Processed Meat Market Report Scope & Overview:

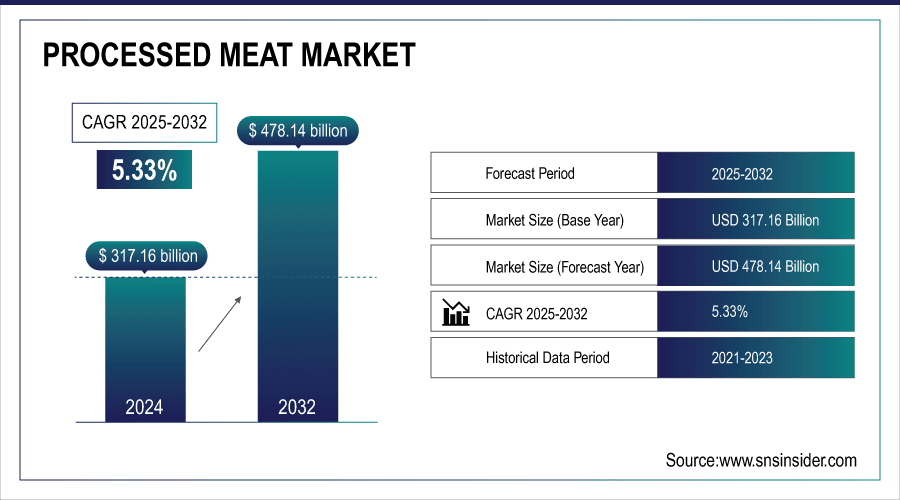

The Processed Meat Market size was valued at USD 317.16 Billion in 2024 and is projected to reach USD 478.14 Billion by 2032, growing at a CAGR of 5.33% during 2025-2032.

The global market is driven by rising consumer preference for convenience foods, busy lifestyles, and increasing urbanization. Innovations in processed meat products, including ready-to-eat and flavored options, cater to evolving consumer demands. Expanding retail channels, supermarkets, and online platforms enhance product accessibility, while growing interest in protein-rich diets further accelerates consumption. These factors collectively support sustained growth, offering manufacturers opportunities to innovate and expand their presence in the processed meat sector globally.

-

Over 35% of households purchase pre-marinated or flavored meat products to save cooking time.

-

Around 30% of online grocery shoppers regularly buy processed meats through e-commerce or subscription services.

To Get More Information On Processed Meat Market - Request Free Sample Report

Processed Meat Market Trends:

-

Consumers prefer protein-rich and convenient processed meat products due to busy lifestyles and changing dietary habits.

-

Ready-to-eat meats such as sausages, deli meats, and packaged poultry save preparation time and offer convenience.

-

Urbanization and higher disposable incomes increase adoption of packaged meats over fresh options.

-

Product innovations such as low-sodium, fortified, and ready-to-cook offerings attract health-conscious consumers.

-

Expansion of supermarkets, convenience stores, and e-commerce platforms improves product availability and accessibility.

-

Online sales, subscription models, and digital marketing enhance brand awareness, repeat purchases, and global market penetration.

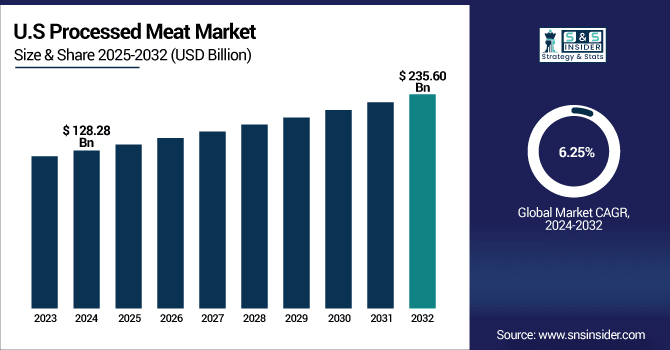

The U.S. Processed Meat Market size was valued at USD 128.28 Billion in 2024 and is projected to reach USD 235.60 Billion by 2032, growing at a CAGR of 6.25% during 2025-2032.

The U.S. market for Processed Meat is driven by rising demand for ready-to-eat and convenience-based products. Urban consumers prefer packaged and processed meats due to busy lifestyles, while awareness of protein-rich diets boosts adoption. Expansion in retail and foodservice channels, along with innovations in flavor, packaging, and preservation, enhances acceptance. Competitive pricing, promotions, and growing popularity of frozen and minimally processed meats further strengthen the market’s growth trajectory across the country.

Processed Meat Market Growth Drivers:

-

High Consumer Preference for Protein-Rich and Convenient Meat Products Increasing Market Demand Rapidly

Consumers are increasingly seeking protein-rich and convenient processed meat products due to fast-paced lifestyles and changing food habits. Ready-to-eat meats such as sausages, deli meats, and packaged poultry provide quick meal solutions, saving preparation time. Urbanization and higher disposable incomes enable households to adopt packaged meats over fresh options. Product innovations, including low-sodium and fortified meat offerings, further attract health-conscious consumers. Retail expansions in supermarkets and convenience stores increase availability, making processed meat more accessible. This growing consumer preference directly drives consistent revenue growth in the processed meat sector globally.

-

Over 55% of consumers globally prefer ready-to-eat or packaged processed meat products due to busy lifestyles.

-

Around 50% of working professionals consume processed meats at least three times a week for convenience.

Processed Meat Market Restraints:

-

Rising Costs of Raw Materials and Supply Chain Challenges Affecting Processed Meat Market Profitability

Volatility in raw material prices, including meat and feedstock, negatively affects the processed meat market. Fluctuating livestock costs, seasonal supply constraints, and transportation expenses increase production costs. Additionally, disruptions in cold chain logistics and packaging material shortages can delay product delivery. Manufacturers face margin pressures due to rising operational costs while maintaining competitive pricing. These challenges limit market growth by reducing affordability and accessibility for consumers. Continuous efforts to optimize supply chains and stabilize raw material procurement are necessary to mitigate the impact of cost fluctuations and sustain profitability.

Processed Meat Market Opportunities:

-

Expansion Of E-Commerce and Direct-To-Consumer Platforms Facilitating Global Market Reach and Sales

The growth of e-commerce and direct-to-consumer platforms is enhancing market penetration for processed meats. Consumers increasingly prefer online shopping due to convenience, variety, and home delivery services. Subscription models, bundle offers, and online promotions encourage repeat purchases. Digital marketing and social media campaigns help educate consumers and increase brand awareness. Manufacturers benefit from cost-effective distribution, reduced intermediary expenses, and improved consumer data insights. This shift enables access to untapped demographics, boosts sales, and supports global expansion. E-commerce adoption acts as a significant growth driver, reshaping market strategies and consumer engagement.

-

Over 40% of consumers are influenced by social media campaigns or digital marketing to buy processed meats.

-

Nearly 35% of households prefer home delivery over in-store pickup for processed meat products.

Processed Meat Market Segmentation Analysis:

-

By Product Type, Poultry Meat held the largest share of around 35.60% in 2024, and is projected to be the fastest-growing segment with a CAGR of 6.80%.

-

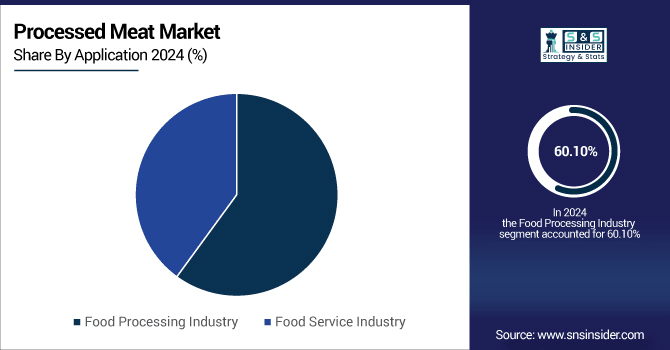

By Application, Food Processing Industry segment dominated the market with approximately 60.10% share in 2024, while Food Service Industry segment is expected to register the highest growth with a CAGR of 6.20%.

-

By Form, Fresh accounted for the leading share of nearly 45.30% in 2024, whereas Frozen segment is anticipated to be the fastest-growing segment with a CAGR of 6.10%.

-

By Distribution Channel, Supermarkets segment led the market with about 50.20% share in 2024, whereas Online Retail is forecasted to grow the fastest at a CAGR of 8.20%.

By Application, Food Processing Industry Segment Dominate While Food Service Industry Segment Shows Rapid Growth

Food Processing Industry segment dominated the Processed Meat Market with the highest revenue share of about 60.10% in 2024, driven by bulk demand for ready-to-cook and value-added meat products. Processed meats are widely used in packaged meals, snacks, and prepared foods, ensuring steady revenue. Food Service Industry segment is expected to grow at the fastest CAGR of about 6.20% from 2025-2032 due to increasing consumption in restaurants, hotels, and fast-food chains. Hormel Foods supplies a wide range of processed meats to foodservice clients, supporting this rapid growth.

By Product Type, Poultry Meat Leads Market and Registers Fastest Growth

Poultry Meat segment dominated the Processed Meat Market with the highest revenue share of about 35.60% in 2024 due to its affordability, wide acceptance, and versatility in meals. Its lean protein content appeals to health-conscious consumers globally. Poultry Meat segment is expected to grow at the fastest CAGR of about 6.80% from 2025-2032 as increasing demand for quick-cooking and ready-to-eat products drives consumption. Tyson Foods has been innovating in pre-marinated and ready-to-cook poultry products, boosting adoption across retail and foodservice sectors.

By Form, Fresh Segment Lead While Frozen Segment Registers Fastest Growth

Fresh segment dominated the Processed Meat Market with the highest revenue share of about 45.30% in 2024 due to higher consumer preference for taste, texture, and nutritional value. Fresh meats are perceived as healthier and more natural compared to processed or frozen alternatives. Frozen segment is expected to grow at the fastest CAGR of about 6.10% from 2025-2032 owing to increasing demand for long-shelf-life products. Perdue Farms has expanded its frozen poultry and meat offerings, catering to growing consumer demand for convenient, longer-lasting products.

By Distribution Channel, Supermarkets Segment Lead While Online Retail Grows the Fastest

Supermarkets segment dominated the Processed Meat Market with the highest revenue share of about 50.20% in 2024 due to extensive reach, brand variety, and in-store promotions. Organized retail stores provide product visibility and consistent quality, attracting consumers. Online Retail segment is expected to grow at the fastest CAGR of about 6.25% from 2024-2032 as e-commerce adoption increases. Cargill has strengthened its online presence and direct-to-consumer platforms, making processed meats more accessible and convenient for shoppers.

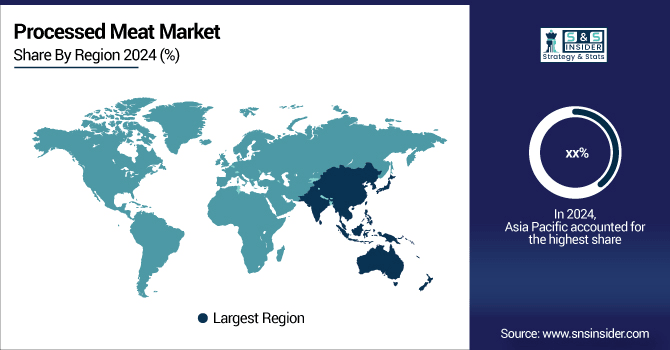

Asia Pacific Processed Meat Market Insights:

Asia Pacific segment is expected to grow at the fastest CAGR of about 7.20% from 2024-2032, driven by rising disposable incomes, urbanization, increasing demand for protein-rich diets, and expansion of organized retail and foodservice sectors. Rapid population growth and changing lifestyle patterns contribute to market acceleration in the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Processed Meat Market Insights:

North America region dominated the Processed Meat Market with the highest revenue share of about 30.20% in 2024 due to high meat consumption, advanced processing infrastructure, and established retail networks. Consumer preference for convenience foods and processed protein-rich diets further strengthen the market.

Europe Processed Meat Market Insights:

Europe’s processed meat market is driven by high consumer preference for convenience foods and protein-rich diets. Rising demand for ready-to-eat and premium meat products, coupled with innovations in flavor, packaging, and preservation, supports growth. Established retail networks and foodservice channels enhance product availability.

Latin America (LATAM) and Middle East & Africa (MEA) Processed Meat Market Insights:

Middle East & Africa and Latin America is growing due to rising urbanization, increasing disposable incomes, and changing dietary habits. Demand for ready-to-eat, protein-rich, and convenient meat products is expanding, supported by retail and foodservice growth, innovations in flavor and packaging, and consumer preference for high-quality processed meats.

Processed Meat Market Competitive Landscape:

Tyson Foods, a leading U.S.-based meat processor, produces high-quality beef, pork, and poultry products for retail, foodservice, and industrial clients. Its Tyson Fully Cooked Chicken Strips offer convenient, ready-to-eat protein solutions, while Tyson Hickory Smoked Sausages provide flavorful, pre-cooked options for quick meals. With a strong focus on innovation, sustainability, and food safety, Tyson continuously develops products to meet growing consumer demand for protein-rich, convenient, and high-quality processed meat offerings globally.

-

In July 2025, Tyson introduced these gluten-free, high-protein nuggets with simplified labeling, catering to consumer demand for clean-label products.

JBS S.A., headquartered in Brazil, is one of the world’s largest meat processors, offering beef, poultry, and pork products across retail and foodservice channels. Its Seara Processed Chicken Nuggets deliver quick, easy-to-cook protein for families, while Swift Premium Deli Ham provides ready-to-eat, high-quality meat options. Committed to innovation, global distribution, and sustainability, JBS ensures consistent product quality and safety, catering to evolving consumer preferences for convenient and protein-rich processed meats globally.

-

In February 2025, JBS expanded its Seara brand with new chicken nugget offerings, enhancing its portfolio in the processed meat sector.

Hormel Foods, based in the U.S., is a global leader in branded and packaged meats, serving retail and foodservice sectors. Its Hormel Natural Choice Turkey Breast offers lean, high-protein, ready-to-eat options, while SPAM Classic provides a convenient, long-shelf-life processed meat solution. Focused on innovation, health-conscious product development, and strong distribution networks, Hormel continues to meet growing consumer demand for flavorful, convenient, and quality-processed meat products globally.

-

In August 2025, Hormel introduced this product as part of its Natural Choice line, emphasizing minimally processed, preservative-free deli meats to cater to health-conscious consumers.

Processed Meat Market Key Players:

Some of the Processed Meat Market Companies are:

-

JBS S.A.

-

Tyson Foods, Inc.

-

WH Group Limited (Smithfield Foods)

-

Hormel Foods Corporation

-

Cargill, Incorporated

-

The Kraft Heinz Company

-

Conagra Brands, Inc.

-

BRF S.A.

-

Danish Crown Group

-

NH Foods Ltd.

-

Marfrig Global Foods S.A.

-

Vion Food Group

-

OSI Group, LLC

-

Maple Leaf Foods Inc.

-

Seaboard Corporation

-

Perdue Farms Inc.

-

Sanderson Farms

-

Pilgrim’s Pride Corporation

-

Mountaire Farms

-

Sigma Alimentos, S.A. de C.V.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 317.16 Billion |

| Market Size by 2032 | USD 478.14 Billion |

| CAGR | CAGR of 5.33% From 2024 to 2032 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Beef, Pork, Poultry Meat and Sheep Meat) • By Application (Food Processing Industry and Food Service Industry) • By Form (Fresh, Frozen and Shelf Stable) • By Distribution Channel (Supermarkets, Convenience Stores, Online Retail and Specialty Stores) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | JBS S.A., Tyson Foods, Inc., WH Group Limited (Smithfield Foods), Hormel Foods Corporation, Cargill, Incorporated, The Kraft Heinz Company, Conagra Brands, Inc., BRF S.A., Danish Crown Group, NH Foods Ltd., Marfrig Global Foods S.A., Vion Food Group, OSI Group, LLC, Maple Leaf Foods Inc., Seaboard Corporation, Perdue Farms Inc., Sanderson Farms, Pilgrim’s Pride Corporation, Mountaire Farms and Sigma Alimentos, S.A. de C.V. |