Refurbished Smartphone Market Report Scope and Overview:

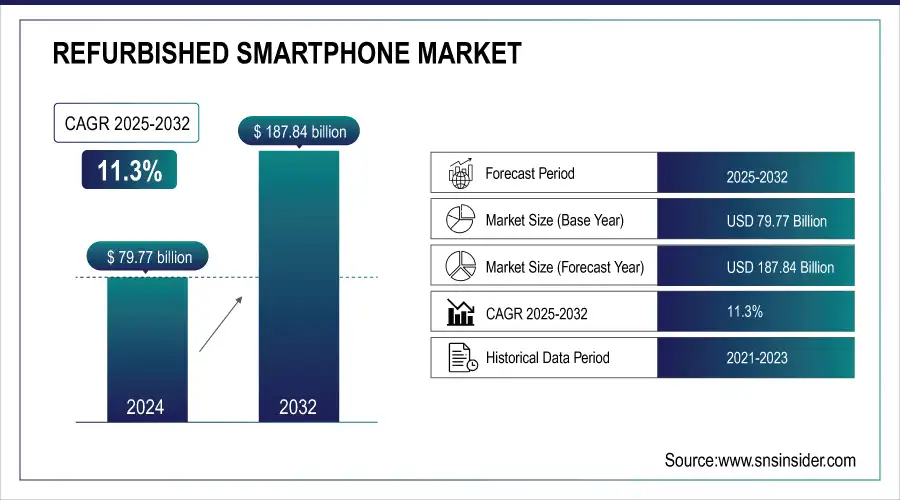

The Refurbished Smartphone Market size was valued at USD 88.78 billion in 2025E and is expected to grow to USD 209.07 billion by 2033 and grow at a CAGR of 11.3% over the forecast period of 2026-2033.

Get E-PDF Sample Report on Refurbished Smartphone Market - Request Sample Report

The Refurbished smartphone market has seen impressive expansion due to increased consumer focus on sustainability and a rising need for budget-friendly tech products. Refurbished smartphones, previously owned devices that go through extensive testing, repairs, and restoration, offer consumers a cheaper option to new models. Consumers are increasingly focusing on reducing electronic waste and looking for eco-friendly options that minimize their environmental impact, further boosting the attractiveness of this market. Improvements in the refurbishment procedures have enhanced the performance and dependability of these gadgets, with numerous providers providing warranties to establish consumer confidence.

Refurbished Smartphone Market Size and Forecast:

-

Market Size in 2025E: USD 88.78 Billion

-

Market Size by 2033: USD 209.07 Billion

-

CAGR: 11.3% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2021–2024

Refurbished Smartphone Market Highlights:

-

Sustainability and affordability are driving demand as refurbished devices reduce e-waste and provide budget-friendly alternatives

-

Online sales expansion through platforms like Amazon, Flipkart, and Back Market boosts accessibility with convenience, warranties, and wide product choices

-

Strategic collaborations such as Back Market with Verizon Visible highlight innovative bundled offers that enhance affordability and attract new customers

-

Consumer perception issues remain a restraint as doubts about quality and reliability persist, requiring awareness campaigns and strict certification processes to build trust

-

Lack of standardization in grading systems across sellers creates inconsistent customer experiences and hesitancy in adoption

-

Component availability challenges, especially for older models, hamper smooth refurbishment and cause delays in supply

Refurbished Smartphone Market Drivers:

-

Expansion of online sales is driving growth in the refurbished smartphone Market.

The emergence of e-commerce platforms has played a major role in driving the growth of the secondhand smartphone market, especially in developing countries. Consumers can now purchase affordable and reliable devices without sacrificing quality thanks to the growing availability of refurbished smartphones on online platforms. Many market competitors are taking advantage of this trend by making strategic investments and acquisitions to enhance their position. In January 2022, India's prominent e-commerce company Flipkart Group purchased Yantra, an electronics e-commerce startup. The goal of this purchase was to improve Flipkart's services after customers make a purchase and to grow its online shopping business, with a focus on the smartphone sector.

Refurbished Smartphone Market Restraints:

-

Obstacles that are impeding the expansion of the refurbished smartphone Market.

Even though there is an increasing need for refurbished smartphones, various obstacles in the market still prevent it from reaching its maximum capability. A significant obstacle is how refurbished devices are seen as lower in quality and reliability than brand new smartphones. A lack of trust in the durability and performance of refurbished products persists among many consumers due to the belief that they are used, damaged, or outdated devices. It can be challenging to dispel this misunderstanding despite reputable companies following strict testing, repairing, and certifying processes to guarantee that refurbished devices are just as functional as brand new ones.

Refurbished Smartphone Market Segment Analysis:

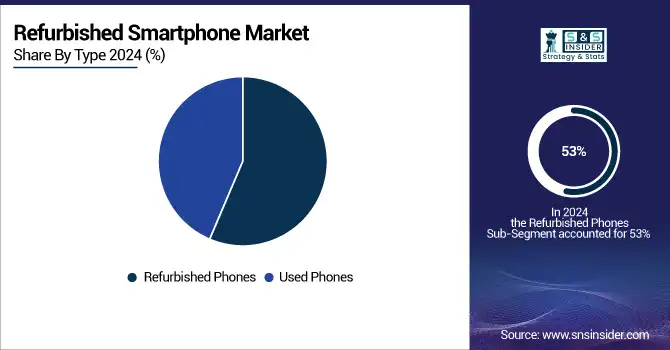

By Type

In the refurbished smartphone market of 2025E, refurbished phones dominated with 53% of the market's total revenue share. The growing consumer desire for affordable options over high-priced flagship models is fueling this domination. Refurbished phones are used devices that have been carefully tested, repaired, and checked for quality to make sure they work properly before being sold again. These gadgets are frequently available at a much cheaper cost compared to the latest models, appealing to financially cautious customers, especially in cost-driven areas like Asia-Pacific and Africa. Major companies in the industry, such as Apple, Samsung, and Xiaomi, have achieved notable progress in the refurbished smartphone market.

By Pricing

In 2025E, low-priced refurbished and used smartphones priced below $200 dominate the market, driven by strong demand from price-sensitive consumers, students, and emerging economies seeking affordable device access. This segment benefits from high volume sales and widespread availability. From 2026–2033, premium refurbished smartphones priced above $500 are expected to register the fastest CAGR, supported by rising consumer acceptance of refurbished flagship devices, extended device lifecycles, and improved refurbishment quality and warranty assurance.

By Sales Channel

In 2025E, online and e-commerce sales dominate the refurbished smartphone market due to convenience, wider product selection, competitive pricing, and certified warranty programs. From 2026–2033, physical retail stores are expected to grow at the fastest CAGR, driven by consumer preference for device inspection, instant availability, and growing trust in organized offline refurbishment chains.

By Application

In 2025E, individual consumers represent the dominant application segment, supported by affordability needs and frequent device replacement cycles. From 2026–2033, business adoption is expected to register the fastest CAGR as enterprises increasingly deploy refurbished smartphones for cost-efficient workforce mobility and sustainability goals.

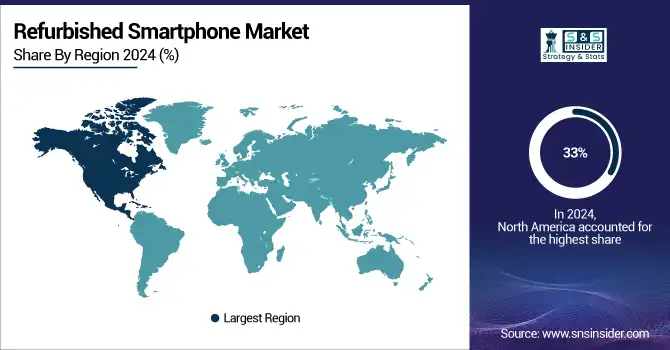

Refurbished Smartphone Market Regional Analysis:

North America Refurbished Smartphone Market Trends:

In 2025E, North America led the refurbished smartphone market, capturing a 33% market share. This dominance is largely driven by the rising consumer demand for affordable smartphones, coupled with increased environmental awareness and sustainability initiatives. Consumers in the U.S. and Canada are increasingly opting for refurbished smartphones due to their cost-effectiveness and quality assurance, with leading companies such as Apple, Samsung, and Amazon playing pivotal roles. Apple's "Certified Refurbished" program and Amazon’s "Renewed" platform have made it easier for consumers to access high-quality, refurbished devices that meet stringent standards, often backed by warranties and customer support.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Asia-Pacific Refurbished Smartphone Market Trends:

The Asia-Pacific region is to be the fastest-growing market for refurbished smartphones from 2026 to 2033, driven by increasing consumer demand for affordable technology and heightened environmental awareness. Countries like China, India, and Japan are leading this growth, with a burgeoning middle class seeking cost-effective alternatives to new devices. In China, companies like Huawei and Xiaomi have made significant strides in refurbishing practices, launching programs to offer certified refurbished smartphones at competitive prices. Similarly, India’s market is witnessing rapid developments, with firms such as Flipkart and Amazon expanding their refurbished segments to cater to the tech-savvy youth.

Europe Refurbished Smartphone Market Trends:

Europe represents one of the most mature markets for refurbished smartphones, supported by strong regulatory frameworks promoting sustainability and circular economy practices. In 2025E, the region captured a substantial market share, with countries like Germany, the U.K., and France at the forefront. Consumers are highly receptive to refurbished devices due to rising environmental awareness and favorable government policies encouraging electronics recycling and reuse. France, for instance, has introduced regulations mandating clear labeling of refurbished devices, ensuring transparency for buyers.

Latin America Refurbished Smartphone Market Trends:

Latin America is emerging as a promising market for refurbished smartphones, fueled by rising smartphone penetration and a cost-sensitive consumer base. In 2025E, Brazil and Mexico were the key contributors, with increasing demand for budget-friendly smartphones driving growth. Consumers in the region are turning to refurbished devices as a viable alternative to expensive new models, supported by e-commerce expansion and trade-in programs. In Brazil, marketplaces like OLX and Trocafone have strengthened their refurbished smartphone offerings, supported by growing partnerships with carriers and retailers.

Middle East & Africa Refurbished Smartphone Market Trends:

The Middle East & Africa (MEA) market for refurbished smartphones is at a developing stage but shows strong growth potential. In 2025E, demand was particularly notable in the UAE, Saudi Arabia, South Africa, and Nigeria, where cost sensitivity and rising smartphone penetration are key drivers. Consumers in the region are increasingly drawn to refurbished smartphones as an affordable entry point to premium brands such as Apple and Samsung. The UAE and Saudi Arabia are witnessing rising adoption through online platforms and certified reseller programs, with companies like Jumbo Electronics offering refurbished iPhones and Samsung devices.

Refurbished Smartphone Market Key Players:

-

Gazelle (Refurbished iPhone)

-

Decluttr (Certified Refurbished Smartphone)

-

Back Market (Refurbished Samsung Galaxy)

-

Amazon Renewed (Renewed iPhone 13)

-

Best Buy Outlet (Refurbished Pixel Phones)

-

Apple Certified Refurbished (Certified Refurbished iPhone 12)

-

Samsung Certified Pre-Owned (Certified Pre-Owned Galaxy S21)

-

Swappa (Used & Refurbished Phones)

-

BuyBackWorld (Refurbished Samsung Galaxy S20)

-

GameStop (Refurbished Xbox Smartphone)

-

Glyde (Refurbished iPhone 11)

-

Blinq (Refurbished OnePlus Devices)

-

Quick Mobile Fix (Refurbished Google Pixel)

-

MusicMagpie (Refurbished Smartphone)

-

The iOutlet (Refurbished iPhone XR)

-

eBay Refurbished (Certified Refurbished iPhone & Samsung)

-

CeX (Refurbished Smartphones & Gadgets)

-

Reboxed (Refurbished iPhone & Android Devices)

-

Refurbished.com (Refurbished Apple & Samsung Smartphones)

-

Mobile Klinik (Refurbished iPhone & Android Smartphones)

Refurbished Smartphone Market Competitive Landscape:

Orange Belgium, established in 1996, is a leading telecommunications operator offering mobile, internet, and digital services. As part of the Orange Group, it provides innovative solutions to individuals and businesses across Belgium. The company emphasizes customer experience, digital transformation, and sustainability, while expanding its presence in refurbished smartphone distribution.

-

In March 2024, Orange Belgium introduced a new online store for secondhand smartphones in collaboration with Recommerce. The company offers a two-year warranty for its products. It is striving to lessen CO2 emissions.

ReFit Global, established in 2017, is a technology-driven company specializing in refurbished smartphones and sustainable electronics solutions. The company focuses on reducing e-waste by offering high-quality, certified refurbished devices backed by warranties. Through strategic partnerships and advanced refurbishment practices, ReFit Global promotes affordability, circular economy initiatives, and eco-friendly consumer technology adoption worldwide.

-

In August 2023 ReFit Global introduced a digital platform for reconditioned smartphones. The company offers its products at an incredible 50% discount.

| Report Attributes | Details |

| Market Size in 2025E | USD 88.78 Billion |

| Market Size by 2033 | USD 209.07 Billion |

| CAGR | CAGR of 11.3% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Refurbished Phones, Used Phones) • By Pricing Range (Low-priced Refurbished and Used Mobile Phones (Less than $200), Mid-Priced Refurbished and Used Mobile Phones ($200-$500), Premium Refurbished and Used Mobile Phones (More than $500) • By Sales Channel (Online/ e-Commerce Sales of Refurbished and Used Mobile Phones, Refurbished and Used Mobile Phones Sold at Physical Retail Stores) • By Application (Individual, Businesses) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Gazelle, Decluttr, Back Market, Amazon Renewed, Best Buy Outlet, Apple Certified Refurbished, Samsung Certified Pre-Owned, Swappa, BuyBackWorld, GameStop, Glyde, Blinq, Quick Mobile Fix, MusicMagpie, The iOutlet, eBay Refurbished, Walmart Restored, PayMore Stores, RefurbMe, FoneGiant. |