Release Liner Market Report Scope & Overview:

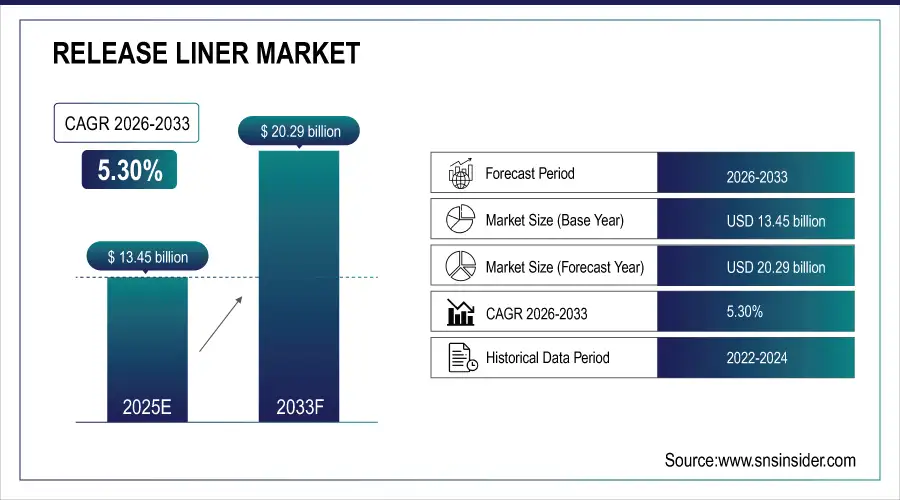

The Release Liner Market size was valued at USD 13.45 Billion in 2025E and is projected to reach USD 20.29 Billion by 2033, growing at a CAGR of 5.30% during 2026-2033.

The Release Liner Market analysis highlights the increasing demand in labeling and packaging industry. Non-silicone alternatives have expanded dramatically but silicone-coated liners are in the lead because of their performance. Robotics and green materials enable an efficient sustainable way of working.

The labeling sector was the largest release liner consuming segment with over 55% share of global demand in 2025, led by e-commerce packaging, food & beverage labelling and pharmaceutical compliance needs.

Market Size and Forecast:

-

Market Size in 2025E: USD 13.45 Billion

-

Market Size by 2033: USD 20.29 Billion

-

CAGR: 5.30% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Release Liner Market - Request Free Sample Report

Release Liner Market Trends

-

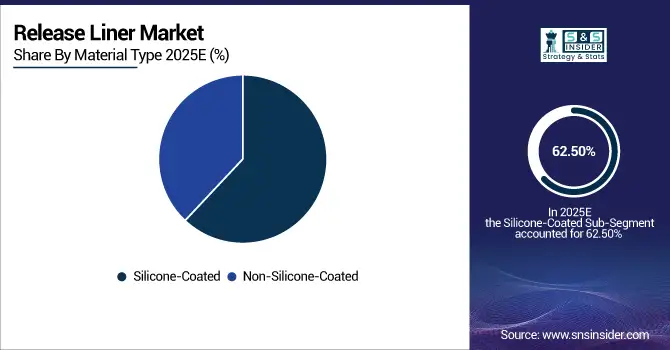

Silicone-coated release liners still dominate the market, being preferred for their performance, adhesive properties and multi-use durability.

-

Rising applications due to environment friendly alternatives in packaging is propelling the demand for sustainable, recyclable and biodegradable liners worldwide.

-

Rising applications in hygiene, medical and personal care products are boosting demand for advanced release liners.

-

Advances in adhesion, barrier, and surface coatings enhance performance of the product and extend production life.

-

Release liner use expanding globally on Asia-Pacific, LATAM, MEA’s rapid industrialization and packaging market growth.

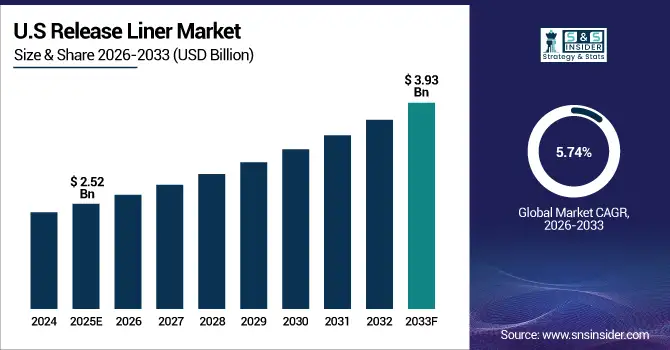

The U.S. Release Liner Market size was valued at USD 2.52 Billion in 2025E and is projected to reach USD 3.93 Billion by 2033, growing at a CAGR of 5.74% during 2026-2033. Release Liner Market growth is driven robust demand from the labeling, packaging, hygiene and industrial segments, the U.S. release liner market is growing at a parallel pace. Silicone adhesive layers are widely used as a result of their high performance and stability.

Release Liner Market Growth Drivers:

-

Increasing Demand from Packaging, Labeling, Hygiene, and Industrial Applications Driving Release Liner Market Growth

Growing demand of high-performance release liners in packaging, labeling, hygiene, and industrial applications is acting a market driver. Silicione-coated liners are the best for durability and consistent adhesive release while advancements in technology provides efficiency gains and product improvements. Growth in end use industries, Increase In demand for pressure sensitive adhesives, growing industrial production in developing markets also drive demand. Global release liners manufacturers are focusing on R&D and increased production capacities, along with evolution in new eco-friendly materials to keep abreast with changing demands.

In 2025, over 90% of release liner demand stemmed from PSA applications, with global PSA consumption rising by 6% annually due to growth in e-commerce, medical tapes, and automotive assembly.

Release Liner Market Restraints:

-

High Production Costs and Limited Adoption of Non-Silicone Alternatives Restricting Release Liner Market Expansion

However, the high cost of production of silicone-coated liners and less adoption of non-silicone alternatives hamper market growth. The cost of production is higher due to the need for high-tech machinery, a professional workforce and raw materials. The price awareness in emerging geographies can act as an inhibitor for widespread deployment. Moreover, manufacturers are facing regulatory compliances, environmental limitations and waste processing needs. These reasons are expected to curb any significant investment in capacity additions, which could inhibit penetration and possibly growth in particularly cost sensitive applications such as low-end packaging and small industrial uses.

Release Liner Market Opportunities:

-

Adoption of Eco-Friendly Materials and Emerging Markets Driving Future Release Liner Market Potential

With the growing importance of eco-friendlier, recyclable and biodegradable release liners there are major opportunities. Increasing demand in developing regions of Asia-Pacific, LATAM and MEA is promising for growth. Technical advances in coatings, substrates, and automated production maximize the performance of products while minimizing cost and environmental impact. Increasing use in hygiene, medical and specialty industrial end markets also contributes to the opportunities. R&D and eco-friendly production methods lead to expanding globally cross to seek these new customers, solidify brand positioning on the one hand, on the other hand also capture and enjoy global market expansion of release liner factory's dividend from.

In 2025, over 35% of new release liner product launches featured recyclable, compostable, or silicone-reduced designs, driven by EU packaging regulations and corporate net-zero commitments from major brand owners.

Release Liner Market Segment Analysis

-

By Material Type, silicone-coated liners led with 62.50% share in 2025, while non-silicone-coated liners were the fastest growing (CAGR 8.30%).

-

By Substrate Type, paper-based liners dominated with 55.67% share in 2025, while film-based liners were the fastest growing (CAGR 9.20%).

-

By Labeling Technology, pressure-sensitive adhesives (PSA) led with 48.23% share in 2025, while in-mold labels were the fastest growing (CAGR 10.10%).

-

By Application, labels held 52.45% share in 2025, while hygiene was the fastest growing segment (CAGR 9.84%).

By Material Type, Silicone-Coated Leads Market While Non-Silicone-Coated Registers Fastest Growth

The silicone coated release liner is leads due to widely used as they have better and strong adhesion with remarkable release characteristics, toughness greater holding power etc. They are frequently found in labels, tapes and industrial uses. While, non-silicone-coated liners growing fastest due to favored by manufacturers for their cost-efficient and environment-friendly nature. Researchers note that demand for ‘green’ materials and advancements in non-silicone coatings are spurring adoption, particularly in packaging and hygiene applications, resulting in rising production and market gains across the world.

By Substrate Type, Paper-Based Liners Dominate While Film-Based Liners Shows Rapid Growth

Paper based liners dominate the market and still represent the cash-cow realm in the release liner market in view of their low cost, versatility and ubiquitous use in labels, tapes and industrial applications. Meanwhile, Film liners, are increasingly popular because they have mechanical strength and moisture resistance and can be tailored to special needs. Rapid progress in polymer films and growing demand from high-performance applications like medical, hygiene and electronics industries are expected to push the growth of film-based liners market across the world.

By Labeling Technology, Pressure-Sensitive Adhesives (PSA) Lead While In-Mold Labels Registers Fastest Growth

Pressure-sensitive adhesive (PSA) release liners have the largest share of the market owing to their ease in use, versatility, and ubiquity in labeling and packaging applications. In-mold labels, however, now is the fastest-growing segment as consumers demand high-quality and long-lasting graphics on containers and specialty items. The rise in the adoption of in-mold labels, worldwide, is owing to technological advancements supporting molding and adhesive solutions coupled with growing consumer packaging & attractive promotion enabled through the use of such products.

By Application, Labels Lead While Hygiene Grow Fastest

Labels is the dominating application segment in the release liner market and it is driven by packaging, promotional headers/branding and industrial labels requirements. For this segment leads the silicone-coated and paper-based liners, because of their high effectiveness and robustness. While, hygiene applications, such as diapers, wipes and sanitary items, are the fastest growing segment. Growing consumer demand for cosmetics, new generation of liner technologies and increasing use of green materials in hygiene products are driving this segment and offering manufacturers from around the globe fresh opportunities.

Release Liner Market Regional Analysis:

Asia-pacific Release Liner Market Insights

In 2025 Asia-Pacific dominated the Release Liner Market and accounted for 44% of revenue share, this leadership is due to the continuous trend in demand from the packaging, labeling, and electronics industries, demand for release liners was high with seven percent. Growth is being driven by rapid industrialization, rising e-commerce and rising demand for hygiene products. Powerful manufacturing competence and the trend of sustainable liner materials further market competitiveness and market extending.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Release Liner Market Insights

China continues as the regional leading contributor due to being home to largest production of packaging material, with export rising. Growing applications in automotive, consumer goods, and label industries accelerate the growth of the market.

North America Release Liner Market Insights

North America is expected to witness the fastest growth in the Release Liner Market over 2026-2033, with a projected CAGR of 10.38% due to high demand in label, healthcare and industrial applications. Increasing penetration of pressure-sensitive adhesives and green materials provides impetus to the market. Rapid advances in technology, as well a focus on sustainability by key manufacturers increase efficiency and the U.S. continues to be the largest earning country in this region.

U.S. Release Liner Market Insights

In the U.S. market packaging, medical and hygiene sectors are flourishing. High product demand in the American release liner industry due to silicone coating technology and recoverable substrates will contribute towards market growth.

Europe Release Liner Market Insights

In 2025, Europe emerged as a promising region in the Release Liner Market, due to profits from the demanding environmental norms that support the adoption of recyclable and biodegradable material. Growth is driven by switching to higher-end labels, industrial tapes and healthcare. It is countries like Germany and the Netherlands that spearhead technological developments such as coating efficiency, paper recycling, or sustainable production processes.

Germany Release Liner Market Insights

Germany serves as a center for the European release liner market and is backed by its developed manufacturing and automotive industries. Sustainability, as well as the high quality of label application in the country, drive market growth.

Latin America (LATAM) and Middle East & Africa (MEA) Release Liner Market Insights

The Release Liner Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing packaging, construction and hygiene applications. The use for liners is fueled by industrialization, urbanization as well as the need for consumer goods. As production capacity grows, increasing imports, sustainability initiatives and investment in local production are driving regional market growth.

Release Liner Market Competitive Landscape:

3M Company is ruling the market of release liner by providing expertise pressure sensitive adhesives technology and coating. The firm specializes in high performance liners for industrial, medical and labeling applications. Cyclone uses an innovation-based model, paired with a focus on sustainability to increase product life, ease recyclability and enhance operations efficiency at plants around the world.

-

In March 2024, 3M unveiled its Scotchpak™ Release Liner Fluorosilicone Coated Polyester Film 9709, offering enhanced chemical resistance and improved performance in aggressive adhesive environments. The innovation strengthens 3M’s presence in medical and industrial adhesive applications.

Mondi Group is one of the largest suppliers of sustainable release liners, base papers and film solutions used in pressure sensitive products such as labels, tapes and hygiene components. Eco materials, recycle and energy-save process is emphasized by the company. The company has inhouse operations which facilitate optimization of performance and improvement of cost effectiveness thereby driving competitiveness within the worldwide release liner market Its involvement in developing coating technologies makes it more competitive.

-

In May 2025, Mondi expanded its re/cycle MailerBAG capacity at its Krapkowice plant, reinforcing sustainable, paper-based packaging and liner capabilities. This expansion supports growing demand from e-commerce and logistics sectors.

Loparex LLC is a worldwide producer of specialty release liners for the healthcare, industrial and consumer markets. The universal silicone coating, film extrusion and liner customization capabilities of the company enable high-performance adhesives applications. The fact of its excellent sustainability acts and its worldwide sourcing capacity makes the company a leading player in the release liner business.

-

In February 2024, Loparex launched its Bubble Liner Technology for construction applications, providing anti-skid properties, improved pressure resistance, and enhanced performance. The innovation caters to industrial and architectural coating applications.

UPM-Kymmene Oyj is one of the leading release liner suppliers for labelling, packaging and specialty applications. It utilizes bio-based ingredients and advanced coating technologies to minimize its environmental impact. Its emphasis on innovation, environmental stewardship and maximum production rates makes it the market’s leading Release Liner.

-

In October 2024, UPM Specialty Papers and Michelman launched a new generation of high-performance, recyclable paper-based packaging structures, combining UPM’s base papers with water-based coatings that offer both barrier and heat-seal functionalities.

Release Liner Market Key Players:

-

3M Company

-

Loparex LLC

-

UPM-Kymmene Oyj

-

Mactac (LINTEC Corporation)

-

Avery Dennison Corporation

-

Ritrama S.p.A.

-

Gascogne Laminates

-

Siliconature S.p.A.

-

DuPont Teijin Films

-

Dow Inc.

-

Ahlstrom-Munksjö

-

Elkem ASA

-

Felix Schoeller Group

-

Beckers Group

-

Rayven, Inc.

-

Intertape Polymer Group (IPG)

-

Saint-Gobain Performance Plastics

-

WestRock

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 13.45 Billion |

| Market Size by 2033 | USD 20.29 Billion |

| CAGR | CAGR of 5.30% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Silicone-Coated, Non-Silicone-Coated) • By Substrate Type (Paper-Based Liners, Film-Based Liners) • By Labeling Technology (Pressure-Sensitive Adhesives (PSA), Glue-Applied Labels, Shrink Labels, In-Mold Labels, Others) • By Application (Labels, Pressure-Sensitive Tapes, Hygiene, Industrial, Medical, Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | 3M Company, Mondi Group, Loparex LLC, UPM-Kymmene Oyj, Mactac (LINTEC Corporation), Avery Dennison Corporation, Ritrama S.p.A., Gascogne Laminates, Siliconature S.p.A., DuPont Teijin Films, Dow Inc., Ahlstrom-Munksjö, Elkem ASA, Felix Schoeller Group, Sappi Limited, Beckers Group, Rayven, Inc., Intertape Polymer Group (IPG), Saint-Gobain Performance Plastics, WestRock. |