Levulinic Acid Market Report Insights:

Get More Information on Levulinic Acid Market - Request Sample Report

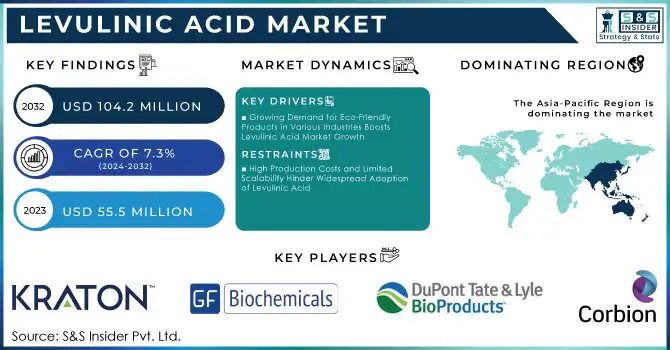

The Levulinic Acid Market Size was valued at USD 55.5 Million in 2023 and is expected to reach USD 104.2 Million by 2032 and grow at a CAGR of 7.3% over the forecast period 2024-2032.

Levulinic acid is gaining significant attention in the chemical industry due to its versatile applications and its role in the development of bio-based chemicals. Its production from renewable sources, such as agricultural waste, is particularly attractive in the current landscape focused on sustainability. One notable development in April 2024 emphasizes the potential of utilizing bagasse, a byproduct of sugarcane processing, to produce levulinic acid. This approach offers an environmentally friendly and cost-effective method of production, which could lead to a greener chemical industry. The use of bagasse not only reduces reliance on conventional feedstocks but also supports circular economy principles by repurposing waste material. This innovation could revolutionize the chemical sector by providing a sustainable alternative to petrochemical-based processes, enhancing the market's growth potential in the coming years.

Moreover, industry players continue to focus on scaling up the production of levulinic acid through advanced biotechnological processes. In May 2022, GFBiochemicals, a key producer in the sector, raised significant capital to expand its levulinic acid production capacity. This move highlights the increasing interest in biobased chemicals, which are seen as crucial for reducing carbon footprints and improving the sustainability of various industries, including pharmaceuticals, agriculture, and food processing. The market is also experiencing a push toward developing new and efficient production methods, further bolstering the potential for levulinic acid to become a key ingredient in the transition to a more sustainable chemical industry. Companies such as GFBiochemicals are leading this charge, with innovations that streamline production processes and improve the overall economic feasibility of levulinic acid. These advancements are expected to drive the growth of the levulinic acid market by making the compound more accessible and commercially viable.

Levulinic Acid Market Dynamics:

Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts Levulinic Acid Market Growth

-

Increased Focus on Renewable Feedstocks for Sustainable Chemical Production Drives Market Expansion

-

Rising Demand for Levulinic Acid in Biofuels and Bioplastics Supports Market Growth

-

Technological Advancements in Levulinic Acid Production Enhance Efficiency and Reduce Costs

-

Government Regulations and Policies Promoting Sustainable Chemicals Drive Market Demand

Stricter environmental regulations and government policies are pushing industries to adopt greener alternatives to petrochemical-based products. Levulinic acid is seen as a promising sustainable solution due to its production from renewable biomass and its role in reducing environmental impacts. Governments worldwide are implementing stricter rules around emissions, waste management, and sustainability, which are compelling manufacturers to turn to bio-based chemicals. Levulinic acid’s ability to contribute to compliance with these regulations is making it an increasingly popular choice in sectors such as agriculture, pharmaceuticals, and chemicals. As these policies continue to evolve, the demand for levulinic acid is expected to grow, further driving the market.

Restraint:

-

High Production Costs and Limited Scalability Hinder Widespread Adoption of Levulinic Acid

Despite the growing demand for levulinic acid, high production costs and scalability issues remain significant barriers to its widespread adoption. The production of levulinic acid from biomass requires advanced technologies, which can be expensive to implement. Additionally, large-scale production is still limited by the availability of affordable feedstocks and the inefficiency of some production processes. Although technological advancements are helping to address these challenges, the cost remains a key hurdle for many industries, especially small and medium-sized enterprises (SMEs) that may find it difficult to invest in the necessary infrastructure. Until these challenges are overcome, levulinic acid's market penetration will be somewhat restricted.

Opportunity:

-

Expansion of Levulinic Acid Applications in Pharmaceuticals and Healthcare

Levulinic acid’s potential applications in pharmaceuticals and healthcare are emerging as significant growth opportunities for the market. It is used as a key intermediate in the production of various bioactive compounds, including antibiotics and anti-inflammatory agents. The rise of biopharmaceuticals and natural products in the healthcare sector is expected to increase the demand for levulinic acid. Additionally, its biodegradable properties make it suitable for use in drug delivery systems and medical devices. As the pharmaceutical industry increasingly shifts towards sustainable and bio-based raw materials, levulinic acid presents a promising opportunity for further market expansion.

-

Utilization of Levulinic Acid in the Food and Beverage Industry Offers New Growth Potential

-

Growing Interest in Levulinic Acid-Based Polymers for Biodegradable Packaging Solutions

Challenge:

-

Limited Feedstock Availability and Environmental Concerns Impact Levulinic Acid Production

While levulinic acid is seen as a sustainable alternative to petrochemical-based products, its production is heavily reliant on the availability of feedstocks such as agricultural waste and biomass. The variability in feedstock availability due to seasonal fluctuations, agricultural practices, and regional limitations can hinder consistent production. Additionally, concerns over the environmental impact of large-scale biomass harvesting, such as deforestation or soil degradation, pose challenges to the sustainability of levulinic acid production. These factors can result in price volatility and limit the long-term scalability of levulinic acid, making it a challenge for companies to meet growing market demand consistently.

Intellectual Property Trends and Patent Innovations in the Levulinic Acid Market

The patent and intellectual property landscape for the levulinic acid market indicates increasing innovation, particularly in the bio-based production processes. Companies are filing patents around methods to enhance the yield and cost-efficiency of levulinic acid from renewable resources, as well as innovations in downstream applications such as biodegradable plastics, pharmaceuticals, and biofuels. For instance, key players like GFBiochemicals and Avantium are actively involved in filing patents related to new technologies for bio-based levulinic acid production, with a focus on sustainable and environmentally friendly processes.

| Patent Holder | Innovation/Patent Focus | Patent Applications | Technology Type |

|---|---|---|---|

| GFBiochemicals | High-yield production of levulinic acid from biomass | Multiple applications in the last 5 years | Bio-based processing methods |

| Avantium | CO2-based production and polymer applications | Filed patents on CO2-utilizing technologies | Green chemistry and CO2 sequestration |

| Biofine International | Acid hydrolysis process for biomass conversion | Multiple filings focused on enhancing efficiency | Acid Hydrolysis technology |

| DuPont Tate & Lyle Bio Products | Bio-based levulinic acid production for industrial applications | Innovations around industrial scalability | Bio-based and renewable feedstock |

This growing trend of patent filings in the levulinic acid industry is reflective of a broader push towards sustainability, with several players looking to capitalize on bio-based technologies to reduce dependency on fossil fuels. Companies are increasingly focusing on improving the economic feasibility of levulinic acid as a platform chemical, both in terms of production methods and its applications across various industries such as food, pharmaceuticals, and agriculture

Levulinic Acid Market Segment Analysis

By Source

In 2023, the biomass-based segment dominated and accounted for the largest share of the levulinic acid market, accounting for about 80%. This dominance is attributed to the increasing emphasis on sustainable and renewable sources in the chemical industry. Biomass-derived levulinic acid is produced from agricultural residues, such as bagasse and wood chips, which not only provide an eco-friendly alternative to fossil fuel-based raw materials but also align with global environmental goals. The shift toward bio-based chemicals, driven by the need to reduce carbon emissions and reliance on fossil fuels, has spurred the growth of this segment. For instance, several industry players are adopting biomass as a primary feedstock for levulinic acid production, in line with the broader push for sustainability.

By Technology

The Biofine process dominated the technology segment in 2023, capturing around 60% of the market share. This process, which involves converting biomass into levulinic acid through a specialized catalytic reaction, is widely preferred due to its efficiency in high-yield production. The process’s ability to use a variety of biomass feedstocks like agricultural waste and forestry residues makes it particularly attractive in the context of increasing demand for renewable chemicals. Companies involved in bio-based chemical production have largely adopted this technology because it aligns with their sustainability objectives while optimizing production costs. For example, significant investments have been made in scaling up Biofine-based facilities to meet the rising market demand.

By End-use Industry

In 2023, the chemicals segment dominated the levulinic acid market, accounting for about 40% of the market share. Levulinic acid is primarily used as a precursor in the production of various biochemicals, including solvents, plasticizers, and bio-based plastics. The increasing demand for eco-friendly and biodegradable products in the chemical industry is driving the growth of this segment. Furthermore, levulinic acid’s use in producing high-value chemicals such as gamma-valerolactone (GVL) and 2,5-furandicarboxylic acid (FDCA) further solidifies its dominance in this industry. As companies shift toward greener alternatives, the chemicals sector’s reliance on levulinic acid continues to grow, contributing significantly to the market’s overall expansion.

Levulinic Acid Market Regional Overview

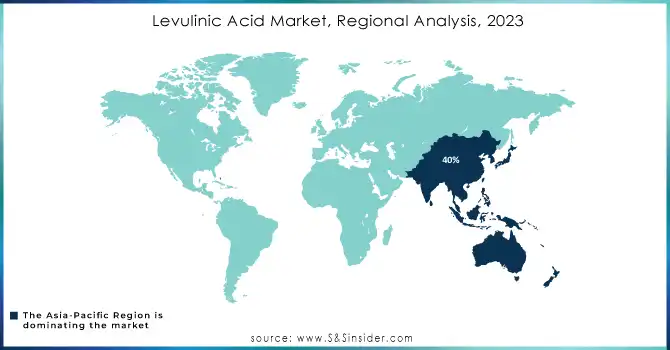

In 2023, the Asia-Pacific region dominated the levulinic acid market, with an estimated market share of over 40%. The region’s leadership can be attributed to the extensive production capacities in China, which is a major hub for biomass-based levulinic acid production. The increasing industrialization in countries like China, India, and Japan, along with the region’s substantial agricultural output, particularly from biomass sources such as rice husks, contributes significantly to this dominance. China remains the leading country in levulinic acid production due to its large-scale biomass-based manufacturing capabilities and the growing demand for eco-friendly and bio-based chemicals in various applications such as agriculture, energy, and automotive sectors. The government’s favorable policies towards sustainable practices and green technologies further support the region's market leadership. For instance, in China, companies like Shanxi Lihua Bio-Technology are making advancements in levulinic acid production, driving the growth of this sector

Moreover, the North American region is the fastest-growing in the levulinic acid market, with a projected CAGR of around 12% from 2023 to 2030. This growth is largely driven by the increasing adoption of bio-based chemicals in the U.S. and Canada, where demand for sustainable alternatives in sectors like automotive, pharmaceuticals, and fuel additives is rising rapidly. The U.S. is particularly active in promoting green technologies and expanding renewable energy sources, which directly boosts the demand for levulinic acid as an eco-friendly and versatile chemical. Key players in the region, including DuPont Tate & Lyle Bio Products, are innovating to provide cost-effective solutions that appeal to environmentally conscious industries. Additionally, market trends such as the push for bio-based fuel additives and agricultural products are expected to contribute to the region’s robust market growth

Need Any Customization Research On Levulinic Acid Market - Inquiry Now

Key Players in Levulinic Acid Market

-

Beijing Sino-High Technology (Levulinic Acid, Furfuryl Alcohol)

-

BioChem (Levulinic Acid, 5-Hydroxymethylfurfural)

-

Corbion (Lactide, Polylactic Acid (PLA))

-

Dupont Tate & Lyle Bio Products (Susterra Propanediol, Bio-PDO)

-

GFBiochemicals (Levulinic Acid, 5-Hydroxymethylfurfural)

-

Kraton Polymers (Kraton Polymers, Levulinic Acid)

-

Nexant Inc. (Levulinic Acid, Butyric Acid)

-

Renewable Energy Group, Inc. (Biodiesel, Renewable Diesel)

-

Segetis, Inc. (Levulinic Acid, 5-Hydroxymethylfurfural)

-

Shanxi Lihua Bio-Technology Co., Ltd. (Levulinic Acid, 5-Hydroxymethylfurfural)

-

Amyris Inc. (Farnesene, Biofene)

-

Avantium (Furanics, Levulinic Acid)

-

Global Bio-Chem Technology Group Company Limited (Levulinic Acid, Furfuryl Alcohol)

-

Green Biologics (Butanol, Acetone)

-

Jilin Province Juxin Bio-Tech Co. (Levulinic Acid, 5-Hydroxymethylfurfural)

-

Metabolic Explorer (Butanol, Acetone)

-

Mitsubishi Chemical Corporation (Levulinic Acid, Butyric Acid)

-

Sambazon (Açaí Pulp, Açaí Powder)

-

Sierra Energy (Waste-to-Energy Solutions, Gasification)

-

Wuhan Huali Environmental Technology Co., Ltd. (Levulinic Acid, Furfuryl Alcohol)

Recent Developments

-

June 2023: Avantium N.V. formed a partnership with SCG Chemicals Public Company Limited to jointly develop CO2-based polymers. As part of their collaboration, the companies plan to scale up production to a pilot plant with an estimated capacity of 10 tons per annum. This initiative reflects their shared commitment to advancing sustainable polymer technologies and reducing the carbon footprint associated with polymer production. The pilot phase is an important step in moving from lab-scale research to commercial viability, focusing on creating bio-based alternatives using CO2 as a raw material

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 55.5 Million |

| Market Size by 2032 | US$ 104.2 Million |

| CAGR | CAGR of 7.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Fossil Fuel-based, Biomass-based) • By Technology (Acid Hydrolysis, Biofine Process, Others) • By End-use Industry (Chemicals, Automotive, Agriculture, Energy, Pharmaceutical, Food & Beverages, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GFBiochemicals, Corbion, The Bio-Based Chemicals Company (BioChem), Shanxi Lihua Bio-Technology Co., Ltd., Kraton Polymers, Renewable Energy Group, Inc., Beijing Sino-High Technology, Dupont Tate & Lyle Bio Products, Segetis, Inc.Nexant Inc. and other key players |

| Key Drivers | • Growing Demand for Eco-Friendly Products in Various Industries Boosts Levulinic Acid Market Growth •Increased Focus on Renewable Feedstocks for Sustainable Chemical Production Drives Market Expansion |

| Restraints | • High Production Costs and Limited Scalability Hinder Widespread Adoption of Levulinic Acid |