Ready-mix Concrete Market Report Scope & Overview:

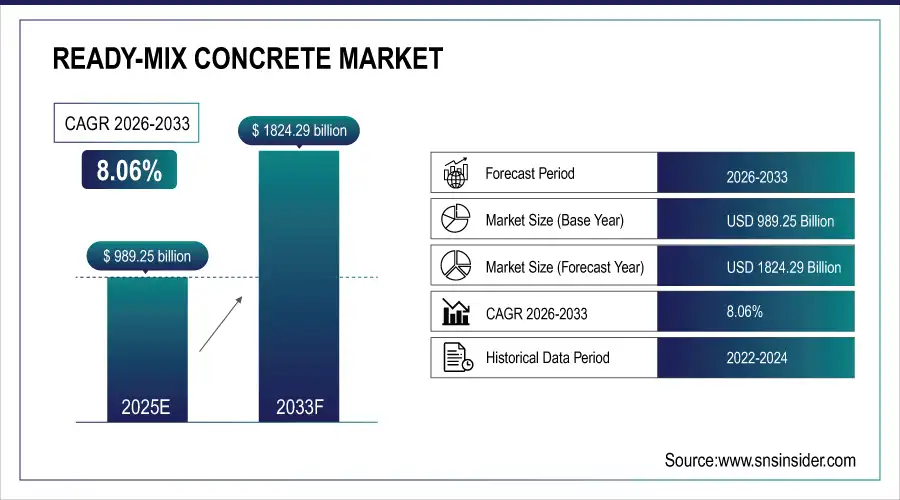

Ready-mix Concrete Market was valued at USD 989.25 billion in 2025E and is expected to reach USD 1824.29 billion by 2033, growing at a CAGR of 8.06% from 2026-2033.

The Ready-mix Concrete Market is growing due to rising urbanization, rapid infrastructure expansion, and increasing demand for durable, high-quality construction materials. Government investments in housing, transportation, and industrial projects are boosting market adoption. The shift toward sustainable, efficient construction practices and technological advancements in mixing and delivery systems further enhance productivity, consistency, and cost efficiency, driving steady global demand for ready-mix concrete across residential, commercial, and infrastructure sectors.

According to the latest official U.S. government statistics from the U.S. Geological Survey for 2024, Portland and blended cement production in the U.S. decreased by 4% to about 84 million tons.

Cement was produced at 99 plants in 34 states plus Puerto Rico, with Texas, Missouri, California, and Florida as the top producers representing approximately 43% of total production. Total cement shipments in 2024 were around 110 million tons, valued at roughly USD 17 billion.

Market Size and Forecast

-

Market Size in 2025: USD 989.25 Billion

-

Market Size by 2033: USD 1824.29 Billion

-

CAGR: 8.06% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Ready-mix Concrete Market - Request Free Sample Report

Ready-mix Concrete Market Trends

-

Rising urbanization, infrastructure development, and construction activities are driving the ready-mix concrete (RMC) market.

-

Growing demand for high-quality, consistent, and time-saving concrete solutions is boosting adoption.

-

Expansion of commercial, residential, and industrial construction projects is fueling market growth.

-

Advancements in admixtures, additives, and sustainable concrete formulations are improving performance and durability.

-

Focus on reducing labor costs, on-site waste, and construction time is shaping market trends.

-

Increasing preference for eco-friendly and low-carbon concrete is supporting sustainable construction practices.

-

Collaborations between RMC manufacturers, contractors, and construction technology providers are accelerating innovation and deployment.

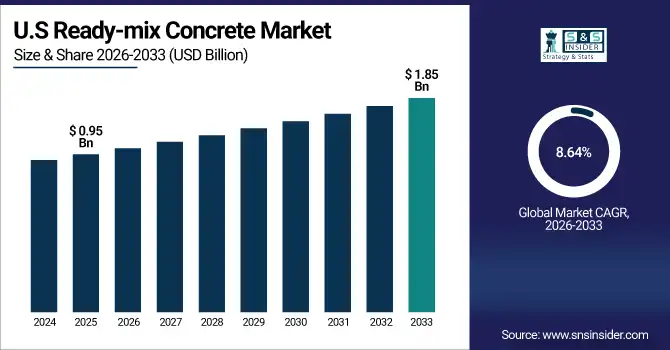

U.S. Ready-mix Concrete Market was valued at USD 0.95 billion in 2025E and is expected to reach USD 1.85 billion by 2033, growing at a CAGR of 8.64% from 2026-2033.

The U.S. Ready-mix Concrete Market is growing due to rising infrastructure investments, urban redevelopment projects, and demand for sustainable, high-performance building materials. Advancements in automated batching, logistics efficiency, and increased residential and commercial construction activity further strengthen market expansion.

Ready-mix Concrete Market Growth Drivers:

-

Rising Urbanization and Infrastructure Expansion Globally Driving Demand for Ready-Mix Concrete Market Growth

Rapid urbanization and increasing infrastructure projects worldwide are significantly boosting the demand for ready-mix concrete. Governments and private sectors are investing heavily in residential, commercial, and transport infrastructure, including roads, bridges, airports, and high-rise buildings. RMC provides consistency, high quality, and reduced construction time compared to on-site concrete mixing. Its advantages in labor efficiency, uniformity, and sustainability make it highly preferred. Additionally, modernization of cities, rising population density, and large-scale smart city initiatives are further accelerating the adoption of ready-mix concrete, supporting market expansion across emerging and developed regions globally.

Ready-mix Concrete Market Restraints:

-

Fluctuating Raw Material Prices and Dependence on Cement and Aggregate Supply Chains

The ready-mix concrete market is restrained by volatility in raw material prices, including cement, sand, and aggregates. Global supply chain disruptions, inflation, and regional shortages increase production costs for concrete manufacturers. Price fluctuations affect project budgeting, contract negotiations, and profitability for construction companies. Dependence on local suppliers and import duties in certain regions further exacerbate cost instability. Such unpredictability may discourage small-scale players and reduce competitiveness. Additionally, inconsistent quality of locally sourced materials can compromise concrete performance, limiting adoption in high-specification projects. These financial and supply chain challenges restrain the overall growth of the ready-mix concrete market.

-

In 2025, the U.S. implemented a 25% tariff on cement imports from Canada and Mexico, which together account for about 27% of U.S. cement imports, equating to roughly 7 million metric tons or nearly 7% of total U.S. consumption.

-

On February 1, 2025, the White House announced the tariff, effective from March 4, 2025, as part of broader trade policy measures addressing national security and trade imbalances. This tariff led to an estimated increase of around USD 30 per metric ton, raising cement prices from approximately USD 130 to USD 162 per ton. The hike has directly impacted ready-mix concrete producers by increasing input costs and squeezing profit margins, with the higher costs expected to be passed on to end customers, further affecting project budgets and market dynamics.

Ready-mix Concrete Market Opportunities:

-

Technological Advancements and Innovative RMC Solutions Driving Market Expansion

Innovation in ready-mix concrete, such as self-compacting concrete, high-performance concrete, and fiber-reinforced formulations, presents lucrative growth opportunities. These technological developments improve durability, workability, and structural performance, meeting complex construction requirements. Integration of IoT and digital batching systems allows real-time monitoring, precise mixing, and efficient logistics management. Adoption of eco-friendly and sustainable concrete solutions aligns with green building trends and environmental regulations. Manufacturers focusing on product differentiation through specialty mixes and customized concrete solutions can gain competitive advantages, expand market share, and tap into premium construction projects, fueling long-term growth potential in the RMC market.

-

Researchers at the Indian Institute of Technology, Indore (IIT-I) have developed an environmentally sustainable concrete using geopolymer technology, which replaces traditional cement with industrial waste such as fly ash and GGBS. This innovation can reduce CO₂ emissions by up to 80% and cut construction costs by 20%.

-

Additionally, the Sustainable Concrete Buyers Alliance (SCoBA) has been launched to accelerate the adoption of low-carbon building materials, with innovative procurement processes supporting the scaling of sustainable concrete production. Amazon's Chris Atkins highlighted SCoBA's role in driving the market toward net-zero construction materials.

Ready-mix Concrete Market Segment Highlights

-

By Mixer Type, Barrel Truck/In-transit Mixers dominated with ~73% share in 2025; Volumetric Mixers fastest growing (CAGR) due to flexibility in on-site mixing and reduced material wastage.

-

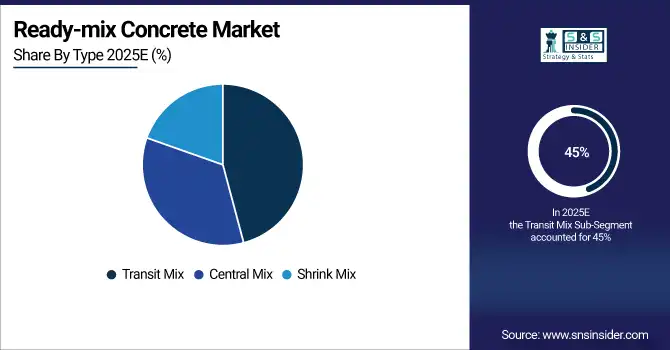

By Type, Transit Mix dominated with ~45% share in 2025; Shrink Mix fastest growing (CAGR)

-

By Application, Residential dominated with ~40% share in 2025; Infrastructure fastest growing (CAGR)

-

By Production Method, Off-site Production dominated with ~63% share in 2025; On-site Production fastest growing (CAGR)

Ready-mix Concrete Market Segment Analysis

By Mixer Type, Barrel Truck/In-transit Mixers segment dominated in 2025; Volumetric Mixers segment expected fastest growth 2026–2033

Barrel Truck/In-transit Mixers segment dominated the Ready-mix Concrete Market in 2025 due to their widespread use, reliability in transporting concrete over long distances, and ability to maintain mix quality. These mixers offer efficiency, consistency, and ease of operation, making them the preferred choice for large-scale construction projects.

Volumetric Mixers segment is expected to grow at the fastest CAGR from 2026-2033 as they allow on-site mixing, customization of concrete ratios, and reduced waste. Their flexibility and cost-efficiency make them increasingly attractive for small to medium construction projects, boosting adoption and market growth during the forecast period.

By Type, Transit Mix segment led in 2025; Shrink Mix segment projected fastest growth 2026–2033

Transit Mix segment dominated the Ready-mix Concrete Market in 2025 because of its ready-to-use formulation, uniform quality, and suitability for large residential and commercial projects. Its ability to ensure consistent concrete strength and reduce on-site labor requirements drives strong revenue generation and market preference.

Shrink Mix segment is expected to grow at the fastest CAGR from 2026-2033 due to rising demand for pre-batched, portable, and easy-to-use concrete solutions. These mixes offer quick preparation, convenience for small construction sites, and reduced storage requirements, making them attractive for modern construction practices and boosting market growth.

By Application, Residential segment dominated in 2025; Infrastructure segment forecast fastest growth 2026–2033

Residential segment dominated the Ready-mix Concrete Market in 2025 due to growing housing demand, urbanization, and large-scale residential construction projects. Ready-mix concrete ensures quality, durability, and faster construction timelines, making it highly preferred in residential applications and contributing to strong market revenue.

Infrastructure segment is expected to grow at the fastest CAGR from 2026-2033 due to increased investments in roads, bridges, airports, and urban development. High demand for durable, high-performance concrete for large-scale public projects is driving adoption, supporting market growth and creating long-term opportunities in the infrastructure sector.

By Production Method, Off-site Production segment dominated in 2025 and expected fastest growth 2026–2033

Off-site Production segment dominated the Ready-mix Concrete Market in 2025 due to centralized manufacturing, consistent quality control, and efficient batching processes. It ensures uniform concrete strength, reduces on-site labor, and minimizes delays, making it highly preferred for large construction projects. The segment is also expected to grow at the fastest CAGR from 2026-2033 as increasing adoption of prefabricated and modular construction, demand for faster project completion, and focus on reducing material waste drive higher reliance on off-site concrete production.

Ready-mix Concrete Market Regional Analysis

Asia Pacific Ready-mix Concrete Market Insights

Asia Pacific dominated the Ready-mix Concrete Market with the highest revenue share of about 68% in 2025 due to rapid urbanization, large-scale residential and commercial construction, and strong infrastructure development. High population growth, government investment in smart cities, and the expansion of industrial zones drive massive demand for ready-mix concrete. The presence of established manufacturers and growing adoption of modern construction techniques further reinforce market dominance, making the region the largest contributor to global ready-mix concrete revenue.

Get Customized Report as per Your Business Requirement - Enquiry Now

Middle East & Africa Ready-mix Concrete Market Insights

Middle East & Africa segment is expected to grow at the fastest CAGR of about 11.27% from 2026-2033 due to increasing infrastructure investments, urbanization, and large-scale government construction projects. Rising demand for highways, airports, and commercial buildings, coupled with expanding industrial zones, fuels ready-mix concrete consumption. Growing adoption of modern construction methods, prefabrication, and public-private partnerships in infrastructure development further accelerates market growth, positioning the region as a rapidly expanding segment in the global ready-mix concrete industry.

North America Ready-mix Concrete Market Insights

North America in the Ready-mix Concrete Market is growing steadily due to large-scale infrastructure projects, urban development, and increasing residential and commercial construction. The adoption of advanced construction technologies, high-quality concrete standards, and focus on sustainable and durable building materials drive market demand. Additionally, government investments in roads, bridges, and smart city initiatives, along with strong presence of established RMC manufacturers, contribute to North America’s significant share in the global ready-mix concrete market.

Europe Ready-mix Concrete Market Insights

Europe in the Ready-mix Concrete Market is witnessing steady growth due to increasing urban development, renovation projects, and sustainable construction practices. Strong regulatory standards, focus on eco-friendly and high-performance concrete, and demand for modern infrastructure support market adoption. Additionally, investments in commercial, residential, and public infrastructure projects, coupled with advanced construction technologies, are driving consistent consumption of ready-mix concrete across the region, maintaining Europe’s significant share in the global market.

Ready-mix Concrete Market Competitive Landscape:

CRH plc

CRH plc is a global leader in building materials, producing cement, aggregates, ready-mix concrete, and sustainable construction solutions. The company emphasizes low-carbon technologies and innovative materials to support environmentally responsible construction worldwide. CRH focuses on enhancing operational efficiency, sustainability, and market presence, particularly in North America and Europe, while providing products that meet modern infrastructure and commercial project requirements.

-

2025: Acquired Eco Material Technologies for USD 2.1 billion, strengthening its North American presence with near-zero carbon cement and supplementary cementitious materials.

Adbri Limited

Adbri Limited is an Australian-based integrated building materials company, offering cement, concrete, and aggregate solutions. The company focuses on supplying high-quality ready-mix concrete for residential, commercial, and infrastructure projects while expanding its market presence through strategic acquisitions. Adbri emphasizes sustainability and operational efficiency, providing environmentally responsible construction materials across South Australia and other key regions.

-

2025: Acquired Premix Concrete SA, including its ready-mix concrete business and quarries, expanding its footprint in South Australia; acquisition under review by the Australian Competition and Consumer Commission.

Zachry Corp.

Zachry Corp. is a diversified construction and engineering company with a focus on infrastructure, industrial, and commercial projects. Its concrete and building materials division specializes in ready-mix concrete solutions, aiming to optimize supply chains and ensure timely delivery for large-scale developments. The company emphasizes efficiency, local presence, and customer-focused solutions for commercial, residential, and public infrastructure projects.

-

2025: Expanded operations in South Texas by acquiring Jarco ReadyMix, forming Arcline Ready Mix to enhance supply chain efficiency and local concrete delivery.

Infra.Market

Infra.Market is an Indian construction supply platform providing building materials such as cement, steel, and ready-mix concrete. Leveraging digital procurement and financing solutions, the company aims to streamline the supply chain and support construction projects efficiently. Infra.Market focuses on technology-driven growth, market expansion, and enabling sustainable building practices in India.

-

2024: Secured an additional USD 50 million in debt financing, expanding its facility to USD 150 million to support ongoing expansion in India’s building materials market, including ready-mix concrete.

Breedon Group

Breedon Group is a UK-based integrated construction materials company supplying cement, aggregates, asphalt, and ready-mix concrete. The company emphasizes growth through strategic acquisitions and international expansion, providing high-quality construction materials and services. Breedon focuses on operational efficiency, sustainability, and strengthening its presence in key markets like the U.S. and the UK.

-

2023: Acquired BMC Enterprises for USD 300 million, enhancing its footprint in the U.S. and strengthening its position in ready-mix concrete and other building materials.

PPC Ltd.

PPC Ltd. is a leading South African cement and building materials company offering cement, concrete, and related products for residential, commercial, and industrial applications. The company focuses on sustainable manufacturing practices, efficiency, and supplying high-quality materials to support the construction industry. PPC emphasizes innovation and expansion to meet growing regional infrastructure demands.

-

2021: Announced a landmark investment in a new integrated cement facility in South Africa with 1.5 million tonnes per annum capacity, promoting sustainable cement production.

Key Players

Some of the Ready-mix Concrete Market Companies

-

CEMEX SAB de CV

-

Heidelberg Materials

-

Holcim Group

-

CRH plc

-

Vulcan Materials Company

-

Martin Marietta Materials

-

Argos USA LLC

-

Buzzi SpA

-

GCC (Grupo Cementos de Chihuahua)

-

Thomas Concrete Group

-

Ozinga

-

Lehigh Hanson

-

Sika AG

-

SRM Concrete

-

Robertson’s Ready Mix

-

Baker Concrete Construction

-

Kent Companies

-

Oldcastle Infrastructure

-

Premix Concrete SA

-

Adbri Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 989.5 Billion |

| Market Size by 2033 | USD 1824.29 Billion |

| CAGR | CAGR of 8.06% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Transit Mix, Central Mix, Shrink Mix) • By Application (Residential, Commercial, Infrastructure) • By Production Method (Off-site Production, On-site Production) • By Mixer Type (Barrel Truck/In-transit Mixers, Volumetric Mixers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | CEMEX SAB de CV, Heidelberg Materials, Holcim Group, CRH plc, Vulcan Materials Company, Martin Marietta Materials, Argos USA LLC, Buzzi SpA, GCC (Grupo Cementos de Chihuahua), Thomas Concrete Group, Ozinga, Lehigh Hanson, Sika AG, SRM Concrete, Robertson’s Ready Mix, Baker Concrete Construction, Kent Companies, Oldcastle Infrastructure, Premix Concrete SA, Adbri Limited |