High Voltage Switchgear Market Size & Overview:

Get more information on High Voltage Switchgear Market - Request Free Sample Report

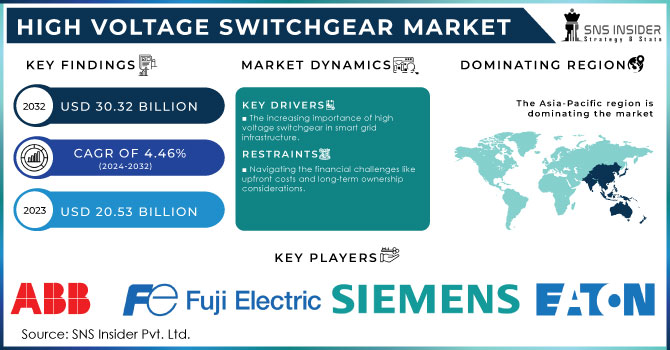

The High Voltage Switchgear Market size was valued at USD 20.53 Billion in 2023. It is estimated to reach USD 30.32 Billion by 2032, growing at a CAGR of 4.46% during 2024-2032.

The high voltage switchgear market is essential for the electrical power distribution and transmission sector. This tool is crucial for averting electrical malfunctions, guaranteeing the secure running of power systems, and upholding the dependability of electricity provision in diverse sectors like utilities, industrial, and commercial settings. The mounting need for electricity worldwide, along with the necessity for dependable power transmission infrastructure, is fueling the expansion of the high voltage switchgear market. According to the U.S. Energy Information Administration, the overall electricity usage in the United States in 2023 was roughly 4,145 billion kWh, indicating a 2% increase from the year before. It is predicted that electricity usage will keep increasing and reach approximately 4,195 billion kWh by the end of 2024. In 2023, the electric power industry was responsible for most of the energy consumption, producing approximately 1,500 billion kWh, with wind and solar energy contributing around 14% of the total generation. Significantly, the residential sector used around 11% of the total electricity, with the commercial sector making up about 9%. High voltage switchgear allows electricity to be transmitted long distances with minimal power loss, vital for ensuring a continuous energy supply to industries, homes, and businesses. The market's expansion is greatly influenced by the continued movement towards renewable energy sources. As countries pledge to decrease carbon emissions and boost the proportion of renewables in their energy portfolio, the incorporation of renewable energy sources like wind and solar power necessitates effective and trustworthy high voltage switchgear to manage fluctuating power demands.

The infrastructure & transportation sector remains the largest consumer of high voltage switchgear, with significant investments being made to modernize the aging power infrastructure. Governments and private utilities worldwide are modernizing their transmission & distribution systems to keep up with rising energy needs and enhance grid reliability. In 2024, the U.S. government allocated more than USD 30 billion toward smart grid infrastructure, including funds from the Inflation Reduction Act and the Bipartisan Infrastructure Law. This funding is intended to improve grid reliability and resilience while also helping to incorporate renewable energy sources. A significant project involves investing USD 3.5 billion in upgrading grids in 44 states, aiming to bring about 35 gigawatts of new renewable energy online, enough to power around 30 million households. Many utilities are increasingly interested in smart grids, as they improve power distribution efficiency and better incorporate renewable energy sources by using advanced switchgear systems.

MARKET DYNAMICS

Drivers

-

The increasing importance of high voltage switchgear in smart grid infrastructure.

The adoption of smart grid technology is quickly increasing as governments and utility companies prioritize upgrading their electrical systems to enhance efficiency, reliability, and sustainability. Smart grids facilitate the bidirectional transmission of electricity and data, which enhances the supervision, regulation, and administration of energy networks. High voltage switchgear is an essential element of intelligent grids, guaranteeing the secure and effective transmission of electricity.

Governments around the world are starting programs and allocating funds to assist in the creation and implementation of smart grid infrastructure. In the United States, the Smart Grid Investment Grant (SGIG) program has given billions of dollars to update the country's electric grid. Just like in Europe, countries such as Germany and the U.K. have adopted smart grid plans as a component of their overall energy transition strategies. Advanced switchgear is needed for smart grids to manage varying power loads, integrate renewable energy sources, and oversee distributed energy resources such as electric vehicles and energy storage systems. As smart grid projects become more widespread worldwide, there will be a growing need for advanced high voltage switchgear.

-

Meeting the growing demand for electricity amidst global industrialization.

The increased need for electricity worldwide is a result of fast industrialization, urbanization, and population growth. The growing demand for generating and distributing power is a main factor driving the High Voltage Switchgear Market. High voltage switchgear is crucial in enabling control, protection, and isolation of electrical equipment within power systems, guaranteeing safe and effective distribution of electricity. Due to the increasing global population, particularly in developing areas, there has been a rapid increase in the need for electricity. Growing economies like India, China, and nations in Africa are quickly becoming more urbanized and industrialized, prompting significant investments in energy infrastructure. High voltage switchgear is crucial in enabling these extensive electrification initiatives.

Moreover, advancements in power generation technologies, such as renewable energy sources, are increasing the need for advanced high voltage switchgear to guarantee safe and smooth integration into the grid. The growth of wind and solar power requires dependable high-voltage equipment for distribution and transmission, resulting in significant market expansion. This pattern is due to government efforts to encourage the adoption of clean energy and the necessity for efficient electrical grids.

Restraints

-

Navigating the financial challenges like upfront costs and long-term ownership considerations.

High voltage switchgear systems necessitate substantial initial financial investments, which may deter both utility companies and industrial users. These systems can be intricate, typically requiring specialized equipment, skilled workers, and thorough testing in large-scale installations. The expense of acquiring and setting up high voltage switchgear can be overly expensive, especially for smaller utilities or industries with restricted funding. Furthermore, the maintenance and replacement costs associated with high voltage switchgear contribute to the overall cost of ownership. Although modern switchgear systems are more reliable and efficient, their adoption rate may be hindered by high initial costs, especially in emerging markets with budget limitations.

-

Addressing installation complexities and maintenance challenges.

The complexity and specialized skills needed for high voltage switchgear systems installation and maintenance are demanding. Errors made during the installation process may result in system malfunctions, creating safety risks and raising the likelihood of expensive breakdowns. Furthermore, ensuring the functionality of high voltage switchgear systems entails routine examination, evaluation, and substitution of parts, a process that can be both costly and time-consuming. Dealing with high voltage switchgear can present major operational obstacles for utilities and industrial users. The presence of skilled workers and specialized equipment required to set up and upkeep these systems can hinder their widespread use, particularly in areas lacking a skilled workforce.

KEY MARKET SEGMENTS

By Insulation Type

Gas-insulated switchgear led the market by 42% market share in 2023 because of its compact design, high efficiency, and capability to function in severe environmental conditions. The sealed system utilizes sulfur hexafluoride (SF6) as an insulating medium, providing improved arc-quenching capabilities and insulation qualities. GIS systems are preferred in urban settings and industrial uses where there is limited space. Siemens' 8DQ1 GIS, for example, is employed in high-voltage power systems to effectively transmit large quantities of electricity. GIS's extended lifespan and decreased maintenance requirements are key factors in its market leadership.

Air-insulated switchgear is accounted to have a growth rate during 2024-2032 because it is cheaper than GIS and requires less maintenance. AIS utilizes surrounding air for insulation, making it ideal for situations without space limitations, such as rural or suburban locations. It is commonly used in power distribution grids, renewable energy systems, and industries with expansive outdoor substations. Schneider Electric's PIX Air-Insulated Switchgear is commonly employed in Infrastructure & Transportation networks and industrial power distribution, providing a dependable, environmentally friendly, and economical option to gas-insulated systems.

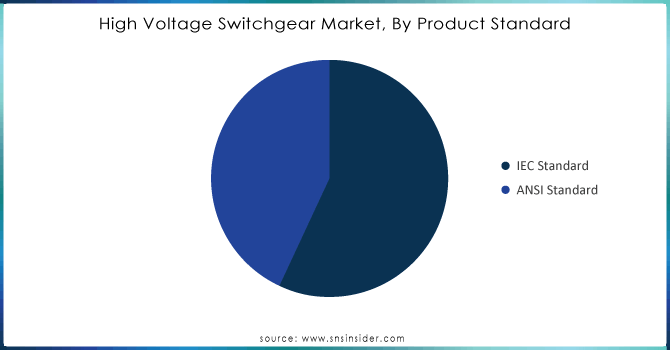

By Product Standard

The IEC Standard segment led the market with 54% market share in 2023, due to its worldwide acknowledgment and broad adoption, particularly in Europe, Asia, and other regions following international guidelines. IEC standards offer strict technical guidelines for switchgear, guaranteeing safety, dependability, and effectiveness in power distribution. These guidelines aim to ensure switchgear products can be easily exported and traded worldwide by being compatible with various countries' regulations. Siemens and ABB, for instance, incorporate IEC standards when developing their high-voltage switchgear products, which are commonly utilized in major power plants and grids, especially in Europe and Asia.

The ANSI Standard segment is to experience the fastest growth rate during the forecast period 2024-2032. ANSI standards are created to address the distinct electrical infrastructure and regulatory requirements of the United States and neighboring areas. These criteria emphasize the importance of reliability, safety, and performance to guarantee that high-voltage switchgear can effectively manage different levels of voltage. General Electric (GE) manufactures high-voltage switchgear following ANSI standards, designed for North American utility companies and large industrial projects.

Need any customization research on High Voltage Switchgear Market - Enquiry Now

By Component

Circuit breakers dominated the market with a 35% market share in 2023. Their purpose is to halt the flow of current automatically if there is a fault, ensuring that electrical systems are safe and reliable. The rising need for electricity and the growth of renewable energy sources are prompting the use of circuit breakers in substations and industrial settings. For example, Schneider Electric provides advanced circuit breaker solutions that improve operational efficiency and reliability in electrical distribution networks.

Relays are going to be the most rapidly expanding sector during 2024-2032, driven by the growing demand for automated control and monitoring of electrical systems. These devices are crucial for safeguarding and managing electrical circuits by enabling or cutting off the current flow according to pre-set conditions. The growth of relay applications in power distribution and industrial automation is being driven by the increase in smart grid technologies and the need for energy-efficient solutions. Siemens offers various protective relays that improve system reliability and reduce downtime in power generation and distribution, as an illustration.

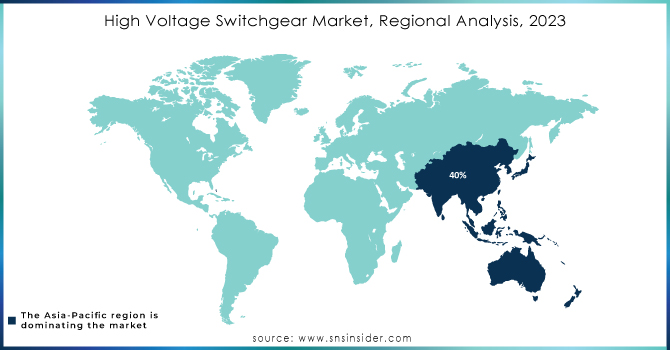

REGIONAL ANALYSIS

The Asia-Pacific region dominated the market in 2023 with 40%, mainly attributed to rapid urbanization, industrialization, and growing electricity needs. Nations such as China and India are making substantial investments in their electrical infrastructure to accommodate increasing energy requirements, leading to a significant need for high voltage switchgear. Major uses in this area consist of creating power, transferring it, and distributing it through grids, with top firms like Siemens and ABB taking the lead in offering top-notch switchgear solutions.

North America accounted for experiencing the fastest CAGR of 4.85% during 2024-2032 because of the strong demand for advanced electrical infrastructure and the rise of renewable energy projects in the region. The rising attention to smart grid technology in the area and the updating of old electrical grids are important factors driving growth. Big companies such as General Electric and Schneider Electric are actively participating in this market by offering creative solutions to improve the reliability and efficiency of grids.

KEY PLAYERS:

The key players in the High Voltage Switchgear market are:

-

ABB Ltd. (Gas-insulated switchgear, Air-insulated switchgear)

-

Siemens AG (High-voltage circuit breakers, Dead-tank switchgear)

-

General Electric (Gas-insulated circuit breaker, Compact switchgear)

-

Schneider Electric (High-voltage vacuum circuit breakers, Modular switchgear)

-

Eaton Corporation (VacClad-W switchgear, VCP-WG medium-voltage switchgear)

-

Mitsubishi Electric Corporation (Gas circuit breaker, HV Gas-insulated switchgear)

-

Hitachi Energy (Gas-insulated switchgear (GIS), Live-tank circuit breaker)

-

Toshiba Corporation (Gas-insulated switchgear, Vacuum circuit breaker)

-

CG Power and Industrial Solutions Ltd. (Indoor switchgear, Outdoor switchgear)

-

Hyosung Heavy Industries (Gas-insulated switchgear (GIS), Hybrid switchgear)

-

Alstom (Air-insulated switchgear, Generator circuit breakers)

-

Lucy Electric (High-voltage ring main units, Vacuum circuit breakers)

-

Powell Industries, Inc. (High-voltage metal-enclosed switchgear, Power control room switchgear)

-

Meidensha Corporation (Gas-insulated switchgear, Vacuum interrupter)

-

Ormazabal (Air-insulated switchgear, Modular ring main unit)

-

Tavrida Electric (Auto recloser switchgear, MV switchgear)

-

Nissin Electric Co., Ltd. (Gas-insulated switchgear (GIS), Vacuum circuit breakers)

-

Hyundai Heavy Industries (Gas-insulated switchgear, Air-insulated switchgear)

-

Fuji Electric Co., Ltd. (High-voltage gas-insulated switchgear, Vacuum circuit breakers)

-

CHINT Group (Indoor high-voltage switchgear, Gas-insulated metal-enclosed switchgear)

RECENT DEVELOPMENTS

-

In September 2024, Toshiba’s high-voltage switchgear entered the market. It enables the use of nitrogen instead of SF ₆ to reduce the ecological footprint of grids across Asia;

-

In August 2024, Hitachi’s SF₆-free switchgear 550 kV, the Hitachi Energy EconiQ 550 kV, was launched. Superb performance environmental regulations reliable take the traditional switchgear’s performance and footprint but without the emissions. The EconiQ technology was used by TenneT and SSEN to support their grid expansion and environmental targets, as well as other businesses;

-

In January 2024, Siemens’ high-voltage switchgear was revealed. It is meant for eco-friendly utilities needing reliable, compact solutions;

-

In November 2023, the cable system was launched by NKT. The SF₆-free switchgear-supported product is used to eliminate the emissions while preserving the high-voltage networks’ functionality;

-

In February 2023, GE Energy Industrial Systems launched Green Gas for Grid to substitute SF₆. The advantage of this switchgear is that its g³ mixture, is based on 3M Novec green gas. It provides a new alternative to utilities with new high-voltage applications, but the traditional ones have no longer any reasons to stick to SF₆.

-

In March 2023, ABB launched its SF₆-free switchgear within PrimeGear offerings. Being part of the gear units and embracing the latest in gas and vacuum technology to improve sustainability and safety, it is mainly tailored for urban substations.

| Report Attributes | Details |

| Market Size in 2023 | USD 20.53 Billion |

| Market Size by 2032 | USD 30.32 Billion |

| CAGR | CAGR of 4.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Insulation Type (Gas Insulated, Oil Insulated, Air Insulated) • By Product Standard (IEC Standard, ANSI Standard) • By Component (Circuit Breakers, Relays, Switch, Others) • By Application (Transmission & Distribution Network, Manufacturing & Processing, Infrastructure & Transportation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd., Siemens AG, General Electric, Schneider Electric, Eaton Corporation, Mitsubishi Electric Corporation, Hitachi Energy, Toshiba Corporation, CG Power and Industrial Solutions Ltd., Hyosung Heavy Industries, Alstom, Lucy Electric, Powell Industries, Inc., Meidensha Corporation, Ormazabal, Tavrida Electric, Nissin Electric Co., Ltd., Hyundai Heavy Industries, Fuji Electric Co., Ltd., CHINT Group |

| Key Drivers | • The increasing importance of high voltage switchgear in smart grid infrastructure. • Meeting the growing demand for electricity amidst global industrialization. |

| RESTRAINTS | • Navigating the financial challenges like upfront costs and long-term ownership considerations. • Addressing installation complexities and maintenance challenges. |