytics to deal with large amounts of data, which can help in delivering proactive customer care and operational effectiveness. Analytics tools adoption is propelled by the emergence of IoT devices and the need for real-time intervention. Analytics are utilized by several companies for measuring various variables, consumer understanding, and anomaly detection, thus supporting the expansion of this segment. Artificial Intelligence is expected to grow at a CAGR of 24.95% since business organizations are opting for artificial intelligence solutions to understand data effectively and provide personalized service recommendations to consumers. AI aids in cross-selling and upselling as well as improves customer navigation on web portals. The expectation of big growth in ServiceNow's AI-based software products is indicative of AI's continuing role in proactive service.

By Application

Customer Experience Management leads with a 25.08% revenue share, wherein vendors are centering around improving customer delight, customer loyalty, and brand loyalty. It goes a long way in moving towards lower churn, lowering operational costs through proactive services in this slice. For example, the CXone MPower offering by NICE Ltd. bundles application programming interface (APIs) for AI tools that link customer service automation to enhance customer experience management. The Cloud Management segment is expected to grow at a 25.62% CAGR, as heightened demand for system monitoring, proactive security patches, and capacity management factors into the growth. Cloud management provides a single common ground for monitoring IT infrastructure and achieves the best uptime and availability. This segment is also driven by ease of deployment and customization.

By End-Use

The BFSI sector has the largest proactive services market share of 20.46%, with proactive services being utilized to improve customer engagement and handle sensitive financial information. More mobile banking services are being made available, meaning outbound communication to reduce inbound queries is needed. The BFSI sector increasingly views proactivity as the only way to withstand the test of time, which is partially why Tech Mahindra's move to expand its BFSA focus comes into the picture. Healthcare is estimated to grow at the fastest rate of 26.60% CAGR, with organizations adopting proactive services to cater to patient real-time data monitoring and predictive analytics. They help early detection of disease and equipment maintenance, in which patients experience greater benefits at reduced costs. The recent use of advancements like AI by Hinge Health to automate the delivery of care is an illustration of healthcare incorporating proactivity into the proactive services industry.

Proactive Services Market Regional Analysis:

North America Proactive Services Market Insights

North America is responsible for a 34.42% share because of its early adoption of technology, a strong digital infrastructure, and the extensive presence of key IT and cloud computing service providers. High focus on security, customer experience, and compliance with stringent regulations also fuels the demand for a proactive solution.

Get Customized Report as per Your Business Requirement - Enquiry Now

The United States is the regional leader because of its advanced technological environment, huge base of enterprise organizations, and heavy investments in digital transformation efforts.

Europe Proactive Services Market Insights

Europe is witnessing steady growth as firms and Industries across the region raise their heads towards the IT modernisation, especially in Germany, the U.K., and France. Its focus on data sheltering, automated aids, and enterprise-level IT optimization is nurturing demand for managed and consulting services in the region.

Germany is driving the market forward due to its industrial background, early adoption of proactive analytics, and an emphasis on operational efficiency.

Asia Pacific Proactive Services Market Insights

The Asia Pacific region is becoming the fastest-growing region with a CAGR of 25.50%, on account of increasing digitalization, a growing number of SMEs, and increasing investments in IT infrastructure, particularly in developing economies. AI & analytics-based services are gaining traction from Governments & Enterprises, focusing on seamless customer experience and improved operational reliability.

China has taken the lead because of its Industrial growth, huge technology-based economy, and the former proactive services market trends of utilizing preplacement tools and devices to support quality assurance, a moonshot for AI-driven solutions.

Latin America (LATAM) and Middle East & Africa (MEA) Proactive Services Market Insights

Middle East & Africa and Latin America, where proactive services adoption is still in its early growth phase, are starting to see increased demand for proactive services with regional digital transformation initiatives, cloud adoption infrastructure modernization trends. In MEA, the UAE is at the forefront of smart city initiatives, while Brazil continues to be the most profitable market in Latin America, owing to rapid urbanization along with increasing demand for managed IT services.

Proactive Services Market Key Players:

The major key players of the proactive services market are Amazon Web Services, Inc., Cisco Systems, Inc., DXC Technology, Fortinet, Inc., Hewlett-Packard Enterprise Company, Huawei Technologies Co., Ltd., International Business Machines Corporation (IBM), Juniper Networks, Inc., Microsoft Corporation, Genesys, and others.

Competitive Landscape for Proactive Services Market:

DXC Technology is a global IT services provider delivering proactive services through AI-driven analytics, cloud platforms, and automation. The company helps enterprises predict issues, optimize IT operations, and reduce downtime across hybrid environments, supporting improved operational efficiency, service reliability, and customer experience in the Proactive Services Market.

-

In May 2024, DXC Technology launched a partnership with Dell Technologies to drive Enterprise Intelligence Services (EIS) forward with the integration of AI, machine learning, data analytics, and intelligent automation in order to offer comprehensive insight into enterprise operations.

Huawei is a leading global technology provider offering proactive services through AI-powered network management, IoT platforms, and cloud solutions. The company enables predictive maintenance, real-time monitoring, and intelligent automation for telecom and enterprise systems, helping organizations reduce downtime, enhance operational efficiency, and improve service reliability in the Proactive Services Market.

-

In September 2024, Huawei unveiled 17 new products and 7 solutions at HUAWEI CONNECT, enhancing the digital intelligence of SMEs in education, healthcare, and manufacturing.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 8.04 Billion |

| Market Size by 2035 | USD 35.64 Billion |

| CAGR | CAGR of 20.9% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Services (Design & Consulting, Managed Services, Technical Support) •By Technology (Analytics, Artificial Intelligence, Others) •By Enterprise Size (Large Enterprise, Small & Medium Enterprise) •By Application (Cloud Management, Customer Experience Management, Data Center Management, End-point Management, Network Management, Others) •By End-Use (BFSI, Government, Healthcare, Manufacturing, Media & Communications, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Thermo Fisher Scientific, Agilent Technologies, Shimadzu Corporation, Bruker Corporation, PerkinElmer Inc., Beckman Coulter, Mettler Toledo, Eppendorf AG, Sartorius AG, Waters Corporation, Bio-Rad Laboratories, GE Healthcare Life Sciences, Tecan Group Ltd., Anton Paar GmbH, Hitachi High-Tech Corporation, Labconco Corporation, Oxford Instruments plc, HORIBA Scientific, Jeol Ltd., Analytik Jena AG |