Process Orchestration Market Size & Overview:

Get more information on Process Orchestration Market - Request Free Sample Report

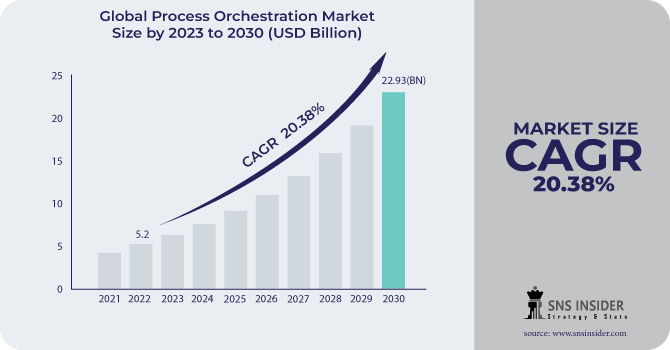

Process Orchestration Market size was valued at USD 7.4 billion in 2023 and is expected to reach USD 33.5 billion by 2032 and grow at a CAGR of 18.3% over the forecast period of 2024-2032.

The process orchestration market has witnessed significant growth driven by digitization initiatives across the private/public sector. All Governments worldwide are investing heavily in automation and infrastructure to make business processes easy. The recent statistics from the U.S. Department of Commerce track a 14% spike in investment in automation, and IT modernization to an USD 125 billion in government spending in 2023. This increase in the rise of making operations more efficient with fewer manual interventions is paving the way to present a platform for the process orchestration market. The growing demand for advanced orchestration platforms, in turn further spurred by Europe's Digital Strategy program of spending €200 billion to accelerate digital transformation until 2025, is also driving the growth of the market. Asia-Pacific countries like India and China are also rapidly adopting these technologies. According to the Indian Ministry of Electronics and Information Technology, their digitalization initiatives, which aim to automate 80% of public services by 2030, are contributing to the increased uptake of process orchestration solutions.

With the increase in remote and hybrid work models, businesses globally are turning to scalable and automated solutions that focus on meeting their evolving customer needs. The move towards automation and the need to connect different systems together has helped to drive the adoption of process orchestration platforms, which have also benefited from an increasing focus on the cloud. For example, the U.K. government has set a guideline of requiring cloud services in all departments, leading to a demand increase of 22% for Cloud Orchestration tools. These government-backed initiatives are fostering an ecosystem where businesses are actively seeking process orchestration tools to improve agility and reduce costs. Process orchestration provides a platform for IT and business specialists to collaborate and monitor business process applications while securely exchanging information. This platform enables enterprises to service business operations more effectively. Furthermore, it is well known to improve the efficiency of corporate processes.

Process Orchestration Market Dynamics

Drivers

-

Organizations are increasingly focusing on digital transformation to enhance operational efficiency. Process orchestration is pivotal in automating workflows and improving real-time decision-making.

-

The migration to cloud platforms is fueling demand for process orchestration tools due to their flexibility and cost-efficiency. These solutions enable streamlined processes across distributed teams and locations.

-

The integration of AI and automation technologies is accelerating market growth by enhancing process orchestration capabilities. Companies are leveraging these innovations to reduce human intervention and improve productivity.

The increasing migration to cloud-based platforms is a significant driver of the Process Orchestration Market. Cloud-based offerings seamlessly integrate different systems within an organization, providing consistently high levels of performance and agility to meet changing business needs. As per a recent report published, worldwide spending on public cloud services and infrastructure is expected to grow by 20.6% in 2023, reaching USD 591.8 billion, up from USD 490.3 billion in 2022. This surge underscores the escalating preference for cloud solutions among businesses of all sizes. The cloud-based process orchestration tools come with the benefits of flexibility, scalability, and reduced infrastructure cost. For instance, comprehensive solutions such as ServiceNow and Microsoft Azure allow organizations to implement automation across functions and locations. For example, in the healthcare sector; where-cloud orchestration tools assist in merging together multiple patient data management systems to provide seamless operations around regulatory barriers like HIPAA.

Furthermore, teams can work together as orchestration tools allow access from anywhere which increases productivity. With the world moving towards remote work and hybrid setup, they are likely to need more such cloud-based orchestration solutions. A recent survey found that 70% of executives are planning to increase their investment in cloud technologies in the coming years, illustrating the critical role cloud adoption plays in driving process orchestration initiatives across industries.

Restraints

-

The initial investment in process orchestration solutions can be significant, especially for small and medium-sized enterprises (SMEs). This financial barrier often hinders widespread adoption among these businesses.

-

Integrating modern orchestration tools with legacy systems poses challenges due to complexity and time requirements. Many organizations struggle to transition smoothly, slowing down adoption.

The challenge of integrating the modern orchestration tool with legacy systems is one of the major restraints for the Process Orchestration Market. A lot of the organizations are using or relying upon legacy infrastructure that is bulky and bound to integrate. These legacy systems often use different technologies and data formats, leading to compatibility issues that require significant customization and development efforts. Additionally, the integration process can be time-consuming, potentially causing disruptions to ongoing operations. This complexity not only makes Implementing process orchestration costly but also delays its benefits substantially. This leads them to be reluctant to adopt new solutions while still keeping their imperfect systems. The challenge of navigating this integration landscape is a significant barrier for companies looking to modernize their processes and improve overall operational efficiency.

Opportunities

- Digital Transformation and Workflow Automation is creating opportunities for the market

Many organizations are undergoing digital transformation initiatives to modernize their operations and leverage emerging technologies such as artificial intelligence (AI), robotic process automation (RPA), and the Internet of Things (IoT). Process orchestration plays a crucial role in integrating these technologies and orchestrating complex workflows, providing an opportunity for vendors in the market.

Process Orchestration Market Segment analysis

By Component

The process orchestration market was dominated by the software segment, which accounted for 69% of the total share in 2023. The growth of this sector is mainly attributed to the rising need among enterprises for automation in complex workflows, business flow process management, and reducing operational costs. The software solutions enable complete integration of numerous business functions assuring both agility and scalability within the operations. The growth was also propelled by the growing demand for automation tools to manage a skilled labour workforce, with 70% of enterprises planning to integrate such solutions into their existing systems by 2025.

In addition, governments are actively supporting software-based orchestration tools through their policy frameworks. As an example, in 2023 the EU passed regulations driving digital-first solutions with a subsequent software adoption rate of 25% rise. With the software segment providing features of low-code development, real-time analytics, and enhanced interoperability across cloud and on-premises systems which helps in leading harmony among several enterprise functions, the software segment is continue growing.

By Enterprise Size

The process orchestration market was dominated by large enterprises in 2023, generating the highest revenue share. Large corporations, with their complex and wide-ranging operations, require highly scalable and integrated orchestration solutions to manage thousands of workflows and processes simultaneously. That need for scalability and automation is part of the reason large enterprises opt for process orchestration solutions. Government initiatives have also contributed to this trend. According to the U.S. Census Bureau in 2023, large enterprises accounted for 53% of the national GDP, and most have invested these funds heavily into automation technologies to maintain competitive advantages.

In Europe, large enterprises automatically benefited from the European Commission's Digital Europe Programme which set aside USD 1.08 billion each year for automation and digital transformation. This, combined with the financial strength of large enterprises, has allowed them to invest in high-end process orchestration platforms. For large enterprises, especially ones in sectors like manufacturing, IT, and BFSI, the need to optimize operations and power innovation means that process orchestration is now a strategy rather than an isolated solution.

By End User

In 2023, BFSI (Banking Financial Services, and Insurance) segment held the highest share of about 23% in the process orchestration market. Automation in this sector, propelled by regulatory compliances and the demand for better customer service has made invaluable contributions to growth. According to the U.S. Federal Reserve, financial organizations boosted their spending on automation tools in 2023 by USD 18 billion dollars to be efficient and effective in the constantly evolving regulatory environment. Lastly, considering EBA (European Banking Authority) guidelines on ICT and security risk management, process orchestration is also increasingly adopted by European banks to mitigate risks and gain more efficiency in their operations.

BFSI is one of the most complex sectors, which has multiple legacy systems operating, with increasing volumes of digital transactions happening, and orchestration platforms playing autonomous roles in alignment with all process management. As digital transformation is playing out in the financial sector, process orchestration tools play an important role in automating transaction monitoring, compliance management, and customer service workflows.

.png)

Need any customization research on Process Orchestration Market - Enquiry Now

Regional Analysis

North America accounted for the largest share of the process orchestration market in 2023 with a contribution of 34% share of global revenues. The region leads due to the robust technology infrastructure, cloud technology adoption rate, and digital transformation driven by private enterprises as well as government sectors. According to the Government Accountability Office (GAO), the U.S. government earmarked USD 115 billion toward digital programs in 2023 alone. As such, it has expedited process orchestration solution implementation verticals such as healthcare, BFSI, and manufacturing.

However, the Asia-Pacific region will have a rapid CAGR growth over the forecast period due to growing digitization projects in countries such as China and India. In 2023, domestic automation investments increased by 22%, according to China’s Ministry of Industry and Information Technology, while the government in India pushed for its "Digital India" campaign to facilitate more public sector as well as private sector automation. The growing ICT industry in the region, cloud-based orchestration platforms and their adoption are some of the initiatives contributing to market growth.

Key Players

Key Service Providers/Manufacturers:

-

IBM (IBM Cloud Pak for Business Automation, IBM Business Process Manager)

-

Oracle (Oracle Integration Cloud, Oracle BPM Suite)

-

Microsoft (Power Automate, Azure Logic Apps)

-

Appian (Appian Automation, Appian Process Automation)

-

Pega (Pega Process Automation, Pega Customer Service)

-

TIBCO Software (TIBCO Cloud Integration, TIBCO BusinessWorks)

-

SAP (SAP Business Process Management, SAP Cloud Platform Integration)

-

MuleSoft (Anypoint Platform, MuleSoft Composer)

-

Red Hat (Red Hat Process Automation Manager, Red Hat Fuse)

-

ServiceNow (ServiceNow Orchestration, ServiceNow IT Business Management)

Key Users of Services and Products

-

Bank of America

-

Wells Fargo

-

Deloitte

-

Siemens

-

CitiGroup

-

Pfizer

-

Procter & Gamble

-

British Airways

-

Nestlé

-

Tesla

Recent News and Developments

-

Kyndryl Holdings, Inc. introduced a range of workflow orchestration services in January 2024 specifically for business process automation. This solution improves operational efficiency, simplifies productivity, and enhances user experience in digital workplaces. Some features include An easy-to-use interface, Real-time visibility of the process, Enormous access control capabilities, and high encryption which helps manage complexity in work production.

-

In February 2023: The U.S. General Services Administration (GSA) announced its digital automation strategy to improve public sector workflows, allocating USD 50 million for process orchestration solutions to other federal agencies.

| Report Attributes | Details |

| Market Size in 2023 | USD 7.4 billion |

| Market Size by 2032 | USD 33.5 billion |

| CAGR | CAGR of 18.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Business Function (Supply Chain Management and Order Fulfillment, Marketing, Human Resource Management, Finance and Accounting, Customer Service and Support) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises) • By End Use (BFSI, Manufacturing, Healthcare, IT & Telecommunications, Retail, Energy and utilities, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

IBM, Oracle, Microsoft, Appian, Pega, TIBCO Software, SAP, MuleSoft, Red Hat, ServiceNow |

| Key Drivers |

•Organizations are increasingly focusing on digital transformation to enhance operational efficiency. Process orchestration is pivotal in automating workflows and improving real-time decision-making |

| Market Opportunities | •The initial investment in process orchestration solutions can be significant, especially for small and medium-sized enterprises (SMEs). This financial barrier often hinders widespread adoption among these businesses. •Integrating modern orchestration tools with legacy systems poses challenges due to complexity and time requirements. Many organizations struggle to transition smoothly, slowing down adoption. |